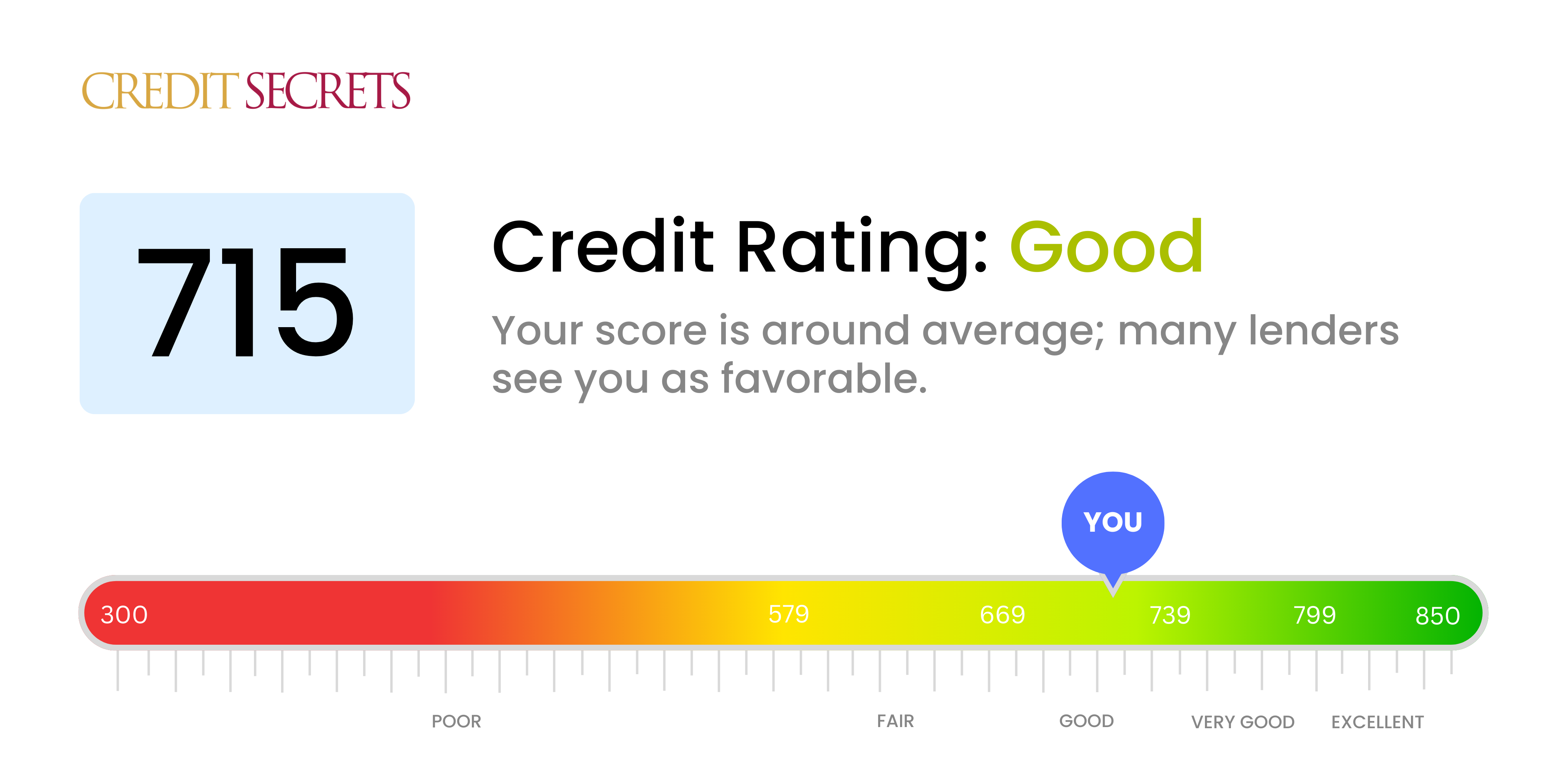

So, you’ve pulled your report and there it is: 715. It’s a weirdly specific number, right? It feels high, but you’re probably wondering if it’s "buy a house without a headache" high or just "you’re doing okay" high.

Honestly? You’re in a great spot.

A 715 credit score firmly plants you in the "Good" category according to FICO. Most lenders look at this and see a responsible adult who pays their bills. But here’s the kicker: the difference between a 715 and a 740—the gateway to "Very Good"—can actually save you thousands of dollars over the life of a mortgage or an auto loan. It’s the difference between getting the "advertised" rate and the "standard" rate.

The Reality of 715 Credit Score Approval Odds

Lenders don't just see a number; they see a risk profile. If you have a 715, you are statistically unlikely to default. According to FICO data, only about 1% of consumers in the "Good" range (670 to 739) are likely to become seriously delinquent in the future. That’s a massive win for you.

