You’d think checks were dead. Between Apple Pay, Venmo, and those tapping credit cards that feel like magic, the idea of carrying a paper book and a ballpoint pen feels ancient. Like using a rotary phone. But then you move into a new apartment with a landlord who only takes "paper," or you have to pay a contractor who looks at your phone like it’s an alien artifact when you mention Zelle. Suddenly, you’re staring at a blank piece of paper, sweating because you don't want to mess up a $2,000 payment.

Honestly, looking at a filled out check sample for the first time in years can be a bit of a reality check. It’s one of those basic adulting skills that nobody actually teaches you in school because they assume your parents did it, or that technology would have killed it off by now. It hasn't. According to the Federal Reserve’s 2023 Diary of Consumer Payment Choice, while check use is declining, they are still used for large-value payments like rent and government remittances. You can't just wing it. If you mess up the decimal point or the "legal line," that check is getting bounced faster than a rubber ball, and your bank might hit you with a $35 fee just for the headache.

Anatomy of a Perfect Transaction

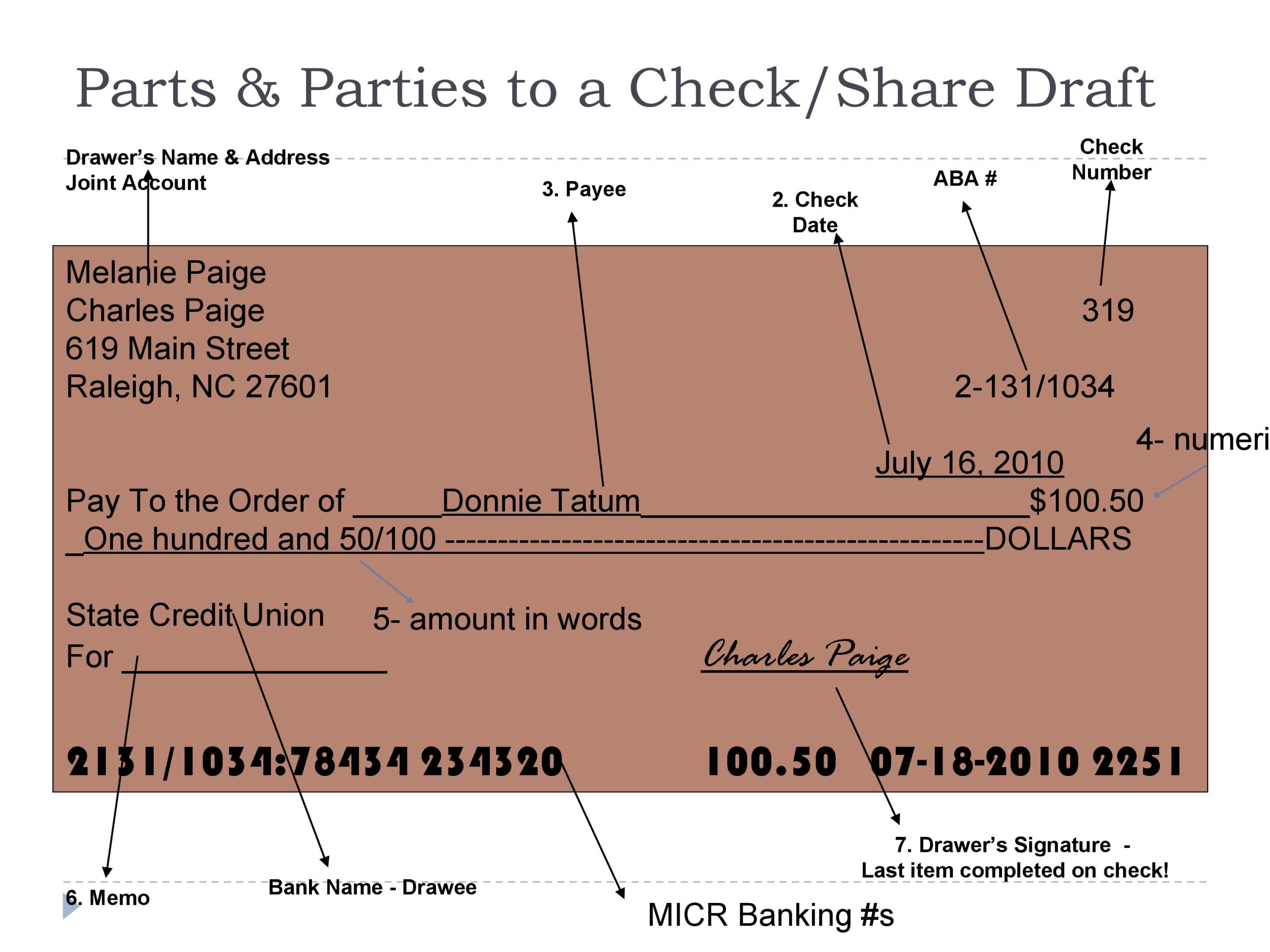

Let's break down what a properly filled out check sample actually looks like. It isn't just about putting numbers in boxes. There is a specific logic to why the lines are there.

