If you walk into a shop in downtown Harare today with a single US dollar bill, you aren’t just a tourist with pocket change. You’re someone holding the most stable pillar of the local economy. It’s weird. Honestly, it’s a bit of a mess. Most people outside the country think 1 dollar in Zimbabwe is either worth a trillion "Zim dollars" or that the country is still using those giant novelty notes from 2008.

Neither is exactly true.

The reality on the ground in 2026 is a strange, overlapping system of gold-backed digital tokens, US cash, and a legacy of hyperinflation that just won't quit. To understand what a dollar actually buys you there, we have to look at the "ZiG" and the sheer power of the Greenback.

Why 1 Dollar in Zimbabwe Still Matters So Much

The US dollar is king.

While the government has tried—six times now—to launch a successful local currency, the people have a long memory. They remember 2008. They remember when a loaf of bread cost more than a car used to. Because of that, your single US dollar is often the preferred way to pay for a "kombi" (commuter minibus) ride or a quick snack at a roadside stall.

👉 See also: Dayan Kolev Net Worth: How a Jump Rope and a Phone Built a Million-Dollar Brand

As of early 2026, the official local currency is the Zimbabwe Gold (ZiG). It was launched in 2024 as a gold-backed replacement for the old Zimbabwean dollar (ZWL) which had basically become worthless.

When the ZiG first hit the streets, the exchange rate was around 13 or 14 ZiG to 1 US dollar. Fast forward to January 2026, and the official rate has drifted to about 25.60 ZiG per 1 USD.

But here’s the kicker: the "official" rate is rarely what you get on the street.

The Parallel Market Reality

In the real world—the world of vegetable markets and small shops—the gap is wider. If you're trading that 1 dollar in Zimbabwe on the parallel market, you might get significantly more ZiG than the bank says you should. This "black market" rate is what actually drives the prices of groceries.

If a shopkeeper sees you have US cash, their eyes light up.

Why? Because they need that "hard" currency to restock their shelves. Most suppliers for electronics or imported food won't take ZiG. They want the USD. So, that single dollar bill in your pocket actually has more "buying power" than its official equivalent in local currency. It’s sort of an unwritten rule of the Zimbabwean street.

