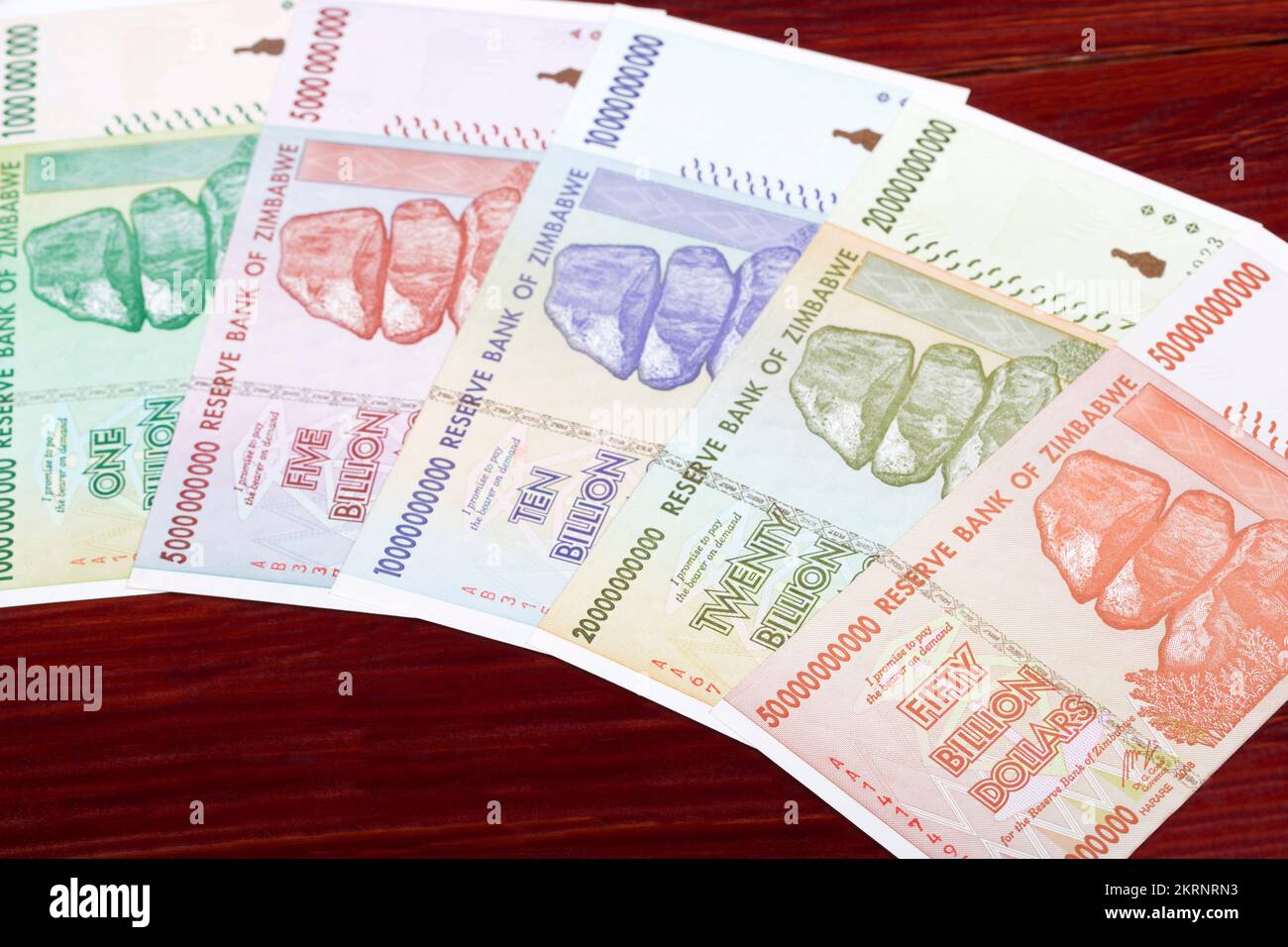

If you’ve ever seen a 100-trillion-dollar bill, you probably weren't looking at the bank account of a tech billionaire. You were likely holding a piece of history from Harare. Converting zimbabwean dollars to usd is not just a simple math problem; it is a wild ride through one of the most volatile economic stories of the 21st century.

Honestly, it’s confusing. Most people think the "Zim dollar" is just one thing. It’s not. There have been several versions, multiple "rebirths," and now, a gold-backed newcomer called the ZiG.

📖 Related: 60 Yuan to Dollar: What You Actually Get After Fees and Inflation

Why the Math Doesn't Always Add Up

Let’s be real. When you search for the exchange rate of zimbabwean dollars to usd, you might find a number like 25 or 26. But wait—wasn't it 35 quadrillion to one at some point? Yes.

