You’re standing at a checkout counter, or maybe you’re hunched over your laptop at 2:00 AM trying to snag concert tickets before they sell out. You pull out that piece of plastic. You type in the sixteen digits. Then, the site asks for that little three or four-digit code on the back. That’s your card number with cvv in action. It feels like a minor hurdle, honestly. Just a few extra numbers to memorize or squint at. But that tiny code is basically the only thing standing between your bank account and a random person in a different time zone buying a high-end espresso machine on your dime.

Most people think the card number is the "key" to their money. It isn’t. Not really. The card number is more like the address to your house. Anyone can find an address. The CVV? That’s the physical key to the front door. Without it, the address is just a location on a map.

👉 See also: AI Face Swap Porn: The Reality Behind the Viral Tech and Why It Is So Dangerous

Why the CVV actually exists

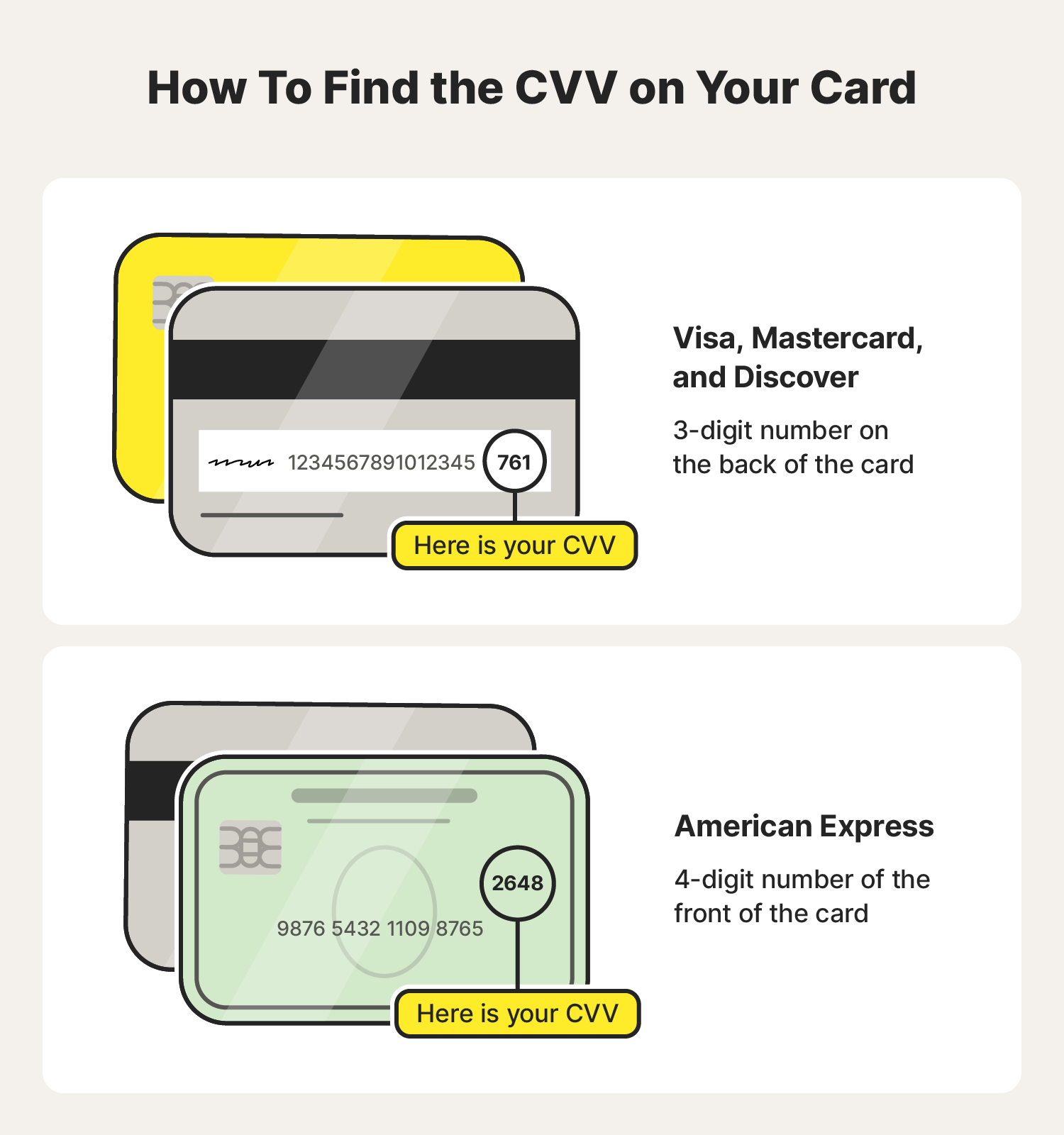

It stands for Card Verification Value. Sometimes you’ll hear it called CVV2, CVC, or CID if you’re using American Express. Back in the day, when we were all swiping cards through those "knuckle-buster" carbon paper machines, we didn't really need this. But then the internet happened. Suddenly, "Card Not Present" (CNP) transactions became the norm.

