If you’ve spent any time looking at the usd to costa rica colon recently, you’ve probably noticed something weird. For years, the exchange rate was predictable—boring, even. You’d show up at Juan Santamaría Airport, trade your dollars for a thick stack of colorful plastic bills, and go about your day. But lately, things have gotten chaotic. The Costa Rican Colon (CRC) has been on a wild ride, strengthening against the US Dollar in ways that have caught tourists, expats, and even local business owners totally off guard.

It’s frustrating.

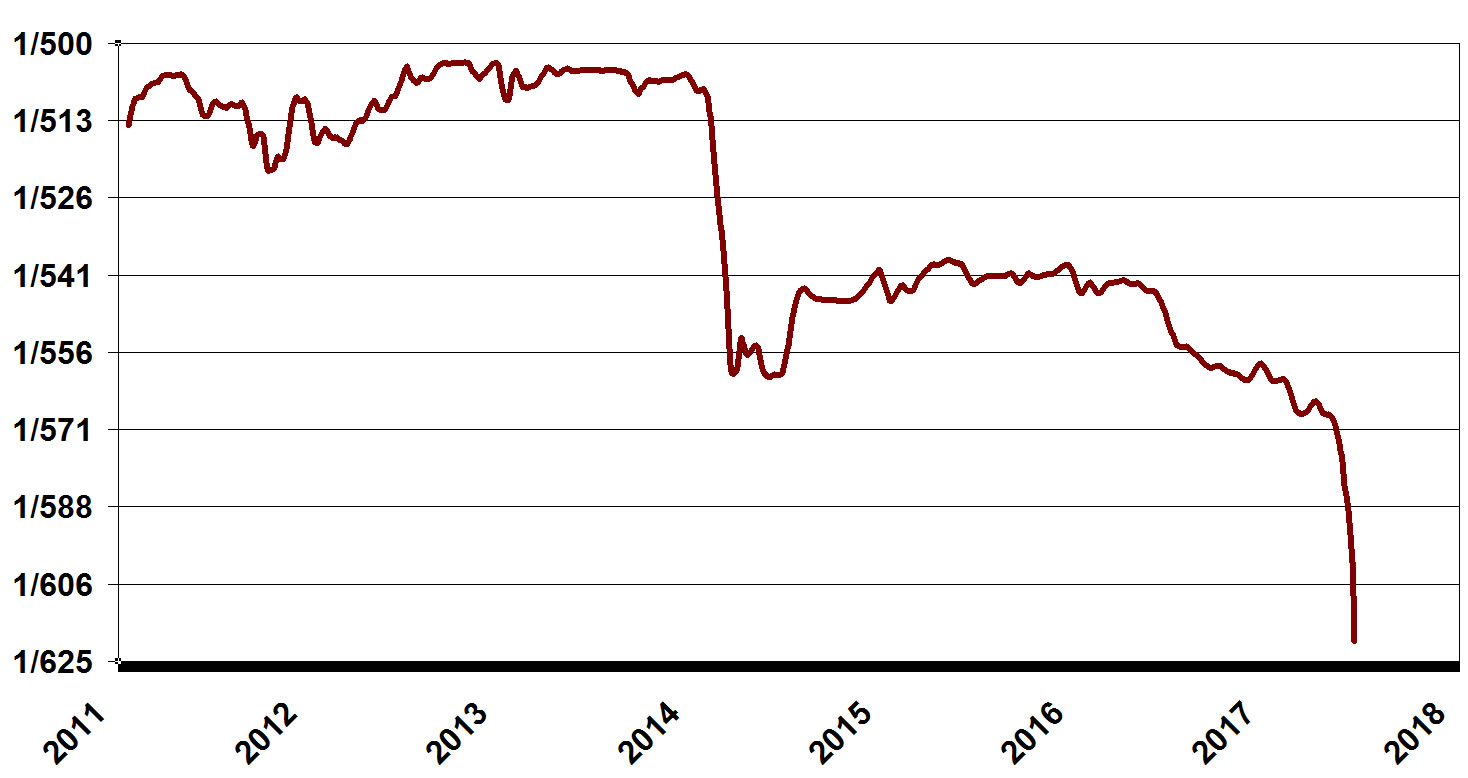

Honestly, trying to time the market in Costa Rica right now feels like trying to predict when a sloth is going to cross the road. You know it’s going to happen, but the "when" and "how" are anyone's guess. In early 2023, the rate was hovering near 700 colones to the dollar. Fast forward a bit, and it plunged toward the 500 mark. That’s a massive swing. If you’re a traveler, your vacation suddenly got 20% more expensive. If you’re a local coffee exporter getting paid in dollars but paying your staff in colones, you’re likely sweating.

The Mystery of the "Super Colon"

Why is the usd to costa rica colon behaving this way? Usually, when a small country's currency gets this strong, it’s because the economy is booming. And while Costa Rica is doing okay, the real drivers are a bit more technical.

One big factor is the massive influx of Foreign Direct Investment (FDI). Companies like Intel and various medical device manufacturers have poured billions into the country. When these companies bring in dollars to build factories, they have to buy colones to pay for local labor and materials. This creates a huge demand for the colon. Think of it like a limited edition sneaker—the more people want it, the higher the price goes. In this case, the "price" of the colon is measured in how many dollars you have to give up to get one.

