Let’s be real for a second. When that financial aid award letter hits your inbox, it looks like a foreign language. You see "Direct Subsidized" and "Direct Unsubsidized" sitting there, and honestly, most people just click "Accept All" without a second thought. But you’re basically making a four-figure (or five-figure) decision in a vacuum.

If you’re staring at those two options and wondering which is better subsidized or unsubsidized loans, the short answer is almost always subsidized. It's the "holy grail" of student debt. But life—and the Department of Education—is rarely that simple. Especially with the massive 2026 shakeups from the "One Big Beautiful Bill" (OB3) Act, the rules of the game are changing for anyone entering a master’s program or professional school this year.

The Interest Trap: Why "Subsidized" Is the Gold Standard

The biggest difference—and the reason one is clearly "better"—comes down to who pays the bill while you're cramming for finals.

With a Direct Subsidized Loan, the U.S. government acts like a generous benefactor. They pay the interest for you while you're in school at least half-time. They also cover it during your six-month grace period after graduation. Basically, if you borrow $3,500 in September, you still owe exactly $3,500 when you walk across that stage four years later.

Direct Unsubsidized Loans are the opposite. They start ticking the second the money hits your school account.

For the 2025-2026 school year, the interest rate for undergraduate loans is fixed at 6.39%. On an unsubsidized loan, that interest "capitalizes." If you don't pay it off while you're in school—and let's be honest, most students don't—that interest gets added to your principal balance. You end up paying interest on your interest. It's a snowball effect that can add thousands to your debt before you even get your first paycheck.

Which is Better Subsidized or Unsubsidized Loans?

If you have the choice, you take the subsidized loan first. Every single time. It’s essentially an interest-free loan for the duration of your degree.

