Money isn't free. Most people realize that when they look at their credit card statement or a mortgage quote that makes them want to lie down in a dark room. But the "price" of money—the actual, foundational cost of every dollar moving through the American economy—is basically just a number decided by a small group of people in Washington, D.C.

That number is the federal funds rate.

If you look back at federal funds rate history, you aren't just looking at a chart of boring percentages. You're looking at the pulse of every major boom, bust, and "black swan" event of the last seventy years. It is the lever the Federal Reserve pulls to keep us from hyperinflation or a total collapse. Sometimes they pull it too hard. Sometimes they don't pull it fast enough. Honestly, the history of this rate is a series of "oops" moments followed by aggressive course corrections.

The Wild 1970s and the Volcker Shock

Back in the late 70s, the U.S. economy was a total mess. We're talking double-digit inflation that made a loaf of bread feel like a luxury purchase. The Fed, led by Paul Volcker at the time, decided to do something absolutely radical. They didn't just nudge rates; they nuked the economy to save the currency.

💡 You might also like: Is there such a thing as a $500 bill? Why collectors are obsessed with them

In 1981, the federal funds rate hit an all-time peak of 20%.

Can you even imagine that today? A 20% benchmark rate means a mortgage would cost you 22% or 23%. It was brutal. People were literally mailing car keys to the Fed because they couldn't afford their loans. Farmers were protesting on tractors outside the Eccles Building. It worked, though. It killed inflation, but it also triggered a massive recession. This era set the tone for how we view the Fed today—as the "lender of last resort" that is willing to break the economy's leg to make sure it doesn't die of a fever.

Why the 2% Target Isn't Actually Magic

We hear about the 2% inflation target constantly. It’s treated like a law of physics. But if you dig into the archives, you’ll find that the 2% goal is relatively new and somewhat arbitrary. New Zealand's central bank actually started the trend in the late 80s, and the U.S. eventually just... adopted it. It’s not a magic number, but the Fed uses the federal funds rate to chase it like a greyhound chasing a mechanical rabbit.

The Era of "Easy Money" and the Great Financial Crisis

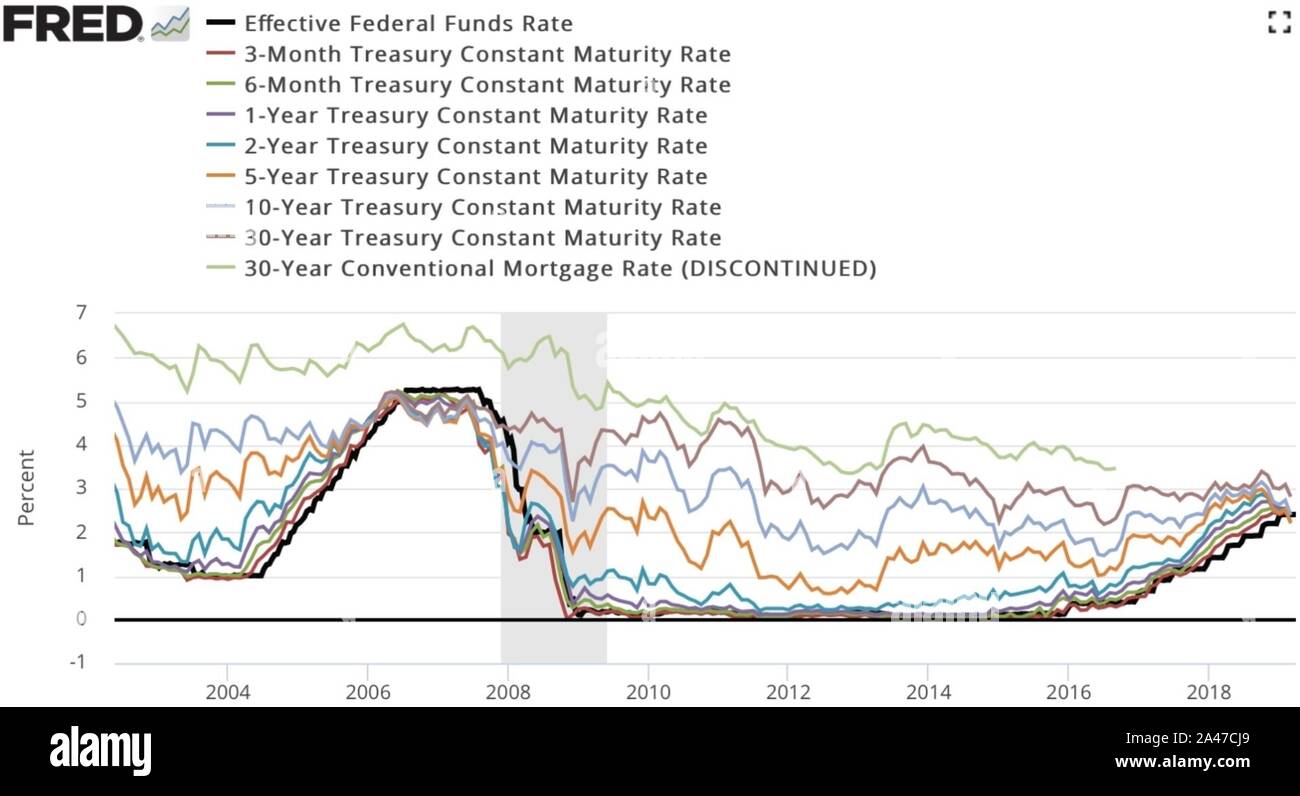

Fast forward to the early 2000s. After the dot-com bubble burst and 9/11 shook the world, the Fed slashed rates. They kept them low for a long time. This is where things get spicy. By keeping the cost of borrowing so low, they accidentally (or arguably, through negligence) fueled the housing bubble.

