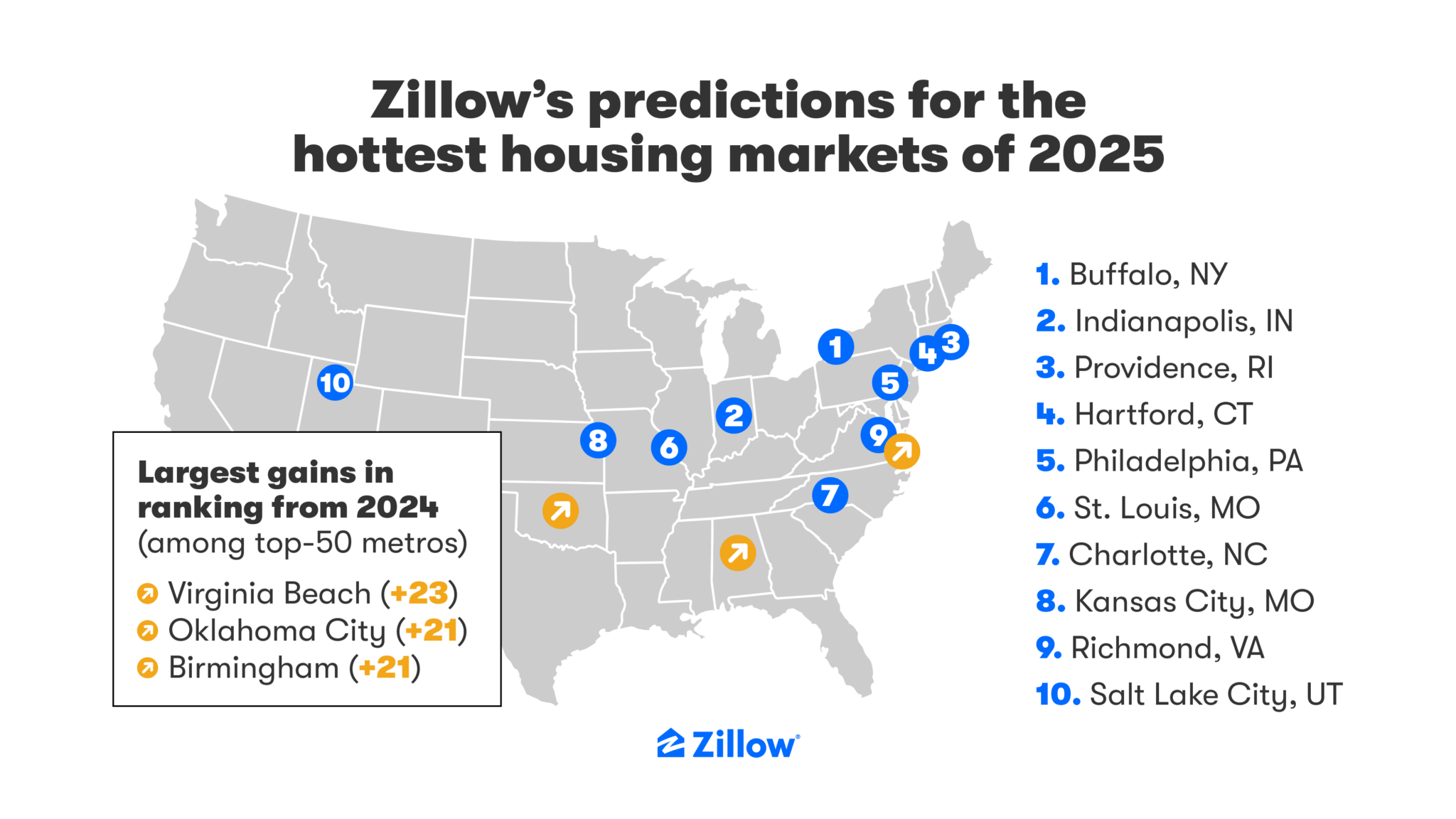

You’ve seen the headlines. Real estate in America feels like a weird game of musical chairs where the music never actually stops. It’s exhausting. But if you’re looking at Zillow hottest markets 2025, the data tells a story that isn't just about high interest rates or the "locked-in" effect of 3% mortgages.

Honestly, it’s about a massive migration toward places most people used to overlook.

