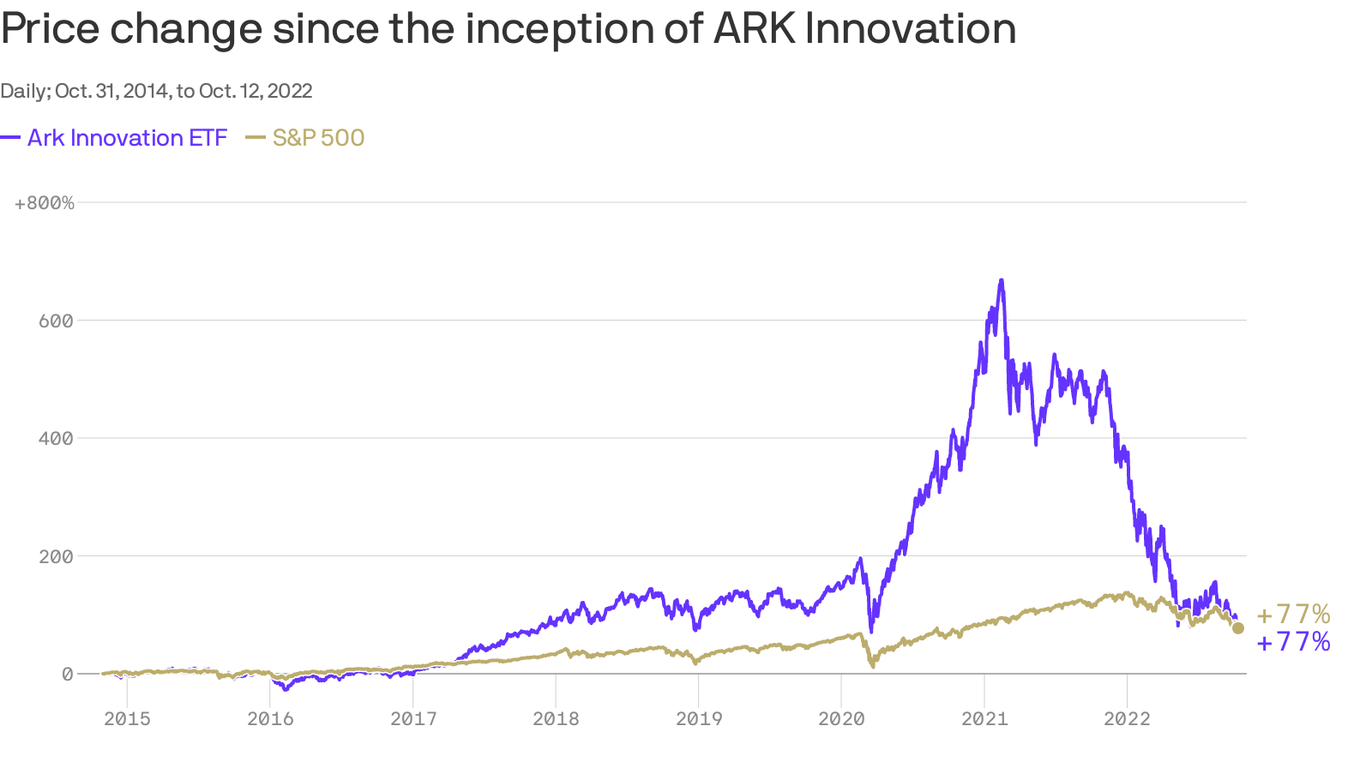

Look at the charts. Seriously. If you’ve been following the saga of the Cathie Wood ARK Innovation ETF performance, you know it’s been a wild, stomach-churning ride that would make most rollercoaster enthusiasts pale.

Early 2026 is here. And the narrative is shifting again.

Remember 2022? People were calling it a "wealth incinerator." Fast forward to the close of 2025, and ARKK didn't just walk back into the room—it kicked the door down with a 35.5% annual surge. That’s nearly double what the S&P 500 managed.

But figures like that don't tell the whole story. They never do.

✨ Don't miss: Effective Demand: The Economic Concept Most People Get Wrong

The High-Stakes Comeback of 2025

You've probably heard the term "disruptive innovation" until your ears bled. For Cathie Wood, it’s not just a buzzword; it’s a religion. By the time we hit January 2026, the fund's price sat around $82.54, a massive recovery from its darker days, yet still roughly 50% below that fever-dream peak in 2021.

Is she back? It depends on who you ask at the water cooler.

The 2025 win was driven by a few massive bets that finally stopped bleeding. Palantir (PLTR) went on an absolute tear, gaining 128% in a single year. Tesla, ever the crown jewel, remains the largest holding at roughly 13% of the portfolio. When Elon Musk’s empire breathes, ARKK moves.

But it's not all Tesla and AI bots.

Why the Strategy Shift Matters Right Now

Lately, the "Wooden Sister"—as she's affectionately or mockingly called in some trading circles—has been pivoting. Hard.

