You’re standing at a kiosk in Heathrow or maybe just staring at a checkout screen on a UK-based website, wondering why 100 GBP to dollars doesn't look like the number you saw on Google five minutes ago. It's frustrating. You see one rate on your phone, but the actual math hitting your bank account feels like a punch in the gut.

The truth is that the "mid-market rate" is a bit of a lie for most of us.

When you search for the value of 100 British pounds, you're usually seeing the interbank rate—the price banks charge each other. But you aren't a bank. You're a person trying to buy a pair of boots from a boutique in London or prep for a trip.

Exchange rates are alive. They breathe. They move based on what the Bank of England says about inflation and how the Federal Reserve feels about interest rates in D.C. If you want to get the most out of your money, you have to stop looking at the conversion as a fixed math problem and start looking at it as a timing and platform problem.

Why 100 GBP to Dollars Changes While You’re Sleeping

Markets don't sleep. While you’re tucked in bed in New York, traders in Tokyo and London are screaming at screens, reacting to the latest employment data or a random comment from a central banker. This constant flux means that 100 GBP to dollars can fluctuate by 1% or 2% in a single afternoon. That might only be a few dollars on a small transaction, but if you're doing this repeatedly, you're essentially burning cash.

The British Pound (GBP) is often nicknamed "Cable." This goes back to the 19th century when a giant cable under the Atlantic synced the exchange rates between the London and New York stock exchanges. Today, that cable is fiber-optic and moves at light speed, but the volatility remains.

💡 You might also like: Stock Market Today: What Really Happened Behind the Record Highs

Politics drives this more than anything else. Look back at the "Mini-Budget" crisis of 2022. The pound plummeted to near-parity with the dollar. People were panicking. If you were holding 100 GBP then, it was worth barely $103. A few months later? It bounced back toward $1.25. That’s a massive swing for such a short window. It proves that the "value" of your money is actually just a reflection of global confidence in the UK government’s ability to manage its debt.

The Spread: Where Your Money Actually Goes

If the official rate says 1 GBP is $1.30, your bank will probably charge you $1.34 to buy that pound. Or, if you're selling, they’ll only give you $1.26. That gap is the "spread."

Retail banks are notorious for this. They hide their fees inside a bad exchange rate so they can claim "zero commission." It’s a marketing trick. You’re still paying; you just can’t see the bill. When you convert 100 GBP to dollars at an airport booth like Travelex, you might lose $10 to $15 just in the spread and convenience fees.

Honestly, it’s a racket.

How to Get the Best Rate Without Getting Scammed

Stop using airport kiosks. Just don't do it. They have captive audiences and they know it. If you need physical cash, use an ATM from a major bank once you land, and always—always—choose to be charged in the "local currency."

When a machine asks if you want them to do the conversion for you, say no. That’s called Dynamic Currency Conversion (DCC). It’s a way for the ATM owner to apply their own terrible exchange rate on top of whatever your bank is already charging. By choosing the local currency (GBP if you're in the UK, USD if you're in the States), you force your home bank to handle the math, which is almost always cheaper.

