Honestly, if you look at a map of the world today, it's easy to think of countries as static shapes. But money? Money is fluid. It moves, it pools, and lately, it’s been shifting faster than most of us can keep up with.

We’re sitting here in early 2026, and the leaderboard for the biggest economies in the world looks a bit different than it did just a few years ago. You’ve got the usual suspects, sure. But there’s a tug-of-war happening between old-school industrial power and the new-age AI gold rush that’s flipping the script for some major players.

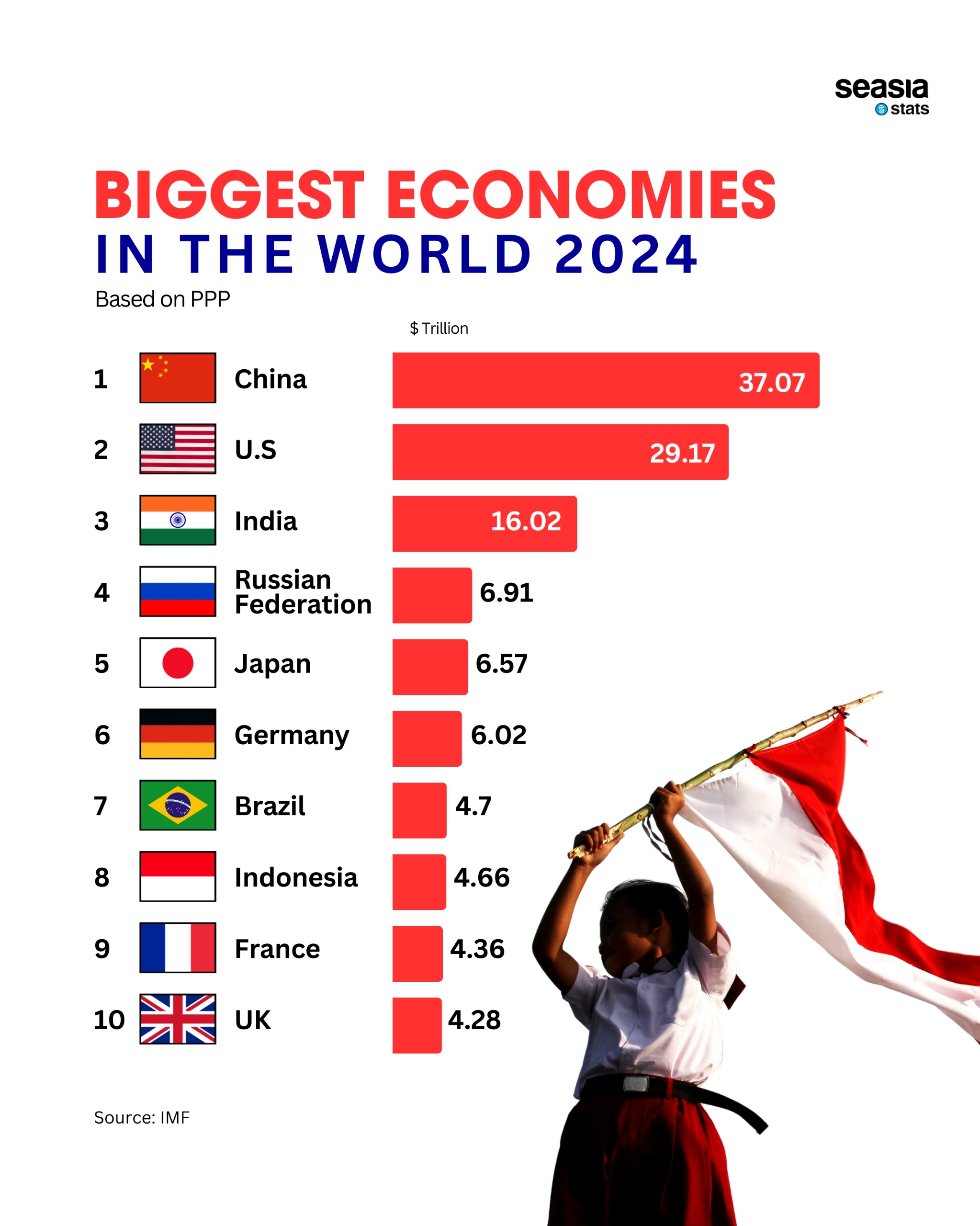

Basically, we measure this stuff using Gross Domestic Product (GDP). It's sort of the "sticker price" of everything a country produces. But here’s the kicker: nominal GDP—the one you see in the headlines—is often priced in U.S. dollars. If you switch to Purchasing Power Parity (PPP), which looks at what your money actually buys you locally, the list changes completely.

The Heavyweights: Who's Actually Winning?

