Succession isn't just a HBO show. It’s a messy, high-stakes reality for the world's biggest families. People obsess over the firstborns, the anointed princes and princesses groomed since birth to sit in the big leather chair. But if you look at the data of modern dynastic shifts, it’s the youngest son of a conglomerate who often ends up being the most disruptive force in the boardroom.

They are the wild cards.

Growing up as the youngest in a massive business empire like Samsung, Hyundai, or even a Western titan like the Murdochs means living in a permanent shadow. You aren't the heir. You're the backup. This lack of immediate pressure creates a very specific kind of psychology that either leads to spectacular burnout or aggressive, revolutionary innovation.

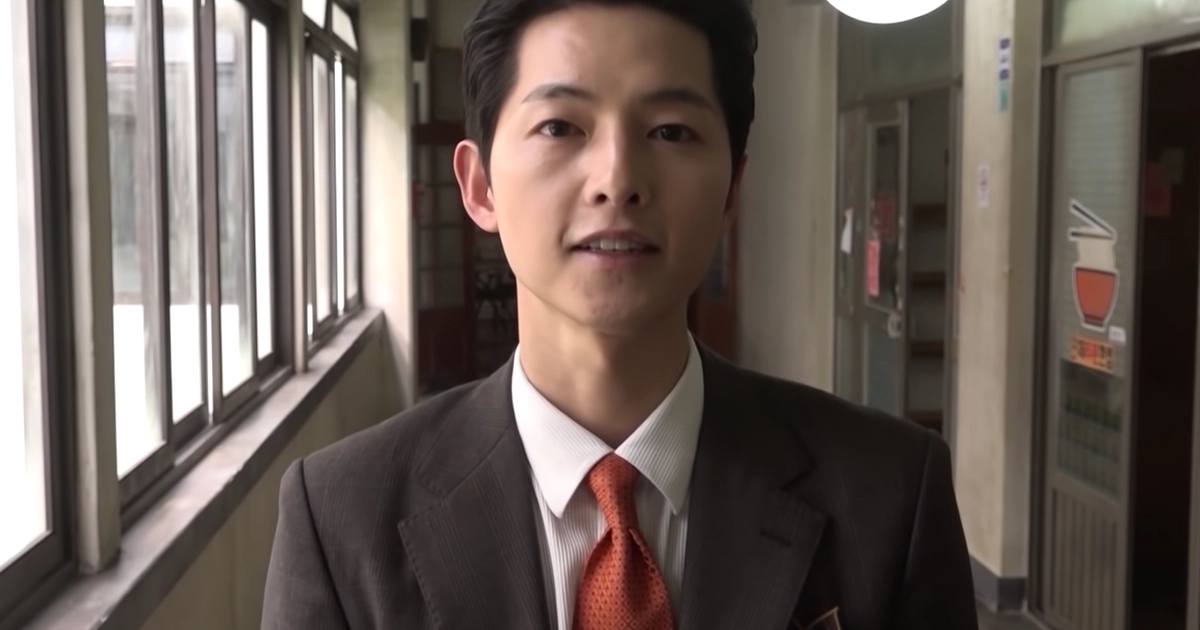

Why the Youngest Son of a Conglomerate Often Wins

In traditional Confucian-influenced business cultures, like those in South Korea (where the term chaebol dominates), primogeniture used to be the law of the land. The oldest son got the crown. Everyone else got the scraps. But that’s dying.

Look at the history of the Lotte Group or even the fractured branches of the Hyundai family. When the "spare" knows they won't inherit the core business by default, they go out and build something new. They take risks the oldest brother won't touch because the oldest brother is busy trying not to break what already exists.

Innovation is born from being overlooked.

It’s about the freedom to fail. If the eldest son of a conglomerate messes up a $500 million acquisition, it’s a national scandal. If the youngest son loses $50 million on a tech startup, the family calls it "expensive tuition." This safety net, combined with a chip on the shoulder, creates a "nothing to lose" mentality that is incredibly dangerous for competitors.

🔗 Read more: Is The Housing Market About To Crash? What Most People Get Wrong

The Pivot from Tradition to Tech

We're seeing a massive shift in how these younger siblings operate. They aren't staying in heavy industry. You won't find many third or fourth-generation younger sons clamoring to run a shipping yard or a steel mill. They want VC. They want AI. They want the stuff that makes their fathers look old-fashioned.

Take a look at the Lee family of Samsung. While the leadership structure is incredibly rigid, the various branches and younger descendants have consistently pivoted into fashion, luxury retail, and entertainment. They are diversifying the family’s risk without even trying.

