If you’re planning a trip to Victoria Falls or trying to settle an invoice in Harare right now, you’ve probably realized that "what currency in Zimbabwe" isn't a simple question. It's a bit of a moving target.

Honestly, the situation is weird. You can walk into a supermarket and see prices in two different numbers that don't seem to have anything to do with each other. One is the US Dollar (USD), and the other is the Zimbabwe Gold (ZiG).

The ZiG is the official national currency. It was launched in April 2024 to replace the old, battered RTGS dollar that had basically become worthless. But here’s the kicker: even though the government is pushing the ZiG hard, the USD is still the king of the street.

So, what is the ZiG exactly?

Basically, the ZiG—which stands for Zimbabwe Gold—is what the central bank calls a "structured currency."

Unlike the previous versions of the Zimbabwe dollar, which were backed by nothing but hope and a printing press, the ZiG is theoretically backed by physical assets. We're talking about roughly 2.5 tons of gold and about $100 million in foreign currency reserves.

📖 Related: Truck Town Summerville GA: What Most People Get Wrong About This Local Legend

The idea was to tie the value of the money to the price of gold. If gold goes up, the currency should, in theory, stay stable. When it launched, the exchange rate was set around 13.56 ZiG to 1 USD. But as anyone living in Bulawayo or Mutare will tell you, the "official" rate and the rate you get on the street are two very different things.

By late 2025 and moving into 2026, the official rate has hovered around 25 to 26 ZiG per US Dollar, but the black market (or "parallel market") often demands much more.

Why is everyone still using US Dollars?

You’ve gotta understand the history here. Zimbabweans have been burned. A lot.