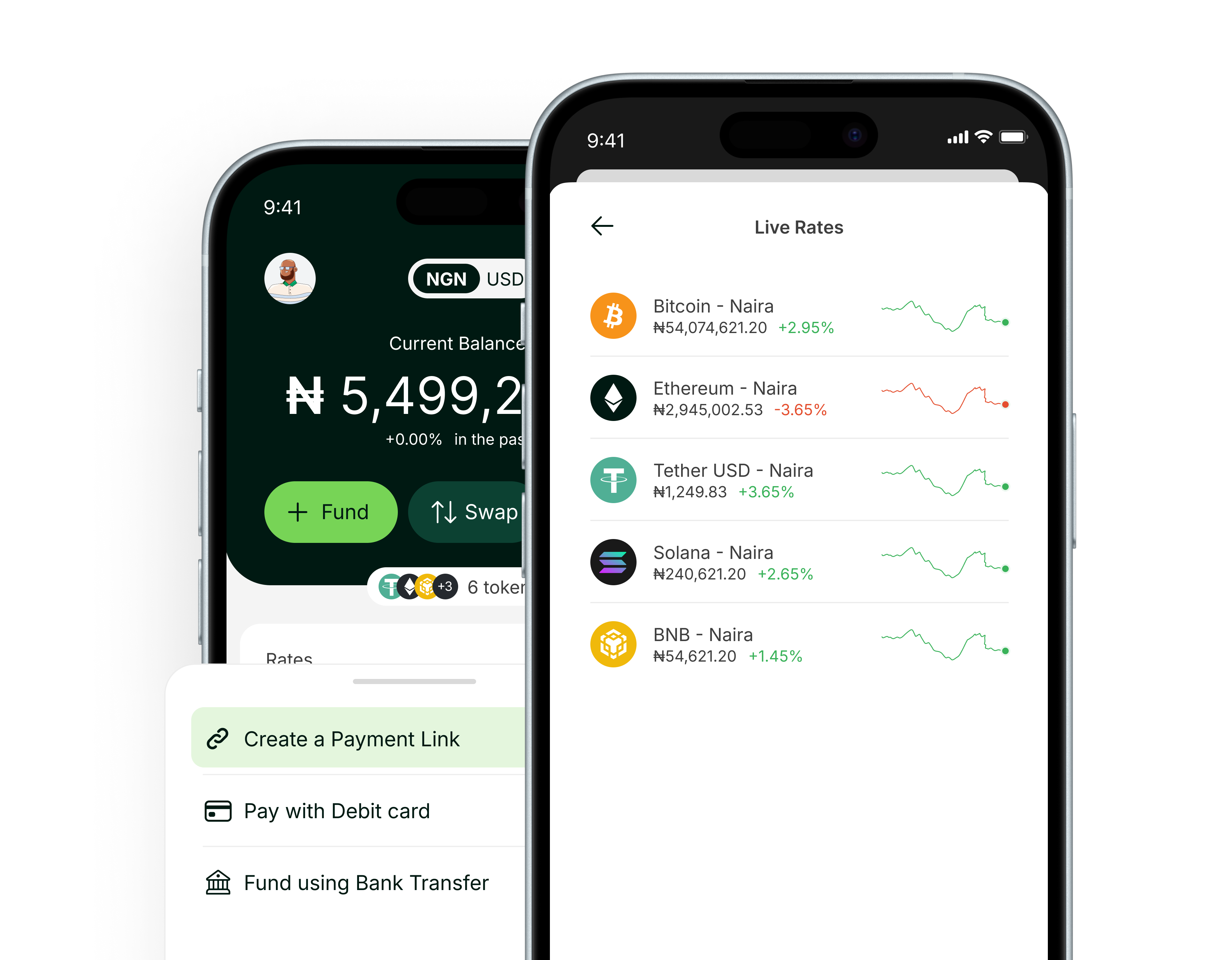

Digital-first banks are changing the game here. Companies like Revolut or Wise (formerly TransferWise) use the actual mid-market rate. They charge a tiny, transparent fee—usually less than 1%—instead of hiding it in the spread. If you convert 100 GBP to dollars on Wise, you’ll likely end up with several more dollars in your pocket than if you used a traditional wire transfer from a high-street bank like HSBC or Barclays.

The "Cost of Living" Context

It's one thing to know the math; it's another to know the "vibe" of the money. In 2024 and 2025, inflation in the UK has been a rollercoaster.

100 GBP doesn't buy what it used to in London. You might get a decent dinner for two at a mid-range gastropub, or maybe two tickets to a West End show if you’re sitting in the "nosebleed" section. When you convert that 100 GBP to dollars, you're looking at roughly $125 to $130 depending on the month. In most American cities, $130 feels roughly equivalent in purchasing power, though tipping culture in the US will eat into that faster than it would in the UK.

Timing Your Conversion Like a Pro

If you see the pound hitting a six-month high against the dollar, and you have an upcoming trip to the US, lock it in. Don't wait.

📖 Related: Anil Ambani Reliance Power: Why the Comeback Story is Getting Complicated

The pound is currently sensitive to "interest rate differentials." Basically, if the Bank of England keeps rates high while the Fed starts cutting them, the pound gets stronger. Investors want the higher yield, so they buy pounds. This pushes the price of your 100 GBP to dollars conversion up.

Conversely, if the UK economy looks stagnant—which has been a recurring theme lately—the pound softens.

Keep an eye on the "Purchasing Power Parity" (PPP). This is the idea that, eventually, exchange rates should adjust so that a basket of goods costs the same in both countries. The "Big Mac Index" from The Economist is a famous, if slightly silly, way to track this. Historically, the pound has often been "overvalued" against the dollar, making the UK feel expensive for Americans. But that gap has closed significantly over the last decade.

Real-World Example: Buying Software or Goods

A lot of people encounter the 100 GBP to dollars issue when shopping online. Many UK brands don't adjust their prices daily. They might set a price of £100 and $140. If the actual exchange rate means £100 is only worth $128, you are getting ripped off by $12 just by clicking the "USD" button on their site.

Always check if you can pay in the original currency of the store. If your credit card has "no foreign transaction fees" (like many travel cards), your card issuer will give you a much better rate than the merchant's website will.

Actionable Steps for Your Money

Don't just stare at the chart. If you need to move money, do it smartly.

🔗 Read more: How to Make Money with Fiverr Without Losing Your Mind

First, check your credit card's benefits. If you have a card that offers 0% foreign transaction fees, use it for every single purchase. This effectively gives you the best possible 100 GBP to dollars rate without you having to do any work.

Second, download a dedicated currency app. XE is the gold standard for tracking, but Wise is better for actually moving the money.

Third, if you are a business owner or someone moving large amounts, look into "forward contracts." This lets you lock in today’s rate for a transfer you don't need to make for another few months. It protects you from the sudden "flash crashes" that have haunted the pound since the Brexit vote.

Finally, stop thinking in round numbers. $100 and £100 are not the same thing and likely won't be in our lifetime. The "psychological parity" messes with your spending habits. Always do the quick "plus 25 percent" mental math when looking at British prices to see what they actually cost in American terms. It'll save you from a nasty surprise when your bank statement arrives.

To maximize your value, avoid the big banks for the actual conversion, use travel-specific fintech tools for spending, and always decline the "convenience" of having a merchant do the conversion for you at the point of sale. That's how you keep your 100 GBP from shrinking into a measly sum of dollars.