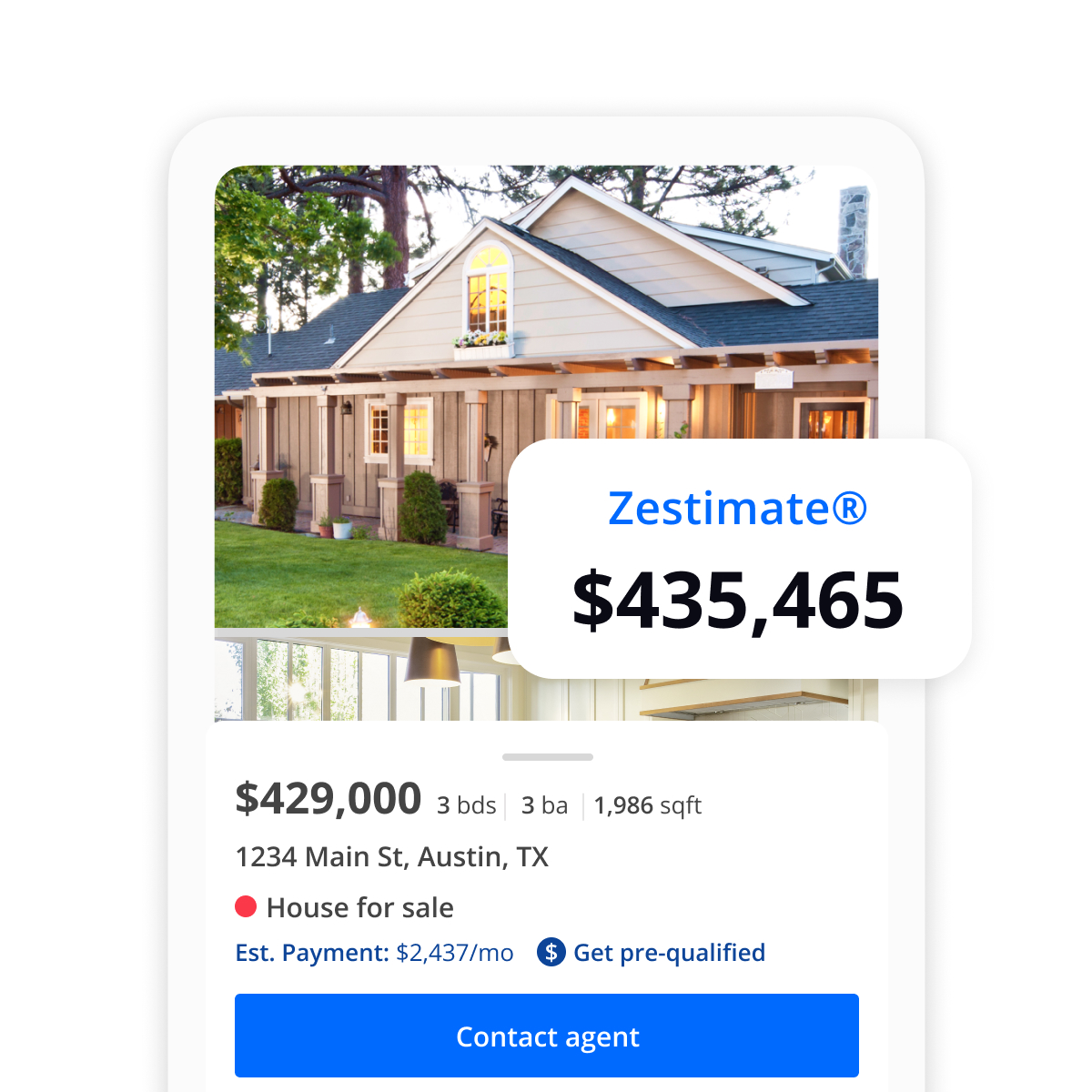

You’re sitting on your couch, scrolling through your phone, and you decide to look up your own house. We’ve all done it. You see that big, bold number at the top—the Zillow Zestimate home valuation—and suddenly you feel a little richer. Or maybe you feel insulted. "My kitchen is way nicer than the neighbors'," you think. "How is their Zestimate higher than mine?" It’s a weirdly emotional experience for something generated by an algorithm sitting in a server farm in Seattle.

