If you’ve checked your portfolio this morning, you probably did a double-take. Or maybe you just felt that familiar itch to sell. Honestly, it’s wild out there. As of today, January 15, 2026, the metal markets are behaving like a caffeine-addicted roller coaster.

Gold is hovering around $4,605.76 per ounce.

📖 Related: 1 US Dollar to Ethiopian Birr: What Most People Get Wrong

Silver is sitting near $88.38 per ounce.

Wait, let those numbers sink in for a second. We aren’t in 2024 anymore. We aren't even in the "normal" volatility of 2025. This is a brand-new reality where the "precious" in precious metals feels a lot more like "strategic necessity." If you bought silver back when it was struggling to break thirty bucks, you’re basically a genius right now. But if you’re looking to buy today's gold and silver prices per ounce, you've gotta understand that the rules have changed.

Why Today's Gold and Silver Prices Per Ounce Are Breaking Brains

The "why" is a messy cocktail of geopolitics and some pretty weird news coming out of Washington. Most of the chatter right now is about the Federal Reserve. Specifically, the criminal investigation into Fed Chair Jerome Powell. That’s not a sentence I ever expected to write, but here we are in 2026.

When the independence of the Fed gets called into question, people run. They don't run to the dollar; they run to things they can actually hold in their hands. That’s why we saw gold tag a fresh peak above $4,630 yesterday before cooling off a bit today. It’s a classic safe-haven rotation, but on steroids.

The Silver Explosion Is Different

Silver is the real story, though.

While gold is up roughly 70% over the last year, silver has basically gone vertical. It’s up over 180% in the same timeframe. Why? Basically, the world realized it can't build a green future without it.

- China's Export Curbs: On January 1st, China slapped massive restrictions on silver exports. They've labeled it a "strategic metal." When the world’s biggest supplier stops sharing, the price does exactly what you’d expect.

- The Solar Hunger: Every solar panel being installed in 2026 needs silver.

- The EV Shift: Electric vehicles use significantly more silver than internal combustion cars.

So, you have this "perfect storm" where industrial demand is screaming at the same time investors are panicking about the Fed. That’s how you get silver hitting $92 an ounce earlier this week before settling into today's range in the high eighties.

