You’ve seen the headlines, and honestly, they're kind of a mess. One day it’s a "Trump family project" and the next it’s a "national bank contender." But if you actually dig into the on-chain data and the regulatory filings for January 2026, the reality of world liberty financial crypto holdings is way more interesting than the political shouting matches suggest.

It isn't just a pile of "Trump coins." It’s a massive, multi-billion dollar treasury that is currently trying to strong-arm its way into the federal banking system.

The Massive Whale in the Room: USD1

The absolute crown jewel of the treasury isn't even the WLFI token itself. It’s USD1.

This is their dollar-pegged stablecoin, and by early 2026, it has already cleared $3.4 billion in circulation. That is a staggering number for a project that was basically just a whitepaper a couple of years ago. Unlike some of the sketchier offshore stablecoins we’ve seen fail in the past, USD1 is fully backed by a mix of:

📖 Related: Oil Market News Today: Why Prices Are Crashing Despite Middle East Chaos

- Short-term U.S. Treasury bills.

- Cash deposits at regulated U.S. banks.

- High-quality money market funds.

What’s wild is who is holding it. Recent data shows that institutional giants like Binance are sitting on massive chunks of USD1. In fact, one single Binance-controlled address was spotted holding nearly $1.9 billion of the stuff. When the big exchanges start treating your stablecoin like a primary reserve, you’ve basically made it to the big leagues.

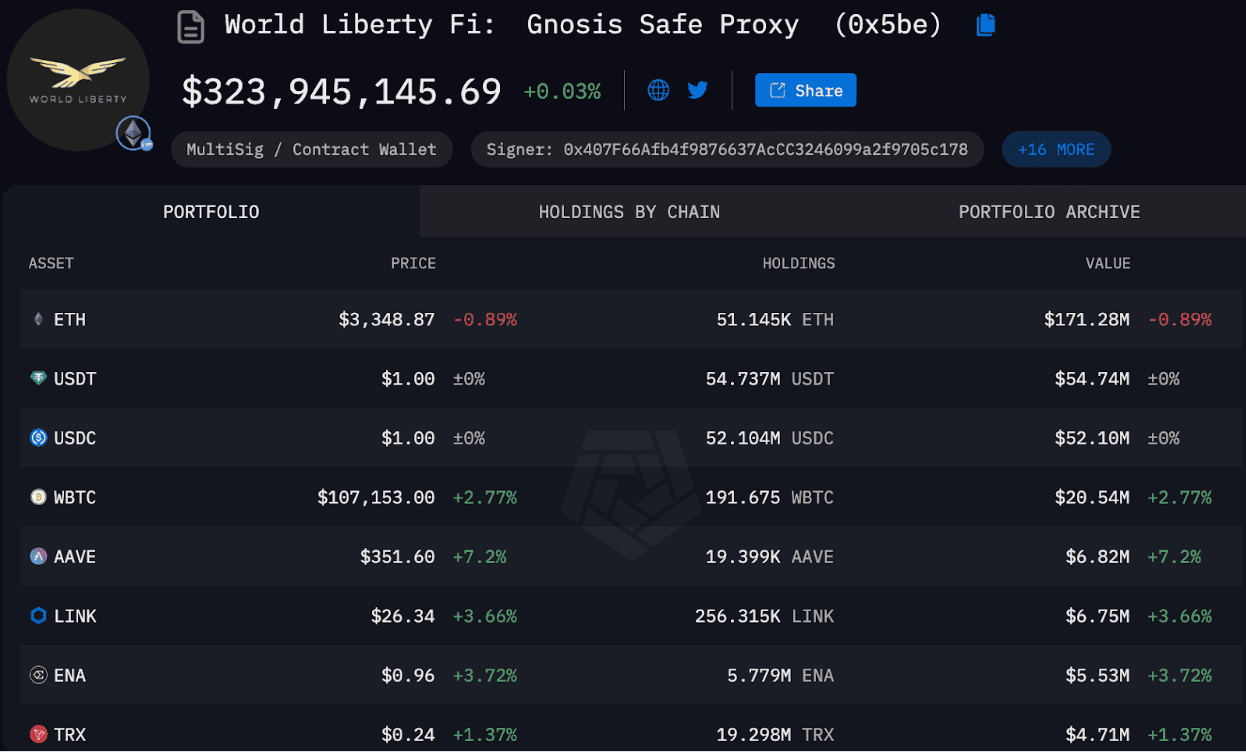

What’s Actually in the Treasury?