Right now, the United States is still holding onto that number one spot in nominal terms. It’s massive. We’re talking a projected GDP of over $31.8 trillion for 2026.

Why? It isn't just because of burgers and Hollywood. It’s the "AI supercycle." Companies in Silicon Valley are pouring hundreds of billions into chips and data centers, and Wall Street is reaping the rewards.

But then you look at China.

China is sitting at number two with about $20.7 trillion. Now, some folks say China is slowing down because of its aging population and a messy property market. That’s true, kinda. But in terms of sheer manufacturing muscle, they are still the "world's factory." And if you measure by PPP? China actually surpassed the U.S. years ago.

The Top 5 at a Glance (Nominal GDP 2026)

- United States: $31.82 Trillion

- China: $20.65 Trillion

- Germany: $5.33 Trillion

- India: $4.51 Trillion

- Japan: $4.46 Trillion

Notice something? India just hopped over Japan.

That’s a big deal. For decades, Japan was the untouchable tech giant of Asia. But a shrinking workforce and a weak yen have taken their toll. Meanwhile, India is basically a rocket ship. Their economy is growing at over 6% a year while most of the "developed" world is struggling to hit 2%.

✨ Don't miss: Forever 21 Tallahassee FL: Why the Mall Staple Disappeared

Germany and the European Struggle

Germany is currently the third-largest economy, but it’s a "quiet" third. They’ve got the Mittelstand—those medium-sized companies that make the super-specific parts for every machine on earth.

But honestly, Europe is feeling the squeeze. High energy costs and the pressure of competing with Chinese electric vehicles (EVs) have made things tough. Germany's growth is sluggish, barely hovering around 0.9%. It’s enough to keep them in the top three for now, but India is breathing down their neck. Experts at the IMF think India could snatch that third-place spot by 2027 or 2028.

The "Middle Class" of Global Power

Beyond the top five, things get really interesting. You have the UK and France. They’re old money. They’re stable. They have massive service sectors and luxury brands (looking at you, LVMH), but they aren't "growing" in the way emerging markets are.

Then you have Brazil and Mexico.

Mexico has been a huge winner of "nearshoring." Since the U.S. started moving supply chains out of China, a lot of that work went south of the border. In 2026, Mexico's GDP is crossing the $2 trillion mark. Brazil isn't far behind at $2.29 trillion, powered by huge agricultural exports and a growing middle class.

Why Should You Care About These Rankings?

It sounds like a bunch of dry numbers, but it affects your life. When India grows, it means a billion more people are entering the global consumer market. When the U.S. dominates in AI, it dictates what kind of tech you’ll be using at work next year.

Also, keep an eye on Russia. Despite all the sanctions and the war in Ukraine, they’ve managed to stay in the top 10 (around $2.5 trillion nominal). It’s a weird, resilient economy propped up by oil and a massive shift toward military production.

👉 See also: Today's Gold and Silver Prices Per Ounce: What Most People Get Wrong

The PPP vs. Nominal Trap

I mentioned this earlier, but it’s worth a deeper look. If you go to a McDonald's in New York, a Big Mac might cost you $6. In Jakarta or Mumbai, that same burger (or the local equivalent) might cost $2.

If you only look at nominal GDP, the U.S. looks nearly twice as rich as China. But if you look at Purchasing Power Parity (PPP), the rankings look like this:

- China

- United States

- India

- Russia

- Japan

Under PPP, the "East" is already dominating. This is why geopolitical tensions are so high—the actual physical output of goods in Asia has already eclipsed the West.

Actionable Insights: What to Do With This Info

If you’re looking at the biggest economies in the world and wondering how to play it, here are some practical moves:

Diversify your perspective. Don't just watch the S&P 500. India’s Nifty 50 and the growth in Southeast Asian markets (like Indonesia and Vietnam) are where the long-term momentum is.

Follow the "Nearshoring" trail. Countries like Mexico and Poland are becoming the new hubs for Western manufacturing. If you’re in logistics, manufacturing, or even real estate, these are the regions to watch.

Watch the AI CAPEX. The reason the U.S. is still #1 is because they are spending more on technology than anyone else. If that spending slows down, the U.S. lead could shrink faster than people expect.

Don't ignore the "Slow" giants. Japan and Germany might have slow growth, but they still hold the keys to high-end engineering and robotics. They are essential "bridge" economies.

The global economy isn't a scoreboard that resets every year; it’s a living, breathing thing. While the U.S. and China battle for the top spot, the real story for 2026 is the rise of the "middle powers" and the explosive growth of the Global South.

To stay ahead of these shifts, you should monitor the IMF's "World Economic Outlook" updates released every April and October. They provide the most granular data on these rankings. Additionally, tracking the "Real GDP" growth versus "Nominal GDP" can tell you if a country's rise is due to genuine productivity or just currency fluctuations.