Timing is everything. If you’ve ever sat in a midtown Manhattan office watching a flickering Bloomberg terminal or just tried to coordinate a Zoom call with a colleague in London, you know the frantic energy that hits right around mid-morning. It's that specific window where the world’s two most important financial hubs collide. Specifically, understanding what happens at 4pm UK time in New York isn't just about adjusting your watch; it’s about navigating the most volatile and high-stakes hour in the global business day.

New York is five hours behind London. Usually.

When the clock strikes 4:00 PM in London, it is exactly 11:00 AM in New York City. This isn't just a random moment in the afternoon. It is the "London Fix." It’s the moment the European markets wrap up their day while the American markets are hitting their stride. It’s messy, fast, and occasionally expensive if you aren't paying attention.

The London Fix and the 11 AM New York Rush

Why does this specific crossover matter so much?

Money. Trillions of dollars of it.

The WM/Refinitiv Spot Benchmark Rate, commonly known as the London 4 PM fix, is the industry standard for valuing portfolios and settling currency contracts. Because so many trillions of dollars in assets are pegged to the prices at this exact moment, banks and hedge funds go into a frenzy to execute trades. If you are in New York at 11:00 AM, you are living through the peak of global liquidity.

📖 Related: Will the US ever pay off its debt? The blunt reality of a 34 trillion dollar problem

Think about it this way.

The London Stock Exchange (LSE) is closing its doors. Traders in the City are trying to flatten their positions. Meanwhile, in New York, the "smart money" has just finished their morning coffee and is reacting to the European closing prices. This overlap creates a massive surge in trading volume.

Honestly, if you're trying to move a large amount of currency, this is when you do it. You want liquidity. You want depth. You get both when the UK is heading to the pub and New York is heading to lunch.

The Daylight Savings Trap

Here is where people actually get it wrong. Most people assume the five-hour gap is a law of nature. It’s not.

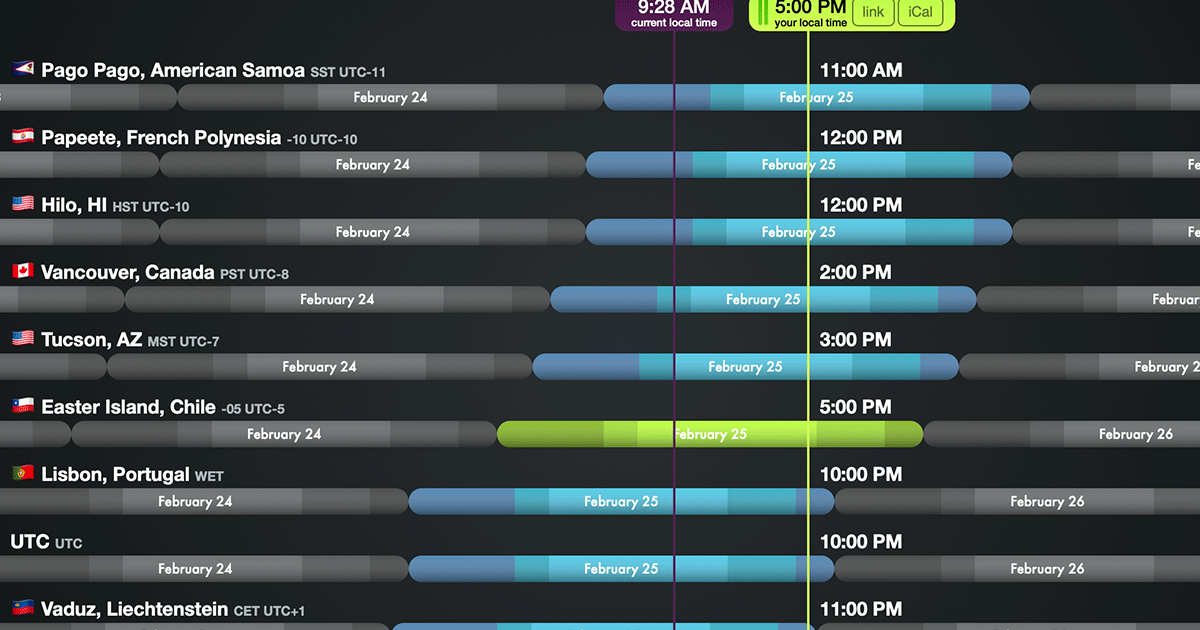

Because the United Kingdom and the United States do not synchronize their clocks for Daylight Savings Time (DST), there are a few weeks every year—usually in late March and late October—where the gap shrinks to four hours. During these "shoulder weeks," 4pm UK time in New York shifts to 12:00 PM.

