You’ve seen the headlines. They're everywhere. TikTok "prophets" are screaming about a 2008-style meltdown, while your uncle at the barbecue insists that the whole thing is a house of cards waiting for a stiff breeze. It’s scary stuff. If you’re trying to buy a home or even just keep the one you have, the question of will the housing market crash feels less like a financial query and more like a survival tactic.

But here’s the thing: the data doesn’t care about our anxiety.

👉 See also: 1 US Dollar Iraqi Dinar: What Most People Get Wrong

Actually, as of early 2026, the market is doing something far more boring—and far more frustrating—than crashing. It’s resetting. We aren't seeing a vertical drop off a cliff. Instead, we're watching a long, slow grind toward something that looks like "normal." If you're waiting for 40% price cuts to sweep the nation, you might be waiting for a train that isn't on the tracks.

The "Crash" Myth vs. The "Reset" Reality

Why hasn't the floor fallen out? In 2008, we had a glut of homes and a sea of bad loans. Today, it’s the opposite. We’ve had a decade of underbuilding. People are literally living in their parents' basements because there isn't enough physical wood and drywall to house them.

Lawrence Yun, the Chief Economist at the National Association of Realtors (NAR), recently noted that home sales are actually projected to increase by about 14% this year. That doesn't happen in a crash. In a crash, everyone runs for the exits and nobody is buying. Right now, people are still clawing at each other for decent listings in places like Chicago and Syracuse, even if things have cooled off in Austin or Phoenix.

Why prices are sticky

- The Golden Handcuffs: Most homeowners are sitting on mortgage rates below 4%. They aren't moving unless they absolutely have to. This keeps inventory tight.

- Equity Cushions: Most people have a ton of value in their homes. They aren't "underwater" like they were twenty years ago.

- Institutional Buying: Big money firms are still snapping up single-family rentals, providing a floor for prices.

Basically, for a real crash, you need "forced sellers." You need people who must sell because they can't afford the payment or because the bank is taking the house. With delinquency rates at historic lows, that flood of foreclosures just isn't there.

📖 Related: Hide Your Money Y'all: Why Privacy Is the New Financial Flex

Will the Housing Market Crash in Specific Cities?

While a national collapse looks unlikely, some places are definitely feeling the heat. If you live in Florida or Texas, you might think the crash is already here. Insurance premiums in coastal Florida have gone absolutely nuclear. When your homeowners insurance jumps from $2,000 to $8,000 a year, that effectively lowers how much house a buyer can afford.

Redfin’s latest 2026 outlook calls this the "Great Housing Reset." In markets like Austin, San Antonio, and Miami, prices are actually dipping or staying flat while the rest of the country ticks up. It’s a geographic Great Divide.

The Haves and the Have-Nots

It’s honestly kinda brutal out there for first-time buyers. The median age of a first-time buyer has jumped to 40. That's a record. If you have equity from a previous home, you're fine. You can roll that cash into a new place and barely feel the 6% interest rates. But if you’re trying to save a down payment while paying record-high rents? It feels impossible.

The market isn't crashing; it's bifurcating. It’s becoming a club that’s increasingly hard to join.

Mortgage Rates and the 6% "New Normal"

