Tax years usually blend together into one big, gray blur of paperwork and "where did I put that receipt?" moments. But 2016 was a bit of a bridge. It was the final full year of the tax code as we knew it before the 2017 Tax Cuts and Jobs Act (TCJA) came along and flipped the table on everything. If you're looking back at your old returns or trying to figure out an amendment, understanding the 2016 marginal tax rates is basically like reading a map of a city before they built a giant highway through the middle of it.

Most people think "marginal rate" means the government takes that percentage of their whole paycheck.

They don't.

It's a bucket system. You fill one bucket at a low rate, then the next bucket at a slightly higher rate. By the time you get to the 2016 marginal tax rates for the top earners, you're looking at seven different tiers. It’s not a flat penalty; it’s a ladder.

The Seven Tiers of 2016

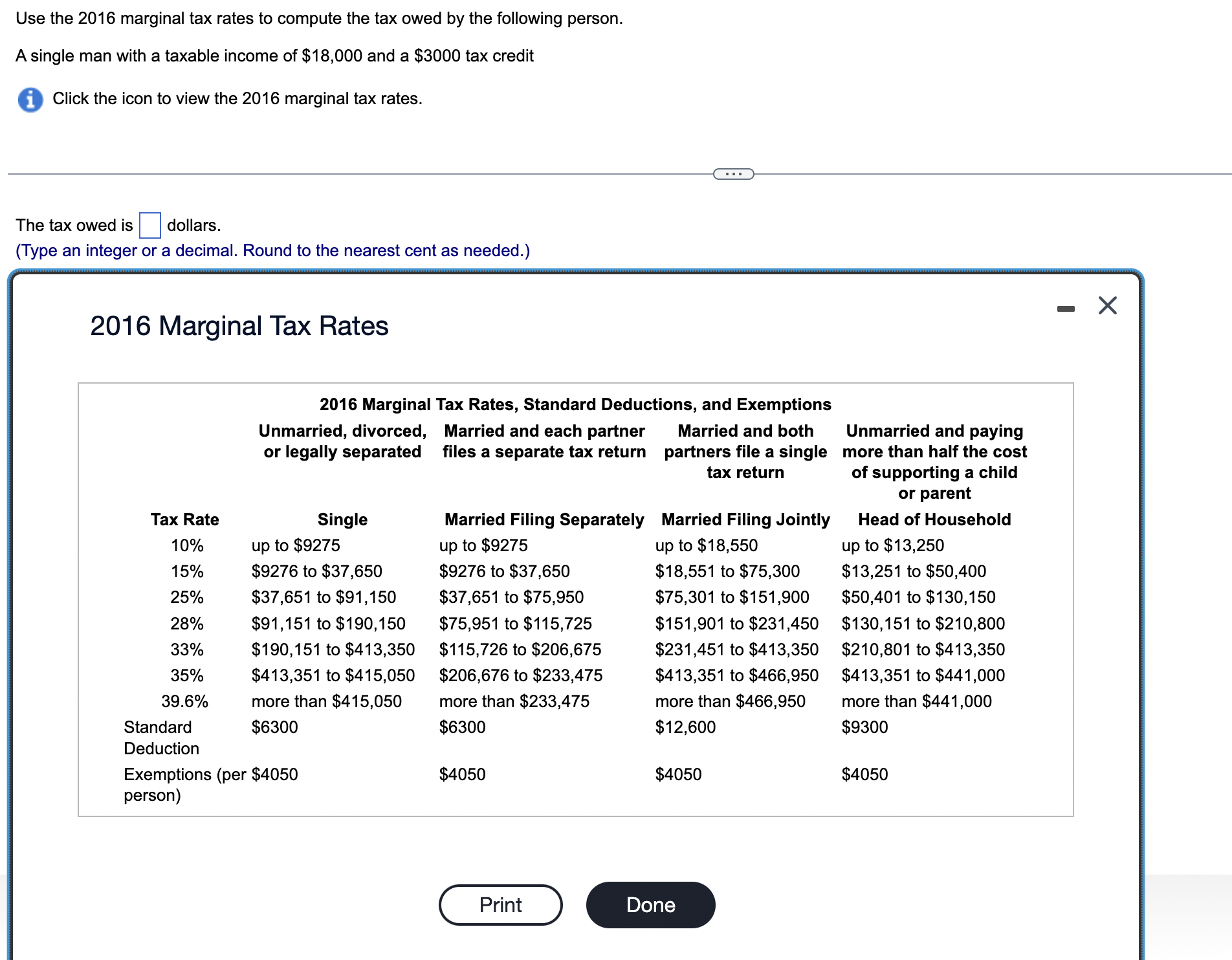

Back in 2016, the IRS stuck with a seven-bracket system. These rates were 10%, 15%, 25%, 28%, 33%, 35%, and the big one, 39.6%.

For a single filer, that 10% rate applied to the first $9,275 of taxable income. If you made $9,276, only that one extra dollar was taxed at 15%. This is where people get tripped up. I've heard folks say they turned down a raise because it would "push them into a higher bracket" and they'd "make less money." Honestly, that’s almost never how it works. You only pay the higher rate on the money that actually sits inside that specific bracket.

Married couples filing jointly had it a bit different, obviously. Their 10% bracket went up to $18,550.

The jump from 15% to 25% was the "big" one for the middle class. In 2016, for singles, that happened at $37,650. For married folks, it was $75,300. If you were earning just above that, you were feeling the first real "bite" of the federal government. It's a weird psychological threshold. You feel like you've made it because you're in a "higher bracket," but then you see the withholding on your W-2 and it's a bit of a gut punch.

