Tax season is usually about as exciting as watching paint dry, but 2026 is looking a lot different. Honestly, if you’ve been following the news, you probably heard the "tax cliff" was coming because the old 2017 tax cuts were supposed to vanish into thin air. That didn't happen. Instead, we got the One Big Beautiful Bill Act (OBBB), which basically took most of those lower rates and made them permanent.

It’s a relief for most, but the math has shifted.

👉 See also: US National Debt Over Time Graph: What Most People Get Wrong

The IRS recently dropped the official numbers for the 2026 IRS tax brackets, and they’ve adjusted everything for inflation. This matters because if your boss gave you a 3% raise but the tax brackets didn't move, you’d actually end up "poorer" after taxes. It's called bracket creep. The good news is the IRS bumped the thresholds up, so you can earn a bit more before you get bumped into a higher percentage.

The 2026 IRS Tax Brackets: Where Do You Land?

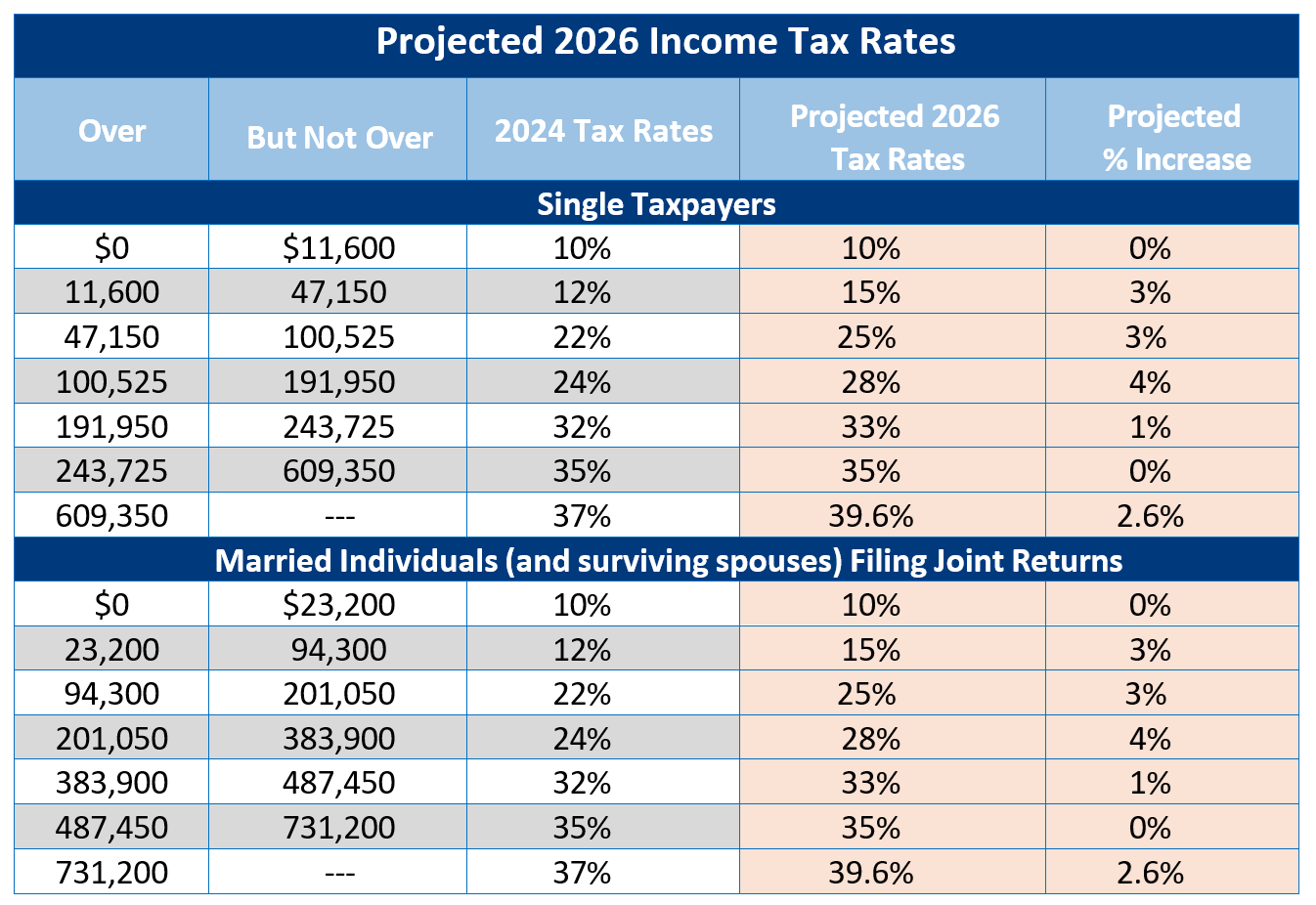

We still have seven tax rates. They range from 10% at the bottom to 37% at the very top. Most people think if they hit the "22% bracket," all their money is taxed at 22%. That’s a total myth. Our system is progressive. You pay 10% on the first chunk, 12% on the next, and so on.

