Amazon isn't just a store anymore. Honestly, if you still think of it as "the place where I buy laundry detergent," you’re missing the entire investment thesis for the next decade. Right now, in early 2026, we’re seeing a massive shift in how the market values this beast.

Amazon stock in 5 years is going to look less like a retail play and much more like a toll booth for the entire digital economy.

Some analysts are throwing around a $5 trillion market cap by 2030 or 2031. It sounds nuts. That would mean the stock price hitting roughly $490 to $500 per share, nearly doubling from where we sit today. Is it possible? Well, when you look at the math behind AWS and the advertising explosion, it starts to look less like a "maybe" and more like a mathematical inevitability.

The AWS Engine is Catching a Second Wind

Cloud computing was supposed to slow down. Everyone said the "easy growth" was over. Then Generative AI walked into the room.

AWS is currently seeing growth rates accelerate back toward 20% year-over-year. Why? Because you can't run a massive AI model on a laptop. Companies are renting "digital real estate" from Amazon at a record pace. CEO Andy Jassy recently noted that AWS is on track to double its power capacity by 2027. They aren't building these data centers for fun; they're building them because the demand is relentless.

💡 You might also like: Who Is the Owner of Zappos: What Really Happened to the Shoe Giant

By 2031, AWS could easily be generating over $80 billion in operating profit alone. That’s not revenue—that’s the money left over.

Advertising: The Quiet Gold Mine

You’ve noticed the ads on Prime Video, right? Kinda annoying as a viewer, but as a shareholder? It’s brilliant.

Amazon’s advertising business is growing faster than almost any other part of the company. It’s sitting at about a 22-23% growth rate. Think about it: when you go to Google, you’re looking for information. When you go to Amazon, you’re looking to spend money. That makes Amazon’s ad space the most valuable real estate on the internet.

In 2025, ad revenue breached the $60 billion mark. By the time we reach 2031, this segment could be contributing $50 billion or more to the bottom line. The margins here are rumored to be in the 30% to 40% range, similar to Meta.

What Most People Get Wrong About the Retail Side

The "Store" part of Amazon is often called a drag on profits. But that’s a surface-level take.

- Robotics: Amazon is deploying a literal army of robots. We’re talking about "Project Leo" (the rebranding of their logistics tech) and fulfillment centers that are increasingly autonomous.

- Regionalization: They stopped shipping everything from one central hub and started acting like a network of local stores. This slashed shipping costs.

- The "Everything" Infrastructure: Amazon is now a logistics company that happens to sell its own stuff. They are competing with UPS and FedEx, and they’re winning.

Amazon Stock in 5 Years: A Reality Check

Not everyone is a bull. It's worth acknowledging the "bear case" because blind optimism is how portfolios die.

The biggest risk? Regulation. The FTC is constantly breathing down their neck. There’s also the "satellite risk." Project Kuiper (now sometimes referred to as Amazon Leo) is a massive capital sink. They need to get thousands of satellites into orbit to compete with Starlink. If they miss their FCC deadlines or the tech fails, that’s billions of dollars down the drain.

Also, Microsoft Azure is a real threat. AWS is the king, but Azure is a very hungry prince. If Amazon loses the AI infrastructure war to Microsoft, the $5 trillion dream evaporates.

The Numbers That Actually Matter

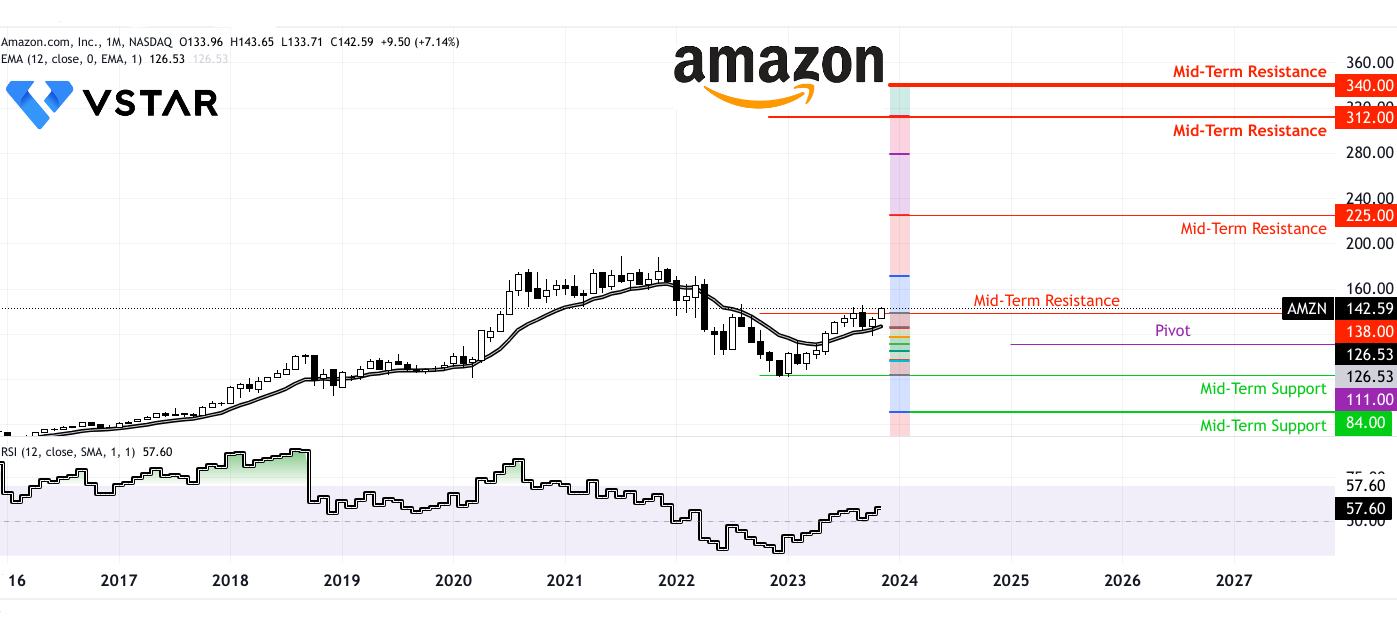

If we look at the consensus of 55+ analysts tracking the stock in 2026, the average one-year price target is hovering around $295. But the long-term projections—the ones looking at 2030—range from a conservative $250 (the "everything goes wrong" scenario) to over $430 in a bull market.

📖 Related: What the Shein distribution center photos actually tell us about fast fashion

To hit that $5 trillion mark, Amazon needs to grow its operating profits by about 20% annually. They’ve done 40% annually over the last 13 years. So, asking for 20% is actually... kinda conservative?

How to Play This

If you're looking at amazon stock in 5 years, don't get distracted by the quarterly noise.

- Watch AWS Margins: If these stay above 30%, the engine is healthy.

- Track Ad Revenue Share: It’s currently about 10% of total revenue. If it hits 15%, the stock re-rates higher.

- Ignore the "PE Ratio" Trap: Amazon always looks expensive on a P/E basis because they reinvest every cent into growth. Look at "Operating Cash Flow" instead.

The next five years won't be a straight line up. There will be "pull-forward" crashes like we saw in 2022. But the diversification into AI, high-margin ads, and satellite internet makes this a very different company than the one that survived the dot-com bubble.

Actionable Insight: If you're an investor, the "palatable entry point" is usually during the mid-year lulls when people worry about "consumer spending slowing down." The real value isn't in the packages on your porch; it's in the servers you never see.

Monitor the Project Kuiper launch schedule through the end of 2026. If they meet the July 2026 FCC deadline for satellite deployment, it clears one of the biggest "dark clouds" hanging over the stock's long-term valuation.