👉 See also: Pacific Plus International Inc: Why This Food Importer is a Secret Weapon for Restaurants

It sounds like a minor annoyance. It’s actually a logistical nightmare for international shipping, flight schedules, and algorithmic trading bots that weren't programmed by someone looking at a calendar. I've seen seasoned analysts miss earnings calls because they forgot that London "sprung forward" a week before New York did.

Real World Impact: From Premier League to Wall Street

It isn't just about stocks and bonds, though that’s where the heaviest lifting happens.

If you’re a sports fan in Manhattan trying to catch a late afternoon kickoff in the UK, the timing is brutal. A 4:00 PM "tea time" match in England starts right when you're probably stuck in a meeting or ordering a sandwich at 11:00 AM.

- Television Rights: Networks like NBC Sports have built entire empires on this time difference. They know that the 4 PM UK slot is prime real estate for Saturday morning viewing in the US.

- Corporate Synergy: Most multinational firms headquartered in New York mandate that all "transatlantic" meetings happen between 8:00 AM and 12:00 PM EST. Why? Because once it hits 4 PM in London, the productivity of the UK team drops off a cliff as they prepare to sign off.

- Tech Deployments: Ever wonder why major software updates or server maintenance often happen in the early morning for New York? They are trying to hit the window before the UK goes home but after the US West Coast has gone to bed.

Why 11 AM is the "Golden Hour" for Productivity

If you are working a remote job or managing a global team, you’ve probably noticed that your inbox explodes around 11:00 AM in New York.

This is the peak of the "overlap."

✨ Don't miss: AOL CEO Tim Armstrong: What Most People Get Wrong About the Comeback King

From 9:00 AM to 12:00 PM EST, both sides of the Atlantic are at their desks. This four-hour window is arguably the most productive block of time in the Western world. But once the clock hits 4pm UK time in New York, the window begins to slam shut.

In London, the "Out of Office" replies start creeping in. In New York, the focus shifts from collaboration to internal execution. If you haven't gotten an answer from your London contact by 11:30 AM, you aren't getting it until tomorrow. That is the reality of the 4 PM cutoff.

Navigating the Volatility

Traders often refer to the period leading up to the London close as a "stop-run" period. Because the volume is so high, price swings can be violent.

If you’re a casual investor, don't be surprised to see your portfolio take a weird dip or spike right around 11:00 AM New York time. It’s often just the "Fix" settling. Central banks and massive institutional funds are rebalancing. It’s not necessarily a sign of a market crash or a moonshot; it’s just the plumbing of the global financial system flushing itself out.

Basically, the 4 PM London / 11 AM New York junction is the heartbeat of global commerce.

Actionable Takeaways for Timing the Transatlantic Gap

To manage this time difference effectively, you need more than just a dual-timezone watch. You need a strategy.

- The "Fix" Rule for Transfers: If you need to transfer large sums of money internationally (like for a property purchase or business invoice), aim for the 11:00 AM EST window. The spreads are often tighter because the liquidity is at its maximum.

- The "Two-Week" DST Alert: Mark your calendars for the last week of March and the last week of October. Check specifically for "British Summer Time" versus "Eastern Daylight Time." Do not trust your calendar app to get it right 100% of the time for recurring meetings.

- Communication Hard-Stop: If you are in New York, treat 11:00 AM as your deadline for "urgent" requests to Europe. Anything sent after 4:00 PM London time is effectively being sent into a black hole until the next morning.

- Market Awareness: If you are day trading, be aware that the 11:00 AM to 11:30 AM EST window often sees a "reversal" of morning trends as European traders exit their positions.

The world doesn't run on a single clock. It runs on the friction between them. Whether you're waiting for a soccer match to start or a currency trade to settle, the moment it becomes 4pm UK time in New York is the most important transition of the day. Respect the clock, or the clock will definitely disrespect your schedule.