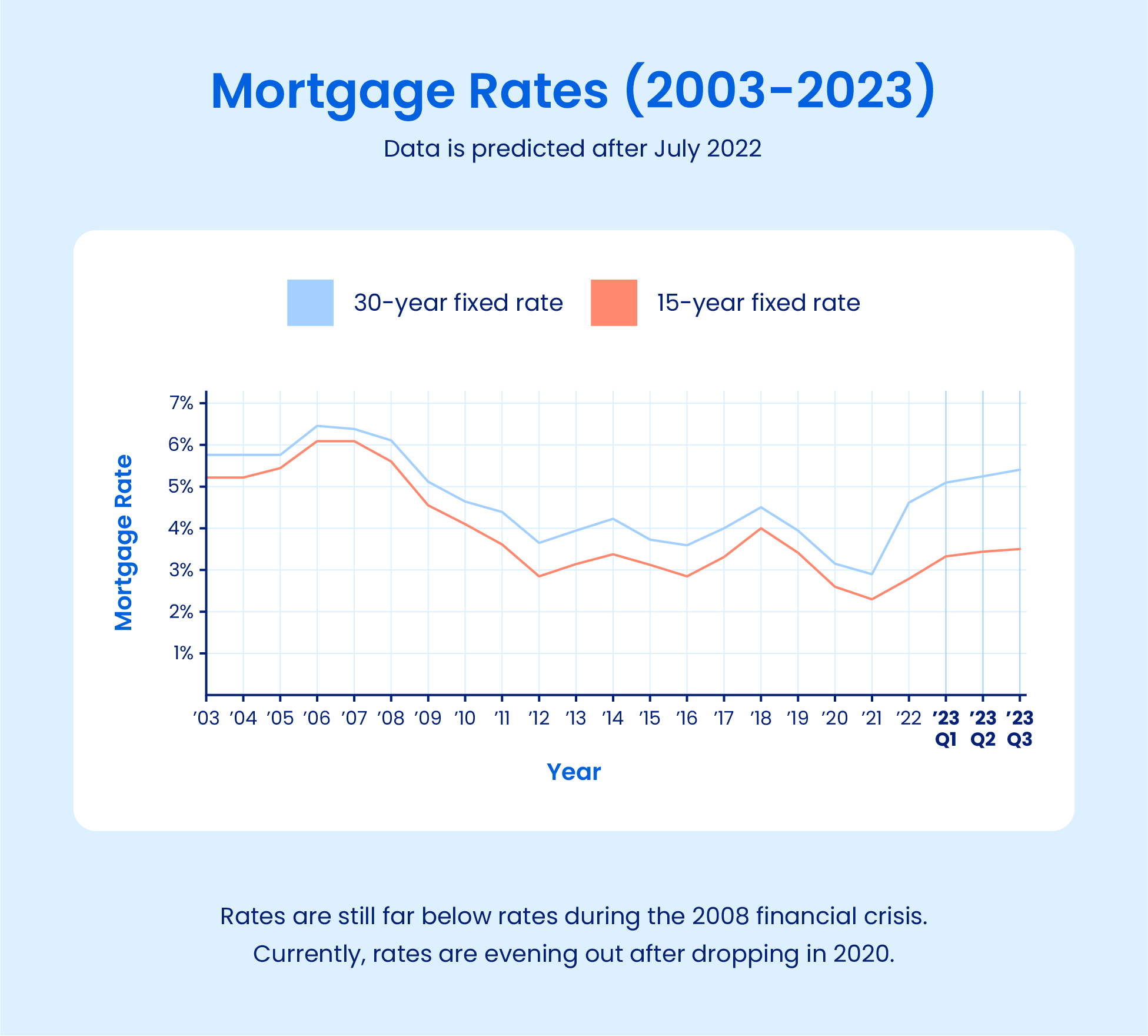

We all remember those 3% rates from the pandemic. They were a gift from the gods (or the Fed), and they’re probably never coming back in our lifetime. Get used to the 6s. As of mid-January 2026, the average 30-year fixed mortgage rate sits around 6.06%.

Freddie Mac Chief Economist Sam Khater says this is the lowest we've seen in three years. It’s a "good" rate now. Perspective is a funny thing, isn't it? This slight dip has actually triggered a surge in mortgage applications—up 31% year-over-year according to some metrics. This demand is exactly what prevents the housing market from crashing. Every time rates tick down, a fresh wave of buyers jumps back into the pool, propping up prices.

What Most People Get Wrong About 2026

The biggest misconception is that "affordability" only improves if prices drop.

That’s not how it’s happening this time.

Instead, we’re seeing "nominal" prices stay flat or rise 1-2%, while wages finally start to grow faster. It’s a slow-motion rebalancing. Forbes Advisor and Zillow both project that home values will rise modestly—maybe 1.2% to 2%—over the next twelve months. If your salary goes up 4% and the house only goes up 1%, you technically gained ground. It doesn't feel like a win, but mathematically, it is.

Surprising Signals to Watch:

- New Construction Incentives: Builders are the only ones really "cutting" prices, but they do it through mortgage rate buydowns. They might offer you a 4.5% rate even if the market is at 6%.

- The Rise of "Shadow Inventory": There are a lot of people who want to sell but are waiting for a specific number. If rates hit 5.8%, expect a sudden burst of listings.

- Climate Migration: We're starting to see "climate-risk" pricing. Homes in high-fire or high-flood zones are losing value relative to "safe" inland metros.

Is Now a Good Time to Buy?

Honestly? It depends on your timeline. If you’re looking to flip a house in six months, stay away. The easy money era is dead and buried. But if you’re looking for a place to live for the next ten years, the "wait for the crash" strategy has been a losing bet for a long time.

The "perfect" time to buy was 2012. The second best time was 2019. Since we don't have a time machine, you have to look at your own monthly budget. If you can afford the payment at 6% and you find a house that doesn't need a total gut job, waiting for a 20% price drop that may never come is a risky move. You might just end up paying more in rent while you wait.

Actionable Steps for the Current Market

- Get a "Pre-Approval," Not a "Pre-Qualification": In a market where inventory is still lower than pre-pandemic norms, you need to prove you have the funds. A pre-approval carries more weight with skeptical sellers.

- Look North and West: While the Sunbelt (Florida/Arizona/Texas) is cooling, the Midwest and Northeast (think Cleveland, OH or Syracuse, NY) are seeing steady growth because they started from a more affordable baseline.

- Monitor the Fed's Language: Don't just watch the interest rate hikes; watch the "Quantitative Tightening" (QT) comments. If the Fed stops selling mortgage-backed securities, rates could slide faster than expected.

- Check the "Days on Market" (DOM): If houses in your target neighborhood are sitting for 60+ days, you have leverage. Ask for seller concessions to buy down your interest rate. This is often better than a lower purchase price because it saves you more on your monthly bill.

The bottom line is that the U.S. housing market is too massive and too undersupplied to simply "pop" like a balloon. It’s more like a heavy truck that’s run out of gas—it’s slowing down, it’s frustrating to get moving again, but it’s not about to disappear into thin air. Focus on your local zip code data rather than national doom-scrolling. That's where the real truth lives.

👉 See also: Jessica Ryan Persuasion Pt 2: What Most People Get Wrong About Influence

Next Steps for You

- Check local inventory levels: Look at the "Days on Market" for your specific zip code on sites like Altos Research or Zillow to see if buyers or sellers have the upper hand.

- Calculate your "Break-even": Use a mortgage calculator to see if a 1% drop in interest rates or a 5% drop in price saves you more money (hint: it's usually the interest rate).

- Audit your insurance: If you're looking in a coastal or high-risk area, get an insurance quote before you fall in love with a house. It could be the dealbreaker you didn't see coming.