But here is the thing. That number isn't an appraisal. It isn't even a guarantee of what a buyer will pay. It’s a starting point, a piece of data in a sea of variables that sometimes gets it right and sometimes misses the mark by a mile.

Honestly, the Zestimate is probably the most famous—and most misunderstood—metric in modern real estate. Since its launch in 2006, it has shifted from a quirky tech experiment to something that actually dictates how people feel about their net worth. But if you're planning to sell your home or buy a new one, relying solely on that digital estimate is a dangerous game.

The Math Behind the Curtain

So, how does Zillow actually come up with that number? It’s basically a massive, automated valuation model (AVM). It isn't a person walking through your front door. It’s a neural network that eats data for breakfast.

Zillow pulls from public records, tax assessments, and user-submitted data. They look at "comps"—comparable sales in your area. They look at square footage, the number of bathrooms, and even the local schools. But they also look at things you wouldn't expect, like how many people are clicking on your listing compared to others.

- Public Records: Deeds, property transfers, and tax assessor data.

- Listing Data: If your house is on the market, the algorithm looks at the list price and how long it’s been sitting there.

- User Tweaks: When a homeowner updates their "Home Facts" on the site, the algorithm recalibrates.

In 2021, Zillow made a massive leap by incorporating "spatial data." This means the algorithm started looking at things like road noise or whether you have a view of a park versus a view of a dumpster. They use computer vision to analyze photos—the AI literally "sees" your granite countertops or your 1970s shag carpet.

The accuracy has improved, but it's still just code. In a "hot" market where prices are moving faster than public records can update, the Zillow Zestimate home valuation can lag behind reality by weeks. On the flip side, when the market cools, the Zestimate often stays inflated for too long, giving sellers a false sense of hope.

Why the Accuracy Varies So Much

If you live in a cookie-cutter subdivision in the suburbs of Phoenix, your Zestimate is likely very accurate. Why? Because there are 500 houses just like yours within a three-mile radius. The algorithm has plenty of "clean" data to work with.

👉 See also: Sleeping With Your Neighbor: Why It Is More Complicated Than You Think

But try using it for a 100-year-old farmhouse in rural Vermont. Or a custom-built modern home in a neighborhood of Victorian fixer-uppers. The algorithm chokes.

Zillow is surprisingly transparent about this. They publish their "Median Error" rates for major metropolitan areas. In some cities, the error rate for on-market homes is as low as 2%. For off-market homes? It can jump to 7% or higher. On a $500,000 house, a 7% error is $35,000. That’s not pocket change; that’s the cost of a brand-new SUV or a full kitchen remodel.

The "Zestimate" is a moving target. It changes as more data becomes available, which is why your home value might jump $5,000 on a Tuesday for no apparent reason. Usually, that’s just the algorithm absorbing a nearby sale that finally hit the public record.

The Human Element That Computers Miss

Computers are great at counting bedrooms. They suck at feeling "vibes."

A Zestimate doesn't know if your neighbor has three rusted-out cars on their lawn. It doesn't know that your house smells like fresh-baked cookies or that the street gets incredibly loud during the afternoon school rush. It can't tell the difference between "high-end luxury vinyl plank" and "cheap plastic flooring" unless the listing description is very specific.

This is why real estate agents still exist. An agent performs a Comparative Market Analysis (CMA). They walk the neighborhood. They know that houses on the north side of the tracks sell for 10% more than the south side, even if the ZIP code is the same. Zillow’s algorithm is getting better at this "neighborhood boundary" logic, but it’s still not a local expert.

