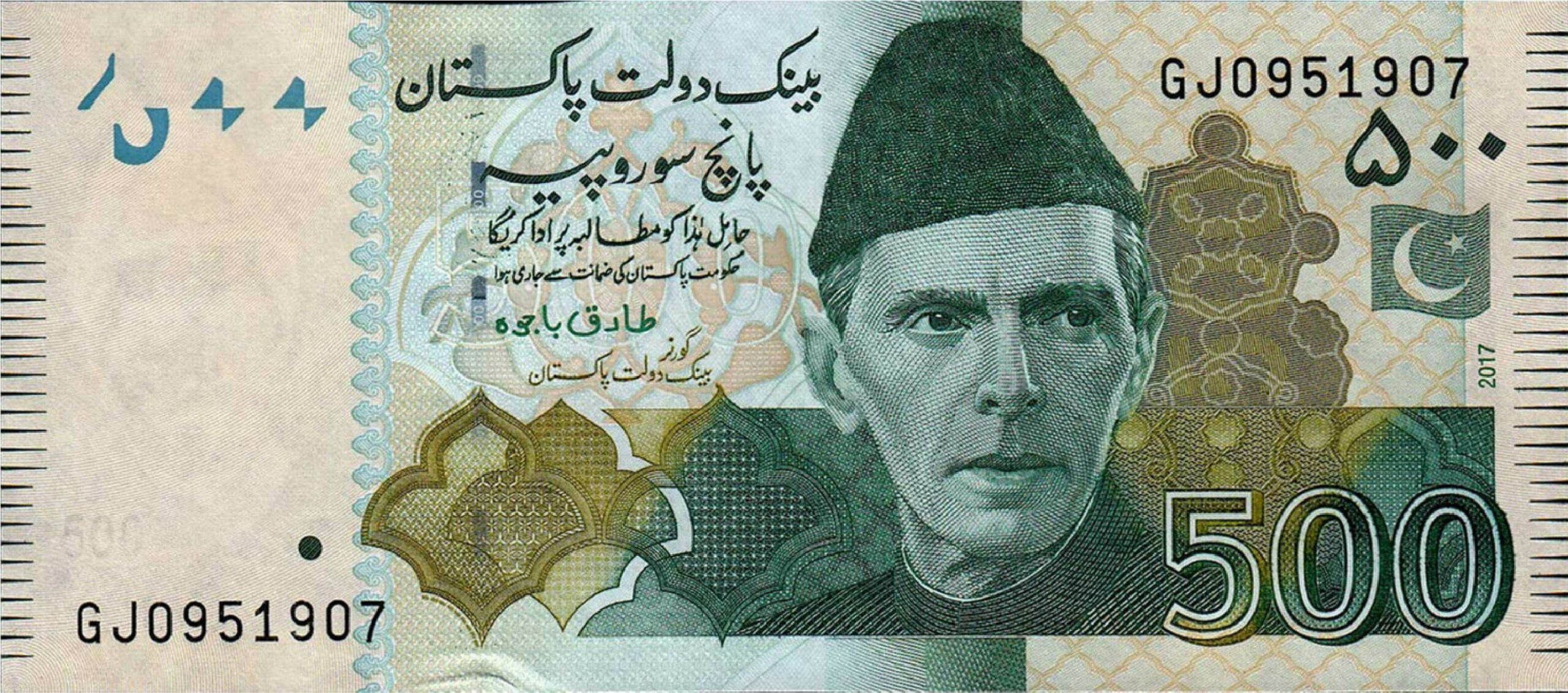

Money is weird. One day you’re looking at the screen and seeing a specific number for the american dollar to pakistani rupees exchange, and by the time you finish your coffee, it’s shifted. It’s frustrating. If you’re sending money home to Lahore or trying to figure out why your imported laptop suddenly costs an extra ten thousand PKR, the volatility isn't just a "market trend." It's your life.

Honestly, most people look at the interbank rate and think that’s what they’ll get at the exchange counter. They won't. There is a massive, often misunderstood gap between the official numbers and the "open market" reality in Pakistan.

The Messy Reality of the American Dollar to Pakistani Rupees Rate

Why does the PKR keep sliding? It’s not just one thing. You’ve got the State Bank of Pakistan (SBP) trying to manage reserves, while the IMF is breathing down the government's neck to keep the exchange rate market-based. When the IMF says "market-based," they basically mean "stop propping it up with borrowed money."

Historically, Pakistan has struggled with a "Current Account Deficit." That’s a fancy way of saying the country buys way more stuff from the world (oil, machinery, palm oil) than it sells (textiles, rice). When you need to buy oil in USD but you only have PKR, you have to sell your PKR to get those dollars. High demand for dollars plus low supply of dollars equals a weaker rupee. It is basic math, but it feels like a punch in the gut when you're watching your savings lose value.

