If you’ve ever seen those trillion-dollar bills on eBay, you already know the Zimbabwe dollar is basically the poster child for hyperinflation. It’s a wild story. People were literally carrying wheelbarrows of cash just to buy a loaf of bread back in 2008. But honestly, the situation with currency exchange Zimbabwe dollar has moved way past those novelty notes. It’s a mess of shifting names, new gold-backed experiments, and a local population that—frankly—doesn't trust its own money anymore.

Right now, if you go to Harare, you aren't going to find many people using the "ZWL" or the old "Bond Notes." The government recently scrapped the old Zimbabwe dollar for something called the Zimbabwe Gold (ZiG).

Money is weird. It only works if we all agree it has value. In Zimbabwe, that agreement broke a long time ago.

The Death and Rebirth of a Currency

Let’s be real: the Zimbabwe dollar has "died" more times than a cat has lives. Most people get confused because the name stays the same even when the actual currency changes. In April 2024, the Reserve Bank of Zimbabwe (RBZ) governor, John Mushayavanhu, introduced the ZiG. It’s supposed to be backed by actual gold and foreign currency reserves.

This was a massive pivot.

Before the ZiG, we had the RTGS dollar and the "Zimdollar" (ZWL), which were losing value so fast that shops were changing prices three times a day. You’d walk in for milk at 9:00 AM, and by noon, the price had jumped 20%. That’s not an exaggeration; it’s a nightmare. The currency exchange Zimbabwe dollar rates were effectively a work of fiction. There was the official bank rate, which was low, and the "black market" or parallel rate, which was the one everyone actually used.

Why does this keep happening?

It’s a mix of bad policy, massive debt, and a lack of foreign investment. When the government prints money to pay for things it can't afford, the value of the money in your pocket disappears. It’s basic supply and demand, but on a catastrophic scale.

The Parallel Market: Where the Real Exchange Happens

If you’re looking at currency exchange Zimbabwe dollar data on a site like Bloomberg or Reuters, you’re only seeing half the picture. Maybe less.

👉 See also: Why Amazon Stock is Down Today: What Most People Get Wrong

The street rate is the heartbeat of the economy. In places like "Roadport" in Harare, money changers deal in USD, South African Rand, and the local currency. They use WhatsApp groups to set the daily rate. It’s decentralized, technically illegal, and totally essential.

The government tries to crack down. They arrest traders. They freeze bank accounts of companies suspected of using the parallel market. But you can't arrest your way out of a currency crisis. If the bank says 1 USD is worth 13 ZiG, but the guy on the corner will give you 25 ZiG for that same dollar, where are you going to go? Exactly.

Why the Gold-Backed ZiG is Different (Sorta)

The ZiG is backed by roughly 2.5 tonnes of gold and about $100 million in foreign currency. That sounds like a lot, but for a whole country? It’s lean.

The idea is that the currency won't inflate because it's tied to a physical asset. Unlike the old currency exchange Zimbabwe dollar versions that were just paper backed by promises, the ZiG has some "weight" to it. However, the skepticism is thick. After decades of losing their life savings—twice—Zimbabweans are understandably hesitant to trade their "hard" US dollars for "soft" local notes.

Most businesses still price things in USD. If you go to a restaurant, the menu might be in US dollars, and if you want to pay in local currency, they’ll use a rate that protects them from the next devaluation.

The US Dollar is King

The US dollar is the unofficial-official currency of Zimbabwe. It has been since the 2009 "dollarization." Even when the government tries to force the use of local currency, the "Greenback" wins.

Think about it.

If you're a farmer and you sell your maize, you want to be paid in a currency that will still buy fuel next month. The currency exchange Zimbabwe dollar volatility makes it impossible to plan. This creates a "dual economy." The wealthy and the connected have access to USD, while the poor, often paid in local currency, see their purchasing power evaporate.

✨ Don't miss: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

It's a brutal divide.

What You Need to Know About the Exchange Rates

If you are actually trying to figure out the value of Zimbabwe money right now, you have to specify which money.

- The ZiG: The current official unit.

- The Old ZWL: Mostly defunct, but still holds interest for collectors.