First, the date. Top right corner. Don't overthink it, but don't "post-date" it unless you’ve cleared it with the person you’re paying. Banks aren't legally required to wait until the date on the check to process it. If you write a check today but date it for next Friday, the person can still try to cash it, and if the money isn't there, you're the one in trouble.

Then there is the "Pay to the Order of" line. This is arguably the most important part. Write the name of the person or business exactly as they told you. If you’re paying "Smyth & Sons" but write "Smith and Sons," a picky bank teller might reject it.

The Number Box vs. The Written Line

This is where people trip up. There are two places to put the amount. You’ve got the little box with the dollar sign next to it ($) and the long line underneath the recipient's name.

Here is the golden rule: The words win. If you write "100.00" in the box but write "One Thousand Dollars" on the line, the bank is legally supposed to honor the written words. It’s called the "words prevail" rule under the Uniform Commercial Code (UCC) Section 3-114. Why? Because it’s harder to accidentally write out "One Hundred Twenty-Four" than it is to slip an extra zero into a numeric box.

When you’re looking at a filled out check sample, notice how the writer usually draws a line from the end of the words all the way to the word "Dollars" printed on the check. Do that. It prevents some scammer from grabbing your check and turning "One Hundred" into "One Hundred and Ninety." It sounds paranoid until it happens to you.

Why Security Features on Checks Actually Matter

You might notice tiny, almost invisible print on your checks. That’s not a printing error. It’s "Microprint." If someone tries to photocopy your check, those tiny words will blur into a solid line, alerting the bank that it's a fake.

There's also the MICR line at the bottom. That's the weird, blocky numbers.

- The first set is your Routing Number. This identifies your bank.

- The second set is your Account Number. This is you.

- The third set is the Check Number. This helps you keep track in your ledger.

If you ever see a filled out check sample where these numbers look "flat" or don't have that specific magnetic ink texture, it's a red flag for fraud. Modern banking relies on these numbers being read by high-speed scanners. If you smudge them with a leaking pen, your check might have to be processed manually, which slows everything down.

Common Mistakes That Make You Look Like an Amateur

Don't use a pencil. Just don't. It seems obvious, but people do it. Use a blue or black pen. Gel pens are actually great because the ink soaks into the paper fibers, making it much harder for someone to "wash" the check—a process where criminals use chemicals to erase your writing and rewrite the amount.

Also, the memo line. It’s optional, but use it. If you’re paying rent, write "January 2026 Rent." If you’re paying a friend back for a trip, write "Vegas Trip." It’s your paper trail. If there’s ever a legal dispute, that memo line is your best friend in a courtroom.

Signing the Back: The "Endorsement" Trap

I’ve seen people sign the back of the check before they even leave their house to go to the bank. Don't do that. Once a check is signed on the back, it’s basically "payable to bearer." That means if you drop it on the sidewalk, anyone who picks it up can technically cash it.

Wait until you are at the teller window or about to take a photo for mobile deposit. If you're doing a mobile deposit, most banks now require you to write "For Mobile Deposit Only" under your signature. If you forget that, the app will keep rejecting your photo and you'll be stuck wondering why the technology hates you.

👉 See also: The 4 Hour Work Week: Why Tim Ferriss’s Blueprint is Still Breaking Brains Two Decades Later

Is the Personal Check Dying?

Sorta. But not really.

Business-to-business (B2B) payments still rely heavily on checks. According to a survey by the Association for Financial Professionals, about 33% of B2B payments in North America are still made via paper check. It’s about the "float." Sometimes businesses like that it takes two days for the money to leave their account.

And let's talk about the "voided check." Even if you never plan on writing a check in your life, your employer will probably ask for a filled out check sample marked "VOID" across the front so they can set up your direct deposit. They need those MICR numbers we talked about. Without a physical check to look at, you’re stuck hunting through your banking app for a PDF that contains the same info.

Practical Steps for Your Next Payment

If you have to sit down and write one today, follow this workflow:

📖 Related: Is NSLS a Scam? What Most People Get Wrong About This Society

- Check your balance first. Seriously. With "real-time" banking, that check might hit your account faster than you think.

- Use a permanent pen. No pencils, no "erasable" ink.

- Start at the far left. When writing the amount in words, don't leave a gap. Start right at the edge of the line.

- The "And" is for Cents. Technically, you should write "One Hundred Twenty-Five and 50/100." The word "and" is the separator for the decimal. Don't write "One Hundred and Twenty-Five."

- Keep a record. Whether it’s the carbon copy behind the check or a digital note, record who you paid and why.

Writing a check feels like a relic of a different era, but it’s a legal document. Treat it with a bit of respect, follow the layout of a standard filled out check sample, and you’ll avoid the headaches of bounced payments and bank fees. If you're out of checks, most banks will print you a few "counter checks" on the spot for a small fee, which is a lifesaver when you're in a pinch and your landlord is knocking on the door.

Next time you open that checkbook, remember that the "legal line" (the one with the words) is the ultimate authority. Keep your handwriting clear, your ink dark, and your signature consistent with what the bank has on file. It's a simple process, but getting the details right is what keeps your money moving where it needs to go without the drama.