If you’ve checked your bank account lately and felt a little light, don’t look at the world’s billionaires latest publication. Seriously. It’s a bloodbath for the middle class but a total rocket ship for the guys at the very top. We aren't just talking about "rich" anymore. We are talking about a wealth gap so wide you could fit the entire planet's problems inside it and still have room for a few more private islands.

Honestly, the numbers coming out of the early 2026 reports, including the updated data from Forbes and the Bloomberg Billionaires Index, are kind of hard to swallow. Elon Musk isn't just winning; he's playing a completely different game. While most people were worried about inflation, Musk’s net worth blasted past the $700 billion mark in late 2025. By January 2026, some trackers have him sitting as high as $779 billion.

It’s wild.

He’s basically on track to be the world’s first trillionaire, and it’s not just because of cars. It’s AI. It’s robots. It’s a massive web of companies like SpaceX and xAI that are currently eating the world.

What the World’s Billionaires Latest Publication Actually Tells Us

So, what’s the big takeaway? Basically, if you aren't in tech, you're falling behind. The world’s billionaires latest publication shows a massive shift where the "old money" of luxury and retail is getting lapped by Silicon Valley’s AI gold rush.

Take Larry Page. Most people forget about the Google co-founder because he stays so quiet, but he’s now the second richest person on the planet. He added over $100 billion to his pile in a single year. How? Alphabet’s Gemini 3 AI model. Every time Google mentions "AI" on an earnings call, his net worth jumps by the size of a small country's GDP.

The Top 10 Shakedown (January 2026 Estimates)

- Elon Musk: ~$726B – $779B (Tesla, SpaceX, xAI)

- Larry Page: ~$270B – $284B (Alphabet/Google)

- Jeff Bezos: ~$255B – $268B (Amazon, Blue Origin)

- Sergey Brin: ~$251B – $264B (Alphabet/Google)

- Larry Ellison: ~$245B – $255B (Oracle)

- Mark Zuckerberg: ~$223B – $236B (Meta)

