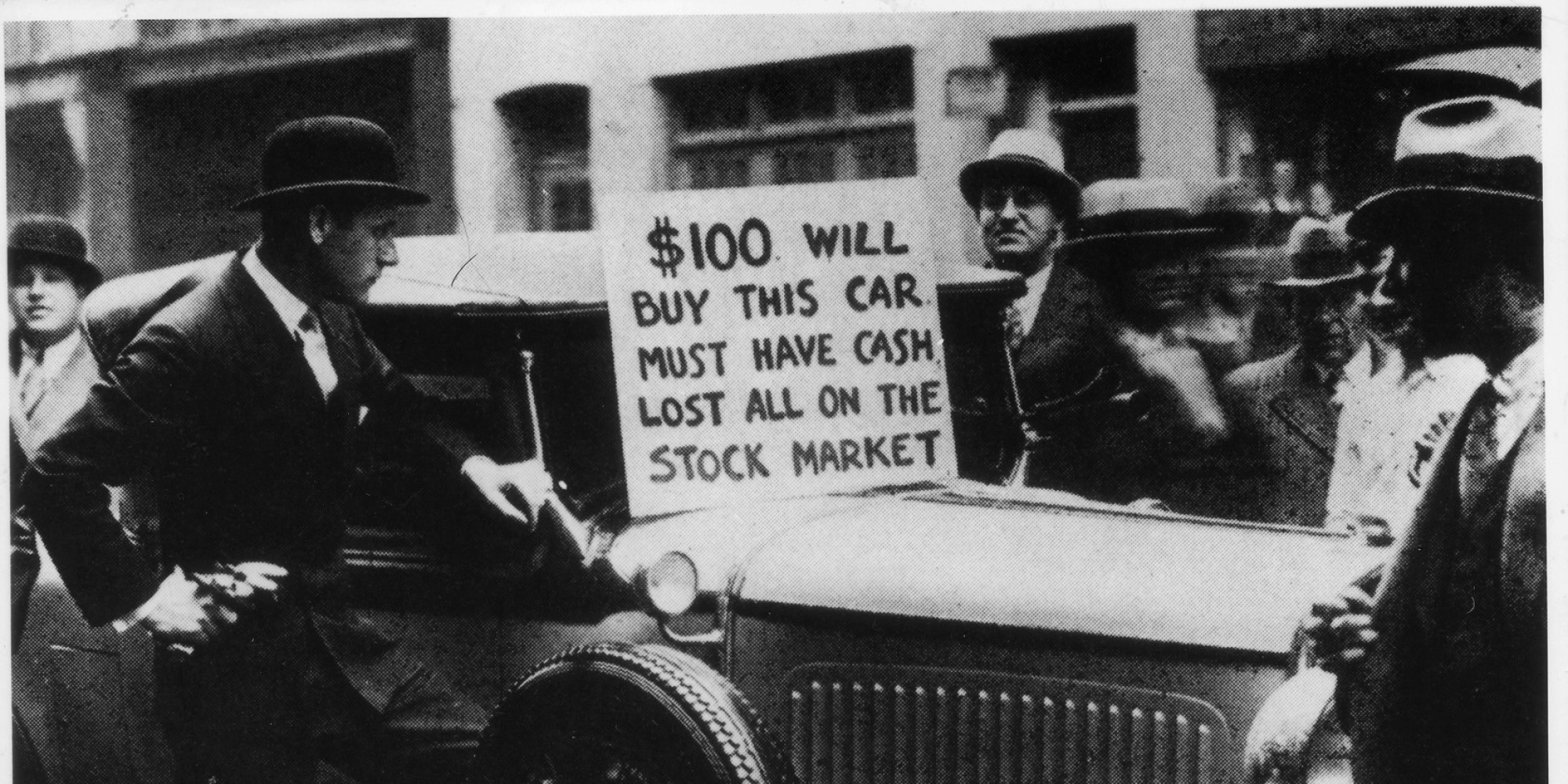

Imagine standing on the corner of Wall Street and Broad in late October. The air is crisp, but the atmosphere is suffocating. People are sprinting. Not the casual jog you see in the park, but a desperate, lung-bursting dash toward brokerage firms that are already overflowing with panicked investors. You've probably heard the legends about the stock market crash of 1929. You’ve seen the grainy photos of men in trench coats huddled around ticker tapes. But honestly, most of the "common knowledge" about Black Tuesday is kinda simplified to the point of being a myth.