We’re seeing a systematic rotation away from some of the older "stay-at-home" tech darlings and a massive dive into the "Genomic Revolution." In the first few weeks of 2026, Wood has been buying the dip on companies like Intellia Therapeutics and Beam Therapeutics.

- Intellia Therapeutics (NTLA): ARK added over 300,000 shares across its funds in the first half of January alone.

- Beam Therapeutics (BEAM): Despite realized losses in previous years, Wood is doubling down on base editing.

- Tempus AI: A newer focus on the intersection of healthcare data and artificial intelligence.

It’s a gutsy move. Most managers would be licking their wounds after the $3.5 billion in realized losses the fund saw in the fiscal year ending July 2024. Wood, however, famously called these losses an "under-appreciated asset" because they can offset future capital gains taxes.

Talk about finding a silver lining in a thunderstorm.

Deciphering the Cathie Wood ARK Innovation ETF Performance

To understand the Cathie Wood ARK Innovation ETF performance, you have to look at the volatility. It’s the fund's defining feature. Its standard deviation—a fancy way of saying how much the price swings—is nearly 40%. Compare that to the S&P 500’s much calmer 17-18%.

You aren't buying a steady climb. You're buying a ticket to a moonshot that might occasionally explode on the launchpad.

The Top 10 Concentration Risk

ARKK is a concentrated bet. While a typical index fund might hold 500 stocks, ARKK holds about 43.

The top 10 holdings usually account for over 50% of the entire fund's value. This is why when Roku or Shopify has a bad day, the entire ETF feels like it’s in freefall. Conversely, when the "Tech Titans" rally, ARKK outpaces the market so fast it leaves investors breathless.

- Tesla (TSLA): The undisputed anchor.

- Roku (ROKU): Despite recent trimming, still a major pillar.

- Palantir (PLTR): The AI darling of 2025.

- Coinbase (COIN): A direct play on the survival of the crypto ecosystem.

Is the 0.75% Expense Ratio Worth It?

Let's talk about the "cost of admission."

ARKK charges a 0.75% expense ratio. If you put $10,000 in, you’re paying $75 a year just for the privilege. If you put that same money into a Vanguard S&P 500 ETF (VOO), you’d pay about $3.

Is Cathie Wood’s active management worth $72 more per year?

If she keeps beating the S&P 500 by 20% like she did last year, the fee is a rounding error. If we see a repeat of the 2022 crash, that fee feels like salt in a very deep wound.

Honestly, it’s a psychological game.

👉 See also: Cold Calling Sucks and That's Why It Works: The Brutal Truth About Sales in 2026

ARK investors aren’t looking for "market average." They are looking for the next Nvidia before it becomes Nvidia. They’re betting on the 2029 forecast of Tesla hitting $2,600. It’s a vision of the future that requires a very high tolerance for seeing red on your screen for months—or years—at a time.

What Most People Get Wrong

The biggest misconception? That ARKK is just a "tech fund."

It’s actually more of a "venture capital" fund that happens to trade on the public markets. Wood buys companies that are often losing money today because they are building the infrastructure for tomorrow.

When interest rates were at zero, this was easy.

In the 2026 landscape of "higher for longer" or at least "moderately high" rates, these companies have to prove they can actually turn a profit. We’re seeing that shift now. Companies like Palantir and Shopify have started showing real earnings, which is why the Cathie Wood ARK Innovation ETF performance has decoupled from the "meme stock" era and started behaving like a legitimate growth engine again.

The 2026 Outlook: Risks to Watch

No expert should tell you it’s all sunshine.

The risks are real. If the Fed doesn't nail the "soft landing," high-beta growth stocks are the first to get sold off. There’s also the "key person risk." ARK Invest is Cathie Wood. Her conviction is the fund's greatest strength and its most debated weakness.

She doesn’t hedge. She doesn't hide in cash. She stays fully invested in "disruptive innovation" even when the market is screaming for safety.

Actionable Steps for Investors

If you're looking at ARKK as a potential addition to your portfolio, don't just dive in headfirst.

- Size it right: Most financial advisors suggest keeping thematic, high-volatility ETFs to 5-10% of your total portfolio.

- Check the overlap: If you already own a lot of QQQ (Nasdaq 100), you might already have heavy exposure to Tesla and other tech names.

- Time horizon: Wood herself says her horizon is five years. If you need this money in eighteen months for a house down payment, stay far away.

- Watch the Genomics: Keep an eye on the biotech holdings. If gene editing hits a clinical breakthrough in 2026, ARKK could see another vertical move.

The story of the Cathie Wood ARK Innovation ETF performance is far from over. It’s a polarizing, fascinating, and ultimately high-octane way to play the stock market. Just make sure you have your seatbelt fastened before the next trading session begins.

For those tracking daily movements, keep a close watch on the $78 to $82 price range. This has acted as a significant psychological level for the fund entering the new year. A sustained break above $85 could signal the start of a new structural bull phase for innovation assets, while a dip below $75 might suggest the 2025 rally was just a temporary reprieve in a longer consolidation period. Check the daily ARK trade logs to see if the "Big Biotech Bet" continues to gain weight relative to the established software players.