The official numbers just dropped, and honestly, they’re a bit of a head-scratcher. If you just look at the headlines, everything seems fine. Solid, even. But if you’ve been trying to find a job lately, or if you’ve watched a friend send out 300 resumes only to get ghosted, you know the vibe on the street doesn’t match the government spreadsheets.

So, let’s get into it.

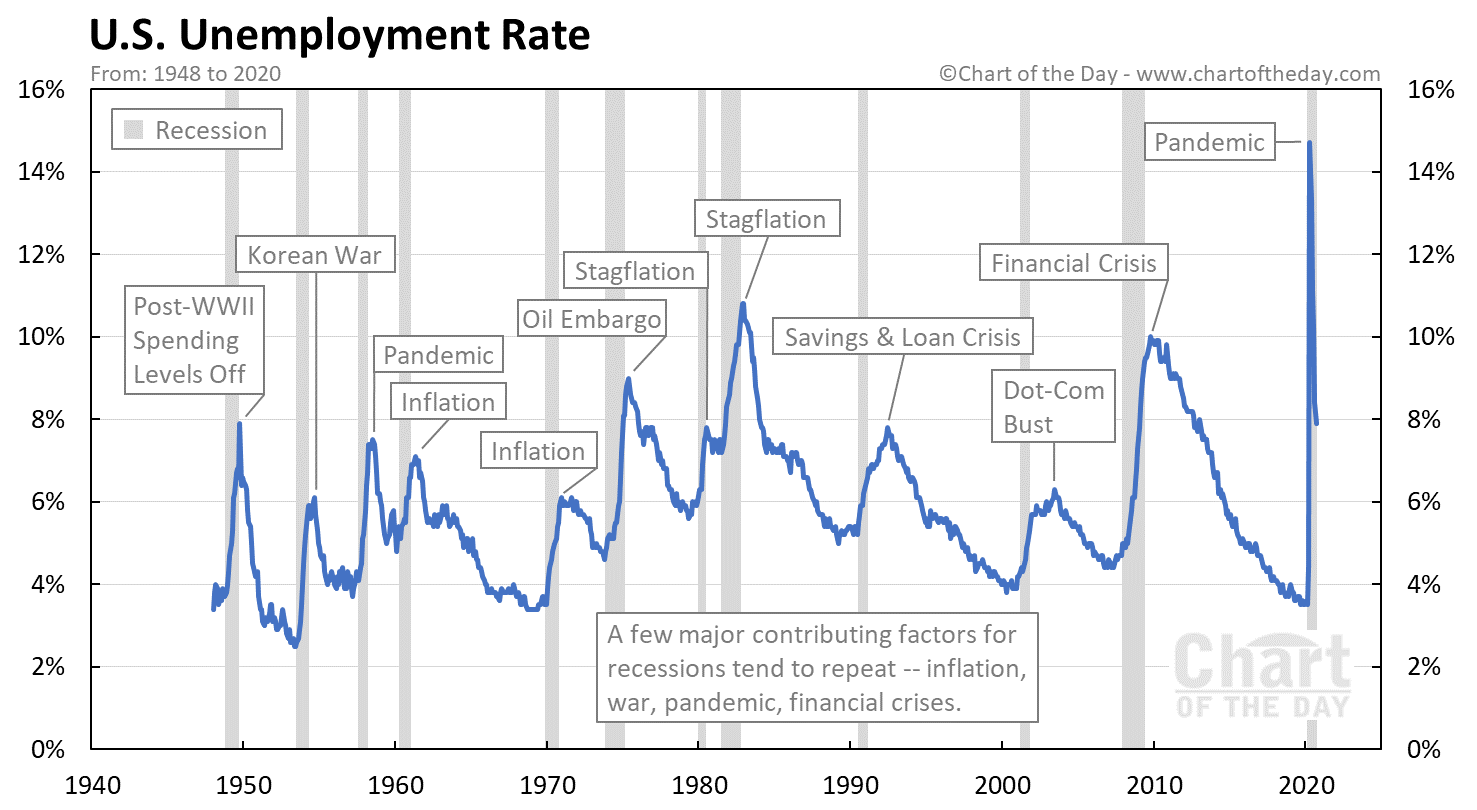

As of the latest data released by the Bureau of Labor Statistics (BLS) on January 9, 2026, the unemployment rate right now in USA is 4.4%.

That’s essentially unchanged from the previous month. On paper, 4.4% is historically low. It’s the kind of number that usually makes economists cheer. But there is a massive "but" hiding under the hood of this report. While the rate is low, the momentum is stalling. We’re in this weird holding pattern where people aren't necessarily getting fired in huge waves, but they aren't getting hired either.

It’s a "wait and see" economy.

Breaking Down the 4.4% Reality

To understand why your LinkedIn feed is full of "Open to Work" banners despite a 4.4% rate, we have to look at the churn.

In December 2025, the U.S. economy only added about 50,000 jobs. Compare that to 2024, where we were seeing an average of 168,000 jobs added every single month. That is a massive cliff. We’ve gone from a sprint to a slow, labored walk.