Buffalo is back at the top. Again. For the second year in a row, Zillow crowned Buffalo, New York, as the number one market to watch. It sounds wild if you only associate the city with lake-effect snow and wings, but the numbers don't lie. In a world where a starter home in California costs a million dollars, a city where you can find a solid house for $260,000 becomes a magnet.

Why the Zillow Hottest Markets 2025 are Moving Inland

The "Heat Index" Zillow uses isn't just about price. They look at job growth, how fast homes are flying off the shelves, and—this is the big one—how many new jobs are being created compared to how many homes are actually being built.

💡 You might also like: Why the Delaware River Port Authority Actually Runs Your Commute (and Your Wallet)

In Buffalo, builders basically can't keep up. The city has seen a nearly 50% drop in inventory since the pre-pandemic days. When you have two new jobs being created for every one home permit issued, you get a pressure cooker.

The Top 5 Standouts

- Buffalo, NY: Expecting a 2.8% value jump this year.

- Indianapolis, IN: The only top-five city where price growth is actually accelerating.

- Providence, RI: People are fleeing Boston’s prices and landing here.

- Hartford, CT: Saw the highest home value growth in the country recently, hitting 4.2% to 4.6%.

- Philadelphia, PA: The "affordable" giant of the Northeast.

It’s a Rust Belt renaissance, kinda.

Investors are pivoting. First-time buyers are finally saying "enough" to the Sun Belt’s skyrocketing costs and looking toward the Great Lakes and the Northeast. Even if the national market feels flat, these specific pockets are simmering.

The Hartford Surge and the Death of "Cheap"

Hartford is the sleeper hit of the Zillow hottest markets 2025 list. For a long time, it was just a place people drove through on the way to New York or Boston. Not anymore.

Inventory in Hartford is down a staggering 68% compared to 2018. Think about that. For every three homes that used to be for sale, there is now only one. This scarcity pushed Hartford to lead the pack in price appreciation, and Zillow's economists, including Skylar Olsen, note that competition here is among the fiercest in the nation.

It’s not just about the price tag; it's about the "BuyAbility." That’s a term Zillow uses to describe how much house you can actually get for your paycheck. In places like Charlotte (No. 7) and Kansas City (No. 8), the math still works for middle-class families. Barely.

Regional Shifts You Need to Know

The West is basically on ice. San Francisco, San Jose, and Portland are sitting at the very bottom of the list. Why? Because the "sticker shock" has finally hit a ceiling. When a mortgage payment on a median home takes up 40% of your gross income, the market stalls.

✨ Don't miss: How Many Pounds Is One Dollar Right Now? Why the Rate Keeps Moving

Salt Lake City managed to claw its way back to No. 10 this year, the only Western city in the top ten. It’s got that rare mix of tech jobs and a (relatively) younger population that still wants to own.

What This Means for Your Wallet

If you’re looking to buy in one of these "hot" zones, brace yourself. These aren't the kind of markets where you can lowball a seller and ask for a new roof. In Hartford and Buffalo, more than 60% of homes are selling above the asking price.

Wait, what about mortgage rates?

They are the "unpredictable" variable. Most experts, including those at Zillow, expect rates to hover around 6% throughout 2026. We’ve moved past the "shock" phase of high rates, and people are starting to accept this as the new normal.

Actionable Steps for 2025 Buyers

- Get a "BuyAbility" Check: Don't just look at the Zestimate. Use tools that factor in current 2026 mortgage rates to see your real monthly outflow.

- Look for "Inventory Creep": In the Sun Belt (like Austin or Phoenix), inventory is actually rising. If you want a deal, look where the market is cooling, not where it’s "hot."

- Focus on Jobs-to-Permits: If you're an investor, look for cities where job growth is 2x the rate of new construction. That’s the secret sauce for long-term appreciation.

- Ignore the "National" Average: Real estate is hyper-local. The national market might be "flat," but if you're in Providence, you're still in a bidding war.

The 2025 landscape is for the patient and the picky. The days of "buy anything and it will double in price" are over. Now, it’s about finding value in the cities that the rest of the world is finally starting to notice.

📖 Related: Why 72 Cummings Point Road in Stamford is the Weirdest Office Space Success Story

Next Steps for You: Start by researching the "Jobs-to-Permit" ratio in your specific target zip code. This data is usually available through local municipal planning websites or Zillow’s research database. If the ratio is above 1.5, expect prices to remain sticky regardless of what the national news says.