The Infamous Zillow Offers Disaster

You can't talk about the Zillow Zestimate home valuation without mentioning the time Zillow bet the house on its own math—and lost.

✨ Don't miss: At Home French Manicure: Why Yours Looks Cheap and How to Fix It

In 2021, Zillow shut down its "Zillow Offers" business. This was their iBuying arm where they used the Zestimate to buy houses directly from people. They thought their algorithm was so good they could predict future prices and flip homes for a profit.

They were wrong.

The algorithm overpaid for thousands of homes because it couldn't accurately predict the cooling market. Zillow ended up laying off 25% of its workforce and selling off its inventory at a massive loss. It was a humbling moment for Big Data. If the company that built the Zestimate couldn't use it to turn a profit, why should you treat it as gospel for your own financial planning?

How to Actually Use Your Zestimate

Don't ignore the Zestimate, but don't obsess over it. It’s a tool, like a weather app. It tells you if it’s "generally" sunny or rainy, but it doesn't tell you if a bird is going to poop on your head the moment you walk outside.

If you want to make the most of it, you've got to be proactive.

- Claim your home: Go onto Zillow, verify you are the owner, and update the facts. Did you finish the basement? Add it. Did you add a third bathroom? Make sure it's there.

- Check the "Comps" yourself: Look at the "Recently Sold" filter in your area. If Zillow is comparing your house to a mansion down the street, your Zestimate is artificially high.

- Look at the range: Zillow provides a "Zestimate Range." This is often more important than the single number. If the range is huge (e.g., $450k to $550k), it means the algorithm isn't very confident.

Remember, the Zestimate is often a "trailing indicator." It tells you what happened yesterday. In a rapidly changing economy with fluctuating interest rates, yesterday’s data might as well be from a decade ago.

The Appraisal Gap Reality

When you actually find a buyer and go under contract, the bank sends out a professional appraiser. This person is the final boss of home valuation. They use strict Fannie Mae and Freddie Mac guidelines.

🔗 Read more: Popeyes Louisiana Kitchen Menu: Why You’re Probably Ordering Wrong

The appraiser doesn't care what Zillow says. If the appraisal comes in lower than the Zestimate and your contract price, you have an "appraisal gap." This is where deals go to die. The buyer either has to bring more cash to the table, or you have to lower your price.

Relying on a Zillow Zestimate home valuation to set your asking price without looking at hard appraisal data is a recipe for a "failed to close" status on your listing. It happens all the time. Sellers get anchored to that high digital number and refuse to budge, even when the market is screaming that it's too high.

Taking Action: Your Next Steps

If you are seriously thinking about moving in the next six months, stop staring at the Zestimate. It’s distracting.

Instead, start by looking at the "Days on Market" for homes in your specific neighborhood. If houses are sitting for 40 days but the Zestimate says the value is climbing, the Zestimate is wrong. Data lags. Reality doesn't.

Get a professional's eyes on your property. Most real estate agents will provide a CMA for free because they want your listing. Compare that CMA to the Zestimate. If there’s a gap of more than 5%, ask the agent why. They might point out that your "view" is actually a view of a power line, or that your lack of a garage is a massive dealbreaker that the algorithm is under-weighting.

Finally, check your tax assessment. In many states, the assessed value for taxes is wildly different from the market value. If your Zestimate is way higher than your tax assessment, you’re winning on equity but might be in for a surprise when the county reassesses.

The Zestimate is a conversation starter, not the final word. Use it to get a ballpark idea, then do the real legwork to find out what your home is actually worth in the current market.

Verify your home facts on the Zillow dashboard to ensure the algorithm has the most accurate data possible. Once you’ve updated your square footage and features, wait 48 hours to see how the Zestimate reacts. This is the simplest way to "nudge" the algorithm toward accuracy before you ever talk to a realtor or an appraiser. Check the "Nearby Similar Homes" section on your property page to see exactly which houses Zillow is using to calculate your value; if those houses don't actually compare to yours, you know the valuation is skewed.