You’re staring at that jagged line on the dow j stock chart and wondering if it’s actually telling you anything. Honestly, most people treat the Dow Jones Industrial Average like a weather vane. If it’s up, the economy is "sunny." If it’s down, grab an umbrella. But if you’ve been watching the charts in early 2026, you know it’s way more complicated than a simple line going up or down.

The Dow is weird.

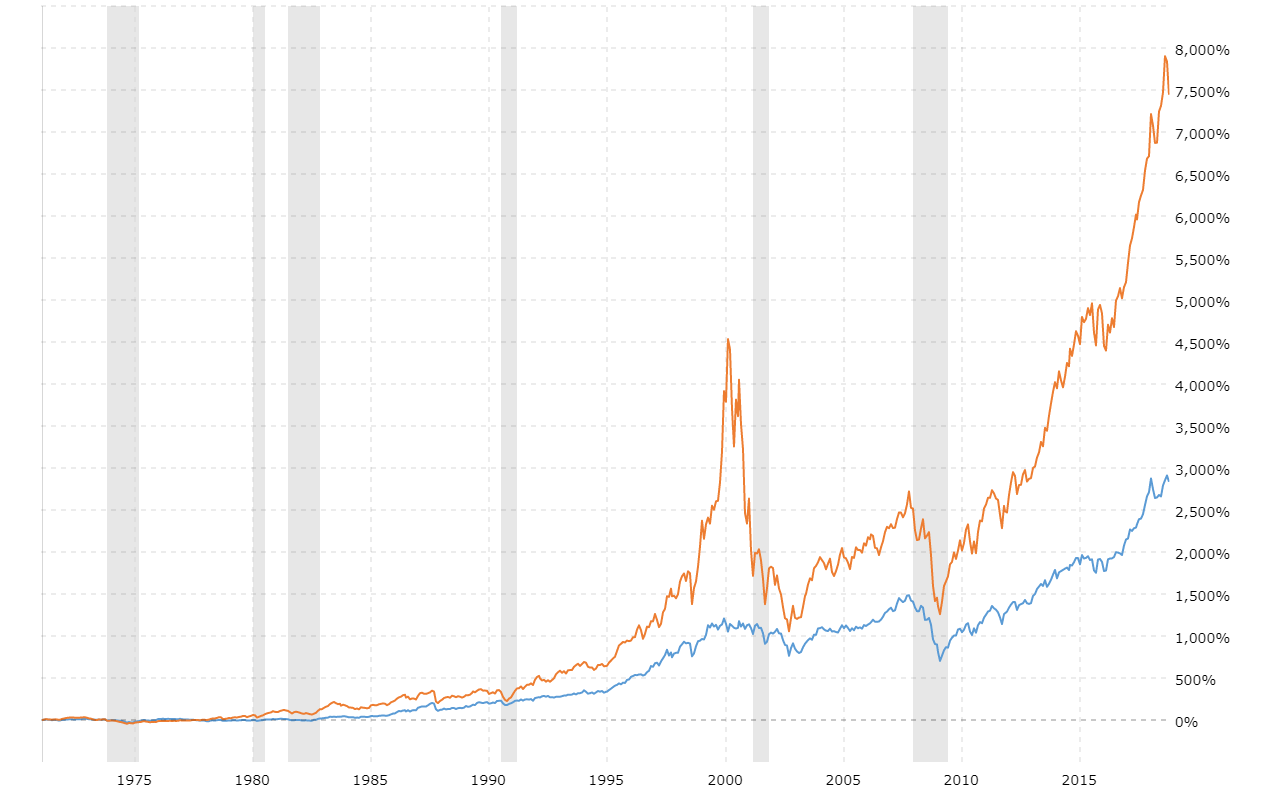

It’s an old-school index in a high-tech world. While the S&P 500 and the Nasdaq are busy obsessing over market caps and how many trillions Nvidia is worth this week, the Dow is still playing by rules written over a century ago. It’s price-weighted. That basically means the company with the highest stock price—not the biggest company—calls the shots.

Why the Dow J Stock Chart Looks So Different Right Now

If you look at the dow j stock chart for January 2026, you’ll see something interesting. While the tech-heavy indexes have been sweating over AI valuations, the Dow has been holding its own, recently hovering around that massive 49,359 mark.

Why the resilience?

