It is early 2026, and if you look at the ticker for Bitcoin, you’ll see it’s been a wild ride. But while the average retail investor is biting their nails over every 5% dip, Cameron Winklevoss is likely just staring at the same horizon he’s been eyeing since 2013. You probably know the story—the Harvard rowing, the Facebook lawsuit, the twins played by Armie Hammer in The Social Network. But honestly, the "Facebook guy" label is so ten years ago. Today, the conversation is strictly about the math behind the Cameron Winklevoss net worth, and frankly, most people are lowballing it.

Calculating a crypto billionaire's wealth isn't like counting cash in a vault. It’s more like trying to measure the height of a wave while you’re surfing on it. As of early 2026, Cameron's personal fortune is estimated to sit somewhere between $4 billion and $5.5 billion. Why the huge range? Because his wealth isn't sitting in a savings account. It's tied up in a massive hoard of Bitcoin, a newly public company, and a venture capital portfolio that reaches into the weirdest corners of Web3.

The $65 Million "Seed Round"

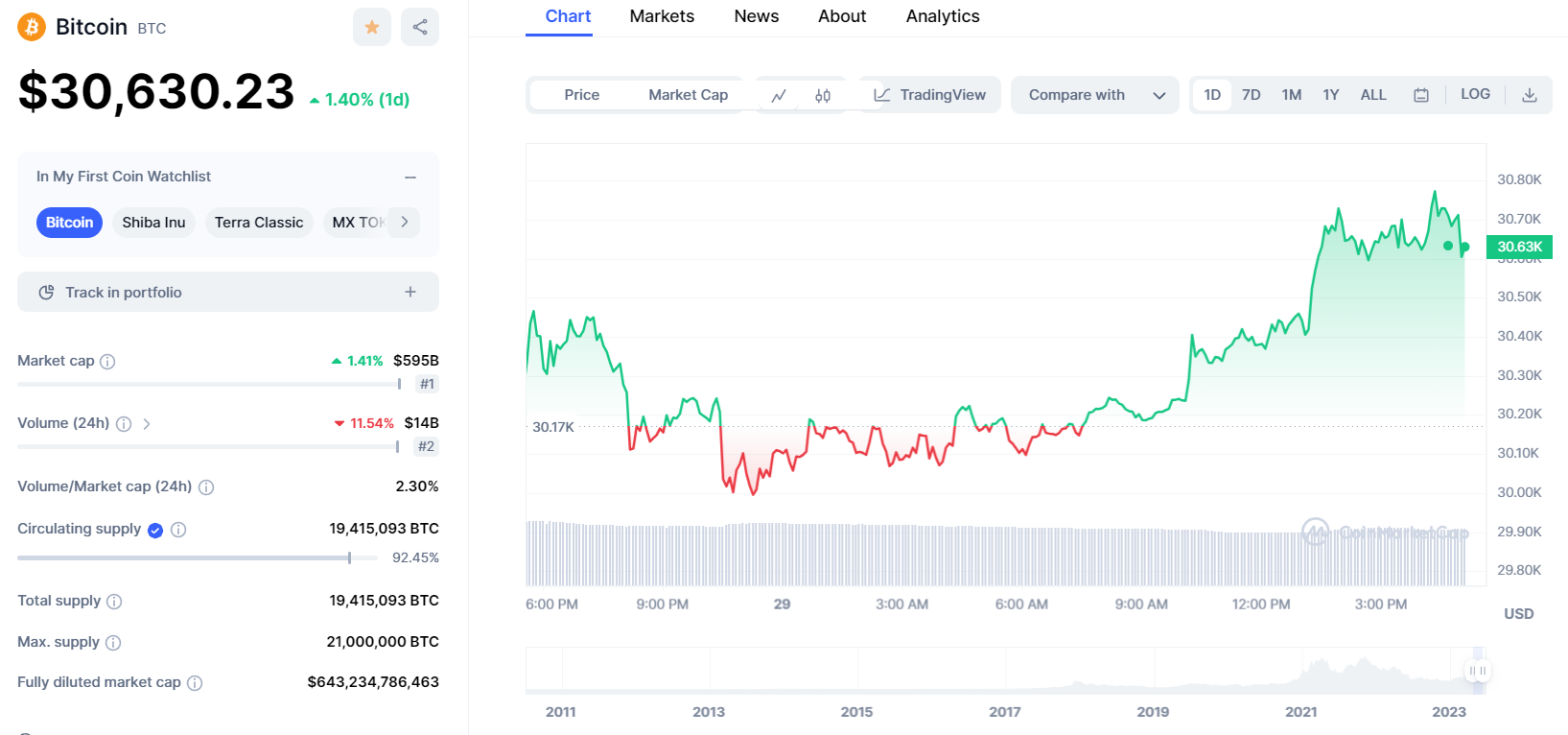

Let’s get one thing straight: the Facebook settlement wasn't the end of their story. It was the prologue. Most people would have taken that $65 million (which was mostly Facebook stock back then) and retired to a private island. Not these guys. In 2013, when Bitcoin was trading for roughly $120, they took $11 million of that settlement money and bought 1% of all the Bitcoin in existence.

Think about that. 1%.

At the time, people thought they were crazy. Silicon Valley laughed. But that stash—estimated to be around 70,000 BTC—is the bedrock of the Cameron Winklevoss net worth. Even with the market volatility we've seen leading into 2026, that single investment remains one of the greatest "alpha" moves in financial history. If Bitcoin is sitting at $90,000, that's over $6 billion for the pair. Split it down the middle, and Cameron is a multi-billionaire before he even eats breakfast.

