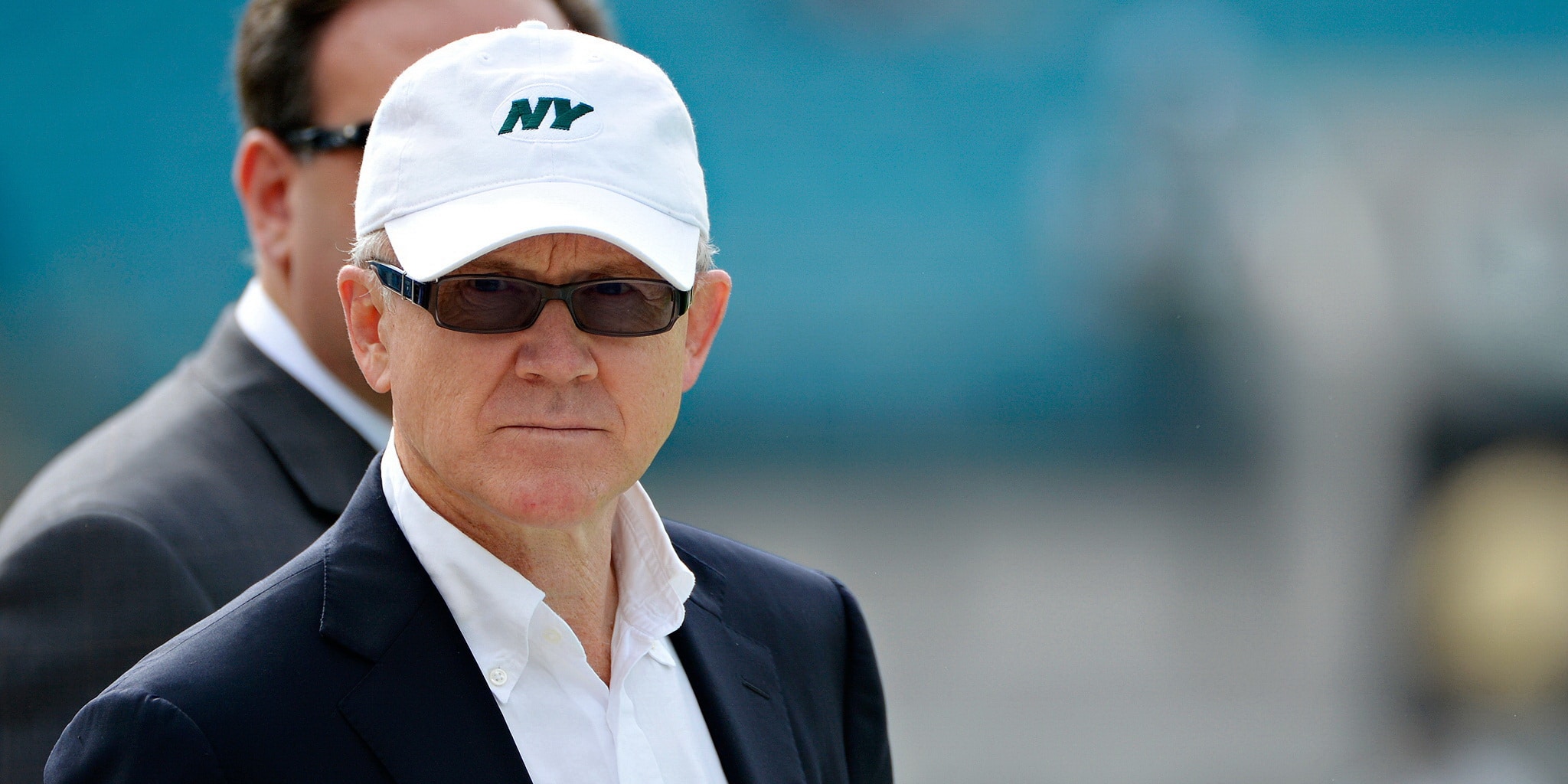

When you see Robert Wood "Woody" Johnson IV on the sidelines of a New York Jets game, it’s easy to focus on the frustrations of a long playoff drought or the latest quarterback drama. But behind the green parka is a financial machine that operates on a level most people can’t even fathom. Honestly, the net worth of Woody Johnson is a moving target that has skyrocketed recently, landing somewhere in the neighborhood of $11 billion as of early 2026.

That’s a massive jump from the $3 billion or $4 billion figures you might see on older Wikipedia pages.

Why the sudden surge? It isn't just about Band-Aids and baby powder anymore. While the Johnson & Johnson heritage provided the "seed money," the real explosion in his wealth comes from the insane valuation of sports franchises and some very calculated moves in international soccer.

The NFL Gold Mine: Beyond the $635 Million Gamble

Back in 2000, Woody outbid Charles Dolan to buy the Jets for $635 million. At the time, people thought he was overpaying. It was the third-highest price ever paid for a sports team. Fast forward to today, and that "overpayment" looks like the steal of the century.

The Jets are now valued at nearly $8 billion.