When they finally started raising rates in 2004—moving from 1% up to 5.25% by 2006—it was too late. The subprime mortgage market was already a house of cards. As rates went up, those adjustable-rate mortgages (ARMs) started resetting. People couldn't pay. Default rates skyrocketed.

Then came 2008.

The Fed panicked. They dropped the rate to 0%. Basically, for the first time in federal funds rate history, money became effectively free for banks. This "Zero Interest Rate Policy" (ZIRP) lasted for seven years. It’s probably the most unnatural period in modern economic history. It forced investors to take massive risks because you couldn't make any money just sitting on cash in a savings account.

The Pandemic Pivot and the Inflation Revenge

Nobody saw 2020 coming. When the world shut down, the Fed went back to the 2008 playbook: drop rates to zero, immediately. They also pumped trillions of dollars into the system through quantitative easing. For a while, everyone was a genius. Stocks went to the moon. Crypto went to the moon. Your neighbor's house doubled in value in eighteen months.

But there’s no such thing as a free lunch.

🔗 Read more: Are We Getting a Stimulus Check for 2025? What Most People Get Wrong

By 2022, the "transitory" inflation the Fed kept talking about turned out to be very much not transitory. We saw the most aggressive hiking cycle since the Volcker days. They moved the rate from 0% to over 5% in what felt like a blink of an eye.

How Rates Actually Change Your Life (Not Just Your Savings)

It’s easy to think this is all high-finance nonsense that doesn't touch regular people. Wrong. The federal funds rate is the "prime" rate's daddy. When the Fed moves, your credit card APR moves. Usually within one or two billing cycles.

- Your Savings: High rates are great for your HYSA. You're finally getting paid to keep cash.

- Your Debt: High rates are a nightmare for anyone with a balance.

- The Job Market: This is the one people miss. High rates make it expensive for companies to expand. If a tech company has to pay 8% on a loan instead of 2%, they aren't hiring. They're doing "efficiency" layoffs.

The Fed has a "dual mandate": stable prices and maximum employment. The problem is that these two things often hate each other. To get stable prices (low inflation), you usually have to cool the job market down. It’s a cold, calculated trade-off.

Common Misconceptions About the "Natural Rate"

A lot of people think there is a "normal" rate we should return to. If you look at the 50-year average, it's somewhere around 5%. But the world has changed. We have way more debt now—both corporate and sovereign—than we did in the 70s.

If we kept rates at 5% forever, the interest on the U.S. national debt would eventually swallow the entire federal budget. This is the "debt trap" that many economists, like those at the Peter G. Peterson Foundation, warn about. The Fed isn't just looking at inflation; they're looking at whether the government can actually afford to pay its bills.

Actionable Insights for a High-Rate World

We are no longer in the era of free money. That ship has sailed and probably sunk. Navigating the current environment requires a different playbook than the one that worked from 2010 to 2020.

👉 See also: General Mills Earnings Power Value Guru: What Most People Get Wrong

Prioritize Liquidity Over Leverage

In the ZIRP era, debt was a tool. Now, debt is a weight. If you have high-interest debt, killing it is a guaranteed return on investment that beats almost any stock.

Ladder Your Fixed Income

If you're putting money into CDs or Bonds, don't lock it all in at once. Use a "ladder" strategy. Buy some now, some in six months, and some in a year. This protects you if the Fed decides they need to keep hiking to fight a second wave of inflation.

Watch the "Real" Rate

The nominal rate is what you see in the headlines. The "real" rate is the federal funds rate minus inflation. If the Fed is at 5% and inflation is at 3%, the real rate is 2%. That’s restrictive. If inflation jumps to 6%, that 5% rate is actually "easy" money. Always do the math.

Re-evaluate Your Risk Tolerance

The "TINA" (There Is No Alternative) era for stocks is over. You can get 4% or 5% on a government bond now. You don't have to be in the casino to grow your wealth. This shift in federal funds rate history means the "60/40" portfolio isn't dead; it was just taking a long nap.

The Federal Reserve is essentially trying to fly a jumbo jet through a hurricane using instruments that are 3 months old. They rely on "lagging indicators." By the time they see the economy is breaking, it’s usually already broken. Understanding this cycle doesn't just make you sound smart at dinner parties; it’s the only way to protect your capital when the people in charge inevitably oversteer.