The "Old" Zimbabwean Dollar (ZWL) basically died in April 2024. Before it was retired, it was trading at over 30,000 to 1 USD officially. On the streets? It was much worse.

The government stepped in and launched the Zimbabwe Gold (ZiG), now officially coded as ZWG. This was supposed to fix everything. It started at 13.56 to the dollar. By the time we hit January 2026, the official rate has hovered around 25.71 ZWG per 1 USD. But here is the kicker: the "official" rate rarely tells the whole story.

The Parallel Market Reality

In Zimbabwe, there are two worlds.

- The Interbank Rate: This is what you see on Google or the Reserve Bank of Zimbabwe (RBZ) website. It looks stable. It looks safe.

- The Street Rate: This is what's happening in the "parallel market."

If you go to a local trader in Harare or Bulawayo, your US dollars will almost always buy more than the official rate suggests. Why? Because the supply of USD is tight. Business owners need greenbacks to import fuel, stock, and spare parts. When the government can’t provide enough USD at the official rate, the price of the dollar on the street goes up. Simple supply and demand, really.

The 100 Trillion Dollar Question

People still buy those old 2008-era 100 trillion dollar notes on eBay as souvenirs. They aren't legal tender. You can't walk into a shop and buy a loaf of bread with them.

"It’s a collector's item now, like a stamp or a vintage coin," says one local numismatist.

👉 See also: Why the Domino Interior Design Logo Actually Works (And Why Most New Brands Fail)

Back in 2008, hyperinflation was so fast that prices doubled every 24 hours. The RBZ just kept adding zeros. Eventually, they gave up. They "demonetized" the currency, which is just a fancy way of saying they admitted it was worthless.

Between 2009 and 2019, the country basically used the US dollar for everything. This brought stability, but it also meant the government couldn't print money to pay its bills. So, they tried to bring back a local currency again. And again. The latest attempt, the ZiG, is backed by actual gold reserves and foreign currency.

How the ZiG Changed the Game

The ZiG was a massive shift. It wasn't just another piece of paper; it was a digital-first, gold-backed asset.

- The Launch: April 8, 2024.

- The Backing: About $285 million in gold and foreign reserves (initially).

- The Devaluation: In September 2024, the RBZ had to devalue the ZiG by about 43% to catch up with the market.

By early 2026, the currency has shown more resilience than its predecessors, but skepticism remains high. When you’ve been burned by hyperinflation three or four times, you don't trust the new guy easily.

Most people still prefer to hold USD. It’s the "mattress money." If you have a choice between a ZiG note and a US five-dollar bill, you’re picking the Lincoln every single time.

Converting Zimbabwean Dollars to USD in 2026

If you are actually trying to move money today, you need to know which "dollar" you are dealing with.

If you have old ZWL notes from 2023 or early 2024, they are basically paperweights. The window to convert them to ZiG at the bank closed long ago.

If you have ZiG (ZWG) and want USD:

- At the Bank: You need a "bona fide" reason, like traveling abroad or paying for imports. You’ll get the rate near 25.70.

- At the Bureau de Change: Rates will be slightly less favorable but more accessible.

- In the Informal Market: Expect to pay a premium. The gap between the official and street rates is the number one thing to watch if you want to understand the health of the economy.

Real Talk on Inflation

Inflation in ZiG terms reached over 30% in a single month back in late 2024. In USD terms, however, prices in Zimbabwe are surprisingly stable (though high compared to neighboring countries like Zambia or South Africa). This "dual economy" means that even if the ZiG loses value, the cost of a soda in USD stays roughly the same.

✨ Don't miss: Current Price of Gold and Silver: What Most People Get Wrong About This Massive 2026 Spike

Actionable Steps for Navigating the Rates

If you’re traveling to Zimbabwe or doing business there, don't just look at the ticker on a finance app.

- Bring Small USD Bills: Change is hard to find. $1, $5, and $10 bills are gold. Literally.

- Use Plastic/Mobile for ZiG: If you have to pay in local currency, swipe your card. The bank will handle the conversion at the official rate, which is usually better for you as a buyer.

- Check the RBZ Daily: The Reserve Bank of Zimbabwe updates its rates every morning. It’s the baseline.

- Watch the Gold Price: Since the ZiG is gold-backed, if global gold prices tank, the ZiG might feel the pressure.

Zimbabwe's relationship with money is complicated. It’s a mix of resilience, hustle, and a lot of history. Whether you’re a tourist curious about the zeros or a business owner looking at the bottom line, understanding the shift from zimbabwean dollars to usd is about more than just numbers—it’s about trust.

Your next step: To get the most accurate current rate for a specific transaction, check the official daily mid-rate on the [suspicious link removed] website and compare it with recent quotes from authorized Bureaux de Change.