Walk through the bustling Makola Market in Accra today, and you’ll hear a different kind of chatter. It’s not just about the price of tomatoes or wax prints. It’s about the "greenback." Honestly, if you’ve been tracking the dollar to ghana cedi rate lately, you know the vibe has shifted. It’s no longer just a story of "everything going up." It’s actually gotten... kinda weird.

In 2025, the cedi did something nobody saw coming. It gained over 40% against the dollar. Think about that. For a currency that has been the poster child for depreciation for thirty years, that was a massive shock to the system. But now we are in January 2026, and the honeymoon phase is hitting some real-world friction.

The Cedi Reality Check in 2026

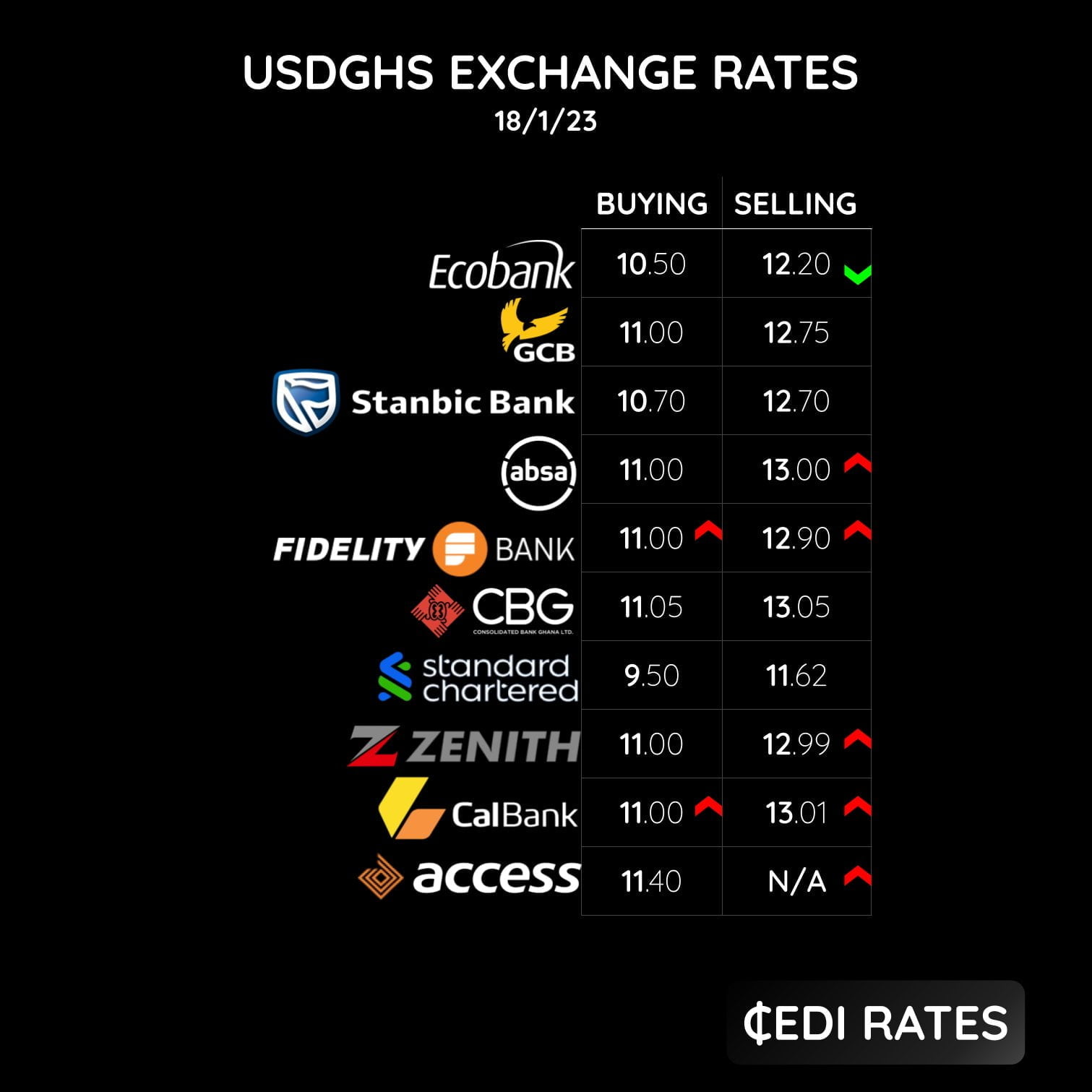

Right now, the rate is hovering around 10.83. One day it’s 10.70, the next it’s pushing 10.95 at the forex bureaus. If you go to Stanbic or GCB Bank, you’ll see the "selling" rate nearly touching 11.00.