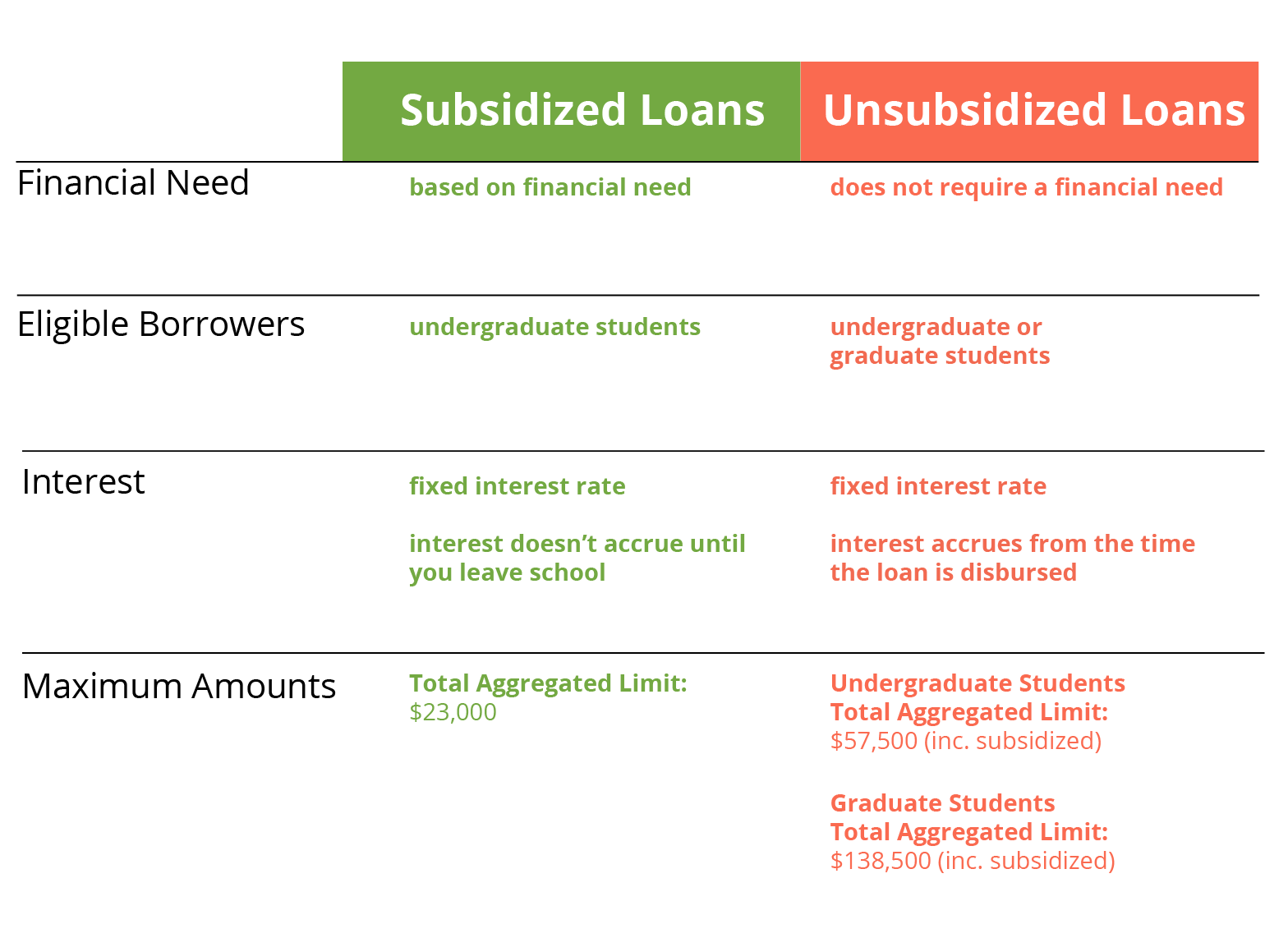

However, there’s a catch. You can’t just "choose" to have a subsidized loan because you want one. The government only gives these to undergraduate students who demonstrate "financial need" via the FAFSA. If your family makes "too much" money (according to the Department of Ed’s specific formulas), you’re stuck with unsubsidized.

The Graduate School Plot Twist (OB3 Act)

If you’re a graduate student, the "which is better" debate is actually over. You don't get a choice. Subsidized loans are only for undergrads.

📖 Related: Cambio de dólar a peso mexicano hoy: Lo que la mayoría ignora sobre el precio actual

And starting July 1, 2026, things are getting even tighter. Under the new OB3 Act legislation, Graduate PLUS loans are being phased out for new borrowers. If you’re starting a Master's or PhD in 2026, you're likely capped at $20,500 per year in unsubsidized loans, with a lifetime limit of $100,000. For medical or law students, those caps are higher ($50,000/year), but the point remains: the "free interest" days are gone once you get that bachelor's degree.

Breaking Down the Numbers: A Real-World Comparison

Imagine you need $5,500 for your junior year.

If that’s a Subsidized Loan:

- Balance at graduation: $5,500.

- Total Interest accrued in school: $0.

If that’s an Unsubsidized Loan (at 6.39%):

- Balance at graduation (2 years later): Roughly $6,200.

- Total Interest accrued in school: ~$700.

That $700 might not seem like a dealbreaker today, but remember, that’s just for one year’s worth of loans. Multiply that by four years, and you’re looking at a used car’s worth of "invisible" debt before you’ve even started your career.

Borrowing Limits You Need to Know

The government doesn't let you borrow an infinite amount of the "good" stuff. For dependent undergrads, there are strict caps:

- Freshman year: $5,500 total (only $3,500 can be subsidized).

- Sophomore year: $6,500 total (only $4,500 can be subsidized).

- Junior/Senior years: $7,500 total (only $5,500 can be subsidized).

Total lifetime limit for undergrads? $31,000, and only $23,000 of that can be subsidized.

The "Legacy Provision" Loophole

If you're already in a program before July 2026, don't panic. There's a "grandfathering" clause. If you've already borrowed for your current degree, you can keep borrowing under the old, more flexible rules for up to three more years. But if you switch majors or start a new degree after the July 1 deadline, you're subject to the new, stricter OB3 caps.

🔗 Read more: AED Currency to Pounds: What Most People Get Wrong

How to Handle an Unsubsidized Loan if You're Stuck With One

Most people end up with a mix of both. It's just the way the math works. If you have to take an unsubsidized loan, you aren't doomed, but you need a strategy.

Pay the interest monthly. You’ll get a statement showing how much interest has accrued. If you can scrape together $20 or $30 a month to pay just that interest while you're in school, you prevent it from capitalizing. This is the single best way to make an unsubsidized loan "feel" like a subsidized one.

Max out the subsidized portion first.

When you go into your student portal to "Accept" your awards, always accept the full subsidized amount before touching the unsubsidized. It sounds obvious, but some portals list them in alphabetical order or by amount, and students often just click the top one.

Watch the fees.

Both loans currently have an origination fee of 1.057% (for loans disbursed through September 30, 2026). This means if you borrow $1,000, you only actually receive about $989. Keep that in mind when you're calculating if you have enough for rent.

Actionable Steps for Your Financial Aid

Stop viewing your financial aid as a "package" and start viewing it as individual products.

First, check your FAFSA Submission Summary. If your Student Aid Index (SAI) is low, and your school didn't offer you subsidized loans, call the financial aid office. Sometimes they make mistakes, or your family's financial situation has changed since you filed.

Second, if you're a grad student looking at the 2026 changes, start looking at "Professional" designations. The Department of Education is still finalizing which programs count as "Professional" (which gets the $50k cap) versus "Graduate" (which gets the $20.5k cap). If your program is on the bubble, you might need to look into private lenders like Sallie Mae or SoFi to bridge the gap if the federal limits aren't enough.

Finally, always use the federal "Loan Simulator" tool before you sign. It’ll show you exactly what your monthly payment will be in four years. Seeing a $600/month payment on paper while you're still a student is a great way to motivate yourself to borrow less today.