If you peek under the hood of their lending protocol, World Liberty Markets (which just went live on the Arbitrum-based Dolomite network), you’ll see the collateral they actually accept. This gives us a pretty clear picture of what the ecosystem considers "valuable" holdings.

Basically, they are playing it safe. They aren't holding "meme coins" or high-risk speculative junk. Instead, the protocol is built around:

👉 See also: Cuanto son 100 dolares en quetzales: Why the Bank Rate Isn't What You Actually Get

- Ether (ETH): The backbone of their DeFi operations.

- Wrapped Bitcoin (WBTC): Because you can't have a serious crypto treasury without the king.

- USD Coin (USDC) and Tether (USDT): They use these for liquidity and to maintain the 1:1 peg of their own USD1.

- WLFI Tokens: The native governance token.

Speaking of WLFI, the distribution is... well, it’s controversial. The total supply is capped at 100 billion tokens, but only about 26.7 billion are circulating right now. The rest? Mostly locked up in the treasury or held by the founding team, which includes Donald Trump Jr., Eric Trump, and Barron Trump.

The $1 Billion Profit Milestone

Here is a stat that most people miss: By December 2025, the Trump family business entity—DT Marks DeFi LLC—had reportedly profited over $1 billion from token sale proceeds and stablecoin fees. And they still hold about $3 billion worth of unsold tokens.

They aren't just holding these for fun. In January 2026, the project’s subsidiary, WLTC Holdings LLC, officially applied for a national trust bank charter with the OCC. If that gets approved, they won't just be "holding" crypto; they’ll be a federally regulated bank that can custody and issue these assets for the world’s biggest institutions.

✨ Don't miss: Dealing With the IRS San Diego CA Office Without Losing Your Mind

The Justin Sun Connection

You can't talk about these holdings without mentioning Justin Sun. The TRON founder dropped a cool $75 million into WLFI tokens in 2025 and became a key advisor. Because of this, a significant portion of the ecosystem’s liquidity now flows through the TRON network.

Critics point out that shortly after this investment, certain SEC investigations into Sun’s companies seemed to lose steam. Whether that’s a coincidence or "the art of the deal," it’s clear that the holdings are deeply intertwined with major global crypto players.

Why the "World Liberty Financial Crypto Holdings" Matter for You

If you’re looking at this from a distance, it’s easy to dismiss it as a celebrity project. Don't. The integration with Aave V3 architecture and the partnership with BitGo for custody shows they are using "battle-tested" tech.

The strategy is simple: create a "regulated rail" for stablecoins before the laws change. If they get that banking license, USD1 could become the preferred choice for cross-border payments, especially in countries like Pakistan, which has already started exploring the stablecoin for national settlement.

Actionable Insights for Investors

- Watch the OCC Application: If World Liberty Trust Company gets that national charter, the legitimacy of USD1 and WLFI will skyrocket. This is the "make or break" moment for the project's institutional status.

- Monitor the Yield War: Traditional banks are currently fighting to ban stablecoins from paying out yield. If World Liberty manages to keep offering rewards through its lending markets, it will continue to drain liquidity from traditional finance.

- Track the Lock-ups: With nearly 74% of WLFI tokens still locked or in the treasury, keep an eye on governance votes. Any move to "unlock" these tokens early could create massive sell pressure or, conversely, signal a major new partnership.

- Diversify Collateral: If you're using their lending markets, remember that while ETH and WBTC are solid, the project is heavily dependent on the current U.S. administration’s pro-crypto stance. Political shifts in the 2028 cycle could change the regulatory landscape overnight.

The era of "wild west" crypto is fading, and world liberty financial crypto holdings represent the new, weirdly corporate, highly political future of the space. It’s no longer about just "holding" coins; it's about who owns the banks that hold the coins.