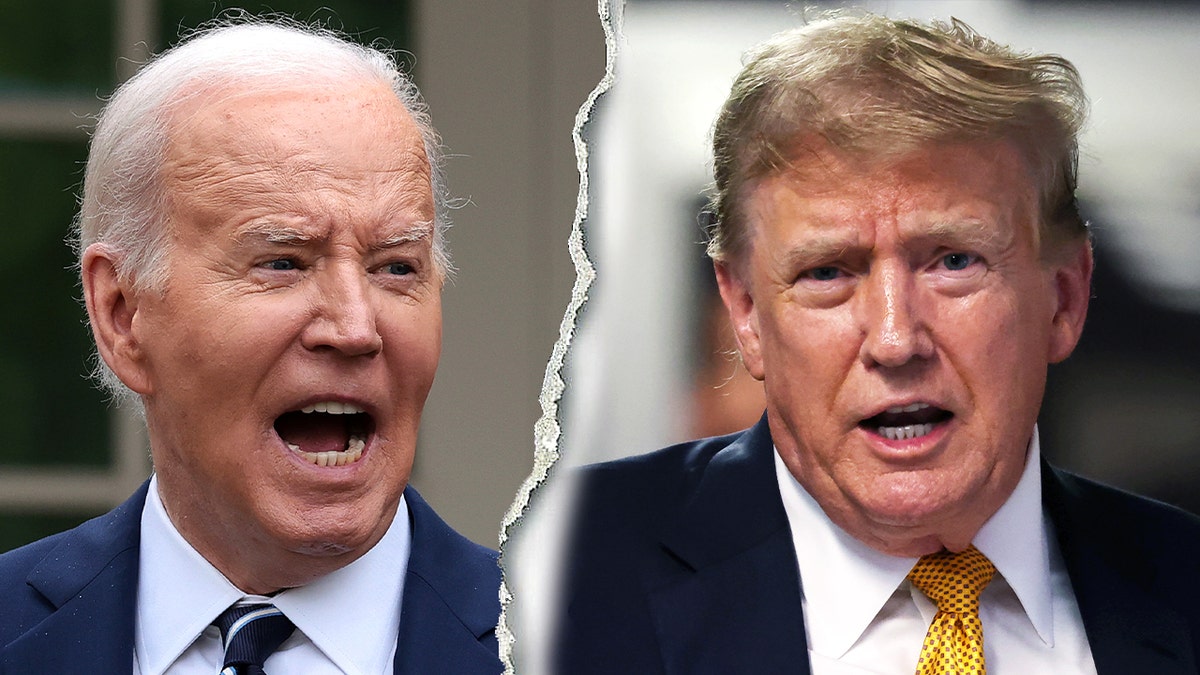

When Joe Biden was on the campaign trail back in 2020, he didn’t exactly hide his feelings about Donald Trump’s trade wars. He called the tariffs "shortsighted" and argued that American consumers—not China—were the ones actually footin' the bill. Most folks naturally assumed that once he got into the Oval Office, he’d start tearing those trade barriers down faster than a cheap fence in a hurricane.

But then he took office. And... nothing happened.

Honestly, it’s one of the biggest "gotcha" moments in modern trade policy. If you’re looking for a quick answer: Yes, Biden kept almost all of Trump’s tariffs in place. But he didn't just let them sit there gathering dust. In 2024, he actually cranked them up to levels that would make even the most hardcore protectionist blink.

The Four-Year Review That Changed Everything

For a long time, the Biden administration just sorta hung out in a state of "strategic review." They kept the Section 301 tariffs—the ones targeting roughly $300 billion to $350 billion worth of Chinese imports—exactly where Trump left them. Businesses were screaming for relief, and many economists were scratching their heads.

Then came May 2024.

After a massive four-year review by the Office of the U.S. Trade Representative (USTR), the White House didn't just say they were keeping the old stuff. They announced a massive new wave of hikes. They basically took Trump's foundation and built a skyscraper of new taxes on top of it.

Why the sudden change of heart?

Washington shifted. It’s not just about "trade" anymore; it’s about "national security" and "economic resilience." The Biden-Harris team decided that if they wanted to build a domestic green energy industry (EVs, solar, batteries), they couldn't let China flood the market with cheap, subsidized goods.

It’s a weird paradox. You want people to buy electric cars to save the planet, but you make those cars way more expensive by taxing the parts. Politics is messy like that.

Breaking Down the New Math (2024-2026)

If you think a 25% tariff is high, wait until you see the new numbers. We aren't talking about small tweaks here. We're talking about doubling, tripling, or even quadrupling the costs of certain items coming from China.