For a single person, here is how the 2026 numbers shake out:

The 10% rate applies to income up to $12,400. Once you pass that, you pay 12% on everything from $12,401 up to $50,400. If you’re doing well and make more than that, the 22% rate kicks in for the portion between $50,401 and $105,700. The jumps continue: 24% starts at $105,701, 32% starts at $201,776, and 35% begins at $256,226. If you’re pulling in more than $640,601, you’ve reached the 37% peak.

Married Couples and Families

If you're married and filing jointly, the numbers basically double.

- 10%: $0 to $24,800

- 12%: $24,801 to $100,800

- 22%: $100,801 to $211,400

- 24%: $211,401 to $403,550

- 32%: $403,551 to $512,450

- 35%: $512,451 to $768,700

- 37%: $768,701 or more

It's a lot of digits to keep track of. Basically, if you and your spouse make a combined $150,000, you aren't "in the 22% bracket" for your whole salary. You're mostly paying 10% and 12%, with only about $49,000 of your income getting hit with that 22% rate.

The Standard Deduction Just Got a Little Bigger

Most of us don't itemize anymore. It’s just too much paperwork. The standard deduction is the "freebie" amount the IRS lets you subtract from your income before they even start looking at those brackets. For 2026, it’s going up again.

Single filers get a $16,100 deduction. Married couples filing jointly get $32,200.

If you’re 65 or older, there’s an extra "bonus" standard deduction. The OBBB added a temporary $6,000 deduction for seniors, but keep in mind there are income limits on that one. If you're a single senior making under $75,000, your total deduction could be significantly higher than the standard $16,100. It’s a huge win for retirees on fixed incomes.

What about the Child Tax Credit?

There was a lot of back-and-forth in Congress about this. For 2026, the credit is staying at $2,200 per child. It didn't revert to the old $1,000 level like people feared. However, it does start to phase out if you make over $200,000 (single) or $400,000 (married).

Tipped Workers and "Trump Accounts"

There are a couple of weird, new things in the 2026 code that weren't there a few years ago. First, tipped workers—think waiters, bartenders, Uber drivers—can now deduct up to $25,000 in tips from their taxable income. That is a massive change. If you work in the service industry, this could honestly be the biggest tax break of your life.

Then there's the "Trump Account." It's a new tax-advantaged savings account for minors that's supposed to start rolling out through banks in 2026. We're still waiting on the final Treasury regulations for exactly how these will be managed, but they're intended to be a new way to save for kids' futures with some serious tax perks.

Planning Your 2026 Strategy

Taxes are annoying, but ignore them at your own peril. If you’re a high earner (congrats, by the way), you need to look at the new Roth catch-up rules. Starting in 2026, if you’re 50 or older and make over a certain threshold, your catch-up contributions to your 401(k) must be Roth. That means you pay the tax now instead of later.

Also, the Alternative Minimum Tax (AMT) exemption moved up to $90,100 for singles and $140,200 for couples. This helps prevent middle-class families from getting hit by a tax originally designed for the super-wealthy.

Real-world scenario

Imagine Sarah. She's single and earns $60,000 a year.

First, she takes her $16,100 standard deduction. Now her taxable income is $43,900.

Looking at the 2026 IRS tax brackets, she’s completely out of the 22% range. All of her taxable income falls into the 10% and 12% buckets. She’ll end up paying way less than she would have under the old pre-2017 rules.

Your Next Steps

To stay ahead of these changes, check your withholding. Since the brackets and deductions shifted, you might be overpaying (or underpaying) the IRS every paycheck. You can use the IRS Tax Withholding Estimator online to see if you need to file a new W-4 with your employer.

If you're over 65, look into that $6,000 bonus deduction to see if your AGI qualifies. And if you're in the service industry, start keeping meticulous records of your tips now, because that $25,000 deduction is going to require some proof if you ever get audited. Finally, if you're a high-income saver over 50, talk to your HR department about the new Roth-only catch-up rules to make sure your retirement plan stays on track for the 2026 tax year.