Checking historical stock data is usually a dry affair, but looking back at the AAPL adjusted close June 30 2020 feels a bit like reading a map of where the modern tech economy actually began its current trajectory. It was a weird time. We were all stuck at home, the world felt like it was ending, and yet, big tech was somehow thriving in a way that defied basic logic.

On that specific Tuesday, Apple’s stock didn't just move; it signaled a massive shift in how the market valued hardware companies that were rapidly becoming services giants.

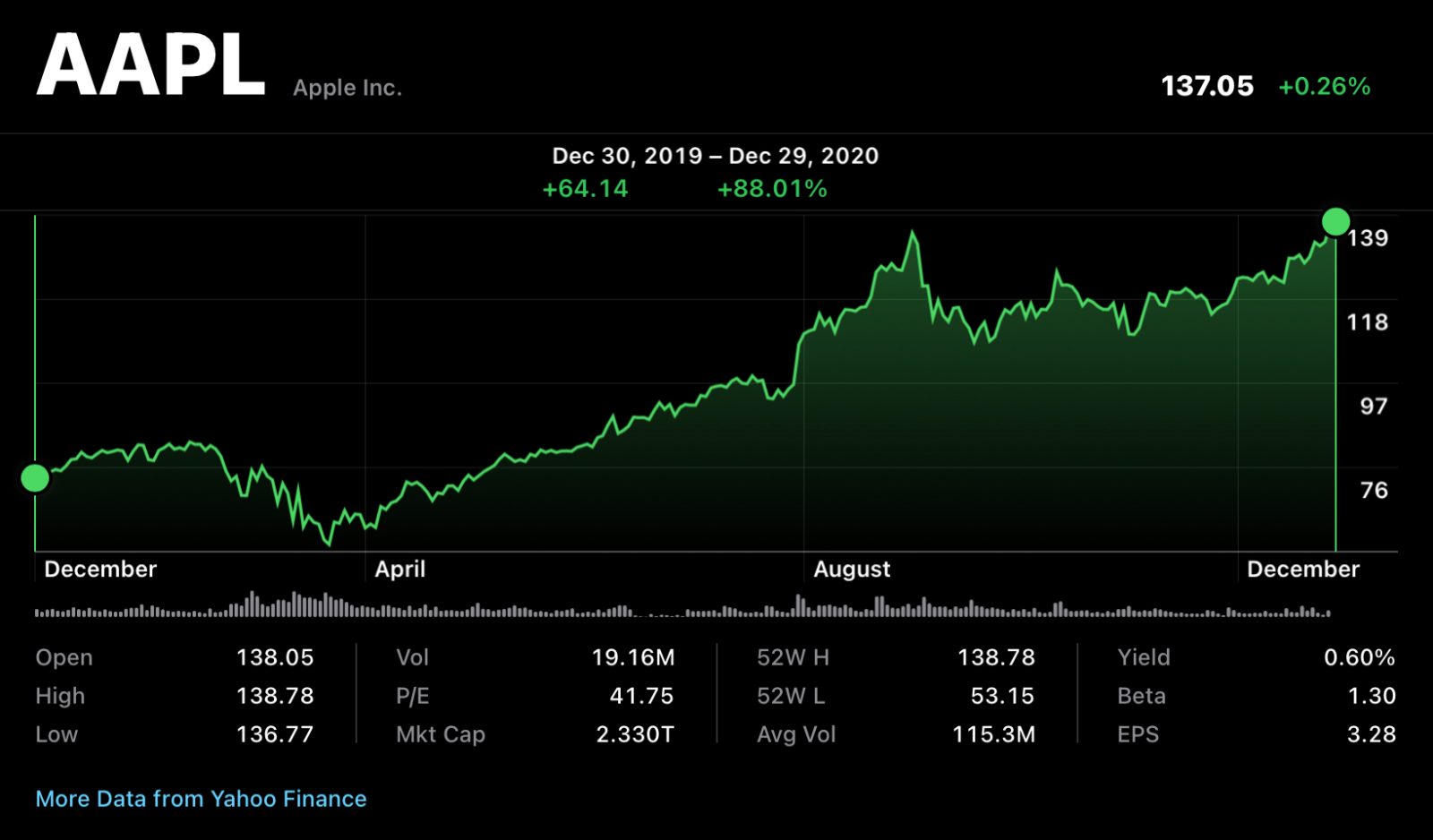

If you look at the raw data, the AAPL adjusted close June 30 2020 was $89.81. Now, if you look at a chart today and see prices in the hundreds, you might be confused. That’s because Apple had a 4-for-1 stock split later that summer, in August. So, when we talk about that $90 price point, we’re talking about the split-adjusted value that accounts for all the corporate actions, dividends, and distributions that have happened since. It’s the "real" price that analysts use to compare apples to apples—pun intended—across different eras of the company’s history.

What was happening in the world?

Context is everything. You can't just look at a number like $89.81 and understand it without remembering the chaos of June 2020. The COVID-19 pandemic was in full swing. Stores were closed. Supply chains in China were a mess. Most people thought iPhone sales would crater because, honestly, who was going out to buy a $1,000 phone when the world was on lockdown?

But something else happened. We all needed iPads for Zoom. We needed Macs for remote work. We needed App Store subscriptions to keep us from losing our minds while stuck on the couch.

By the time the AAPL adjusted close June 30 2020 hit the books, investors were realizing that Apple wasn't just a phone company anymore. It was an essential utility. The market started pricing in this "stay-at-home" alpha. The stock had already rallied significantly from its March 2020 lows, where it had dipped into the $50s (split-adjusted). By June 30, the end of the second quarter, the narrative had shifted from "will they survive the supply chain shock" to "how big will the services revenue get?"

Breaking down the math of the adjusted close

A lot of people get tripped up on the difference between the "close" and the "adjusted close." Let's clear that up. The unadjusted closing price on June 30, 2020, was actually around $364.80. That sounds way higher, right? But that was before the 4-for-1 split. If you held one share at $364, you suddenly held four shares at roughly $91.