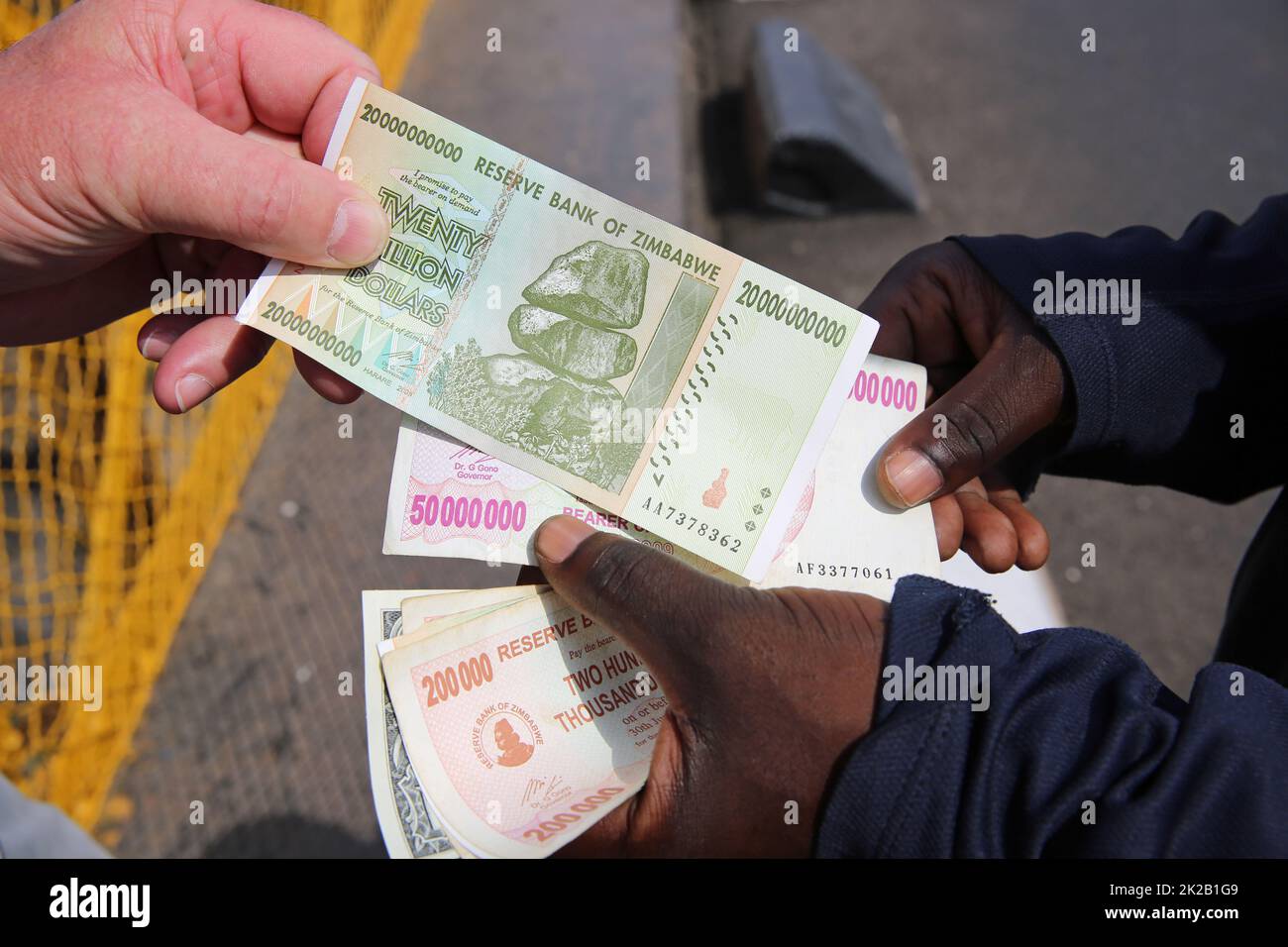

The Ghost of the 100 Trillion Dollar Bill

We’ve all seen them. The blue banknotes with the three balancing rocks on the front and a number followed by fourteen zeros.

People often search for the value of 1 dollar in Zimbabwe and stumble upon these 100 trillion dollar notes. It’s important to realize these are not legal tender. You can't spend them in a supermarket.

If you find one in an old drawer, its value is purely for collectors. Ironically, because they became a global meme for "how not to run an economy," they are actually worth more now than when they were "money." A crisp, uncirculated 100 trillion dollar bill from 2008 can sell for anywhere between $40 and $150 USD on eBay or at coin shops.

✨ Don't miss: High Yield Dividend ETFs: Why Chasing the Biggest Payouts Usually Backfires

Talk about a weird investment.

A Timeline of Currency Collapses

- 1980: The Zim Dollar is born, actually stronger than the US Dollar.

- 2008: Hyperinflation hits 79.6 billion percent per month.

- 2009: The currency is abandoned; Zimbabwe starts using the USD and South African Rand.

- 2019: They try again with the RTGS Dollar (ZWL). It fails.

- 2024: The ZiG is introduced, backed by gold reserves.

- 2026: The ZiG remains in a tug-of-war with the US Dollar for dominance.

What Can You Actually Buy with 1 Dollar?

Let’s get practical. If you’re standing in Harare right now with a single US dollar, what’s the haul?

It’s less than you might think. Zimbabwe is actually a fairly expensive place because so much is imported.

A single dollar will usually get you:

- Two "kombi" rides for short distances in the city.

- A large bottle of water and maybe a small packet of biscuits.

- About 3 to 4 ears of roasted maize from a street vendor.

- A few minutes of "bridge" data or a very small airtime voucher.

If you try to buy a loaf of bread, you'll likely need a bit more than a dollar, or you'll get your change back in a mix of ZiG coins and maybe a piece of candy. Change is a huge problem. Because there aren't many US coins in circulation, shops often give "credit notes" or small items like lollipops instead of 50 cents.

The ZiG and the 2026 Economic Outlook

The government is pushing hard for the ZiG to become the sole currency by 2030. They’re buying up gold and trying to build trust.

Reserve Bank Governor John Mushayavanhu has been vocal about hitting inflation targets, but the public remains cautious. They’ve been burned too many times. Most businesses still price their goods in US Dollars and then convert that price to ZiG at the checkout counter—often using a rate that protects them from the currency’s daily fluctuations.

If you’re a business owner, this is a nightmare. You have to keep two sets of books. You’re constantly checking the morning "street" rate versus the interbank rate.

🔗 Read more: Subsidized or Unsubsidized Loans: What Most People Get Wrong

Actionable Tips for Handling Money in Zimbabwe

If you're heading to Zimbabwe or dealing with someone there, here is the "pro" way to handle the 1 dollar in Zimbabwe situation:

- Carry Small Denominations: 1s, 5s, and 10s are gold. Most vendors cannot change a $100 bill, and if they do, you'll get the change in ZiG, which you might not want.

- Crisp Bills Only: Zimbabweans are notoriously picky about the physical condition of US bills. If your dollar has a tiny tear or looks too "soft," it might be rejected.

- Download a Rate Tracker: Use local apps or Telegram channels that track the parallel market rate. The official bank rate is almost never the one used in the markets.

- Check for "Zim Gold" Coins: The 1, 2, and 5 ZiG coins are now common. They are useful for exact change, but don't hold onto large amounts of them as their value can shift quickly.

- Use Digital Payments for Big Stuff: Most major grocery stores take Visa or Mastercard, but they will charge you at the official rate. For the best deal, use US cash at small local shops.

Understanding the value of 1 dollar in Zimbabwe is basically a lesson in psychology. It’s not just about math; it’s about how much people trust their government versus how much they trust that green piece of paper from the US Treasury. For now, the green paper is winning.

The best way to stay ahead is to keep your US cash in hand and only convert what you need for immediate spending in the local markets.