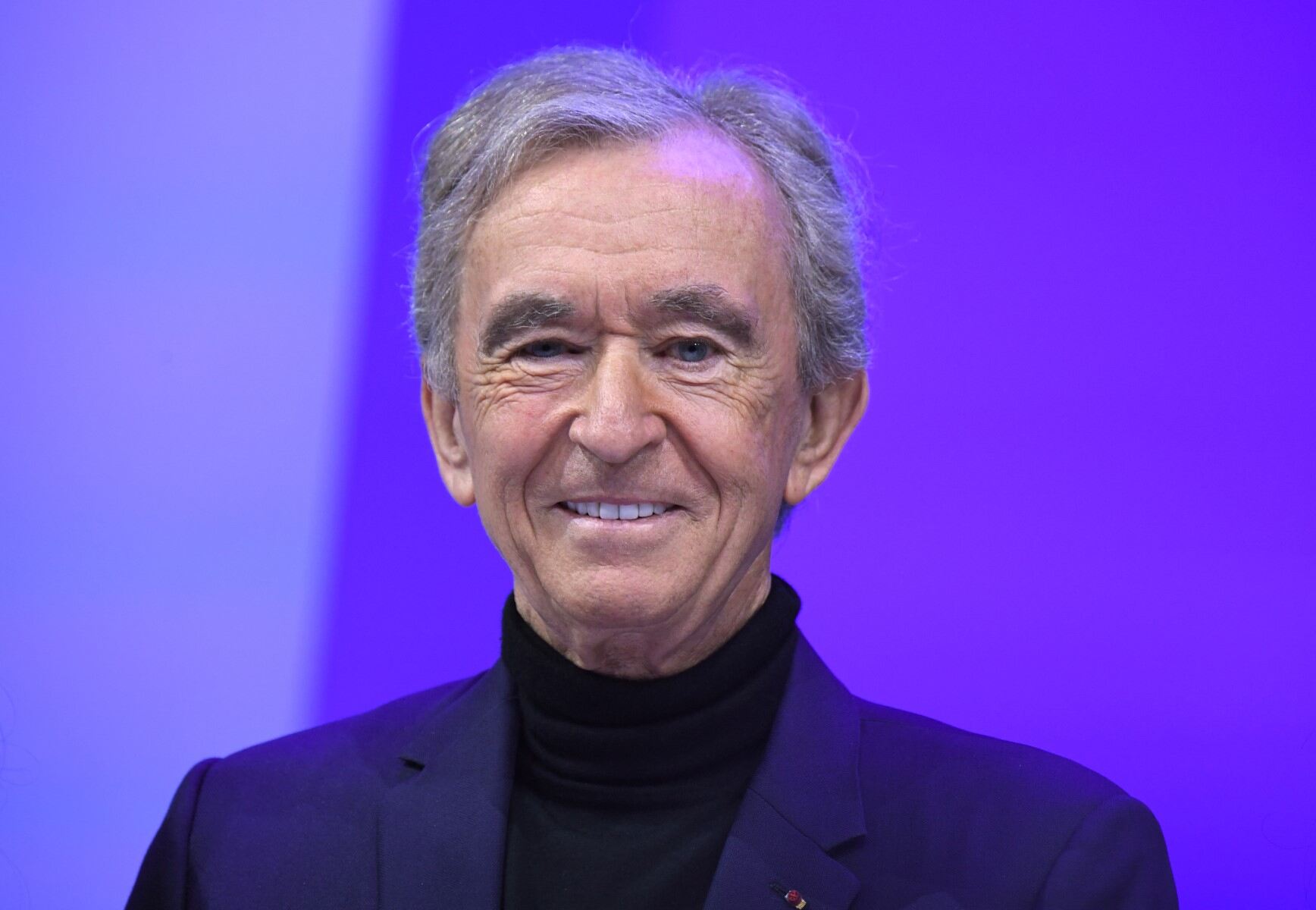

- Bernard Arnault: ~$191B – $207B (LVMH)

- Steve Ballmer: ~$164B – $171B (Microsoft)

- Jensen Huang: ~$154B – $163B (Nvidia)

- Warren Buffett: ~$146B – $154B (Berkshire Hathaway)

Notice something? Bernard Arnault, the king of French luxury, used to trade the #1 spot with Musk. Now? He’s been bumped down to 7th. People aren't buying $3,000 handbags as much as they are betting on the chips that power ChatGPT.

✨ Don't miss: Tangible Net Worth Calculation: What Most People Get Wrong

The AI Bubble or the AI Reality?

There’s a lot of talk about whether this is a bubble. It feels like 1999 all over again. But then you look at Nvidia. Jensen Huang’s company became the first to hit a $5 trillion valuation in late 2025. That’s not just hype; it’s because every single tech company is desperate for his chips.

The world’s billionaires latest publication highlights that 8 out of the top 10 richest people are tech founders. Only Arnault (Luxury) and Buffett (Finance) represent the "traditional" industries. It’s a tech monoculture at the top.

Why the Rich Keep Getting Richer

It’s not just hard work. It’s the way the system is currently wired.

- Stock Options: Most of these guys don't take a "salary." They own massive chunks of their companies. When the stock goes up 50%, their wealth goes up billions.

- AI Integration: Amazon’s Jeff Bezos added billions after a massive cloud deal with OpenAI.

- Government Contracts: SpaceX is now essentially the primary transport for the US government into space, with billions in signed contracts.

The "Wealth Shock" of 2026

The World Inequality Report 2026 dropped some pretty grim stats alongside the billionaire rankings. It turns out that about 60,000 people (the 0.001%) now own three times more wealth than the bottom half of the entire human population. That’s 4 billion people vs. a crowd that could fit into a football stadium.

🔗 Read more: Adams Diversified Equity Fund: What You’re Probably Missing About This 1929 Survivor

It’s a stark contrast.

The world’s billionaires latest publication isn't just a list of winners; it's a map of where power is concentrating. In the US, the top 400 people now control wealth equivalent to 40% of the GDP. Back in the 80s, that number was only 2%.

What You Should Actually Watch

If you want to understand where the money is moving, don't just look at the names. Look at the sectors.

Green Energy and Rare Earths

Gina Rinehart, the Australian mining mogul, nearly tripled her wealth in 2025 because she owns the largest rare-earth portfolio outside of China. These are the minerals needed for EV batteries and tech.

The Robotaxi Pivot

Musk’s wealth didn't just climb; it exploded after Tesla removed human safety monitors from its Robotaxi service in December 2025. Investors are betting that whoever wins autonomous driving wins the next decade.

👉 See also: Rush Truck Center Houston Medium Duty: What Most Fleet Managers Get Wrong

The "EMILLI" Trend

UBS recently started tracking "Everyday Millionaires" (EMILLIs)—people with $1M to $5M. While the billionaires are grabbing the headlines, this group is also growing fast, mostly through real estate and the "great wealth transfer" as older generations pass down assets.

The Bottom Line

The world’s billionaires latest publication confirms that we are living in the age of the "Super-Entrepreneur." The days of the quiet corporate CEO are over. Today’s richest people are more like sovereign states—they have their own satellite networks (Starlink), their own intelligence tools (AI), and their own massive influence over global politics.

It’s a lot to process.

But if you’re looking for a takeaway, it’s this: technology is no longer a "sector." It is the entire economy. If you aren't positioned to benefit from AI or digital infrastructure, you're essentially standing still while the rest of the world accelerates.

Actionable Insights for the 2026 Economy

- Diversify into Infrastructure: Don't just buy the "buzzy" AI apps. Look at the companies building the data centers and power grids that AI requires.

- Watch the Rare Earth Market: As seen with Gina Rinehart, the raw materials for the future are becoming more valuable than the finished products.

- Understand the "Great Wealth Transfer": Over $80 trillion is expected to change hands over the next two decades. Position your financial planning around inheritance and horizontal transfers.

- Monitor Regulatory Risks: The 2026 reports show that governments are under pressure to close fiscal gaps. Expect new wealth tax debates in the UK and potentially the US as inequality reaches these record levels.