It wasn't just one bad day.

Markets don't just "break" because people suddenly decide to be sad. It was a slow-motion car crash that took weeks to hit the wall and years to stop sliding. The 1920s were basically a giant, debt-fueled party where everyone thought the music would never stop playing. And then, the record skipped. Hard.

What Really Triggered the 1929 Crash?

Economists like Milton Friedman and John Maynard Keynes have argued for decades about the "why," but the "how" is pretty clear. In the years leading up to 1929, the American economy was firing on all cylinders—or so it seemed. Steel production was up. The automobile industry was booming. People were buying radios and washing machines on credit for the first time.

But beneath the surface, things were getting weird.

There was this thing called "buying on margin." Basically, you could buy $1,000 worth of stock with only $100 of your own cash. The broker lent you the other $900. It’s a great deal when the stock goes up. You make a killing. But if the stock drops even a little bit? The broker calls you up and demands that $900 immediately. That’s a margin call. When thousands of people get those calls at the same time and don't have the cash to pay, they have to sell their stocks. This creates a massive wave of selling that drives prices down further, triggering more margin calls.

It's a feedback loop from hell.

By September 1929, the market was already "topping out." The Dow Jones Industrial Average hit a peak of 381.17 on September 3. Then, it started to wobble. Most people don't realize that there were several "mini-crashes" in the weeks leading up to the big one. On October 24, known as Black Thursday, the market lost 11% of its value at the opening bell.

👉 See also: ¿Quién es el hombre más rico del mundo hoy? Lo que el ranking de Forbes no siempre te cuenta

A group of wealthy bankers, led by Richard Whitney (acting for J.P. Morgan), tried to save the day. They walked onto the floor of the New York Stock Exchange and started buying massive blocks of United States Steel and other blue-chip stocks at prices above the current market. It worked. Briefly. The market stabilized, and people breathed a sigh of relief over the weekend. They thought the "smart money" had saved them.

They were wrong.

Black Tuesday and the Total Meltdown

Monday, October 28, was a disaster. The Dow fell about 13%. But the real knockout blow came on October 29—Black Tuesday.

The volume of trading was so high that the ticker tape machines, which printed stock prices, couldn't keep up. They were running hours behind. Imagine trying to trade stocks when you don't even know what the current price is. You're flying blind. People were selling "at market," which meant they’d take whatever price they could get. In some cases, stocks in solid companies were being sold for pennies because there simply weren't any buyers left.

The Numbers That Still Sting

- 16.4 million shares changed hands on Black Tuesday alone, a record that wouldn't be broken for nearly 40 years.

- The market lost $14 billion in value in a single day.

- By the time the dust settled in 1932, the Dow had lost roughly 89% of its value from its peak.

It’s hard to wrap your head around that kind of loss. If you had $100,000 in the market in September 1929, you might have had about $11,000 left three years later. That’s not just a "correction." That’s the end of a world.

The Suicide Myth vs. The Reality

We’ve all heard the stories of brokers jumping out of skyscraper windows. While there were a few high-profile suicides, the "epidemic" of falling bodies is largely a legend. The Vice President of the New York Stock Exchange later noted that the suicide rate in New York actually stayed pretty consistent with previous years during the immediate aftermath of the crash.

The real tragedy wasn't a sudden leap from a ledge; it was the slow, grinding poverty that followed.

✨ Don't miss: Philippine Peso to USD Explained: Why the Exchange Rate is Acting So Weird Lately

Banks started failing. Why? Because they had invested their depositors' money in the stock market, or they had lent it to speculators who couldn't pay it back. When people heard their bank might be in trouble, they ran to withdraw their savings. This is a bank run. Since banks only keep a fraction of their cash on hand, they ran out of money and closed their doors forever. Your life savings? Gone. Just like that.