It’s the banks. Goldman Sachs and JPMorgan Chase have been carrying the team. Since the Dow is price-weighted, Goldman Sachs—with its hefty triple-digit stock price—has a much bigger "vote" on where the index goes than a company like Coca-Cola. When bank earnings came out strong in mid-January, the Dow chart showed a "bullish acceleration," even while other sectors were looking a bit shaky.

The 50,000 Psychological Barrier

We’re currently knocking on the door of 50,000. In technical analysis, we call this a "psychological resistance level." There’s no mathematical reason why 50,000 is harder to cross than 49,842, but humans love round numbers. Traders see that big five-zero and they get nervous. They start selling to "lock in profits," which creates a ceiling.

💡 You might also like: Why Your Package Is Stuck: The Hodgkins IL UPS Delay Explained

If the index can't punch through 50k, the dow j stock chart might show a retreat back toward the 48,000 support level. That’s where the 50-day moving average sits right now, acting like a safety net for the price.

Reading the "Noise" on the Chart

When you open a chart, you're usually looking at a line. But pros use candlesticks.

A single "candle" tells you four things: where the price started (open), where it ended (close), and the highest and lowest points it touched during the day. If you see a lot of "long wicks" (those thin lines sticking out of the top or bottom), it means there’s a lot of indecision.

Moving Averages: The Trend’s Best Friend

You’ve probably seen the 50-day and 200-day moving averages. Think of these as the "mood" of the market.

- 50-day: The short-term vibe.

- 200-day: The long-term direction.

In early 2026, the Dow has stayed consistently above both. That’s a "golden" sign for bulls. However, some analysts, like the folks at FOREX.com, are pointing out a "contracting diagonal structure." That’s just a fancy way of saying the highs aren't getting much higher, while the lows are creeping up. Usually, when a chart gets "squeezed" like that, a big move is coming—one way or the other.

The "January Effect" and Sector Rotation

Is a rotation underway? Kinda looks like it.

In 2025, everyone wanted AI. If your company name ended in ".ai" or you sold chips, your stock went to the moon. But 2026 has started with a shift. Money is moving out of the "Magnificent Seven" and into "boring" Dow stocks like Caterpillar, UnitedHealth, and American Express.

This is why the dow j stock chart might look "greener" than the Nasdaq right now. Investors are looking for value. They want companies that actually make physical stuff or handle real money, especially with the Fed's policy still feeling a bit like a "will-they-won't-they" drama regarding rate cuts.

Real-World Factors Influencing the Line

- Tariff Talk: President Trump’s delay on certain furniture tariffs recently gave a boost to some consumer-facing stocks.

- Fed Leadership: The uncertainty over Jerome Powell’s future at the Fed is keeping the "bond ghouls" active, which in turn makes the Dow chart more volatile.

- Earnings Season: We’re in the thick of it. A bad report from a high-priced stock like Goldman can tank the whole index, even if the other 29 companies are doing fine.

Common Mistakes Beginners Make

Don't zoom in too far. If you look at a 5-minute dow j stock chart, it looks like a heart attack. It’s all zig-zags. But if you zoom out to the 1-year or 5-year view, those "crashes" often look like tiny blips.

Another mistake? Ignoring volume.

If the price goes up but the volume (the number of shares traded) is low, the move is "weak." It means nobody really believes in it. You want to see "conviction"—high volume accompanying a price breakout. Without it, you’re likely looking at a "bull trap," where the price spikes just long enough to lure you in before falling back down.

Actionable Steps for Your Portfolio

So, how do you actually use this info? Stop trying to time the exact "bottom" or "top" of the dow j stock chart. Even the experts get it wrong half the time. Instead, focus on these three moves:

- Check the RSI (Relative Strength Index): If the RSI on the Dow is above 70, the index is "overbought." It’s probably a bad time to buy. If it’s below 30, it’s "oversold" and might be a bargain.

- Watch the 48,000 level: This is the current "floor." If the Dow closes below this for two days straight, the uptrend is in serious trouble.

- Diversify away from "Price Heavyweights": Remember that the Dow is skewed by high-priced stocks. If you want a more accurate picture of the whole market, compare the Dow chart to the S&P 500 (SPX) or the Russell 2000 (RUT).

The Dow isn't the "whole market," but it is the market's "blue-chip" soul. By watching the levels at 49,500 and 50,000, you’ll have a much better idea of whether the 2026 rally has legs or if we're all about to hit a ceiling. Stick to the daily close prices for the clearest signal and ignore the midday noise.