The AAPL adjusted close June 30 2020 of $89.81 factors in that split and also the dividends paid out. It’s the most honest way to look at your total return. If you bought $10,000 worth of Apple on that day, you weren't just betting on a gadget. You were betting on a systemic shift in global labor and entertainment.

📖 Related: Target Town Hall Live: What Really Happens Behind the Scenes

The Services Surge

Around this time, Tim Cook and Luca Maestri (Apple’s CFO) were beating the drum on Services. We’re talking iCloud, Apple Music, and the App Store. On June 30, the market was beginning to value those recurring revenue streams more like a software company (think Microsoft or Adobe) and less like a hardware company (think Dell or HP). Software companies get higher valuation multiples because their revenue is predictable. Hardware is "lumpy." You buy a phone once every three years, but you pay for iCloud every single month.

Why that date was a turning point for tech

June 30 marks the end of Q2. It’s a moment when fund managers rebalance their portfolios. They look at what worked and what didn't. In 2020, Apple was the "what worked."

The AAPL adjusted close June 30 2020 represented a 24% gain for the quarter. Just for that quarter! In three months, the largest company in the world grew by nearly a quarter of its value. That is statistically insane. Usually, companies that large move like oil tankers—slow and heavy. In 2020, Apple was moving like a jet ski.

It also showed that the "Apple is dead without Steve Jobs" narrative was officially buried. Tim Cook had steered the ship through a global catastrophe and somehow made the company more valuable than it was before the crisis.

Comparing AAPL to the rest of the "FAANG" pack

How did Apple’s performance on June 30, 2020, stack up against its peers?

- Amazon was on fire because everyone was ordering toilet paper online.

- Netflix was booming because we had nothing else to do.

- Google and Facebook were actually struggling a bit because advertising budgets were being slashed by companies that were going out of business.

Apple was in a unique spot. It had the hardware we needed to work and the services we needed to play. The AAPL adjusted close June 30 2020 reflected a rare balance. It wasn't as volatile as Netflix, and it wasn't as exposed to the ad market as Facebook. It was the "safe haven" of tech.

