So, you want to apply for Apple Credit Card. It sounds easy, right? You just tap a button in your Wallet app and boom—you’re buying a new MacBook Pro with 0% interest. But honestly, the "Apply" button is where the simple stuff ends and the weird, opaque world of Goldman Sachs credit algorithms begins. I’ve seen people with 750 credit scores get rejected while someone with a 640 and a thin file walks away with a $5,000 limit. It’s kinda unpredictable.

Applying for a credit card shouldn't feel like a high-stakes gamble, yet here we are. Apple marketed this card as a "new kind of credit card," but it still relies on the same old plumbing: TransUnion reports, debt-to-income ratios, and the mysterious internal math of the issuing bank. If you’re staring at your iPhone wondering if you should take the plunge, you’ve got to understand how this specific ecosystem works before you hit "Submit."

The Soft Pull Secret and Why it Matters

Most credit cards are jerks. You apply, they ding your credit score with a hard inquiry, and then they tell you "no." Apple did something different here that actually benefits the consumer. When you apply for Apple Credit Card, they use a soft credit pull to determine your eligibility and show you your potential credit limit and APR.

Your score doesn't move. Not a single point.

You only get that hard inquiry—the one that might drop your score by five or ten points—if you actually accept the offer. This is a massive advantage. It means you can basically "shop" your rate without the fear of damaging your credit profile. If Goldman Sachs offers you a measly $500 limit at a 27% APR, you can just say "thanks, but no thanks" and walk away. Your credit report will act like the whole thing never happened. It’s one of the few consumer-friendly moves in the entire industry.

What Goldman Sachs Actually Looks For

They use TransUnion. While most big banks like Chase or Amex might pull from Experian or Equifax depending on where you live, Apple is famously tied to TransUnion. Specifically, they use FICO Score 9.

🔗 Read more: UK Pound in Pakistan: Why the Rates Are Moving and What to Expect

Most people are used to FICO 8, which is the industry standard. FICO 9 is a bit more forgiving. It doesn't penalize you as harshly for paid-off medical collections, which is a huge deal for a lot of folks. However, don't let that fool you into thinking it's a "guaranteed" card. You generally need a score in the mid-600s to even stand a chance, though a "good" chance starts around 700.

But it’s not just the score.

Goldman Sachs is notoriously picky about your debt-to-income (DTI) ratio. If you’re making $40,000 a year but you’re carrying $15,000 in high-interest credit card debt elsewhere, they’re going to pass. They want to see that you have "disposable" income. They also look at your "path" with Apple. Have you been paying your iCloud storage bill on time for five years? Do you have an active Apple ID with a history of purchases? These small, internal data points actually seem to matter more than people realize.

The Path to Apple Card Program

What happens if you get rejected? For most cards, that's a dead end. You get a cold letter in the mail and you're done. Apple has this thing called the Path to Apple Card.

It’s essentially a credit-building boot camp.

If you get turned down, Apple might invite you into this program. They’ll give you specific tasks, like "pay down $400 of debt" or "make on-time payments for 4 months." If you follow their rules, they basically promise you an approval at the end of the period. It’s remarkably transparent. I’ve talked to people who spent six months in the program and came out with a $2,500 limit. It’s probably the most "human" part of the entire application process.

📖 Related: UAW Contract With GM: What Most People Get Wrong About the 2023 Deal

Why the Physical Card is a Trap (Sorta)

When you apply for Apple Credit Card and get approved, you get the digital version instantly. You can go buy a sandwich or a flat-screen TV five minutes later. Then, they ask if you want the physical titanium card.

It's beautiful. It's heavy. It makes a cool "clink" sound when you drop it on a table.

But here’s the kicker: the physical card is the worst way to use the Apple Card. If you swipe that fancy titanium card at a restaurant, you only get 1% Daily Cash back. If you use the digital version via Apple Pay on your phone, you get 2%. If you use it at a partner like Nike, Uber, or Walgreens, you get 3%. Basically, the physical card is a status symbol that actually costs you money in lost rewards. Use the phone. Keep the titanium card in your drawer to show off to your friends later.

Common Application Pitfalls

- The "Frozen" Report: If you’re a responsible adult, you probably have your credit reports frozen. You have to unfreeze TransUnion specifically. If you don't, the application will fail instantly.

- Income Inflation: Don't lie. Goldman Sachs has been known to request income verification (like a W2 or pay stub) if the numbers look funky compared to your age or job title.

- Identity Verification: Make sure your ID isn't expired. You have to scan your driver’s license or state ID with your iPhone camera during the process. If it's blurry or expired, the system will kick you out.

Technical Nuance: The APR Range

The APR on the Apple Card isn't one-size-fits-all. It’s a variable rate that currently ranges from roughly 19.24% to 29.49% based on your creditworthiness. That's high. Honestly, if you're not planning on paying your balance in full every single month, this card is a terrible idea. The "Daily Cash" rewards are great, but they don't mean anything if you're paying 29% interest on a slice of pizza.

📖 Related: Federal Funds Rate History: Why the Fed Can’t Stop Breaking Things

The only exception is the Apple Card Monthly Installments.

