You're standing at the counter or sitting at your desk, pen in hand, and suddenly that tiny rectangular slip of paper looks like a foreign language exam. It happens. You need to know how to write 1200 in a check without it getting bounced or, worse, altered by someone with a wandering eye and a black gel pen. It seems simple enough until you realize there are actually two "correct" ways to say the number out loud, but only one way that bank tellers and automated clearing houses really prefer to see on the legal line.

Let's be real. Most of us venmo or Zelle our way through life now. But when the landlord demands a physical document or you’re closing on a car, the pressure is on.

One thousand two hundred? Twelve hundred?

Honestly, the bank doesn’t care about your grammar, but they care immensely about clarity. If that handwritten line doesn't match the little box on the right, you've got a problem. A big one.

The Correct Way to Write 1200 on the Legal Line

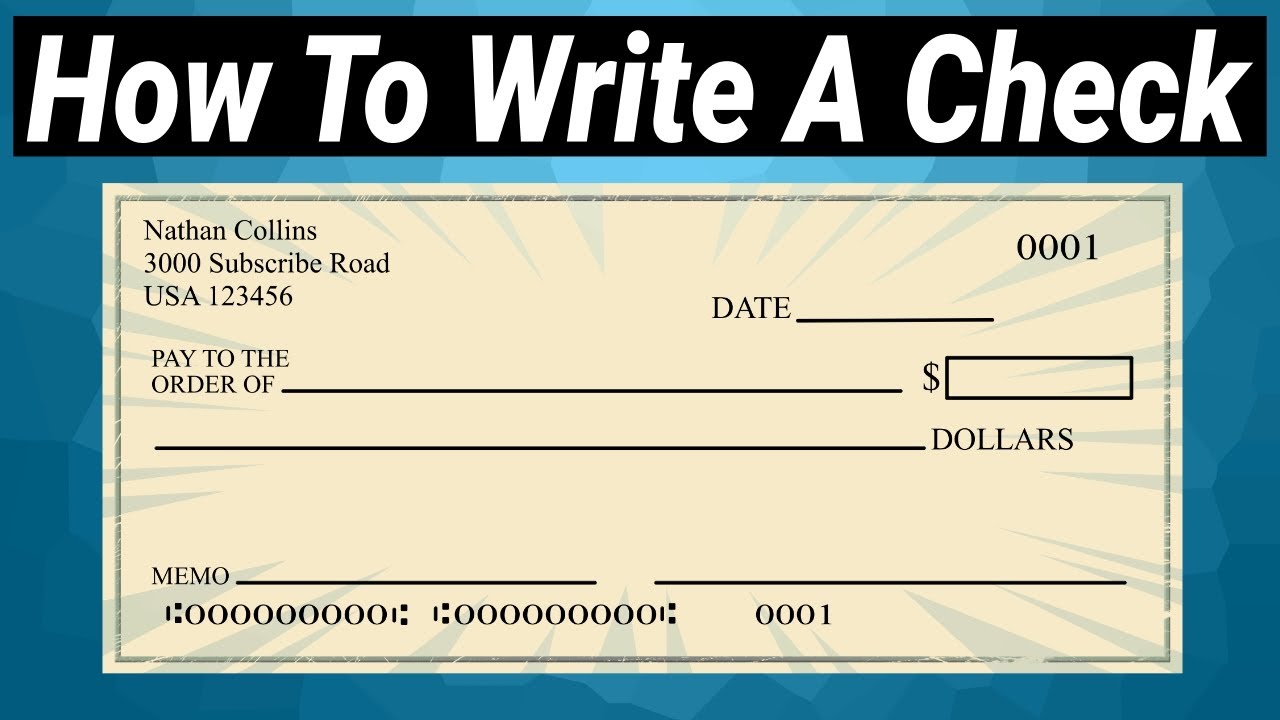

The "legal line" is that long blank space ending with the word "Dollars." This is the most important part of the check. Why? Because according to the Uniform Commercial Code (UCC) Section 3-114, if the numbers in the box and the words on the line don’t match, the words win. The words are the legal obligation.

To write $1,200.00, you should write: One thousand two hundred and 00/100.

Some people prefer writing "Twelve hundred and 00/100." Is it wrong? Not technically. Banks will usually process it. However, "One thousand two hundred" is the gold standard for formal financial transactions. It’s harder to misinterpret. It’s professional. It makes you look like you actually have a savings account.

Why the "and" matters (and where it goes)

Here is a mistake that drives accountants crazy: putting the word "and" in the middle of the number.