🔗 Read more: abb share price nse: Why Most Investors Are Getting the Timing Wrong

When you walk into a dealership or apply for a credit card like the Chase Sapphire Preferred or an American Express Gold, a 715 usually gets you a "yes." You’ve graduated past the subprime stuff. No more "secured" cards or predatory interest rates. You're in the big leagues now, even if you're sitting on the bench waiting for your turn at the "Excellent" status (800+).

Mortgage Rates and the 715 Threshold

Buying a home is where the 715 credit score starts to show its nuances. The mortgage industry uses different "tiers." Usually, the best rates are reserved for people with a 740 or 760.

If you’re at 715, you might be looking at an interest rate that is 0.25% to 0.5% higher than someone with a 760. That sounds small. It’s not. On a $400,000 mortgage, a 0.5% difference can cost you over $40,000 in interest over 30 years. That’s a whole car. Or a lot of vacations.

However, you still qualify for conventional loans. You aren't stuck with FHA loans unless your debt-to-income ratio is wonky. You have options. You have leverage.

Why Your Score is 715 and Not 800

Ever feel like your score is stuck in the mud? You pay everything on time, but it just won't budge.

There are usually three culprits:

- Credit Utilization: This is the big one. If you have a $10,000 limit and you’re carrying a $3,500 balance, your utilization is 35%. Anything over 30% starts to freak out the algorithms. Ideally, you want this under 10%.

- Average Age of Accounts: If you’re young, or you just opened three new cards because you wanted the sign-up bonuses, your "average age" dropped. This makes you look "new" to the credit world. Time is the only cure here.

- The Mix: Do you only have credit cards? Lenders like to see that you can handle different types of debt, like an auto loan or a student loan, alongside your revolving credit.

Credit Cards You Can Actually Get with a 715

You shouldn't be applying for "starter" cards anymore. You've outgrown them.

With a 715 credit score, you should be looking at mid-tier travel and cashback cards. The Wells Fargo Autograph or the Capital One SavorOne are usually within reach. These cards offer actual rewards—real money back on gas, groceries, and dining.

Be careful, though. A 715 is good, but it's not bulletproof. If you have a recent late payment (within the last 2 years) or a high debt-to-income ratio, even a 715 might get a rejection from "snobby" lenders like Chase if your report looks thin.

How to Push Past 715 Fast

If you're at 715 and you want to hit 750 for an upcoming big purchase, you don't need a miracle. You just need a strategy.

The "AZEO" Method. This stands for "All Zero Except One." You pay off every credit card balance to $0 before the statement closing date (not the due date!), except for one card. On that one card, leave a tiny balance—like $10. This shows the credit bureaus that you are using credit, but you aren't reliant on it. It can often bump a score 15-20 points in a single month.

👉 See also: Dow J Stock Chart: What Most People Get Wrong

Check for Errors. It’s boring, but it works. Check AnnualCreditReport.com. Look for addresses you never lived at or accounts you don't recognize. Even a small error can shave points off your score.

Ask for a Limit Increase. Call your current credit card companies. Ask for a higher limit. Don't spend more. By increasing the limit while keeping your spending the same, your utilization ratio drops instantly. It's a math hack.

Does 715 Mean the Same Thing Everywhere?

Not really. You actually have dozens of credit scores.

FICO Score 8 is what most credit card issuers use. But FICO Score 2, 4, or 5 are what mortgage lenders use. Then there's VantageScore (the one you see on Credit Karma), which uses a completely different formula.

It’s very common to have a 715 on Credit Karma but a 690 when you apply for a mortgage. Don't let that catch you off guard. Always assume your "real" mortgage score is slightly lower than your "free" app score.

Actionable Steps to Leverage Your 715 Score

Don't just sit on this number. Use it.

- Refinance High-Interest Debt: If you have an old personal loan or an auto loan from when your credit was 620, refinance it now. A 715 will likely get you a much lower APR, saving you immediate monthly cash flow.

- Audit Your Utilization: Log into your apps. If any single card is over 30% of its limit, move money around or pay it down. This is the fastest way to hit 740.

- Shop Around: When you apply for a loan with a 715, don't take the first offer. You are "good enough" that banks will compete for you. Make them work for it.

- Set Up Autopay: You are one late payment away from your score tanking back into the 600s. A single 30-day late payment can drop a 715 score by 60 to 80 points. It’s devastating. Don't risk it.

A 715 credit score is a position of strength. You aren't struggling, but you haven't quite peaked. You’re in the sweet spot where small, smart moves—like lowering your utilization or just letting your accounts age—will yield massive financial rewards. Keep your balances low and your patience high.