Why the sudden itchiness?

Basically, the holidays are over. When the decorations come down in Osu, the bills come due for importers. Companies are scrambling for dollars to restock after the Christmas rush. The energy and construction sectors are particularly hungry right now. Andrews Akoto from Absa Bank Ghana noted recently that corporate demand is staying "firm," which is code for "there aren't enough dollars to go around easily."

What the Bank of Ghana is Doing (And Why it Matters)

The central bank isn't just sitting there. They’ve announced a plan to pump about $1 billion into the market this month alone. That’s a huge chunk of change.

The goal isn't to make the cedi super strong. They just want to stop it from "misbehaving," as some local analysts like to put it. By auctioning these dollars to commercial banks, they’re trying to prevent those wild 5% jumps that ruin a business owner's week.

- The Gold Factor: A lot of these dollars are coming from the "Gold for Oil" and national gold purchase programs.

- Reserves: Ghana’s gross international reserves are sitting at roughly $13.8 billion.

- Import Cover: That’s about 5.7 months of imports, which is a decent safety net.

The Inflation Plot Twist

Here is what most people get wrong: they think the exchange rate is the only thing that matters for prices.

Actually, it’s the other way around. Inflation in Ghana dropped to 5.4% in December 2025. That is the lowest it has been since 2002. When inflation stays low, the Bank of Ghana feels comfortable cutting interest rates. Lower interest rates usually make a currency weaker, but because Ghana’s inflation is falling so fast, the "real" value of the cedi is actually holding up surprisingly well.

📖 Related: 3rd quarter estimated tax due date 2024: Why the September Deadline Caught So Many People Off Guard

It’s a delicate balancing act. If the bank cuts rates too fast to help businesses, investors might pull their money out and put it back into US Treasury bonds. If they keep rates too high, the economy suffocates.

The "Black Market" vs. The Bank

You've probably noticed that the rate you see on Google isn't the rate you get at the "bureau de change" in High Street.

There's always a gap.

In mid-January 2026, while the interbank rate sits at 10.83, some retail outlets are selling at 11.70. That spread is where the "panic" lives. If you are an individual looking to change $500, that gap hurts. If you are a company moving $500,000, that gap is a catastrophe.

💡 You might also like: Sonata Software Share Price: What Most People Get Wrong

Why the Cedi is Still Vulnerable

- The 2026 Election Cycle: We are heading into an election year. History tells us that Ghanaian governments like to spend money during election years.

- IMF Program: The current IMF arrangement is wrapping up this year. The market is nervous about what happens when the "strict parent" leaves the room.

- Dividend Season: In the first quarter, many big multinational companies in Ghana (like the telcos and mines) send their profits back to their home countries. They need dollars to do that.

Actionable Insights for 2026

If you are holding dollars or need to buy them, the "wait and see" approach is risky. The dollar to ghana cedi rate is currently in a period of "managed volatility."

For Businesses: Don't wait for a "dip" that might not come. If you have a shipment arriving in February, locking in your forex now through forward contracts with your bank is smarter than gambling on the spot market. The Bank of Ghana's $1 billion intervention will help, but the backlog of demand is still there.

For Individuals: If you're receiving remittances from the US or UK, the cedi's relative strength means your "cedi power" isn't as high as it was two years ago. However, since local inflation is down to 5.4%, your money actually buys more bread and fuel than it did when the rate was 15.00.

🔗 Read more: Trump Tariffs: Why an Island of Penguins Is Paying the Price

Watch the Gold Coin: The Bank of Ghana is still pushing the "Ghana Gold Coin" as an alternative investment. If you want to hedge against the dollar without actually holding greenbacks, it’s a legitimate local option that avoids the forex bureau headache.

The cedi has moved past the "crisis" phase of 2023 and 2024. We are now in a phase of "stabilization." It won't be a straight line—expect some bumps in March—but the days of the cedi falling off a cliff every Tuesday seem to be in the rearview mirror for now. Keep an eye on the monthly inflation prints; if they stay under 6%, the cedi has a fighting chance to end the year under 12.00.