Specific events trigger these spikes. Think back to the political instability in mid-2023 or the delays in the IMF's 24th program. Every time a news notification pops up about a delayed loan or a political protest, the american dollar to pakistani rupees rate flinches. Traders get nervous. They start hoarding dollars because they think the rupee will fall further. This creates a self-fulfilling prophecy.

📖 Related: The TD Bank FL Routing Number: Why You Probably Have the Wrong One

Understanding the Triple Rate System

You might notice three different prices for the dollar.

- The Interbank Rate: This is what banks use to trade with each other. It’s usually the "official" rate you see on Google or Bloomberg.

- The Open Market Rate: This is what you actually get at a currency exchange like Western Union or MoneyGram. It’s usually a few rupees higher than the interbank.

- The Grey Market (Hundi/Hawala): This is the unofficial, unregulated market. It’s risky, it’s often illegal, but it sometimes offers a better rate, which pulls dollars away from the official economy and makes the national shortage even worse.

SBP Governor Jameel Ahmad has often spoken about the need to narrow the "spread" between these rates. If the gap gets too wide, people stop using official channels. That’s bad for everyone.

Why Interest Rates in the US Matter to Someone in Karachi

It sounds disconnected, right? Why would the Federal Reserve in Washington D.C. changing interest rates affect the price of milk in Faisalabad?

It’s all about where the "big money" wants to sit. When the US Federal Reserve raises interest rates to fight inflation in America, the US dollar becomes more attractive to global investors. They pull their money out of "emerging markets" like Pakistan and put it into US Treasury bonds because they’re safer and now offer a better return.

When that money leaves, the supply of dollars in Pakistan shrinks. Suddenly, the american dollar to pakistani rupees rate climbs again. You're effectively caught in a global tug-of-war between US inflation policy and Pakistan's debt obligations.

The Role of Remittances

Overseas Pakistanis are the backbone of the economy. Period.

📖 Related: Who Owns ABC TV: What Most People Get Wrong

Billions of dollars flow in from the UAE, Saudi Arabia, the UK, and the USA every single month. These remittances are the primary source of foreign exchange. When the exchange rate is favorable—meaning the dollar is strong—overseas workers often send more money home because their families get more "bang for their buck."

However, if the government tries to artificially "fix" the rate (like we saw during the "Dar-nomics" era), people stop sending money through banks. They wait for the "real" rate to emerge. This creates a massive headache for the SBP because those dollars don't enter the official reserves, making it harder to pay off international debt.

Will the Rupee Ever Stabilize?

Stability is a relative term. In the long run, the PKR has been on a downward trajectory for decades. In 1990, a dollar was about 22 rupees. Today, we're looking at a completely different universe.

True stability requires "structural reforms." This is the phrase economists like Dr. Ishrat Husain or Kaiser Bengali use constantly. It means Pakistan needs to export more than just raw cotton and low-value textiles. It means the country needs to stop relying on "hot money" and short-term loans from friendly nations like China or Saudi Arabia.

There are bright spots, though. The growth of the IT sector in Pakistan is a huge deal. Software exports bring in "clean" dollars that don't depend on the price of fertilizer or weather patterns. If the tech sector continues to grow at its current pace, it could provide the cushion the rupee needs to stop its freefall.

Practical Steps for Dealing with Volatility

If you’re a business owner or someone trying to save, you can't just sit around and hope the rate goes down. It rarely does.

- Hedge your costs: If you know you have to pay for an import in three months, talk to your bank about "forward covering." It locks in a rate today so you don't get hounded by a surprise jump tomorrow.

- Diversify your holdings: Don't keep every single cent in a PKR savings account if you can help it. Look into RDA (Roshan Digital Accounts) if you're an expat, or consider gold, which tends to track with the dollar value.

- Watch the SBP Calendar: The Monetary Policy Committee (MPC) meetings are where interest rate decisions are made. These meetings almost always move the american dollar to pakistani rupees needle.

- Stop timing the market: Unless you’re a professional forex trader, you’ll probably lose. If you need to send money for a wedding or a house, just do it. The stress of waiting for a 2-rupee dip usually isn't worth the mental toll.

The reality of the american dollar to pakistani rupees exchange is that it’s a mirror reflecting the country’s economic health. It isn't just a number on a screen; it’s a signal of how much the world trusts the local economy. For now, the best strategy is to stay informed, keep an eye on the SBP's foreign exchange reserves, and plan for a future where the dollar remains the dominant force in the pocketbook.

To stay ahead of the curve, monitor the weekly "Liquid Foreign Exchange Reserves" report released by the State Bank every Thursday. If those numbers are going up, the rupee has a fighting chance. If they’re dipping, expect the dollar to get more expensive. Always use licensed exchange companies and avoid the temptation of the grey market; the legal protections and contribution to the national economy far outweigh the minor rate difference. For those managing business imports, consult with a trade finance specialist to explore "Letter of Credit" (LC) terms that can mitigate sudden currency fluctuations.