You've probably seen the line item on your paystub or your company’s ledger by now. It’s been there since 2023. FAMLI. It stands for Family and Medical Leave Insurance, and honestly, it’s been a bit of a headache for Colorado HR departments and small business owners who were already drowning in paperwork. But now, things are shifting. We are entering the era of the Colorado FAMLI unemployment audit, and if you haven't tightened up your record-keeping, you might be in for a rude awakening.

It’s not just about paying the premium anymore. It’s about verification.

The Colorado Department of Labor and Employment (CDLE) isn't just sitting back. They are cross-referencing data. They’re looking at what you reported for unemployment insurance (UI) and comparing it directly to what you reported for FAMLI. If those numbers don't match up—even by a few cents—the system flags it. That’s basically how the audit trail starts.

✨ Don't miss: TransUnion Unfreeze Phone Number: How to Thaw Your Credit Fast

Why the State is Auditing FAMLI and Unemployment Now

The state spent the last couple of years just trying to get the portal, My FAMLI+ Employer, to stop glitching. Now that the system is stable, the Division of Family and Medical Leave Insurance is getting serious about enforcement. Think about it. The state is managing a massive pool of money funded by a 0.9% premium on employee wages. They have a fiduciary responsibility to make sure everyone is paying their fair share.

If you’re a business with 10 or more employees, you’re on the hook for at least 0.45% of those wages, with the employee covering the other half. Smaller shops? You just collect and remit the employee's portion. It sounds simple until you realize that "wages" for FAMLI aren't always defined exactly the same way as "wages" for Federal Unemployment Tax Act (FUTA) or even standard state UI in every single edge case.

Discrepancies happen. You might have a 1099 contractor that you accidentally included in your FAMLI count. Or maybe you had a severance package that you handled differently across different tax forms. These are the "red flags" that trigger a Colorado FAMLI unemployment audit. The CDLE has been very clear that they are looking for consistency across all payroll-related filings.

The Most Common Mistakes That Trigger an Audit

Let’s be real: most people aren't trying to cheat the system. They’re just confused. One of the biggest issues is the "Small Employer" exemption. If you have fewer than 10 employees, you don't pay the employer share. But wait. How does the state count those 10 employees? They look at the average number of employees across the previous year. If you hovered around 9 or 10, and your UI filings show 11 while your FAMLI filings show 9, you’re going to get a letter.

Then there’s the "Private Plan" trap.

Some companies opted out of the state run program because they already offered a better internal leave policy. That's fine. It's allowed. But you had to get that plan approved by the state. If you stopped paying premiums because you thought your private plan was good enough, but you never got the official state seal of approval, you are technically delinquent. An audit will find that instantly.

✨ Don't miss: Turning Off Open to Work on LinkedIn Without Making Things Awkward

I’ve talked to accountants who say the biggest mess comes from localized businesses that have employees drifting across state lines. If you have a worker living in Cheyenne but working in a Fort Collins office, where are you paying those premiums? Colorado is aggressive about claiming those wages if the work is "localized" here. If your UI reports show a Colorado presence but your FAMLI reports are missing people, the audit bells start ringing.

Surviving the Audit: What Documents Actually Matter?

If you get that notification, don't panic. But don't ignore it either. The state isn't looking to bankrupt you; they want their data corrected and their premiums paid. You’re going to need a "Source of Truth" document. Usually, this is your payroll register for the last eight quarters.

You’ll need to show:

- Individual employee social security numbers and gross wages.

- Documentation of "excluded" wages (like certain types of insurance premiums).

- Proof of your employee count for every month of the calendar year.

- Copies of your filed Form UITR-1 (Unemployment Insurance Tax Report).

It’s a lot. If you’re using a big provider like ADP or Gusto, they usually have a "FAMLI Reconciliation" report you can pull. If you’re doing this manually on Excel? Godspeed. You’re going to need to justify every single person listed on those sheets.