Let's look at the heavy hitters:

📖 Related: Straight to Hell Book: What Really Happened Behind the Scenes of Wall Street

- Electric Vehicles (EVs): This is the big one. Biden took the existing 25% tariff and shoved it all the way up to 100% in 2024. Basically, if a Chinese EV costs $30,000, the tax alone is now $30,000. It's a wall, plain and simple.

- Semiconductors: These are jumping from 25% to 50% by 2025. With the CHIPS Act trying to bring manufacturing back to the U.S., the government wants to make sure Chinese chips don't undercut the new American factories.

- Solar Cells: These also doubled from 25% to 50% in 2024.

- Lithium-Ion EV Batteries: These went from a relatively low 7.5% up to 25% in 2024. Other non-EV lithium batteries will follow suit in 2026.

- Steel and Aluminum: These jumped to 25% for a wide range of products that were previously at 0% or 7.5%.

It’s a massive list. It even hits medical supplies. Syringes and needles? Those went to 100% almost immediately. Face masks? They’ll be at 50% by 2026.

Did He Remove Any Tariffs?

You'd think there would be some "give" to go with all that "take." Not really.

There were a few tiny olive branches. For example, Biden worked out a deal with the European Union to move away from "flat" tariffs on steel and aluminum and toward a "quota" system. It basically means the first X amount of steel from the EU comes in duty-free, and anything over that gets hit with a tax.

But for China? No. The USTR specifically said they wouldn't eliminate any of the Section 301 tariffs. They did, however, open up a "machinery exclusion process." This is a bit of a lifeline for American manufacturers who need specific Chinese-made machines to build stuff here in the States. If you can prove you can't get the machine anywhere else, you might get a temporary pass on the tariff.

The "De Minimis" Loophole Crackdown

If you've ever ordered a $10 t-shirt from Shein or Temu, you’ve used the "de minimis" rule. It’s a loophole that allows packages worth less than $800 to enter the U.S. without any tariffs or inspections.

In late 2024, the Biden administration moved to shut this down for any products that are already covered by those big China tariffs. They realized that while they were taxing big shipping containers at the port, millions of small boxes were flying right over the wall via air mail. It’s a huge blow to those ultra-fast-fashion giants, and it shows just how serious the government has become about enforcement.

Real-World Impact: Who Is Actually Paying?

Here is the part where it gets kind of uncomfortable. Despite the political rhetoric about "making China pay," most non-partisan studies—like those from the Tax Foundation and the Yale Budget Lab—consistently show that American importers and consumers bear the weight.

When a 100% tariff hits an EV battery, the Chinese factory doesn't just write a check to the U.S. Treasury. The American car company pays that tax when the battery arrives at the dock. To keep their profit margins, that car company then raises the price of the car.

By the start of 2026, the overall effective tariff rate in the U.S. hit roughly 16.8%. That is the highest it’s been since the 1930s. It’s a massive shift away from the "free trade" era we all grew up in.

What Most People Get Wrong

People often think Biden "kept" the tariffs because he was lazy or just didn't want to look "soft on China" during an election year. While the politics definitely mattered, it's deeper than that.

There is a genuine "paradigm shift" happening in Washington. Both parties now largely agree that the U.S. became too dependent on China for critical goods. Whether it's the chips in your phone or the minerals in your car battery, the goal is now "de-risking." Tariffs are the blunt instrument being used to force companies to move their factories to places like Vietnam, Mexico, or back to Ohio and Arizona.

💡 You might also like: Delivering in a Sentence: Why Your Pitch Fails Without One

What This Means For You (Actionable Insights)

If you’re a business owner or even just a shopper, you can't ignore this. The "low-cost China" era is basically over. Here is what you should actually do:

- Audit Your Supply Chain: If you’re importing parts, check their HTS (Harmonized Tariff Schedule) codes. Many items that were safe in 2023 are getting hit with 25% or 50% hikes in 2025 and 2026.

- Apply for Exclusions: If you use specialized manufacturing machinery, keep an eye on the USTR portal. The "machinery exclusion" window is narrow, but it can save a mid-sized factory millions of dollars.

- Watch the "De Minimis" Changes: if you run an e-commerce business relying on direct-to-consumer shipping from overseas, your shipping costs and customs paperwork are about to get a lot more complicated.

- Expect Sticky Inflation: While overall inflation has cooled, products in "protected" sectors (like electronics and building materials) are going to stay expensive because of these trade barriers.

The bottom line? Biden didn't just keep Trump's tariffs—he turned them into a permanent fixture of the American economy. We are living in a new age of "managed trade," where the price of your next car or laptop is as much about geopolitics as it is about supply and demand.