The Gold-to-Silver Ratio Nobody Talks About

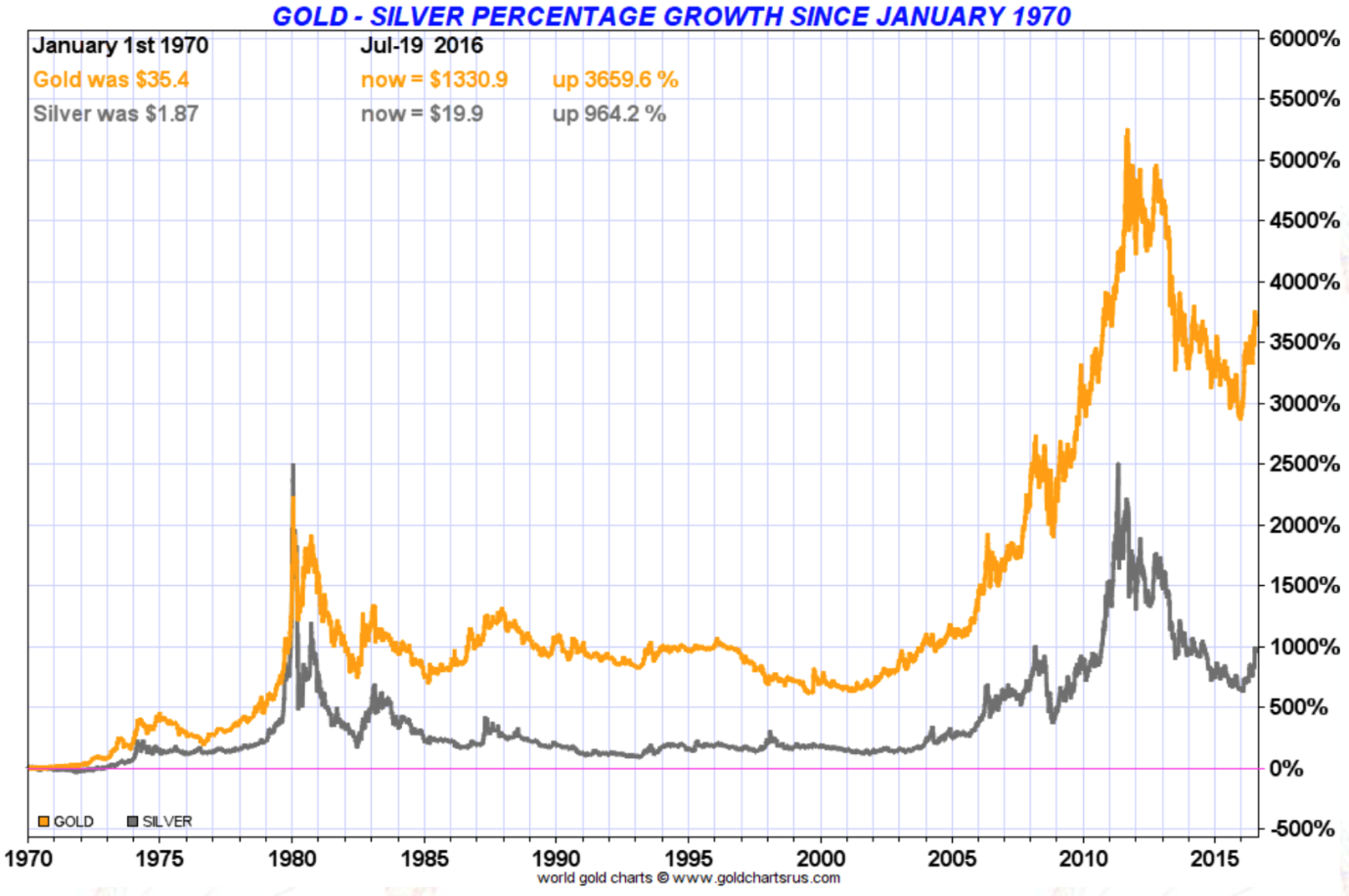

For decades, the "smart" money looked at the gold-to-silver ratio. It used to hang out around 80:1 or even 100:1. If you had an ounce of gold, you could buy 100 ounces of silver.

Today? That ratio has compressed to about 52:1.

This is huge. It tells us that silver isn't just following gold anymore; it's leading. We are seeing a structural shift in how these metals are valued relative to each other. Some analysts, like those over at Citigroup, are even whispering about silver hitting $100 by March. Gold, meanwhile, is eyeing the $5,000 psychological barrier. It’s a lot to process.

What's Actually Driving the Price This Morning?

If you're looking at the charts right now, you’ll see a slight dip. Don't let it spook you too much—it’s mostly profit-taking.

Investors who caught the ride from $4,000 to $4,600 are cashing in some chips. It's natural. Also, we’re waiting on the U.S. retail sales data and the latest CPI (inflation) prints. If inflation comes in hotter than the 2.7% consensus, the dollar might catch a bid, which usually puts a temporary lid on gold.

But honestly, the "correction" we’re seeing today is tiny. Gold only dropped about $20 from its recent peak. In a market this hot, that’s barely a flesh wound. It shows that there are plenty of buyers waiting on the sidelines to jump in on any weakness.

The Reality of Buying Right Now

Thinking about buying? You've gotta be careful with premiums.

Because demand is so high, the "spot price" you see on the news isn't what you'll actually pay at a local coin shop or online dealer. For silver, premiums are frequently reaching 15% to 20% over spot. If the spot is $88, you might be looking at over $100 for a physical American Silver Eagle.

Gold premiums are tighter, usually around 3% to 5%, but when the price is $4,600, that’s still a couple hundred bucks extra per ounce.

Actionable Steps for Today

Don't just stare at the tickers. If you're managing a portfolio in this environment, here is how you should actually handle today's gold and silver prices per ounce:

- Check your allocations. If your gold and silver have doubled in value, they might now make up a way larger percentage of your net worth than you originally intended. Rebalancing isn't a dirty word.

- Verify your storage. With prices this high, that "shoebox in the closet" might not be the best idea anymore. Look into insured depository storage or a high-quality home safe that’s actually bolted to the floor.

- Watch the $4,770 level for gold. The World Gold Council says gold isn't technically "overbought" until it hits $4,770. If it breaks that, we might see another parabolic move.

- Monitor the Fed investigation. Any news regarding Jerome Powell’s status will move the needle instantly. If he’s ousted or if the investigation turns up something "systemic," expect another flight to safety.

- DCA (Dollar Cost Averaging). If you feel like you missed the boat, don't go "all in" at the top. Buy small amounts over several weeks to smooth out the volatility of this crazy 2026 market.

The era of cheap precious metals is over. Whether we are in a bubble or just a "new normal" is still being debated, but for now, the trend is clearly up. Stay liquid, stay informed, and don't panic-sell just because you see a red candle on a Thursday morning.