You're about to wire five figures to a new supplier. Their website looks slick. The invoice has all the right logos. But something feels off. Maybe the font on the invoice is just a tiny bit wonky, or perhaps the deal seems too good to be true in this economy. Honestly, the easiest way to sleep better tonight is by checking VAT registration number details before you hit "send" on that bank transfer. It’s not just about being paranoid. It’s about not getting dragged into a tax fraud investigation by HMRC or the European Commission because you did "business" with a ghost.

VAT fraud is a massive hole in global budgets. We're talking billions. When a business isn't actually registered but charges you VAT anyway, they're basically pocketing a 20% bonus on your dime. If you try to claim that VAT back on your own tax return, the authorities might just say "no." Then you’re out of pocket, and you've got some very awkward explaining to do.

The Reality of Checking VAT Registration Number in a Digital World

Most people think a VAT number is just a random string of digits. It's not. In the UK, it’s a nine-digit code, sometimes with a "GB" prefix. In the EU, the format varies by country—France uses "FR" plus eleven digits, while Germany goes with "DE" and nine. But here is the kicker: just because the format is right doesn't mean the number is live.

Checking VAT registration number status is surprisingly easy, yet thousands of SMEs skip it. Why? Probably because they trust their gut over their data. That's a mistake. You can use the VIES (VAT Information Exchange System) for EU-based businesses or the official GOV.UK checker for British ones. These databases are the gold standard. They pull directly from national tax registries. If the system says "Invalid," stop what you're doing.

Sometimes, a number is invalid because the business just closed down last week and the database updated. Other times, it’s a deliberate "Missing Trader" fraud attempt. You don't want to be the one holding the bag when the taxman comes knocking.

Why Does It Even Matter?

Legally, you have a "duty of care." If you’re a business owner, you’re expected to know who you’re dealing with. If you accidentally get involved in a carousel fraud scheme—where goods are imported and exported multiple times to claim back VAT that was never paid—HMRC can actually deny you the right to deduct input tax. This happened in the landmark Kittel case (C-439/04). The European Court of Justice basically ruled that if you "knew or should have known" that your purchase was connected to fraud, you lose your tax rights.

✨ Don't miss: Finding a Mergers and Acquisitions Database That Actually Works

Checking VAT registration number records is your primary defense. It’s your proof of due diligence. Keep a screenshot. Seriously. If an auditor asks why you traded with "Dodgy Dave’s Electronics" three years ago, showing a timestamped verification from a government portal is your "get out of jail free" card.

How to Actually Do the Check Without Losing Your Mind

If you’re dealing with a UK business, head straight to the Check a UK VAT number service on the government website. It’s free. It’s fast. You type in the nine digits. It tells you the name and address of the business.

Does the address on the screen match the one on your invoice? If the invoice says London but the VAT registration is tied to a residential flat in Blackpool, that’s a red flag. It doesn't always mean fraud—businesses move—but it means you need to ask more questions.

For European partners, VIES is your best friend. But there’s a catch. VIES doesn't always show the name and address due to different data privacy laws in countries like Germany or Spain. In those cases, the system might just tell you the number is "Valid." You’ll have to manually confirm the details with the supplier. It’s a bit of a pain, but better than a tax audit.

Common Red Flags to Watch For

- The "Pending" Excuse: A supplier tells you their VAT number is "pending." They might be telling the truth, or they might be stalling. You generally shouldn't pay VAT to someone who doesn't have a number yet.

- Handwritten Invoices: It’s 2026. If someone is hand-writing a VAT number on a scrap of paper, be skeptical.

- The Number Doesn't Exist: Simple as that. If the checker says "No record found," the number is fake or deactivated.

- Sudden Changes: A long-term supplier suddenly sends an invoice with a brand-new VAT number. This could be a legitimate restructuring, or it could be a hijacked identity.

The Technical Side: The Algorithm Behind the Number

Most UK VAT numbers actually follow a mathematical rule called the Modulus 97 check. It’s a way for software to quickly tell if a number is even possible before checking a database.

Basically, you take the first seven digits, multiply each by a specific weight (from 8 down to 2), sum them up, and then perform some subtractions. If the result matches the last two digits, the number is mathematically "valid." However, scammers know this. They can generate "mathematically correct" fake numbers. That’s why checking VAT registration number status against a real-time government database is the only way to be 100% sure.

What to Do If the Number Is Invalid

Don't panic immediately. Sometimes the VIES system goes down for maintenance. It happens more often than you'd think, especially on Sunday nights.