Then there’s the tourism surge.

🔗 Read more: Are There Tariffs on China: What Most People Get Wrong Right Now

Costa Rica isn't just a budget backpacker destination anymore. It’s a luxury hub. High-spending tourists bring in suitcases full of greenbacks. When those dollars hit the local banks, the supply of USD goes up, and the relative value of the colon rises. It's basic supply and demand, but it’s hitting the "Pura Vida" lifestyle hard.

The Role of the Central Bank (BCCR)

The Banco Central de Costa Rica (BCCR) is the puppet master here. They have a tough job. If they let the colon get too strong, the export sector—think pineapples and bananas—dies because their products become too expensive for the rest of the world. But if they let the colon get too weak, inflation kicks in, and the price of imported gas and electronics at the local Monge store goes through the roof.

The BCCR has been intervening. They buy dollars to try and stabilize the usd to costa rica colon rate, but they can only do so much. Critics, including many members of the Cámara de Exportadores de Costa Rica (CADEXCO), have been vocal. They argue the bank isn't doing enough to protect the people who actually produce things. It’s a messy, political, and deeply economic tug-of-war that affects whether you can afford that extra Imperial beer at sunset.

Real World Impacts: From Tamarindo to San José

Let's get practical. If you're standing at an ATM in Escazú, what does this mean for your wallet?

First, stop using the airport exchange booths. Seriously. They are notorious for "la mordida" (the bite)—offering rates that are sometimes 10% worse than the actual market value. You are basically throwing money into the Reventazón River.

💡 You might also like: Adani Ports SEZ Share Price: Why the Market is kida Obsessed Right Now

Instead, use a local ATM. Most banks like BAC Credomatic or Banco Nacional offer decent rates, though you'll still pay a transaction fee. The smartest move? Pay with a credit card that has no foreign transaction fees. The network (Visa or Mastercard) usually gives you a rate very close to the official interbank usd to costa rica colon price.

- The "Dollarized" Economy: Many things in Costa Rica are priced in dollars—tours, hotels, and real estate. If the colon is strong, your dollars don't go as far when you buy "colon-priced" things like groceries or sodas (local diners).

- The Wage Gap: Local workers earning colones are actually feeling richer in terms of buying power for imported goods. But the guy running a surf school who charges in dollars? He’s effectively taken a pay cut.

How to Handle the usd to costa rica colon Like a Pro

If you’re planning a move or a long-term stay, you need a strategy. You can't just wing it anymore.

1. Watch the "Ventanilla" vs. the "Monex"

The rate you see on Google is the mid-market rate. The rate you get at the bank window (the ventanilla) is always worse. However, for large transactions, savvy residents use the MONEX (Mercado de Monedas Extranjeras). It's the wholesale market where the big players trade. While individuals can't always access it directly, keeping an eye on it tells you where the retail rates are headed in the next 48 hours.

2. The 500 Floor

Economists have been debating if there is a "floor" to how low the usd to costa rica colon can go. Psychologically, 500 colones per dollar is a massive barrier. Every time the rate gets close to that, the Central Bank tends to get aggressive. If you see the rate approaching 500, that’s usually a signal that the "cheap dollar" party might be pausing.

3. Diversify Your Cash

Don't keep all your eggs in one basket. If you're living there, keep some money in a CRC account for daily expenses and some in USD for big purchases. This hedges your risk. If the colon suddenly devalues (which has happened historically), your USD savings will act as a safety net.

📖 Related: 40 Quid to Dollars: Why You Always Get Less Than the Google Rate

Why the Future of the Exchange Rate is Uncertain

Costa Rica is a "frontier market" in many ways. It’s small, which means it’s sensitive to global shifts. If the US Federal Reserve raises interest rates, it usually pulls money out of emerging markets like Costa Rica and back into the US, which would weaken the colon. But if the US economy stumbles, investors might look for stability in "green" havens like Costa Rica.

There is also the debt issue. Costa Rica has a significant amount of external debt. To pay it off, the government needs colones to be worth something, but they also need a functional export economy. It’s a balancing act that would make a tightrope walker nervous.

Actionable Steps for Your Next Transaction

Stop worrying about the day-to-day fluctuations unless you are moving millions. For the average person, the "noise" of the usd to costa rica colon is just that—noise. However, you can save hundreds of dollars by following these specific steps:

- Check the BCCR Official Site: Always look at the Tipo de Cambio on the Banco Central de Costa Rica website before doing a large exchange. This is the "true" north for the currency.

- Avoid Weekend Exchanges: Rates often "freeze" over the weekend at a less-than-favorable spread. If you can wait until Tuesday or Wednesday when the market is fluid, do it.

- Use Apps like Wise or Revolut: If you need to send money to a Costa Rican bank account, these services are significantly cheaper than traditional wire transfers, which can eat $40-$50 in fees regardless of the amount.

- Negotiate in the Local Currency: If you are buying a car or renting a house long-term, try to negotiate the price in the currency you earn in. If you earn dollars, pay in dollars. This removes the "exchange rate risk" from your monthly budget.

The days of the 600+ colon are, for now, in the rearview mirror. Whether we ever see them again depends on the global appetite for Costa Rican exports and how long the "Super Colon" can sustain its strength without breaking the back of the local tourism industry. Keep your eyes on the Central Bank’s announcements and always have a backup plan for your cash.