Honestly, most of us use it without thinking twice. You’re at a checkout, you double-click that side button on your iPhone, and—beep—you’re out the door. It feels like magic, or maybe just a really convenient shortcut. But if you've ever wondered what’s actually happening behind that little spinning "Done" checkmark, you’re not alone.

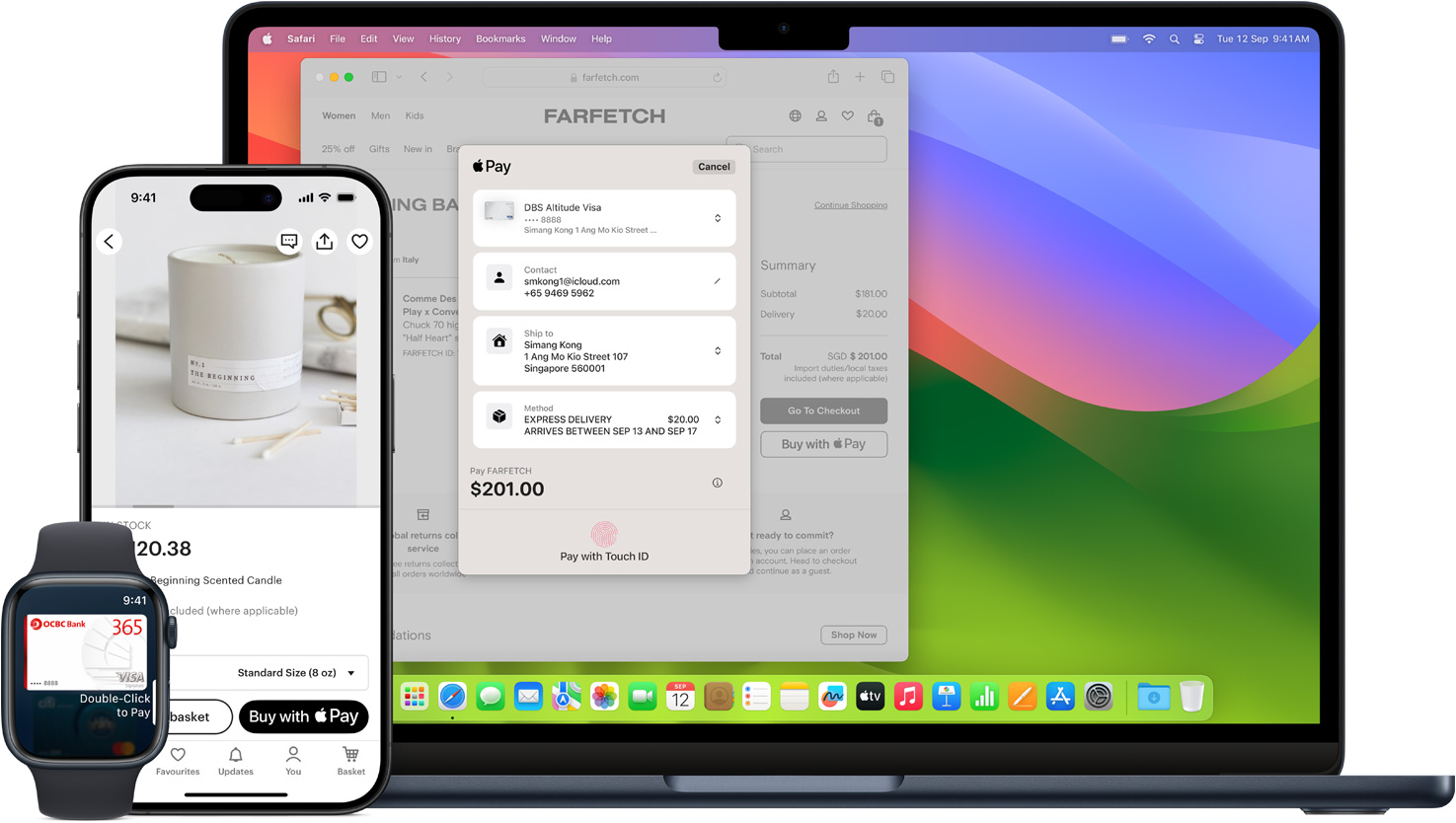

Apple Pay is basically a digital bridge between your bank and a merchant. It’s not a bank itself. It’s a "mobile wallet" that lives on your iPhone, Apple Watch, Mac, or even that fancy new Vision Pro. Instead of digging through a leather wallet for a piece of plastic that’s probably covered in germs, you’re using the tech already in your pocket to transmit payment info securely.

How Apple Pay Actually Works (The "Magic" Bit)

People often think Apple Pay just sends your credit card number through the air. That’s actually a huge misconception. If it did that, a hacker with the right equipment could just "sniff" your card number right out of the sky.

Instead, it uses something called tokenization.

