Everyone wants a free lunch, but in the banking world, a $300 check from JPMorgan Chase is about as close as you’ll ever get to a guaranteed win. Honestly, it’s wild how many people open a basic checking account and just... don't get paid for it. They walk into a branch, sign the papers, and leave money behind because they didn't use a specific coupon code or didn't time their payroll correctly. It's a bummer. If you're looking for a Chase bank direct deposit bonus, you've gotta be a bit more strategic than the average customer.

Banking is competitive. Banks like Chase are basically fighting for your loyalty because once they have your direct deposit, you’re likely to stay for years. That’s why they’re willing to cough up several hundred dollars just to get you through the door. But there are traps. If you don't read the fine print, you'll end up paying monthly fees that eat your bonus alive.

How the Chase Bank Direct Deposit Bonus Actually Works

The most common offer right now is for the Chase Total Checking® account. Usually, you’re looking at a $300 carrot dangled in front of you. To grab it, you have to be a new customer. If you’ve had a Chase account in the last 90 days or closed one with a negative balance, you’re out of luck. They track this stuff closely.

Once you open the account with the required offer code, the clock starts ticking. You generally have 90 days to ensure a "qualifying direct deposit" hits the account. This is where people get tripped up. Not every transfer is a direct deposit in the eyes of Chase’s computer systems.

What counts as a qualifying deposit?

It has to be an electronic deposit of your paycheck, pension, or government benefits (like Social Security) from your employer or the government. P2P transfers don't count. Don't try to Venmo yourself $500 and expect the bonus to trigger. It won't work. Zelle, PayPal, and standard bank transfers from your other accounts at Ally or Wells Fargo are also usually disqualified. Chase is looking for "sticky" income. They want to see that your life's blood—your salary—is flowing into their ecosystem.

The beauty of the current Chase bank direct deposit bonus is that there is often no minimum deposit amount required to trigger the bonus itself. Even a small $50 deposit from your workplace can set off the green light. However, the catch isn't the bonus; it's the monthly maintenance fee.

💡 You might also like: Why the Elon Musk Doge Treasury Block Injunction is Shaking Up Washington

Beating the $12 Monthly Fee

Chase Total Checking® has a $12 monthly service fee. If you're not careful, you'll pay $144 a year just to keep the account open, which effectively cuts your $300 bonus in half by the time you're allowed to close the account without penalty. To waive that $12 fee, you need to do one of three things:

- Have monthly direct deposits totaling $500 or more.

- Keep a minimum daily balance of $1,500.

- Keep an average daily balance of $5,000 or more across any combination of Chase checking, savings, and other balances.

Most people go for the $500 direct deposit route. It’s the easiest. If you earn at least $6,000 a year and have it sent to Chase, the account is effectively free.

The Six-Month Rule Nobody Mentions

This is the big one. You got the bonus. It’s sitting in your account. You feel like a genius. Now you want to close the account and move to a high-yield savings bank, right?

Slow down.

If you close your Chase account within six months of opening it, they will claw that bonus right back. They'll literally suck the $300 out of your remaining balance before they cut you a closing check. It’s in the fine print. You have to keep the relationship alive for at least 180 days. Think of it like a short-term contract. You're trading six months of your banking loyalty for a few hundred bucks.

📖 Related: Why Saying Sorry We Are Closed on Friday is Actually Good for Your Business

Why Chase Does This (The Business Logic)

You might wonder why a bank with trillions in assets cares about giving $300 to a random person in Ohio. It’s about the "primary financial relationship." Data shows that once a person sets up their direct deposit, they are significantly more likely to take out a mortgage, buy a car loan, or open a credit card like the Chase Sapphire Preferred® with that same bank.

The Chase bank direct deposit bonus is essentially a loss leader. They lose money on the bonus today to make thousands off you in interest over the next decade. If you're savvy, you take the bonus, avoid the fees, and use their high-end credit cards for the rewards, but keep your long-term savings in a bank that actually pays more than 0.01% interest. Because, let's be real, Chase's interest rates on standard savings accounts are pretty much non-existent.

Step-by-Step: How to Secure the Bag

First, you need to find the current promotional link. Don't just go to Chase.com and hit "open account." You need the specific landing page that mentions the $300 (or sometimes $200 or $225 depending on the season) offer. Enter your email to get a coupon code.

- Apply Online or In-Person: Use the code during the application. If you’re doing it at a branch, show the banker the code on your phone before they start typing.

- The Funding Stage: You don't necessarily need to put money in right this second, but getting some cash in there helps prevent the account from being flagged as "inactive" and closed automatically.