You should never write "One thousand and two hundred." In the world of mathematics and banking, the word and is a separator. It specifically indicates the decimal point. If you say "one thousand and two hundred," a literalist might think you mean two separate amounts.

Always keep "and" for the cents.

If there are no cents, you still need that "and 00/100" at the end. It closes the door. It tells the bank—and any potential fraudsters—that the amount is exactly 1,200 and not a penny more.

Filling Out the Box: The Numerical Version

The little box on the right side of the check is where you put the digits. You’d think this is the easy part, but people mess it up constantly.

Write 1,200.00.

Don't just write 1200. Use the comma. Use the decimal. Use the zeros.

Start your numbers as far to the left of the box as possible. This is a classic security move. If you leave a gap before the "1," a dishonest person could easily squeeze a "9" in there, and suddenly you’re out nine thousand dollars. It sounds like something out of a cheesy 90s movie, but it still happens.

A Quick Checklist for $1,200 Checks

- Date: Use today's date. Post-dating (writing a future date) is a gamble because many banks' automated systems just ignore the date anyway.

- Payee: Write the name of the person or company clearly. No nicknames.

- The Box: 1,200.00 (Snug against the left edge).

- The Legal Line: One thousand two hundred and 00/100.

- The Memo: Entirely optional, but great for your own records. "January Rent" or "Payment for Services."

- Signature: This must match the signature the bank has on file. If you’ve changed your name or your handwriting has devolved into a scribble since you opened the account at age 16, keep that in mind.

Dealing with Cents

What if you aren't writing a check for exactly 1,200? What if it's $1,200.75?

The process is basically the same, but the fraction changes. You would write: One thousand two hundred and 75/100.

The fraction is a visual cue. It’s much harder to misread "75/100" than it is to misread ".75" scrawled in messy handwriting.

Drawing the Line

After you finish writing "00/100," draw a solid line through the rest of the empty space over to the word "Dollars."

This is not just a stylistic choice. It's a security feature. It prevents anyone from adding extra words to the end of your amount. It’s a small habit that saves massive headaches.

Common Mistakes to Avoid

People get nervous. They overthink.

Don't write "Twelve hundred" if you are worried about the recipient being confused. While "Twelve hundred" is common in speech, "One thousand two hundred" is the standard for banking.

Also, watch your handwriting. If your "o" looks like an "a," you might have issues. If your "1" looks like a "7," you’re asking for a phone call from your bank's fraud department.

If you do mess up? Don't try to scribble it out. Don't use white-out. Banks hate white-out. It looks suspicious. If you make a mistake, write VOID in large letters across the check and start over with a new one. It’s worth the twenty cents for a fresh check to ensure the transaction goes through smoothly.

Security Basics in 2026

We live in an era of high-tech fraud, but old-school check washing is still a thing. Criminals use chemicals to erase your ink and rewrite the amount.

To prevent this, use a Gel Pen.

📖 Related: Dove Unscented Body Wash: Why Your Sensitive Skin Still Loves It

Standard ballpoint ink sits on top of the paper fibers and can be easily washed off. Gel ink (specifically black pigment ink like a Uni-ball Signo or a Pilot G2) actually soaks into the fibers of the paper. It makes it nearly impossible to "wash" the check without destroying the paper itself.

It’s a five-dollar investment that protects your 1,200 dollars.

Why are we still doing this?

You might wonder why we are even talking about how to write 1200 in a check in a world of crypto and instant transfers.

The reality is that checks provide a paper trail that digital apps sometimes lack. For large payments, like a security deposit or a down payment, a canceled check serves as legal proof of payment in a way a screenshot of an app might not. It’s a formal record.

Also, some small businesses still prefer them because they don't want to pay the 3% processing fees associated with credit cards or business apps.

Actionable Next Steps

- Check your ink: Grab a black gel pen for all future check writing to prevent fraud.

- Verify the recipient: Always confirm exactly who the check should be made out to—some businesses have "Doing Business As" (DBA) names that differ from their legal entity.

- Balance your ledger: Immediately record the $1,200 in your checkbook or banking app. Don't wait for it to clear, as some people hold onto checks for weeks before depositing them.

- Draw the line: Get in the habit of drawing that straight line from your fraction (00/100) to the end of the legal line to prevent unauthorized additions.

- Store safely: Keep your checkbook in a secure location, not in your car or an unlocked desk drawer.

Writing a check for a large amount like 1,200 doesn't have to be stressful. By sticking to the "One thousand two hundred and 00/100" format and using a few basic security tricks, you ensure your money goes exactly where it's supposed to without any delays or drama. Keep it clean, keep it clear, and always use the legal line as your primary focus.