The 2-Trillion Dollar March

Shortly after this June 30 marker, Apple became the first U.S. company to hit a $2 trillion market cap. The momentum that built up through the end of June was the fuel for that August breakout. Looking back, that $89.81 price point looks like an absolute steal, but at the time, many analysts were shouting that the stock was overbought and due for a correction. They were wrong. The correction didn't come for a long time, mostly because the earnings kept backing up the price hikes.

👉 See also: Les Wexner Net Worth: What the Billions Really Look Like in 2026

Understanding the risks that were present

It’s easy to look back with 20/20 hindsight and say, "Of course Apple was going up!" But on June 30, 2020, there were real risks. The U.S.-China trade war was still simmering. There were concerns about antitrust legislation in Europe. There was the "Epic Games" lawsuit on the horizon regarding the App Store's 30% cut.

If you were an investor looking at the AAPL adjusted close June 30 2020, you had to weigh these regulatory threats against the massive wall of cash Apple was generating. Honestly, most people just followed the cash. Apple's balance sheet at the time was cleaner than a surgical suite. They had enough cash on hand to buy several smaller countries.

The technical side: Moving averages and support

For the traders out there, the AAPL adjusted close June 30 2020 sat well above its 50-day and 200-day moving averages. This is a classic bullish sign. When a stock stays above those lines, it means the "trend is your friend."

The volume on that day was also significant. Millions of shares changed hands as institutional investors closed out their books for the first half of the year. It wasn't just retail "Robinhood" traders pushing the price up; it was the big boys—Vanguard, BlackRock, and State Street—securing their positions.

What can we learn from this data point today?

Markets are cyclical, but quality is persistent. The AAPL adjusted close June 30 2020 is a reminder that even in the midst of global panic, companies with strong ecosystems and deep integration into daily life tend to win.

If you're looking at Apple today and wondering if it's too late to buy, or if the valuation is too high, remember that people were saying the exact same thing on June 30, 2020. They said it at $90 (adjusted). They said it at $120. They said it at $150.

Actionable insights for modern investors

Don't ignore the "Adjusted" price. When doing historical research, always use the adjusted close. If you look at raw prices, the 2020 split will make your data look like the company lost 75% of its value overnight, which obviously didn't happen. Sites like Yahoo Finance or Bloomberg do this math for you, but it's good to know what's happening under the hood.

✨ Don't miss: Left House LLC Austin: Why This Design-Forward Firm Keeps Popping Up

Watch the Services growth. The trend that peaked around June 2020—the pivot to services—is still the main engine for Apple's valuation. If services growth slows down, the "multiple" the market is willing to pay for the stock will drop.

Contextualize the "Gains." A 24% quarterly gain is a red flag in a normal market, but in a "recovery" market like 2020, it was just the beginning. Always ask: "Is this price rise driven by hype or by actual earnings?" In June 2020, it was a mix of both, but the earnings eventually caught up.

Look at the ecosystem, not just the product. On June 30, 2020, the iPhone 12 hadn't even been announced yet. People weren't buying the stock because of a specific new phone; they were buying the ecosystem. That's still the play today.

The AAPL adjusted close June 30 2020 isn't just a number in a database. It was the moment the market decided Apple was a "forever" company. Whether you're a day trader or a long-term "HODLer," understanding how a giant like Apple behaves during a crisis provides a blueprint for how to handle the next one.

Keep your eye on the adjusted closing prices over long periods—usually five to ten years—to see the real story of wealth creation. Short-term noise is just that: noise. The adjusted close tells the truth about where the money went and why it stayed there.

To get a full picture of your own portfolio's performance from that era, you should pull a "dividend-adjusted" historical data export from a reliable financial portal. Compare your total return against the S&P 500 for the same period starting June 30, 2020. You’ll likely find that Apple’s ability to capture the "at-home" shift outperformed the broader market by a staggering margin, reinforcing why it remains a cornerstone of almost every major mutual fund and ETF in existence today. Check your cost basis, account for the 4-for-1 split, and you'll see exactly how much that mid-2020 pivot was worth.