The "Social Security" Discrepancy

Here is a weird nuance most people miss. FAMLI premiums are capped at the Social Security Wage Base. For 2024, that was $168,600. For 2025, it’s $176,100. If you have high-earning employees and you kept taking the 0.9% premium out after they hit that cap, you’ve over-collected. Conversely, if you stopped paying the employer share too early, you owe the state money.

The Colorado FAMLI unemployment audit frequently catches these cap errors. The state's automated systems are incredibly good at flagging wages that exceed the annual limit. If your payroll software wasn't updated to reflect the new yearly caps, you’re basically handed the state an invitation to look at your books.

What Happens if They Find an Error?

Usually, it starts with a "Notice of Underpayment." You'll get a bill for the back premiums plus interest. The interest rate isn't astronomical, but it adds up. If the state determines you willfully ignored the law, they can hit you with a fine of up to $500 per misrepresentation.

There's also the "Private Plan" penalty. If you told the state you had a private plan but didn't actually maintain it, you might be forced to pay all back premiums to the state fund plus a penalty. It’s significantly cheaper to just do it right the first time.

Honestly, the "audit" is often just a data correction exercise. The CDLE wants the My FAMLI+ portal to match the UI portal. If you can explain the difference—for example, "Employee X moved to Texas on March 1st"—they usually accept the explanation and move on.

Real Talk on "Localization"