🔗 Read more: Black Rifle Coffee Stock Price: Why Everyone Is Watching the Penny Stock Line

Gemini Goes Public: The 2025 Nasdaq Shift

The biggest change to the Cameron Winklevoss net worth in the last year hasn't actually been Bitcoin's price. It’s been the institutionalization of their exchange, Gemini.

For years, Gemini was the "regulated" alternative to the Wild West of FTX or Binance. That patience paid off. In September 2025, Gemini finally pulled the trigger on its IPO. It wasn't just a win; it was a blowout. The company debuted on the Nasdaq with a valuation of roughly $4.4 billion.

- Public Shares: Post-IPO, Cameron and Tyler reportedly hold about 75 million shares combined.

- Equity Value: At the debut price, that put their equity stake at over $1.3 billion each.

- Regulatory Edge: While other exchanges were fighting the SEC, Gemini spent years getting "trust" status, which made their 2025 public listing much smoother than anyone expected.

Honestly, the IPO changed the "flavor" of his wealth. It moved him from a guy with a lot of digital tokens to the President of a publicly traded American financial institution. That’s a massive jump in "real world" credibility.

More Than Just "The Bitcoin Twins"

If you think Cameron's wealth is only tied to BTC, you're missing the forest for the trees. Through Winklevoss Capital, he’s basically an octopus with a tentacle in every promising tech pie. They were early in on Ethereum, Filecoin, and even non-crypto plays.

Then there’s Nifty Gateway. Remember the NFT craze? While the hype has cooled into a more mature "digital collectibles" market by 2026, Gemini’s acquisition of Nifty Gateway in 2019 was a masterstroke. It gave them a foothold in the creator economy that most traditional financiers still don't quite grasp.

The Politics of Billions

You can't talk about his net worth in 2026 without mentioning the influence. In late 2024 and throughout 2025, the Winklevoss twins became some of the most visible political donors in the U.S. We're talking millions of dollars funneled into PACs and campaigns.

Why does this matter for his net worth? Because it's about protecting the asset. By backing crypto-friendly regulation, they are effectively "moating" their wealth. A favorable regulatory environment in D.C. makes Gemini more valuable and keeps the price of Bitcoin stable. It’s a feedback loop of wealth and power that’s hard to ignore.

"We believe Bitcoin will become the world's reserve currency," Cameron famously said at the Amsterdam conference.

👉 See also: FPL Cost Per Kilowatt: What Most People Get Wrong

He’s not just saying that for the headline. He’s betting his entire legacy on it. If he's right, the current Cameron Winklevoss net worth is just a drop in the bucket compared to what's coming.

Breaking Down the Math (The "Napkin" Estimate)

If we were to look at his balance sheet today, it would look something like this:

- Bitcoin Holdings: Roughly $3.1 billion (based on current 2026 market averages).

- Gemini Equity: $1.4 billion (market value of his public shares).

- Other Crypto (ETH, SOL, etc.): Estimated at $300 million - $500 million.

- Venture Capital/Real Estate: $200 million+.

Total? We’re looking at a guy worth roughly $5 billion.

Of course, if Bitcoin decides to drop 20% tomorrow, that number shrinks. But that’s the thing about Cameron—he’s a "HODLer" in the truest sense. He didn’t sell when Bitcoin hit $60k the first time, and he didn't sell during the "Crypto Winter" of 2022. He’s playing a game that ends in decades, not fiscal quarters.

The Gemini Earn "Hiccup"

It hasn't all been upward lines on a graph. The 2023 collapse of Genesis and the subsequent drama with the Gemini Earn program was a huge hit—not just to his wallet, but to his reputation. At one point, $900 million of customer funds were in limbo.

While the settlement in late 2025 finally started making users whole, the legal fees and the hit to Gemini’s brand were real. It’s a reminder that even for billionaires, the crypto world is incredibly fragile. Most experts agree that while this was a massive headache, it didn't "break" the Cameron Winklevoss net worth. It just made him a lot more cautious about who he does business with.

What's Next for the Fortune?

Keep an eye on Gemini Predictions. In late 2025, the exchange launched a prediction market platform in the U.S. This is a huge play. If they can capture even a fraction of the betting and "event-based" trading market, Gemini’s revenue could double by the end of 2026.

Also, watch the "American Bitcoin" mining venture they’ve been backing. It’s supposed to go public soon through a merger. If that pops, Cameron adds another few hundred million to the "VC wins" column.

Actionable Insights for Your Own Portfolio

You don't need $5 billion to learn from the Winklevoss playbook. Their success is built on a few core principles that still apply in 2026:

- Conviction over Consensus: They bought when everyone was laughing. If you believe in a technology, ignore the noise.

- Regulated Growth: They chose the harder, slower path of compliance. In the long run, the "boring" regulated route is what allowed them to go public on the Nasdaq.

- Asset Diversification: Yes, they love Bitcoin, but they own the "picks and shovels" (the exchange) and the "digital art" (Nifty Gateway) too.

To stay ahead of the Cameron Winklevoss net worth and the broader crypto market, you should regularly track Gemini's quarterly earnings reports (now that they are public) and monitor the movement of "whale" wallets associated with early 2013 investors. These provide the clearest signals for where the "smart money" is moving in the current cycle.