Think about that for a second. Even without a Super Bowl ring in the modern era, the team’s value has increased by over 1,100%. This happens because the NFL is basically a legal monopoly on Sunday entertainment. Between the massive TV deals with networks and the shared revenue model, Woody doesn't even need the Jets to win games to make money. He just needs them to exist.

He also co-owns MetLife Stadium with the Giants. Owning the "brick and mortar" where the games happen is a huge revenue driver. We aren't just talking about hot dogs and beer; we're talking about luxury suites, naming rights, and massive concerts that keep the cash flowing even during the NFL off-season.

💡 You might also like: Anthony Davis USC Running Back: Why the Notre Dame Killer Still Matters

The Crystal Palace Pivot

In mid-2025, Woody did something that caught a lot of fans by surprise. He dropped about $254 million to snag a 43% stake in the Premier League club Crystal Palace. This wasn't just a hobby.

Buying into English soccer is a classic "asset substitution" play.

Essentially, Woody is taking the dividends he earns from his Johnson & Johnson stock—which is steady but grows slowly—and dumping them into "scarce" assets. There are only 20 Premier League teams. There are only 32 NFL teams. You can’t just go out and start a new one. By moving his money into sports, he’s protected his wealth against inflation in a way that regular stocks just can't match.

Inherited Wealth vs. The "Self-Made" Hustle

Let's be real: Woody started at the finish line. He is the great-grandson of the guy who started Johnson & Johnson. He grew up in a world of private planes and Palm Beach estates. But there's a nuance here that gets missed.

A lot of heirs just sit on their money and let a wealth manager handle it. Woody didn't do that.

He ran The Johnson Company, a private investment firm in New York, for years. He’s been active in the markets, real estate, and even served as the U.S. Ambassador to the UK under the Trump administration. That diplomatic stint actually helped him build the connections he eventually used to buy into the Premier League.

📖 Related: AC Milan vs Bologna: Why This Matchup Always Ruins the Script

His wealth is basically split into three buckets:

- The Sports Empire: The Jets and Crystal Palace (The biggest chunk).

- The J&J Legacy: Millions of shares in the pharmaceutical giant.

- The "Shadow" Portfolio: Real estate and private equity held through his family office.

In a 2017 ethics disclosure, it came out that he had at least $1.7 billion in assets outside of the Jets. That was nearly a decade ago. Given how the markets have performed, that "side" money has likely doubled.

The Real Estate Flips

Woody doesn't just buy and hold; he knows when to exit. He famously sold his Fifth Avenue duplex for $80 million a few years back. At the time, it was a record for a Manhattan co-op.

He’s got a knack for "trophy" real estate.

Whether it's his massive estate in Palm Beach or his holdings in New York, his real estate portfolio acts as a hedge. If the NFL ever takes a hit (unlikely), he’s sitting on some of the most valuable dirt in the United States.

Why the Fans are Frustrated but the Bankers are Happy

There is a weird tension in the net worth of Woody Johnson. If you ask a Jets fan, they’ll tell you he’s been a disaster because the team hasn't made the playoffs since the 2010 season. They point to the Robert Saleh firing or the Aaron Rodgers era as signs of mismanagement.

👉 See also: 49ers vs Chargers Super Bowl: What Most People Get Wrong

But if you ask a banker? Woody is a genius.

He has managed to grow his net worth from "wealthy heir" to "global power broker." He survived an IRS settlement in 2006 regarding tax shelters and came out the other side even stronger. He understands that in 2026, sports teams are no longer just games; they are "cultural infrastructure." They are too big to fail and too popular to lose value.

What Most People Get Wrong About His Money

People think the Jets are Woody's wealth. They aren't. They are just the most visible part of it.

His family office, The Johnson Company, is a black box. It invests in energy, tech, and healthcare. Because it's private, we don't see the daily wins and losses. But when you add up the $8 billion Jets valuation, the $2 billion-plus in J&J stock, and the various real estate and soccer holdings, that $11 billion figure starts to look very conservative.

He’s also a massive philanthropist. He founded the Lupus Research Alliance and has poured millions into medical research. Some see this as purely altruistic, while others see it as a strategic way to manage a family legacy that started with healthcare. Either way, it's a massive part of where his money goes.

Actionable Insights for the Regular Investor

You probably don't have $600 million to buy a football team. Most of us don't. But you can learn from Woody's strategy of "asset substitution."

- Diversify into Scarcity: Woody moves money from liquid stocks into illiquid, scarce assets (sports teams). You can do a micro-version of this with collectibles, certain real estate, or even land.

- Don't Just Be an Heir: Woody took a legacy and multiplied it. If you have an inheritance or a small business, the goal isn't to maintain it; it's to use it as leverage for the next big thing.

- Ignore the Noise: Woody gets crushed in the New York tabloids every single day. He doesn't care. He stays focused on the long-term valuation of his assets.

The net worth of Woody Johnson is a testament to the fact that in the modern economy, owning the platform (the team, the stadium, the brand) is way more profitable than just being part of the industry. He’s built a fortress that is essentially "recession-proof."

To keep a pulse on how these valuations change, you should track the annual Forbes NFL valuation lists and the Bloomberg Billionaires Index. These are the "gold standards" for seeing how Woody's moves in the Premier League and the NFL continue to shift the needle on his ten-figure fortune.