It’s kinda fascinating how this plays out in the real world. You have these individuals who are "royal" by blood but "scrappy" by circumstance. They use the family name to open doors, sure. But once they are in the room, they are often pushing for digital transformation that the older generation finds terrifying.

The Psychology of the Spare

There’s a real psychological weight to being the youngest son of a conglomerate. Dr. Kevin Leman, a psychologist known for his work on birth order, often points out that youngest children are frequently the most outgoing and risk-oriented. In a business context, this translates to "The Disruptor."

They don't have the "protector" instinct of the firstborn.

Instead, they have the "performer" instinct. They want to prove they are just as capable as the one who was handed the keys. This drives them to outwork, outmaneuver, and out-invest their siblings. Sometimes it leads to family feuds that last decades. Other times, it leads to the conglomerate expanding into markets they never would have touched otherwise, like K-Pop or global e-commerce.

💡 You might also like: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

Real-World Power Moves and Pitfalls

It’s not all private jets and easy wins. The youngest son of a conglomerate often faces immense pushback from the "Old Guard"—the VPs and advisors who have been with the father for thirty years. To these veterans, the youngest son is a kid with a hobby.

- The Startup Route: Many youngest sons are now given a "seed fund" by the conglomerate to start their own subsidiary. This keeps them in the family fold while letting them play CEO.

- The International Outpost: Sometimes they are sent to manage the US or European operations. It’s basically exile, but with a gold-plated budget.

- The Silent Investor: Some choose to stay out of the limelight entirely, using family wealth to become power brokers in the private equity world.

Consider the case of the Shin family (Lotte). The battle between the sons was legendary and ended with the younger son, Shin Dong-bin, eventually taking the reins after a brutal public struggle. It proved that birth order is no longer a guarantee of power. The more agile, more modern-thinking sibling can—and will—take over if the eldest fails to adapt.

Navigating the Family Office

For the youngest, the Family Office is often the primary point of contact. This is the entity that manages the family’s private wealth outside of the public company. Honestly, it’s where the real power often lies. While the eldest is stuck dealing with shareholders and quarterly earnings, the youngest might be directing the family’s private billions into decarbonization startups or longevity research.

They are building the future of the family's wealth while the older brother is maintaining the past.

The Strategy for Modern Successors

If you are looking at this from a business analysis perspective, you have to stop ignoring the younger siblings. They are the ones spearheading M&A (Mergers and Acquisitions). They are the ones who understand that a conglomerate can't survive on 20th-century manufacturing alone.

They bridge the gap.

📖 Related: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

They speak the language of the board and the language of Silicon Valley. That’s a rare skill set. While the "Crown Prince" is learning how to navigate government relations and tax law, the youngest son is at Slush or South by Southwest, spotting the next trend that will keep the family relevant for another fifty years.

The Actionable Reality of the Conglomerate Heir

Understanding the role of the youngest son of a conglomerate isn't just for gossip columns. It’s for investors and partners. If you want to know where a massive company is going next, don't look at what the CEO says in the annual report. Look at what the youngest son is doing with his private investment vehicle.

- Monitor the "Leisure" Divisions: Often, the youngest is put in charge of hospitality, food and beverage, or retail. These are high-data businesses that provide a playground for testing new consumer tech.

- Track the Board Seats: When a younger sibling gets a seat on the board of a tech partner, it’s a sign that a major strategic pivot is coming.

- Watch the Education: Younger sons are increasingly skipping the traditional "safe" MBAs and going for specialized degrees in engineering or data science.

The youngest son isn't just the spare anymore. In many ways, he’s the scout. He’s the one out on the frontier, finding the new land before the main army—the conglomerate—moves in to occupy it. The dynamic has shifted from "who is first in line" to "who is most indispensable in a changing market."

To truly understand a conglomerate’s future, you have to look at the one who wasn't supposed to lead. They are usually the ones who actually will.

Key Takeaways for Navigating Dynastic Business

- Identify the "Innovation Branch": Almost every major conglomerate now has a younger-son-led venture arm. This is where the real growth happens.

- Ignore the "Spare" Label: In the 2026 economy, agility beats seniority. The younger sibling's lack of baggage is their greatest asset.

- Follow the Philanthropy: Younger heirs are using ESG and "impact investing" to build a brand that is separate from—and often more popular than—the core family business.

- Watch for Friction: If you see the youngest son starting a competing or "adjacent" business, it’s a signal of a coming succession battle or a massive strategic split.

- Leverage the Networks: Younger sons often have better ties to global startups and international finance than their older, more "traditional" counterparts.

Succession is no longer a straight line. It's a web. And the youngest son of a conglomerate is often the one spinning the most interesting parts of it.