Why the 39.6% Rate Was a Big Deal

The top rate of 39.6% didn't just appear out of nowhere. It was a remnant of the American Taxpayer Relief Act of 2012. Before that, the top rate was 35%.

👉 See also: Why Saying Sorry We Are Closed on Friday is Actually Good for Your Business

In 2016, you didn't hit that 39.6% ceiling until you were making over $415,050 as a single person or $466,950 as a married couple. It was a high bar. Most people weren't even sniffing that bracket, yet it dominated the political conversation that year.

Personal Exemptions: The Ghost of Taxes Past

Something we don't have anymore—thanks to the 2017 tax overhaul—is the personal exemption. In 2016, this was a massive deal.

Basically, the IRS said, "Hey, you're a person, so you get to subtract $4,050 from your taxable income just for existing." If you had kids, you got another $4,050 for each of them. A family of four could knock $16,200 off their taxable income before even looking at the 2016 marginal tax rates.

But there was a catch.

There's always a catch.

It was called the Personal Exemption Phaseout (PEP). If you made too much money—starting at $259,400 for singles—the IRS started taking those exemptions back. It was a "hidden" tax increase. You weren't just paying a higher percentage; you were losing the right to shield your income. It made the effective tax rate much higher than the nominal marginal rate suggested on paper.

Deductions vs. Exemptions in 2016

Standard deductions were much lower back then. For a single filer in 2016, the standard deduction was only $6,300. Married couples got $12,600.

Compare that to today, where the standard deduction has nearly doubled. Because the 2016 standard deduction was so low, way more people chose to itemize. They’d dig through shoe boxes for charitable donation receipts, mortgage interest statements, and state tax stubs.

✨ Don't miss: Why A Force of One Still Matters in 2026: The Truth About Solo Success

If you were living in a high-tax state like New York or California, the SALT (State and Local Tax) deduction was your best friend. There was no $10,000 cap back then. If you paid $30,000 in state income tax and property tax, you deducted the whole $30,000. This created a massive divide in how the 2016 marginal tax rates actually impacted people depending on where they lived. A guy in Florida making $200k paid a very different "real" rate than a guy in New Jersey making the same amount.

The Alternative Minimum Tax (AMT) Snare

You can't talk about 2016 without mentioning the AMT. It was originally designed to make sure the ultra-wealthy didn't use too many loopholes to pay zero tax.

But inflation is a monster.

By 2016, the AMT was starting to catch upper-middle-class families, especially those with lots of kids or high local taxes. You’d do your taxes once under the regular rules, then do them again under the AMT rules. You paid whichever was higher. It was a parallel universe of tax law. The 2016 AMT exemption was $53,900 for singles and $83,800 for married couples. If your "tax preference items" were too high, the 2016 marginal tax rates didn't even matter—the AMT took over.

Real World Example: The "Typical" 2016 Household

Let’s look at a fictional couple, Sarah and Mark. They made $100,000 combined in 2016.

First, they take their $12,600 standard deduction. Then, they take two personal exemptions totaling $8,100. Their taxable income is now $79,300.

They don't pay 25% on $79,300.

- They pay 10% on the first $18,550 ($1,855).

- They pay 15% on the amount between $18,550 and $75,300 ($8,512.50).

- They pay 25% on the remaining $4,000 ($1,000).

Their total federal bill? $11,367.50.

🔗 Read more: Who Bought TikTok After the Ban: What Really Happened

Even though their "marginal" rate was 25%, their effective rate (what they actually paid relative to their total income) was only about 11.4%. This is the nuance people miss. If you're looking at old 2016 records, don't panic when you see a high marginal bracket. The "buckets" are your friends.

Capital Gains and Dividends

If you were investing in 2016, the rates were tiered based on your income. Most people paid 15% on long-term capital gains. If you were in the 10% or 15% ordinary income brackets, your capital gains rate was actually 0%.

Yes, zero.

For the high rollers in the 39.6% bracket, the capital gains rate jumped to 20%. Plus, there was the Net Investment Income Tax (NIIT) of 3.8% if your income was over $200k (single) or $250k (married). So, for someone at the top, the "real" marginal rate on investment income was 23.8%.

How to Handle 2016 Records Today

Why does this matter now? Audit cycles. While the standard statute of limitations is three years, the IRS can go back six years if they find a "substantial understatement" of income (usually 25% or more). If you're dealing with unfiled returns from that era, or if you're settling an estate, these numbers are the law of the land for that period.

What you should do right now:

- Check your old 1040s: Look at line 44 (Tax) and line 63 (Total Tax) on your 2016 return. If you find errors in how your exemptions were applied, it might be worth a conversation with a pro, though the window for refunds has mostly closed.

- Verify Basis: If you sold an asset in 2024 that you owned in 2016, you need to know what the tax environment was like then to understand your "cost basis" adjustments, especially for things like reinvested dividends which were taxed at those 2016 rates.

- Organize for the Future: 2016 shows us how fast tax laws change. Keep a digital folder for every year. Tax laws are written in ink, but that ink fades and changes color every few years when a new administration steps in.

The 2016 marginal tax rates represent a specific moment in economic history. They reflect a time of lower standard deductions and higher reliance on personal exemptions. While we've moved into a "simplified" era since 2018, the complexity of 2016 is still relevant for anyone digging through their financial history or trying to understand the evolution of the American tax burden. If you're looking at a 2016 tax form, remember: it’s all about the buckets. Fill them one by one, and don't let the top-line percentage scare you away from understanding your actual liability.