- The USD: The benchmark for everything.

The RBZ publishes an interbank rate daily. You can find this on their official website. But again, keep an eye on the "Old Mutual Implied Rate" or other unofficial trackers. They often give a more honest look at what the currency is actually worth on the ground.

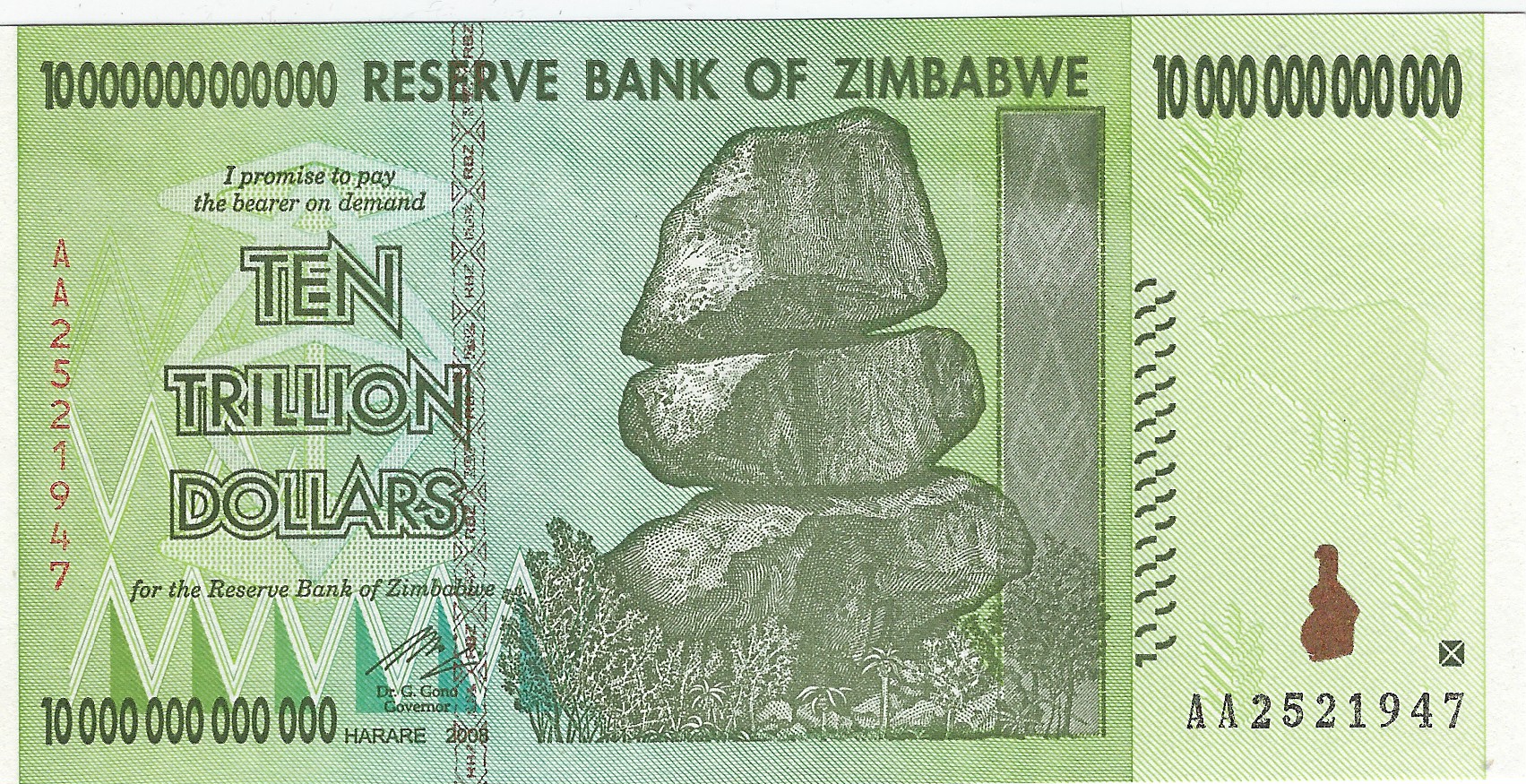

Historical Context: 100 Trillion Dollars

We can't talk about currency exchange Zimbabwe dollar history without mentioning the 100 trillion-dollar bill. It is the highest denomination ever printed for a circulating currency. By 2008, inflation was estimated at 89.7 sextillion percent per year.