This is the real reason people apply. If you buy an iPhone, Mac, or iPad through the Apple Store using the card, you can split the cost over 6, 12, or 24 months at 0% interest. This is a massive financial tool if used correctly. It turns a $1,200 phone into a manageable $50 monthly bill without costing you a penny in interest. Just remember: if you miss a payment or don't pay off the balance, that interest-free magic can disappear quickly.

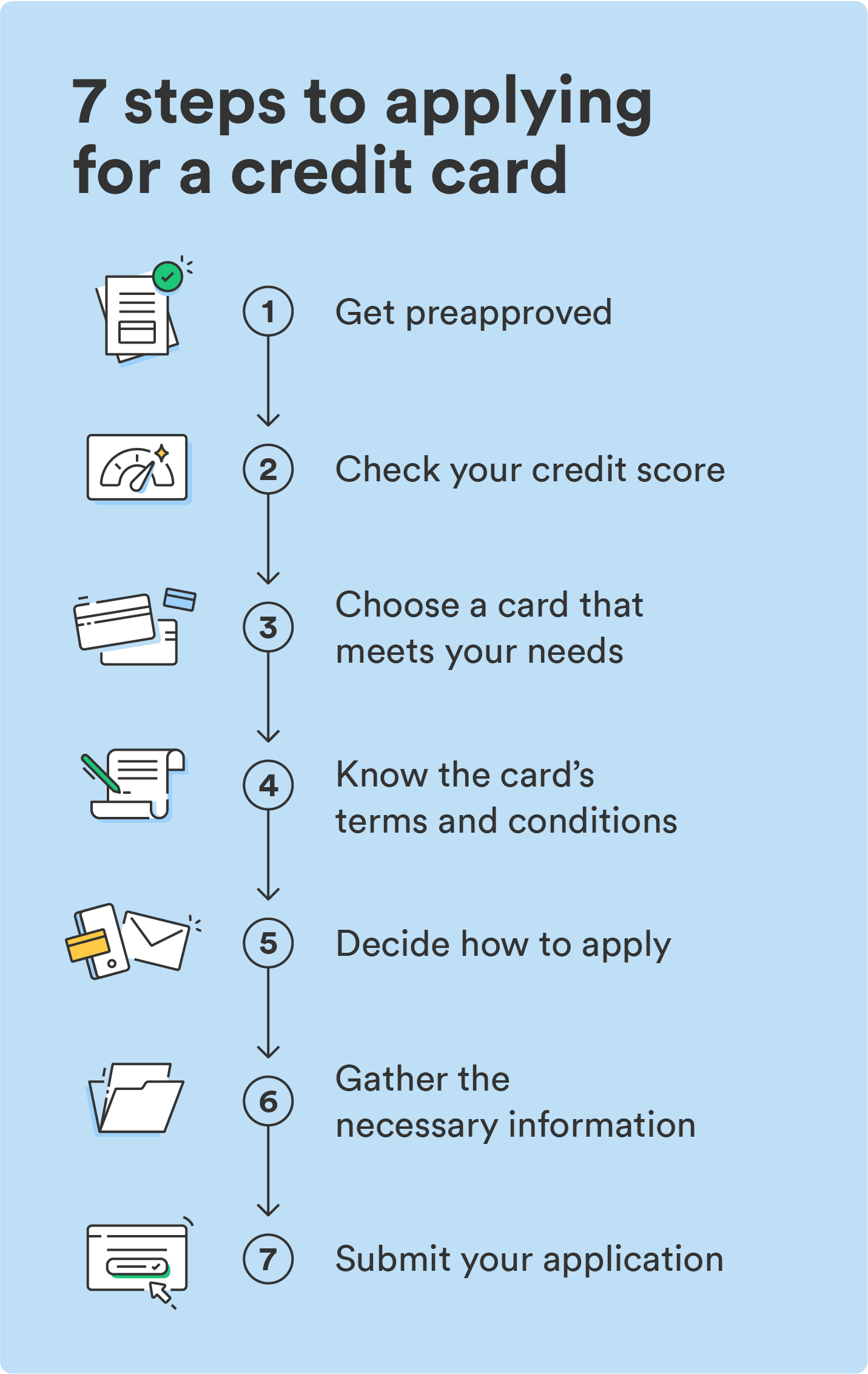

How to Apply: The Step-by-Step

- Open the Wallet app on your iPhone.

- Tap the plus (+) sign in the top right corner.

- Select Apply for Apple Card.

- Fill in your personal info (Name, DOB, Income).

- Review your offer (Limit and APR).

- Accept the offer to finalize the hard pull.

Actionable Insights for Your Application

Before you hit that button in the Wallet app, take three specific steps to ensure you get the best possible offer.

First, go to the TransUnion website and ensure your credit report is accurate and unfrozen. A single misplaced digit in your address can trigger a "could not verify identity" error that takes weeks to fix.

Second, pay down your existing credit card balances to below 30% of their limits. Since Goldman Sachs uses FICO 9, they look closely at your current utilization at the exact moment of the soft pull. Lowering your balance even by a few hundred dollars the week before you apply can result in a significantly higher credit limit offer.

Third, ensure your Apple ID is in good standing. Use an Apple ID that is at least six months old and has two-factor authentication enabled. This sounds like a tech detail, but it’s actually a security check for the bank. If your digital footprint looks "fresh" or "temporary," it’s a red flag for fraud algorithms. Take care of these "boring" details first, and you’ll likely find the application process is as seamless as the marketing suggests.