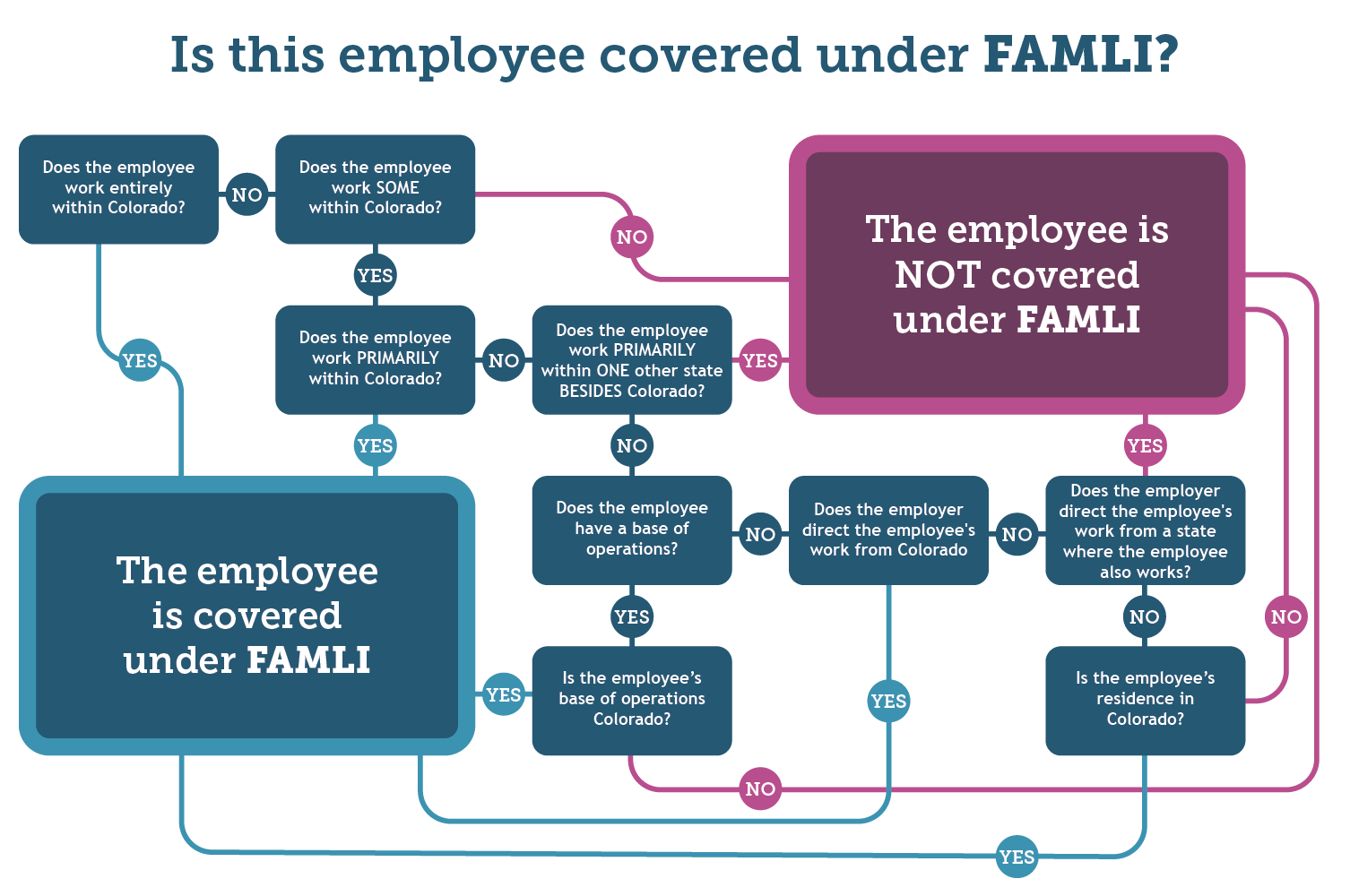

Colorado uses the same four-part test for FAMLI that it uses for unemployment to determine if a worker "belongs" to Colorado.

- Service is localized: The work is mostly done in CO.

- Base of Operations: If work isn't localized, is the "home base" in CO?

- Place of Direction and Control: Is the boss in Denver even if the worker is in a van in Nebraska?

- Residence: If none of the above apply, does the worker live in CO?

If you have remote workers, this is where your Colorado FAMLI unemployment audit will get sticky. You have to be consistent. You can't tell the UI office a worker is in Kansas to save on taxes but tell the FAMLI office they are in Colorado so they can get leave benefits. The state is watching both doors now.

Actionable Steps for Colorado Employers

Stop waiting for the letter. You can self-audit right now. It takes about an hour if your books are clean.

First, pull your 2024 and 2025 UITR-1 filings. These are your quarterly unemployment reports. Look at the total gross wages reported. Now, log into the My FAMLI+ Employer portal and look at the total wages you reported there for the same periods. They should match. If they don't, figure out why. Is it because of the Social Security cap? Is it because of a 1099 vs W2 distinction? Write down the reason now so you aren't scrambling later.

Second, check your employee count. If you are hovering around 10 employees, you need to be hyper-vigilant. The "10 or more" rule is based on the number of employees employed for some portion of a day in each of 20 or more calendar weeks in the current or preceding calendar year. It’s a mouthful, but it means a summer intern could push you over the limit and suddenly you owe the employer share for the whole year.

✨ Don't miss: Marcas venezolanas poco conocidas que están cambiando el juego sin que te des cuenta

Third, ensure your posters are up. Yes, it sounds trivial. But if an auditor comes knocking or an employee files a complaint about not being able to access benefits, the first thing they check is if you notified your staff. You need the "2025 FAMLI Program Notice" posted in a conspicuous place.

Finally, verify your "Wages" definition. FAMLI wages generally include bonuses, commissions, and tips. If you've been calculating the 0.9% premium only on base hourly pay and ignoring that big Q4 bonus, you have an underpayment sitting on your books. Fix it now. The My FAMLI+ portal allows for "amended returns." It’s much better to file an amendment voluntarily than to have an auditor force it on you with a side of penalties.

This isn't just about compliance; it's about avoiding the administrative nightmare of a state investigation. The CDLE is getting more efficient every month. Their goal is a seamless "one-stop" reporting system where UI and FAMLI live in harmony. Until that's fully realized, the burden of consistency is on you. Keep your records for at least six years. That’s the look-back period for many Colorado labor statutes. If you can prove your math, you’ll survive the audit just fine.