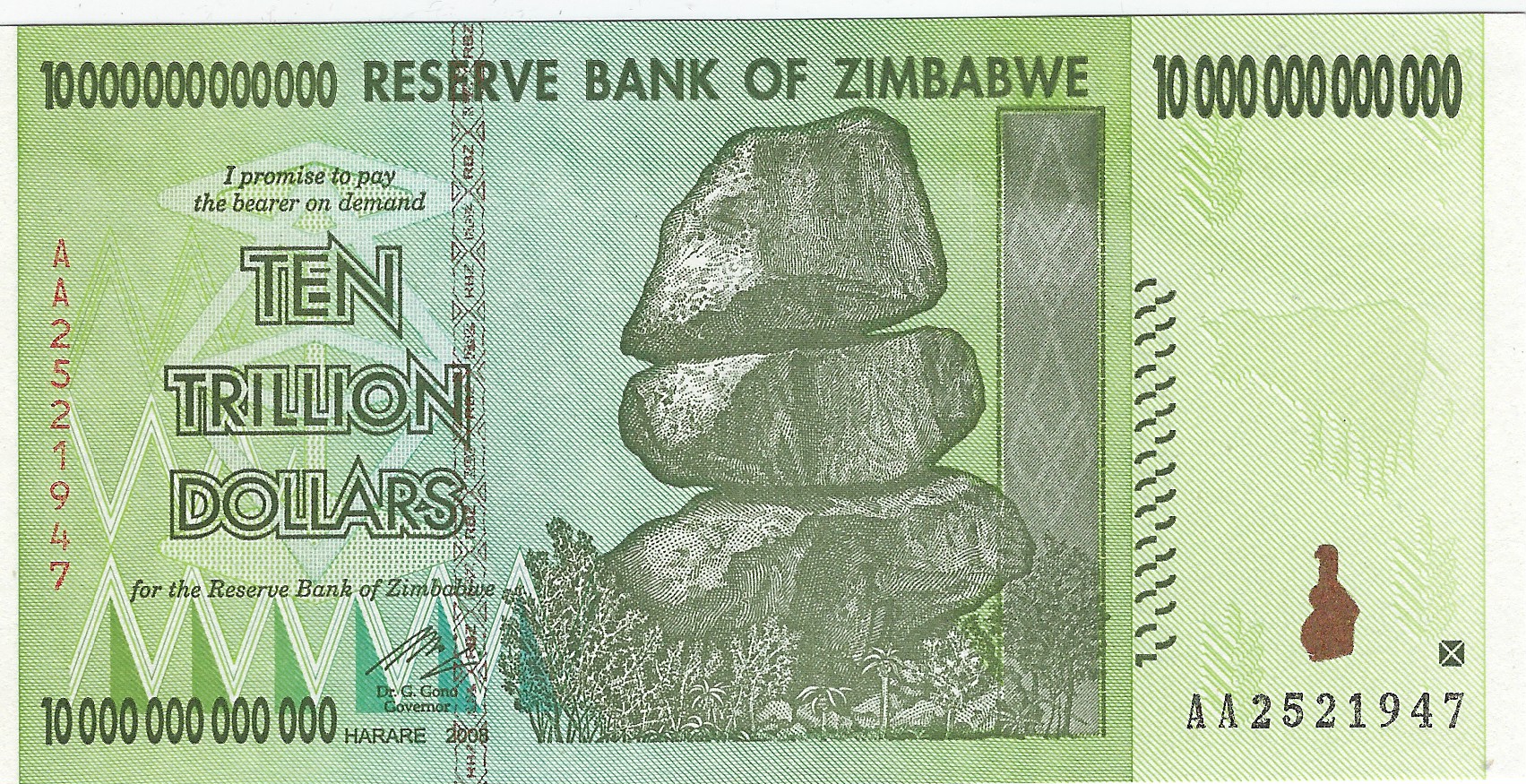

Most people remember 2008, when inflation was so high that the government was printing 100 trillion-dollar notes. When you’ve seen your life savings turn into the price of a loaf of bread overnight, you don't trust a new local currency just because it has a shiny new name.

Currently, about 70% to 80% of transactions in the country are still done in US Dollars.

- Fuel: Almost exclusively USD.

- Rent: Usually USD.

- Groceries: You can use ZiG, but many shops offer "discounts" if you pay in greenbacks.

It’s a dual-currency system that feels a bit like a tug-of-war. The government wants you to use the ZiG to regain "monetary sovereignty," but the average person wants the stability of the dollar.

The 2030 Roadmap (and why it matters now)

President Emmerson Mnangagwa and the Reserve Bank Governor, John Mushayavanhu, have been very clear about one thing: they want the US dollar gone by 2030.

There was even talk about moving that deadline up to 2026, but that hasn't quite panned out. The economy just isn't ready. The International Monetary Fund (IMF) has been poking around, basically telling the government they need more "policy clarity" before they force everyone to ditch the dollar.

To make the ZiG work, the central bank has been aggressively buying gold to beef up its reserves. As of early 2026, those reserves have climbed to over $1.1 billion. That sounds like a lot, but it only covers about a month and a bit of imports. For a currency to be "rock solid," you usually want three to six months of cover.

How to Handle Money if You’re Visiting or Doing Business

If you are heading to Zimbabwe, don't overthink it.

Carry small USD bills. I cannot stress this enough. If you hand a vendor a $50 bill for a $2 Coke, you are going to get your change in ZiG, and the exchange rate they use will probably not be in your favor. Or worse, they just won't have change at all.

Check the latest rates.

Don't just look at Google. Look at what the local "Bureau de Change" is posting. The gap between the official rate and the street rate is where things get expensive for the uninformed.

Plastic is (mostly) fine.

International Visa and Mastercard work in most major hotels and larger retailers in tourist hubs like Victoria Falls. However, once you get off the beaten path, cash is the only language people speak.

✨ Don't miss: Innovative Architects Duluth GA: What Most People Get Wrong

The "Street" Reality

There’s a specific vibe to the Zimbabwean economy that's hard to capture in a textbook. It's the "shakers"—the guys on street corners with thick wads of cash. They are the unofficial barometers of the economy.

When the gap between the official rate and the street rate widens, it’s a sign that people are losing confidence in the ZiG. The government has tried to crack down on these illegal traders, but they always come back. Why? Because the market needs liquidity that the banks sometimes can't provide.

What happens next?

The future of the ZiG depends entirely on trust.

The Reserve Bank is trying to build that trust by keeping the money supply tight. They aren't printing ZiG like crazy—at least not yet. They've even held back on releasing higher-denomination notes (like the 50 or 100 ZiG bills) because they’re afraid it will trigger more inflation.

For now, the country is stuck in this "multi-currency" middle ground. It’s a bit messy, it’s definitely confusing for tourists, and it’s a daily headache for local business owners who have to constantly update their price tags.

Actionable Advice for Navigating Zimbabwe's Currency

If you're dealing with the Zimbabwean economy in 2026, follow these rules:

- Keep your USD: Even if the government says the ZiG is the future, the USD is your safety net. Never convert more than you need for immediate expenses.

- Use ZiG for "Change": Use the local currency for small things—parking fees, street snacks, or public transport (kombis).

- Watch the Gold Price: Since the ZiG is "structured" around gold, a massive drop in global gold prices could theoretically hurt the currency’s backing.

- Pay your taxes in ZiG: If you're running a business, the government often requires a portion of taxes to be paid in the local unit. This is one of the few things keeping demand for the currency alive.

Zimbabwe's money story is far from over. Whether the ZiG becomes a success story or ends up as another museum piece alongside the trillion-dollar notes depends on the next couple of years of fiscal discipline.

Next Steps for You:

Check the current daily exchange rate on the Reserve Bank of Zimbabwe's official website before making any large transactions. If you are traveling, ensure your USD notes are "New Blue" series (post-2013) as many local vendors are still wary of older "small head" bills.