You’ve probably seen the headlines. One day it’s a "revolutionary banking shift," and the next, critics are calling it the biggest conflict of interest in American history. Honestly, trying to track World Liberty Financial holdings feels a bit like watching a high-stakes poker game where the players are also the ones writing the house rules.

Launched by the Trump family in late 2024, the project has morphed from a skeptical "is this real?" meme into a multi-billion dollar entity that’s actually applying for national bank charters. It’s a wild mix of decentralized finance (DeFi), family business, and sheer political gravity. But if you think this is just about a digital coin named WLFI, you’re missing the actual machinery under the hood.

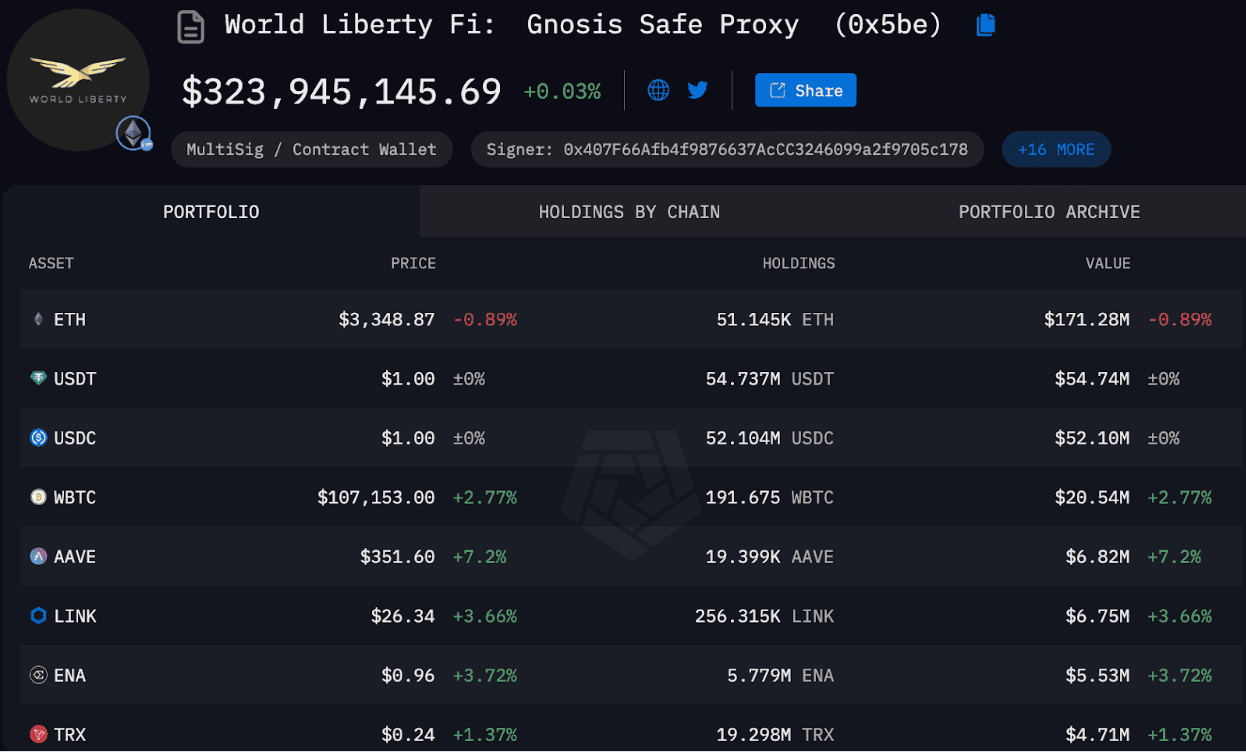

The Reality of World Liberty Financial Holdings

Most people focus on the WLFI token because that’s what hit the exchanges. But the real meat of the operation—the part that actually moves the needle for the Trump organization—isn't just the governance token. It’s the stablecoin.

Enter USD1. This is a dollar-pegged stablecoin backed by U.S. Treasuries and cash equivalents. As of early 2026, it’s not some niche asset anymore. We’re talking about a circulating supply that has hovered around $3.8 billion.

Here is where the math gets interesting. World Liberty Financial generates interest from the assets backing that stablecoin. Reports suggest that a massive chunk of the proceeds—roughly 75%—flows to an entity called DT Marks DEFI LLC. Who owns that? Donald Trump owns 70% of it, with his family holding the rest.

Who Is Actually Running the Show?

While the Trump names are on the marquee, the day-to-day operations are handled by a group of founders that sound like a mix of real estate moguls and crypto veterans.