Banks realized pretty quickly that if someone wrote down your card number and expiration date, they could go on a shopping spree. They needed a way to prove that the person making the purchase actually had the physical card in their hand. That’s the whole point of the CVV. It isn't stored in the magnetic stripe or the EMV chip. It isn't printed on your receipts. It’s only on the card itself.

The technical side of those three little digits

Let's get into the weeds for a second. When a bank issues you a card, they use a specific algorithm to generate that CVV. They take your primary account number (the long one), the expiration date, and a "service code," then they run them through a series of cryptographic keys. The result is that three-digit number.

It’s simple math, but it’s math that only the bank knows. This is why a merchant isn't allowed to store your CVV. According to the Payment Card Industry Data Security Standard (PCI DSS), even if a store saves your card number for "future purchases," they are strictly forbidden from saving the CVV. If a hacker breaks into a retailer’s database, they might get your name and your card number with cvv will still be missing the most crucial piece. They'll have the address, but not the key.

Don't fall for the "verification" scams

People are clever. Scammers are cleverer. You might get a call from someone claiming to be from your bank's fraud department. They’ll say, "We see a suspicious charge for $400. To cancel it, I just need you to verify your card number with cvv."

Stop.

Your bank already knows your CVV. They’re the ones who gave it to you. They will never ask you for it over the phone to "verify" an account. If you give that number away, you’ve just handed over the keys to the kingdom. Honestly, it’s the easiest way for someone to bypass all the high-tech security features the banking world has spent billions of dollars developing.

The rise of dynamic CVVs

The world of fintech is moving fast. Some newer cards, especially from "neobanks" or high-end credit providers, don't even have a printed CVV anymore. Instead, they use a "dynamic CVV." You open an app on your phone, and it generates a code that expires in 10 or 15 minutes.

Think about how much safer that is. Even if a skimmer steals your info at a gas station, by the time they try to use it, the CVV is already dead. It's useless. It’s like a key that reshapes its teeth every few minutes. Companies like Idemia and Oberthur Technologies have been pushing this tech for a few years now, using tiny e-ink screens embedded directly into the plastic. It’s wild stuff.

What happens when you lose it?

If you lose your card, or if you think your card number with cvv has been compromised, you have to act immediately. Don't wait to see if a charge actually goes through. Most credit card companies offer "zero liability" protection, but that only works if you’re proactive.

Once you report it, the bank kills that specific combination of numbers. Even if the thief has the physical card, once it’s flagged in the global payment network (the "rails" run by Visa or Mastercard), that CVV becomes a red flag. The transaction will be declined instantly.

🔗 Read more: Is TikTok Actually Getting Banned? What Really Happened

Practical steps to stay safe

Security isn't about one big wall; it's about a bunch of small habits. You don't need to be a cybersecurity expert to protect your bank account. You just need to be a little bit skeptical.

- Cover the code. Some people actually put a small piece of opaque tape over the CVV on the back of their card. It prevents "shoulder surfers" or dishonest waiters from quickly memorizing it.

- Use virtual cards. Services like Privacy.com or even the built-in features in the Capital One or Apple Card apps allow you to create "virtual" cards. These have a different card number with cvv for every single merchant. If one merchant gets hacked, the card doesn't work anywhere else.

- Check your statements weekly. Don't wait for the end of the month. Scammers often "ping" a card with a $1.00 or $0.50 charge just to see if the CVV is correct. If that small charge works, they go for the big one.

- Never save card info on public computers. It sounds like common sense, but people do it all the time at libraries or hotels. Browsers love to "helpfully" save your payment info. Just say no.

- Wipe the CVV entirely. This is the nuclear option, but some security-conscious people memorize their CVV and then literally scratch it off the card with a coin or a key. If you don't know it, you can't use it, but neither can a thief who finds your wallet.

The reality is that as long as we use the current credit card system, the CVV is our best line of defense in the digital world. It’s a low-tech solution to a high-tech problem, and while it isn't perfect, it’s incredibly effective when used correctly. Just remember that the number is for your eyes only. Keep it that way, and you'll sleep a lot better at night.

Immediate Action Items

If you’re worried about your current card security, take these steps right now. Log into your banking app and see if they offer a "lock card" feature. This is a life-saver if you’ve misplaced your wallet but aren't sure if it’s actually stolen. Next, check your transaction history for any tiny amounts you don't recognize—these are the "probes" hackers use. Finally, if you’re still using a card with a faded or easily readable CVV, consider requesting a replacement with a fresh security code. It’s a small hassle that prevents a massive headache down the line.