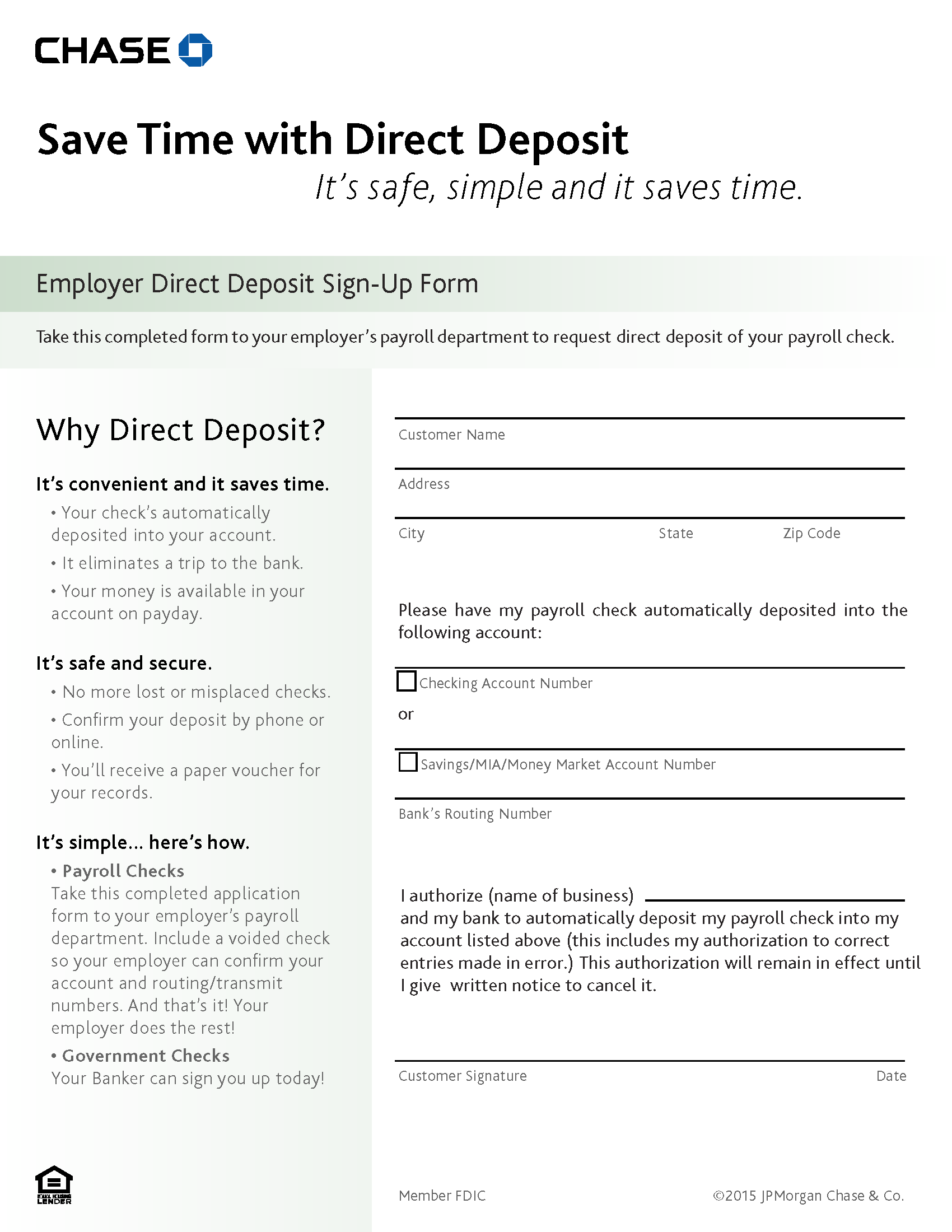

- Update Your HR Portal: This is the most critical step. Log into your work payroll system and switch your direct deposit to your new Chase routing and account numbers.

- Wait for the Notification: Usually, once the qualifying deposit lands, Chase is pretty fast. You’ll typically see the bonus hit your account within 15 days of the qualifying deposit.

- The Holding Pattern: Keep the account open for at least six months. Mark the date on your calendar.

Common Pitfalls to Avoid

I've seen people lose out on this because they mistyped their coupon code. Or, they thought a tax refund counted as a direct deposit (it usually doesn't for the purpose of these bonuses).

Another mistake? Forgetting about the "New Customer" definition. If you are a joint owner on your spouse's Chase account, you might not qualify as a new customer. Check the terms. Usually, if you haven't been the primary owner of a Chase checking account in the last 90 days, you're fine, but it’s worth a quick chat with a teller if you’re unsure.

👉 See also: Why A Force of One Still Matters in 2026: The Truth About Solo Success

Also, be aware of the taxes. The IRS views bank bonuses as interest income, not a gift. Chase will send you a 1099-INT form at the end of the year. You will owe taxes on that $300. If you’re in a 22% tax bracket, you’re really only keeping about $234. It’s still free money, but don't be shocked when your tax bill is a tiny bit higher.

Beyond the Total Checking Account

Sometimes Chase offers bigger fish. If you have $15,000 lying around, you might see a Chase Private Client or a Chase Premier Plus Checking offer that goes up to $700 or $1,000. But for most of us, the Total Checking offer is the sweet spot. It requires the least amount of "parked" cash.

If you're a business owner, look for the Chase Business Complete Checking® bonus. Those can often be $300 or more as well, and the requirements usually involve maintaining a balance and doing a certain number of transactions rather than just a direct deposit. You can actually "double dip" by getting a personal bonus and a business bonus if you qualify for both.

What to Do Right Now

Don't wait. These offers expire and change constantly. Sometimes the bonus is $300, sometimes it drops to $200. If you see the $300 offer live, grab the code.

Even if you don't plan on making Chase your "forever bank," it’s a solid place to keep an emergency fund or a secondary spending account. Their mobile app is arguably the best in the business. It’s slick, fast, and rarely goes down.

Actionable Next Steps:

- Verify your eligibility: Ensure you haven't closed a Chase account in the last 90 days.

- Grab the official coupon: Go to the Chase website or a trusted affiliate site to receive your unique bonus code via email.

- Check your payroll: Confirm you can easily split your direct deposit. Most modern HR systems (like Workday or ADP) let you send a fixed dollar amount (e.g., $500) to one bank and the rest to your main bank. This allows you to meet the fee-waiver requirement without moving your entire financial life.

- Set a "Close Date" reminder: Put a note in your phone for 181 days from today. This ensures you don't close the account too early and lose the bonus.

- Monitor the account: Use the Chase app to confirm the "Qualifying Direct Deposit" label appears on your incoming paycheck. If it just says "Transfer," call them immediately to clarify.

Banking bonuses are one of the few ways to actually "win" against big financial institutions. As long as you follow the rules and stay organized, that $300 is yours for the taking.