- Zach Witkoff: The CEO and the guy you recently saw shaking hands with officials in Pakistan. He's the son of Steve Witkoff, Trump’s real estate ally.

- Zachary Folkman and Chase Herro: These are the DeFi guys. They previously worked on Dough Finance, which... well, it didn't end great after a $2.1 million exploit.

- The Family: Don Jr. and Eric are the "Web3 Ambassadors." They’ve been the public faces, pushing the narrative that this is about "banking the unbanked" and fighting "financial elites."

Why the Recent Bank Charter Application Changed Everything

In January 2026, things got serious. World Liberty Trust—a subsidiary of the main holdings—filed for a de novo national bank charter with the OCC.

Basically, they want to be a "real" bank.

If granted, this license allows them to safeguard USD1 and issue it under a federal framework. It would move them out of the "gray zone" of crypto and into the regulated halls of the U.S. banking system. Naturally, this has caused a massive stir in D.C. Senator Elizabeth Warren has been incredibly vocal, essentially asking how the President can oversee the agency that regulates his own family's bank. It’s a valid question that doesn't have a clear answer yet.

The Justin Sun and Abu Dhabi Connection

You can't talk about World Liberty Financial holdings without mentioning the whales. Chinese-born billionaire Justin Sun—the guy behind Tron—reportedly dropped at least $75 million into WLFI tokens. He’s now an advisor.

Then there’s the Abu Dhabi piece. A state-backed company called MGX reportedly used $2 billion worth of the USD1 stablecoin to finance a deal involving Binance. It’s these kinds of massive, sovereign-level moves that make World Liberty feel less like a "crypto project" and more like a private financial rail for global power players.

Sorting Through the Token Confusion

There’s a lot of noise about whether you can even trade these things. Originally, WLFI was a "non-transferable" governance token. You bought it, you held it, you voted on stuff. That’s it.

But investors eventually voted to make them tradable in mid-2025.

- Price Action: It debuted around $0.30, tanked to $0.20, and has been a rollercoaster since.

- Supply: There are 100 billion tokens in total.

- Insiders: Roughly 70% of the supply is held by insiders. That is... a lot. Most DeFi projects try to be more "decentralized" than that, but World Liberty isn't your average DeFi project.

The Ethics Elephant in the Room

Let’s be real: the conflicts here are massive. The Trump administration has been aggressively pro-crypto, passing bills like the one that regulated USD-backed stablecoins—the exact product World Liberty sells.

Critics argue the project is essentially a way for foreign governments or wealthy individuals to buy influence by pumping the stablecoin or the token. The White House, meanwhile, maintains that the assets are in a trust managed by the Trump children. Whether that "firewall" actually works is something the market—and the voters—are still debating.

👉 See also: 1 USD in Bangladeshi Taka: Why the Rate You See Online Isn't What You Get

Misconceptions vs. Reality

- "It’s just a meme coin": Nope. It’s a protocol built on Aave v3 infrastructure with a serious stablecoin and a pending bank charter.

- "Trump runs it": Officially, he’s "Co-founder Emeritus." He doesn't do the coding. The Witkoffs and the DeFi founders do the heavy lifting.

- "It's only for the rich": In the U.S., you initially had to be an "accredited investor" (net worth over $1M) to buy in, though international rules were more relaxed.

What Happens Next for Your Portfolio?

If you’re looking at World Liberty Financial holdings as an investment, you have to treat it as a political proxy. When Trump’s political capital is high, the ecosystem thrives. If the regulatory walls close in or if the OCC denies that bank charter, things could get messy fast.

The immediate things to watch are the USD1 market cap and the OCC charter decision. If World Liberty gets that bank license, they won't just be a crypto company; they’ll be a federally sanctioned financial institution. That’s a game-changer that could force every major bank on Wall Street to figure out if they’re going to compete or collaborate with the President's firm.

Actionable Insights for Following This Space:

- Monitor the OCC Filings: The de novo application for "World Liberty Trust" is public. If it moves to the "approved" stage, expect a massive spike in USD1 utility.

- Track Stablecoin Reserves: Unlike offshore stablecoins, USD1 claims high transparency. Check their monthly attestations to ensure the Treasuries are actually there.

- Watch the Senate Banking Committee: Any movement on crypto market structure legislation this week will directly impact how World Liberty can operate.

- Diversify Political Risk: If you hold WLFI, realize its value is tied to the current administration's stance. A shift in the political winds is a direct threat to the token's price.