Why It Wasn't Just About the Stocks

The stock market crash of 1929 didn't cause the Great Depression all by itself, but it was the spark that lit the gasoline. The underlying economy was already fragile. Farmers were struggling with falling crop prices. Income inequality was through the roof—the top 1% of families owned about the same amount of wealth as the bottom 42%.

When the market crashed, the "wealth effect" reversed. People stopped spending. When people stop spending, factories stop producing. When factories stop producing, they lay off workers.

Unemployment soared to 25%.

The Smoot-Hawley Factor

To make matters worse, the government made some pretty questionable calls. In 1930, they passed the Smoot-Hawley Tariff Act, which raised taxes on imported goods. The idea was to protect American jobs. Instead, other countries got mad and raised their own tariffs on American goods. Global trade basically evaporated. It’s a classic example of "unintended consequences" ruining an already bad situation.

How the 1929 Crash Changed Your Life Today

You might think 1929 is ancient history, but your current bank account is shaped by it. After the crash, the government realized they couldn't just let the "invisible hand" of the market do whatever it wanted.

They created the Securities and Exchange Commission (SEC) in 1934. Its whole job is to make sure companies don't lie about their earnings and to prevent the kind of wild manipulation that was common in the 20s. They also passed the Glass-Steagall Act, which forced a separation between "regular" banks (where you keep your paycheck) and investment banks (where people gamble on stocks). While some of these rules have been tweaked or repealed over time, the core idea—that the government has a role in keeping the market honest—started right here.

🔗 Read more: Average Uber Driver Income: What People Get Wrong About the Numbers

And then there’s the FDIC. Ever see that little sign at your bank teller's window? It means if your bank goes bust, the government guarantees your deposits up to a certain amount. That exists because of the 1929 aftermath. No more losing your life savings because of a bank run.

Misconceptions That Still Persist

One big thing people get wrong is thinking the crash was a surprise to everyone. It wasn't. There were plenty of "bears" warning that the market was a bubble. Financial expert Roger Babson gave a famous speech in September 1929 saying, "Sooner or later a crash is coming, and it may be a terrific one." He was ridiculed at the time. The "Babson Break" (a small dip after his speech) was seen as a fluke.

Another misconception is that the crash ended the Roaring Twenties instantly. While the vibe definitely changed, the full weight of the Great Depression didn't hit its absolute rock bottom until 1932-1933. It was a slow decay, not a sudden lights-out event.

Actionable Lessons from 1929

If you're looking at your own portfolio today, the 1929 crash offers some pretty blunt advice that still holds up. History doesn't always repeat, but it definitely rhymes.

- Watch the Margin: Leverage is a double-edged sword. Using debt to buy assets can multiply your gains, but it's the number one way to get wiped out in a downturn. If you can't afford to hold the asset through a 50% drop, you're over-leveraged.

- Liquidity is King: In 1929, the people who survived were the ones with cash. When everyone else is forced to sell, having the "dry powder" to buy (or just to pay your rent) is the difference between survival and ruin.

- Don't Trust the "Gurus" Blindly: In 1929, even the most respected economists were saying things like "stock prices have reached what looks like a permanently high plateau" just days before the crash. Trust data, not hype.

- Diversification Isn't Just a Buzzword: People who had everything in high-flying "radio stocks" lost everything. Those with diversified interests (though few did well) fared slightly better.

- Understand the Ticker: Don't trade what you don't understand. The complexity of the market today—with high-frequency trading and derivatives—is different from 1929, but the human psychology of fear and greed is exactly the same.

The most important takeaway? Markets can stay irrational longer than you can stay solvent. The 1929 crash proved that even the biggest, most "unstoppable" bull market has an expiration date.

To protect your future, look back at the people who stood on those street corners in 1929. They weren't stupid. They were just caught in a system that had no safety rails. Today, we have the rails, but the heights are just as dizzying. Stay skeptical of "permanently high plateaus." Keep a healthy emergency fund in a high-yield savings account that is FDIC-insured. Review your investment portfolio to ensure you aren't over-exposed to a single sector, much like the over-concentration in tech and automotive stocks during the late 1920s. History is a great teacher, but only if you're willing to be a student.