Honestly, if you looked at the ticker for the Dow Jones Industrial Average this weekend, you might’ve felt a bit of whiplash. We just wrapped up a week that felt like a tug-of-war between high-tech optimism and old-school political nerves.

The Dow closed Friday, January 16, 2026, down about 79 points, landing at 49,359.33.

💡 You might also like: NVIDIA Stock Explained (Simply): Why It’s Trading at This Level Today

That’s a slight 0.17% dip. Not a crash, obviously. But it’s a weird spot to be in when you consider that just a few days ago, the "Blue Chips" were knocking on the door of the 50,000 milestone. It’s like the market is holding its breath. We’re standing on the edge of a massive psychological barrier, and nobody seems to want to be the one to push it over the line before the long weekend.

What Actually Moved the Needle Today?

You can’t talk about the Dow today without looking at the specific companies dragging the chain. Salesforce (CRM) took a nasty 2.76% hit, and UnitedHealth (UNH) wasn’t far behind, dropping 2.33%. When you only have 30 stocks in an index, these big moves by the heavy hitters really start to sting.

On the flip side, IBM and American Express were out here doing the heavy lifting, both gaining over 2%. It was a classic "mixed bag" scenario.

But why the hesitation? It’s not just about one or two companies. There is a lot of "noise" coming out of Washington and the global stage right now.

- The Fed Chair Drama: Jerome Powell’s term ends in May. The rumor mill is working overtime. Will it be Kevin Warsh? Is Kevin Hassett still in the running? Markets hate "maybe," and right now, the future of the Federal Reserve is a giant "maybe."

- The Venezuela Factor: We’re still seeing the ripple effects of the regime change in Venezuela. While the promise of 30 to 50 million barrels of oil hitting the U.S. sounds great for gas prices, the energy sector is actually sliding. Chevron and other oil giants are feeling the pressure as crude prices pull back to around $56.

- Geopolitical Weirdness: There’s even talk about Greenland and U.S. trade deals with Taiwan that are keeping investors on their toes. It’s a lot to process for a Friday afternoon.

The 50,000 Question: Is a Bubble Forming?

People are starting to get nervous. We’ve had an incredible run. If you look at the 10-year Treasury yield, it’s sitting around 4.14%. That’s stable-ish, but the "bubble" word is starting to pop up in conversations from Davos to Wall Street.

Cathie Wood over at ARK is calling the economy a "coiled spring" ready to bounce even higher due to AI productivity. Meanwhile, others are pointing at the sheer speed of the ascent since the start of the year as a reason to be cautious.

"I do not understand what the credit bureaus are doing with their pricing—they are inviting a lot of scrutiny." — Bill Pulte, FHFA Director.

When regulators start sounding off on X (formerly Twitter) about credit pricing and interest rate caps, bank stocks get twitchy. We saw Goldman Sachs and Morgan Stanley rally earlier in the week on strong earnings, but that enthusiasm is being tempered by talk of new legislation that could cap credit card interest rates at 10%. That’s a massive deal for the Dow’s financial components.

Decoding the Sector Split

It’s basically a tale of two markets right now.

The Tech and Space Rally

While the Dow was sluggish, certain niches were on fire. AST SpaceMobile (ASTS) jumped over 14% after snagging a government contract. Firefly Aerospace followed suit. It feels like the "frontier" stocks are where the excitement is, even if the staid old industrials are taking a nap.

The Banking Tug-of-War

The Dow is heavy on financials. Earlier this week, Goldman Sachs blew past estimates with earnings of $14.01 per share. That should have been a slam dunk for a rally. But then the "Credit Card Competition Act" talk heated up. JPMorgan and Visa investors are suddenly looking at the exit door, worried that "price fixing" (as some call it) will eat into those fat profit margins.

Why Most People Get the Dow Wrong

People often treat the Dow and the S&P 500 like they’re the same thing. They aren't. Not even close.

The Dow is price-weighted. This means a stock with a high share price—like UnitedHealth—has way more influence than a company with a lower share price, regardless of how big the company actually is. When UNH drops 2%, it pulls the Dow down much harder than a 2% drop in a cheaper stock would.