Who is actually getting hired?

Most of the growth is happening in very specific corners. If you aren't in these sectors, it feels like a recession:

💡 You might also like: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

- Health Care: Added about 21,000 jobs (mostly in hospitals).

- Food Services & Bars: Added 27,000 jobs.

- Social Assistance: Added 17,000 jobs.

Meanwhile, retail trade actually lost 25,000 jobs in the same period. The "help wanted" signs are still there, but they’re mostly for nurses or line cooks, not for middle management or tech roles.

The "Real" Unemployment Rate: U-6

There’s a number called the U-6 rate. Most people don't talk about it, but it’s arguably more important for regular folks. While the "headline" rate (U-3) is 4.4%, the U-6 rate—which includes people who have given up looking and those working part-time because they can’t find full-time work—is sitting at 8.4%.

That’s a huge gap.

It means for every person the government officially counts as "unemployed," there’s almost another whole person out there who is underemployed or "discouraged." This is where the frustration comes from. You’re working 20 hours at a grocery store while looking for an accounting gig; the BLS counts you as "employed," but your bank account says otherwise.

Why the Market Feels So Stagnant

Kinda weird, right? If unemployment is low, why is it so hard to move?

Expert Michael Feroli, the Chief U.S. Economist at J.P. Morgan, points to business uncertainty. With trade policies shifting and new tariffs hitting the books—estimated at a static rate of 16.5% recently—companies are terrified of making a bad hire. They’d rather stay lean than expand and have to do layoffs in six months.

We’re also seeing a "joint stepdown" in supply and demand.

📖 Related: How Much Do Chick fil A Operators Make: What Most People Get Wrong

- Lower Demand: Companies are hiring less because of high interest rates and trade jitters.

- Lower Supply: Immigration has slowed down significantly, and the "One Big Beautiful Bill Act" (OBBBA) policy changes have tightened the labor pool.

Because both are dropping at the same time, the unemployment rate stays flat. It’s like a see-saw where both kids got off at the same time. The board didn't move, but there's a lot less action happening.

The Long-Term Trap

One of the scariest stats in the January 2026 report is the rise in long-term unemployment.

There are about 1.9 million people who have been jobless for 27 weeks or more. That’s up nearly 400,000 people from a year ago. If you lose your job right now, you aren't just out of work for a month. You’re likely looking at a half-year grind to find something new.

Demographic Winners and Losers

The 4.4% average hides some pretty stark differences. Honestly, it depends entirely on who you are and what you do.

- Adult Men and Women: Both sitting at 3.9%.

- Teenagers: A brutal 15.7%.

- Black Workers: 7.5%.

- Asian Workers: 3.6%.

- Hispanics: 4.9%.

Teenage unemployment is often a "canary in the coal mine." When companies stop hiring kids for entry-level summer jobs or after-school shifts, it usually means they are bracing for a downturn.

Is a Recession Coming in 2026?

Most analysts, including those at Goldman Sachs and J.P. Morgan, aren't ringing the alarm bells for a full-blown crash just yet. They put the risk of a recession in 2026 at about one-in-three.

The Federal Reserve is in a tough spot. They cut rates slightly at the end of 2025 to stop the bleeding, but since the unemployment rate hasn't spiked past 4.5% yet, they might hold off on more cuts. This is bad news if you’re hoping for lower mortgage rates or easier business loans.

👉 See also: ROST Stock Price History: What Most People Get Wrong

Actionable Steps for Navigating This Market

If you are looking for work or worried about your current spot, "business as usual" won't cut it in 2026. Here is how you play this:

1. Don't quit without a backup.

The "quits rate" is at a multi-year low. People are staying put because they know the "Hire" sign is flickering. If you hate your job, suck it up until you have a signed offer letter in hand.

2. Pivot to "Recession-Proof" niches.

Healthcare, education, and social assistance are the only ones consistently adding bodies. If you’re in tech or marketing, try to find roles within those stable industries.

3. Upskill for AI productivity.

J.P. Morgan’s latest research shows that while AI isn't causing mass layoffs yet, it is slowing down hiring for entry-level roles. You need to show you can do the work of two people using these tools to be the "selective" hire companies are looking for.

4. Watch the "U-6" and "Initial Claims" data.

Ignore the 4.4% headline next month. Watch Initial Jobless Claims (the weekly report). If that number starts consistently staying above 220,000, that’s your signal that the "holding pattern" is over and the layoffs have truly begun.

5. Diversify your income.

Interestingly, self-employment hit an all-time high in 2025. Many people are realizing that having one boss is actually riskier than having five small freelance clients. If you have a skill, start a side hustle now while you still have a paycheck.

The US labor market isn't broken, but it is definitely "cold." Understanding that the unemployment rate right now in USA is a measure of stability—not necessarily a measure of opportunity—is the first step to surviving this cycle.

Stay lean, stay skilled, and keep an eye on those long-term unemployment numbers. They'll tell you when the tide is finally turning.