Numbers stopped making sense.

The government eventually just stopped printing the currency and allowed everyone to use USD, Rand, and even the Botswana Pula. This stopped the inflation dead in its tracks, but it also meant the government couldn't control its own monetary policy. They couldn't print money to stimulate the economy, which led to a different kind of stagnation.

In 2016, they tried "Bond Notes," claiming they were equal to the USD. They weren't. The market figured that out in about five minutes. That led to the re-introduction of a proper Zimbabwe dollar in 2019, which eventually led to the ZiG we see today.

Real-World Advice for Navigating the Zimdollar

If you’re traveling there or doing business, don't rely on ATMs. Most don't give out USD, and if they give out local currency, the currency exchange Zimbabwe dollar rate you get will be the official one—meaning you're basically losing half your money instantly.

🔗 Read more: Kimberly Clark Stock Dividend: What Most People Get Wrong

Bring cash. Small bills.

Everyone wants US dollars, but they rarely have change for a $50 or $100 bill. You’ll end up being forced to buy "change" in the form of chocolates or gum at the grocery store. It's a weird quirk of the local economy.

Also, mobile money is huge. Platforms like EcoCash are how people survive. You can trade currency digitally, pay for groceries, and send money to family in rural areas. It’s often faster and safer than carrying stacks of notes that might become worthless tomorrow.

The Future: Can the ZiG Survive?

The jury is still out. For the ZiG to work, the government needs to stop printing money to cover the deficit. They also need to build trust. Trust is the hardest thing to "mine," much harder than gold.

If they can keep the currency exchange Zimbabwe dollar rate stable for a year or two, people might start putting their USD into bank accounts again. Right now? Most people keep their savings under a mattress or in "hard" assets like bricks and cattle.

Economists like Gift Mugano have been vocal about the challenges. They argue that without a massive boost in local production, no currency—gold-backed or not—can stay stable. You have to make things people want to buy. If you import everything, your currency will always be under pressure.

Practical Steps for Business and Travel

If you are monitoring the currency exchange Zimbabwe dollar for investment or travel, follow these steps to stay ahead:

- Check the RBZ website daily: This gives you the "floor" for the exchange rate, but never assume it’s the market price.

- Monitor ZimPriceCheck: There are several independent websites and social media accounts that track the parallel market rates. These are what the shops use.

- Use USD for big purchases: Cars, rent, and electronics are almost exclusively priced and traded in US dollars.

- Avoid holding local currency: If you receive ZiG or the old ZWL, spend it or convert it as fast as humanly possible. Holding it is a massive risk.

- Watch the Gold Price: Since the new currency is gold-backed, the global price of gold per ounce now directly impacts the theoretical value of the Zimbabwe currency.

Zimbabwe is a beautiful country with an incredibly resilient population. They’ve survived the worst economic mismanagement in modern history and are still standing. Whether the new ZiG is the final answer or just another chapter in the long saga of the Zimbabwe dollar remains to be seen. But for now, the rule is simple: Cash is king, but only if it's the right kind of cash.

Always look at the street. The street never lies about what a dollar is worth.

Actionable Insights for Navigating Zimbabwe's Economy:

- Diversify Assets: Never keep 100% of your liquid capital in local Zimbabwe currency. Convert to "hard" assets or USD immediately upon receipt to hedge against sudden devaluations.

- Verify the "Real" Rate: Before any major transaction, consult with local business owners to find the current "effective" exchange rate, as this often deviates significantly from the official bank figures.

- Digital over Physical: Use mobile money platforms like EcoCash for daily transactions to avoid the logistical nightmare of handling physical notes and the lack of change in the retail sector.

- Monitor Policy Shifts: Follow the Reserve Bank of Zimbabwe's monetary policy statements (MPS) released bi-annually. These documents often signal upcoming changes in currency structure or interest rates that impact exchange stability.