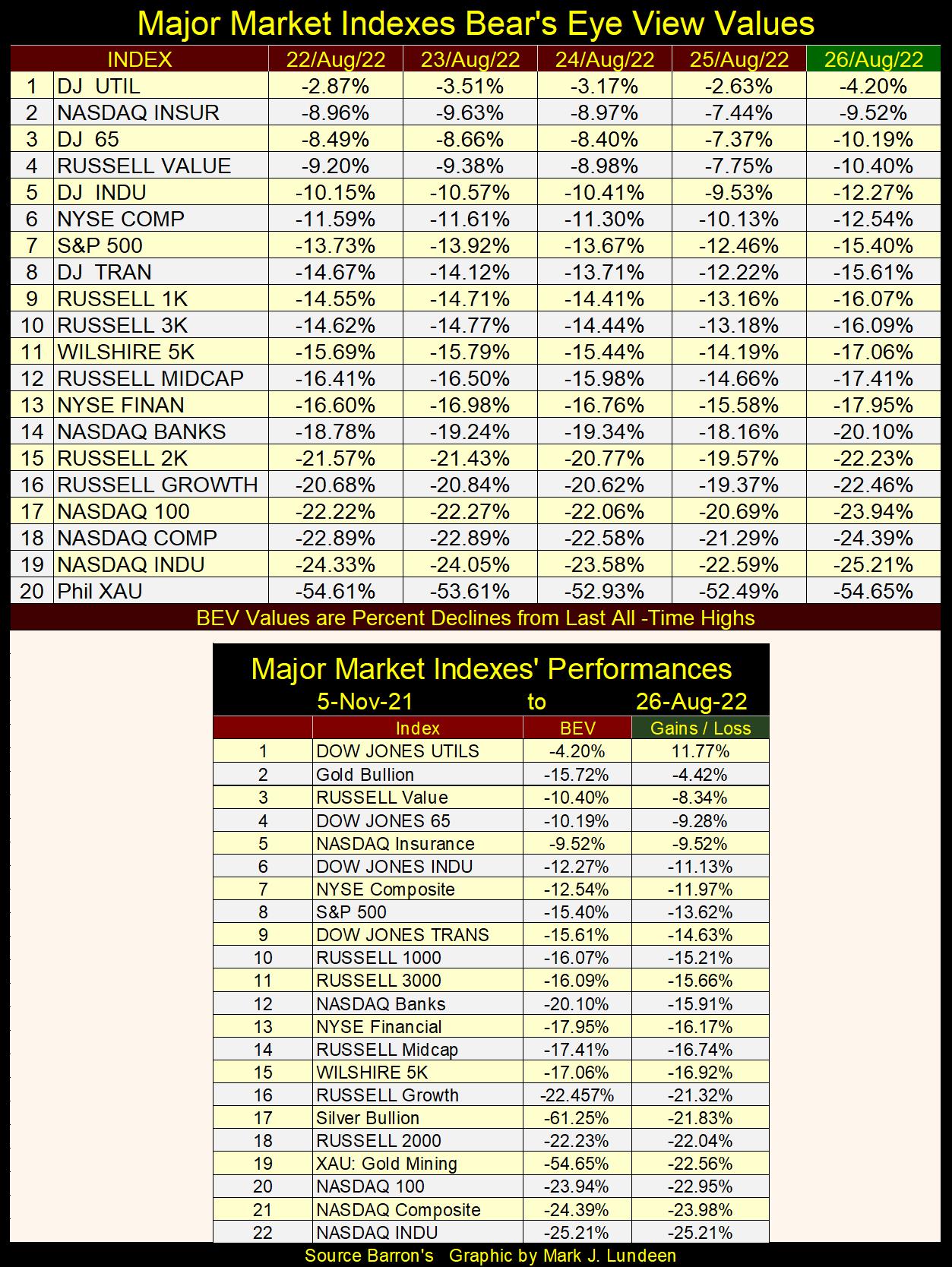

[Image comparing the price-weighting of the Dow Jones vs. the market-cap weighting of the S&P 500]

That’s why the Dow can feel "stuck" even when the rest of the market feels like it’s flying. If the high-priced members aren't participating, the index doesn't move. Right now, the "expensive" members are the ones looking a bit tired.

What to Watch Next Week

The market is closed for the holiday, so we’ve got a long weekend to digest the data. Here’s what’s actually worth your time:

- The 49,250 Support Level: If the Dow breaks below this, we might see a more significant pullback. Technical analysts are watching this number like hawks.

- More Bank Earnings: We’re still in the thick of earnings season. Any more surprises from the big lenders will dictate the direction for the rest of January.

- The "Trump Trade" Evolution: Between Venezuelan oil and new semiconductor deals with Taiwan, the administration’s trade policy is moving fast. Every Truth Social post is a potential market mover.

Actionable Insights for Your Portfolio

Don't panic about a 79-point drop. In a 49,000-point index, that’s just noise. Instead, look at the rebalancing happening. Money is moving out of over-leveraged tech and into "real-world" assets like space infrastructure and reformed energy.

Keep an eye on the 10-year Treasury yield. If it stays below 4.2%, the environment remains relatively friendly for stocks. If it spikes, that 50,000 dream for the Dow might have to wait until spring.

Basically, the Dow Jones Industrial Average is in a "wait and see" mode. You should probably be, too. Focus on quality, watch the policy shifts in D.C., and don't get distracted by the daily ticks. The long-term trend still looks bullish, but the road to 50k is proving to be a bit bumpy.