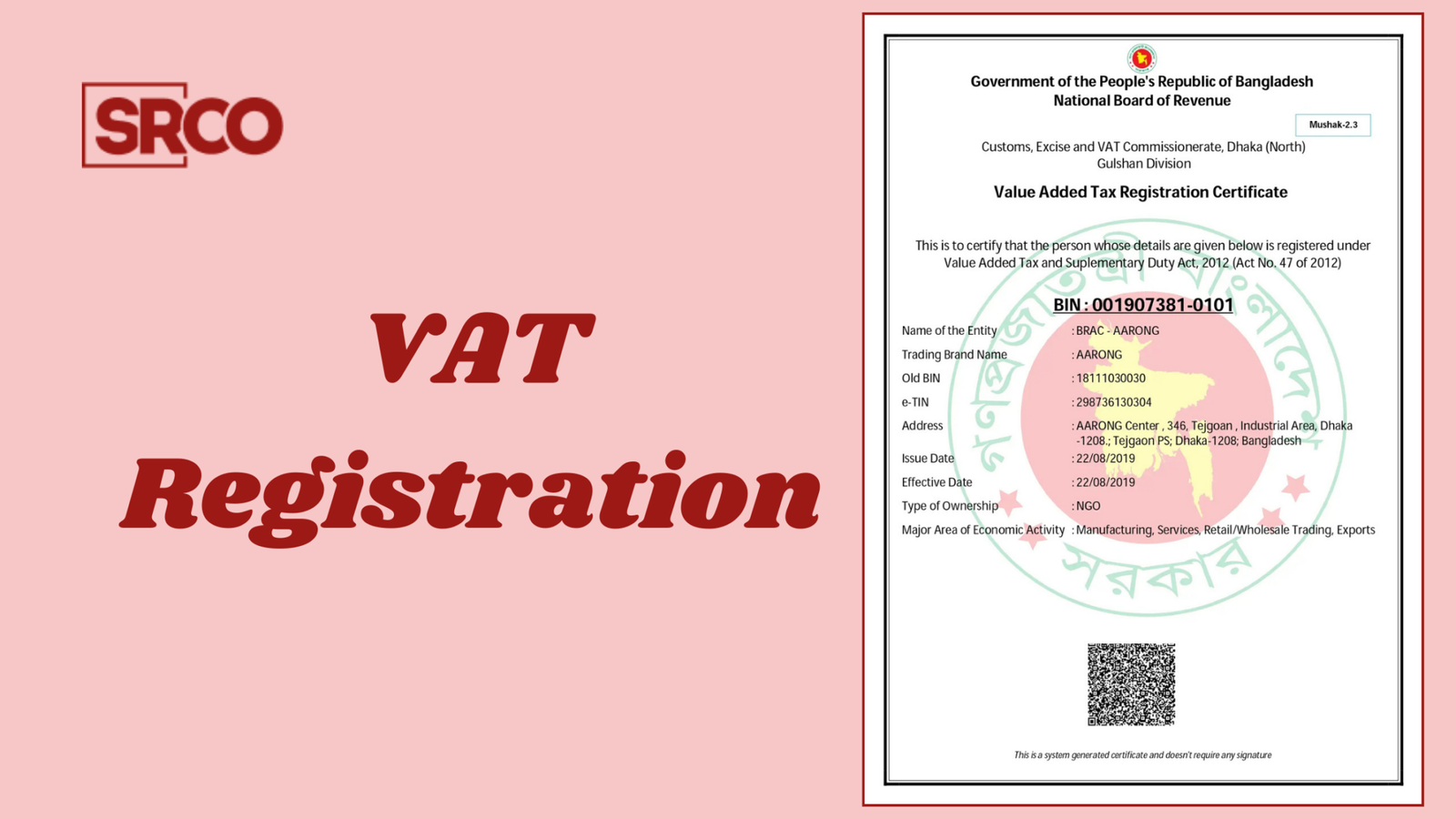

First, double-check your typing. Is that an "O" or a "0"? Then, ask the supplier for a copy of their VAT registration certificate (form VAT4 or equivalent). If they get defensive or weird about it, that’s your signal to walk away. Honest businesses are happy to prove they’re legit because they’re usually checking you too.

Beyond the Basics: Advanced Due Diligence

If you’re in a high-risk sector like wholesale electronics, scrap metal, or construction, checking the VAT number is just the tip of the iceberg. You should also look at:

- Company House records: Does the company actually exist?

- Credit reports: Are they about to go bust?

- Website age: Was their site created three weeks ago?

Tax authorities are getting way more aggressive with "joint and several liability." This means if your supplier disappears without paying the VAT they charged you, the government might try to get it from you instead. It sounds unfair—and it is—but that’s the reality of modern tax law.

Checking VAT registration number data is your bread and butter. Do it every time you onboard a new vendor. Do it once a year for your major existing ones. Business changes fast; people sell companies, licenses lapse, and sometimes, the "good guys" turn into "bad guys" when the cash flow dries up.

Real-World Example: The "Ghost" Wholesaler

Imagine a small coffee shop owner buying beans from a new wholesaler. The wholesaler charges 20% VAT. The owner pays it and claims it back on their quarterly return. A year later, HMRC visits. They find out the wholesaler's VAT number belonged to a defunct bakery that closed in 2019. The coffee shop owner now owes thousands of pounds in back-taxes because they didn't take thirty seconds to verify the number. They thought they were saving money on cheap beans, but the tax bill wiped out their entire year's profit.

🔗 Read more: 270 Pounds in Dollars: Why the Exchange Rate Never Tells the Whole Story

Don't be that guy.

Your Immediate Action Plan

Start by auditing your current supplier list. You don't have to do everyone at once, but grab your top five most expensive invoices. Use the GOV.UK or VIES portals to verify them.

Next, update your onboarding process. If you have an accounts payable team, make "VAT Verification" a mandatory checkbox before any new bank details are entered into your system. It’s a simple process:

- Input: Get the VAT number from the invoice.

- Verify: Run it through the official portal.

- Document: Save a PDF or screenshot of the "Valid" result.

- Match: Ensure the name/address on the portal matches your records.

If you encounter an invalid number, withhold the VAT element of the payment until a valid certificate is provided. Legally, you are well within your rights to do this. Most reputable businesses will understand. If they don't, you probably shouldn't be giving them your money anyway.

Taking these steps transforms a boring administrative task into a powerful shield for your business’s bank account. It’s about more than just taxes; it’s about ensuring the integrity of your entire supply chain.