📖 Related: Why the RGM-84 Harpoon Block II Photos Still Define Modern Naval Warfare

When you add a card to your Wallet app, Apple doesn’t store the actual card number on its servers. They don't even store it on your phone. Instead, they talk to your bank, and the bank issues a "Device Account Number." This is a completely different, unique number that’s tucked away in a tiny, physical chip on your phone called the Secure Element.

When you pay for a $6 latte:

- Your phone generates a one-time-use "token."

- This token is sent to the terminal via Near Field Communication (NFC).

- The merchant receives this token, not your card number.

- The bank sees the token, knows it’s linked to you, and approves the charge.

If someone were to somehow "steal" that token, it would be useless. It’s like a movie ticket that only works for one specific seat at one specific time. Once it’s used, it’s garbage.

Is It Really Safer Than a Physical Card?

Short answer: Yes.

Think about your physical debit card. It has your name, the 16-digit number, the expiration date, and that little three-digit code on the back. If you hand that to a waiter who disappears for ten minutes, they have everything they need to go on an Amazon spree.

Apple Pay eliminates that. The merchant never sees your name or your card details. Plus, there's the biometric layer. You can’t pay without Face ID, Touch ID, or your passcode. If you lose your wallet, you’re calling the bank to cancel everything. If you lose your iPhone, you can just go into the "Find My" app and hit Lost Mode. That immediately kills Apple Pay on that device without you even needing to cancel your physical cards.

🔗 Read more: The First Invented Cell Phone: What Most People Get Wrong About Martin Cooper's Brick

It’s way less of a headache.

Setting Things Up Without the Fuss

Getting started is pretty straightforward, but there are a few quirks people miss. You basically just open the Wallet app and hit the plus (+) icon.

- The Camera Trick: Most of the time, you can just point your camera at your card. It’ll scan the numbers automatically.

- The Verification Step: Your bank will usually send a text or make you open their specific app to "bless" the connection. Don't skip this, or the card will just sit there in "Pending" limbo.

- The Mac Setup: If you have a MacBook with a Touch ID sensor, you can set this up in System Settings > Wallet & Apple Pay. It makes online shopping dangerously easy because you don't have to type in your address every single time.

Where Can You Actually Use It?

In 2026, it’s almost easier to ask where you can’t use it.

About 90% of retailers in the U.S. now accept contactless payments. You’ll see the little "wave" symbol or the Apple logo on the card reader. It’s become the standard for transit too. In cities like New York, London, or Tokyo, you don't even need a transit card anymore; you just tap your phone on the turnstile.

There are still a few holdouts. Some major retailers (we’re looking at you, certain grocery chains and discount warehouses) still want you to use their own proprietary apps or physical cards. But for the most part, the "I forgot my wallet" excuse is becoming a thing of the past.

What People Get Wrong About Privacy

A big worry is that Apple is tracking what you buy. "Does Apple know I just bought three boxes of Oreos at 11 PM?"

Surprisingly, no.

Apple’s whole business model (at least the part they brag about) is privacy. They don’t keep a history of your transactions that can be tied back to you. The transaction stays between you, the merchant, and your bank. They aren't building a profile of your shopping habits to sell to advertisers, which is a major difference between them and some of their competitors.

The 2026 Landscape: Digital IDs and Beyond

It’s not just about credit cards anymore. Apple is pushing hard to replace your entire wallet.

In many states now—like California, Arizona, and Georgia—you can actually add your Driver’s License or State ID to the Wallet app. TSA at hundreds of airports now accepts these digital IDs. You just tap your phone, and it shares only the info the agent needs to see (like your identity and flight status) without showing them your home address or exact birthdate unless necessary.

Then there are the "Keys." Some newer BMWs and Hyundais let you use Apple Pay technology to unlock and start your car. You just walk up, and the phone talks to the car.

Actionable Steps to Secure Your Wallet

If you’re ready to lean into it, here’s how to do it right:

🔗 Read more: Vizio TV Reset: What Most People Get Wrong When Their Screen Goes Dark

- Audit Your Wallet: Go into the Wallet app and remove any old or expired cards. It keeps things clean.

- Enable Express Transit: If you commute, go to Settings > Wallet & Apple Pay > Express Transit Card. This lets you tap into subways or buses without needing to authenticate with Face ID first. It’s a lifesaver when you’re in a rush.

- Set a Strong Passcode: Since your phone is now your wallet, that 4-digit "1234" code isn't going to cut it. Move to a 6-digit code or an alphanumeric one.

- Use Apple Pay Online: Whenever you see the Apple Pay button on a website, use it. It prevents you from having to "trust" that random website with your actual credit card details.

Apple Pay isn't just a gimmick; it’s a shift in how we handle the "physical" parts of our lives. It’s faster, it’s objectively more secure than a magnetic stripe, and honestly, it’s just one less thing to carry. If you haven't set it up yet, you're basically doing extra work at the cash register for no reason.