Cash is boring. Or at least, that’s what the Wall Street crowd wants you to think while they chase crypto gains and AI stocks. But honestly? Having a massive pile of liquid cash sitting in a savings account with high interest rate is one of the most underrated power moves you can make in 2026.

The math has shifted. We aren't in the "0.01% interest" era anymore. If your bank is still paying you pennies while they lend your money out at 7% or 8%, you're basically giving them a free gift. Why do that? You've worked too hard for your money to let a legacy bank get rich off your laziness.

But here is the thing: not all high-yield accounts are created equal. Some are just marketing traps.

The bait and switch of modern banking

You see a flashing ad. 5.50% APY! It looks incredible. You move your life savings over, feeling like a genius. Then, three months later, you realize that rate was an "introductory teaser" that just expired. Now you're earning 3%. Or maybe you realize that to keep that high rate, you have to jump through ten hoops, like making twenty debit card transactions a month or maintaining a balance that never drops below fifty thousand dollars.

It's exhausting.

Real wealth isn't built on chasing a 0.1% difference between two banks. It’s built on consistency. A legitimate savings account with high interest rate should be "set it and forget it." You want a bank that has a history of staying competitive, not just one that buys customers with a temporary loss-leader rate. Look at institutions like Ally Bank, SoFi, or Marcus by Goldman Sachs. They don't always have the absolute highest "teaser" rate on the internet, but they consistently stay in the top tier. That matters more over five years than a flash-in-the-pan promo does over five months.

APY vs. APR: Don't get it twisted

People mix these up constantly. APY (Annual Percentage Yield) is what you earn. APR (Annual Percentage Rate) is usually what you pay on a loan. The "Y" in APY accounts for compound interest. Basically, it’s interest on your interest.

Imagine you put $10,000 into an account. If it’s compounding monthly, that tiny bit of interest you earned in January starts earning its own interest in February. Over a decade, that snowball effect is massive.

If you’re looking at an account and the fine print says "simple interest," run. You want compounding. Most modern high-yield savings accounts (HYSAs) compound daily and credit monthly. That is the gold standard.

Where is the catch?

Usually, the catch is accessibility. A high-interest account is often at an online-only bank. No branches. No teller to talk to. If you're the kind of person who needs to walk into a physical building to feel "safe," you're going to pay for that privilege in the form of lower interest rates.

💡 You might also like: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

Brick-and-mortar banks have huge overhead. Electricity, rent, security guards, those little bowls of peppermint candies—it costs money. Online banks don't have those costs. They pass the savings to you. Honestly, when was the last time you actually needed a physical teller? Most of us do everything on our phones anyway.

Is your money actually safe?

This is the big one. After the banking jitters we've seen in recent years, people are rightfully paranoid.

If the bank isn't FDIC insured, don't even look at it. Period. The Federal Deposit Insurance Corporation covers up to $250,000 per depositor, per insured bank, for each account ownership category. If you have $500,000, split it between two banks. It’s that simple.

Some fintech apps—the ones that look like banks but aren't actually banks—use "sweep" programs. They move your money into partner banks that have FDIC insurance. It’s usually safe, but you need to read the "About Us" page. Make sure you know exactly whose vault your digital dollars are actually sitting in.

The inflation monster is still hungry

Let’s be real for a second. Even a savings account with high interest rate isn't a "get rich quick" scheme. If your bank is paying you 5% but inflation is running at 4%, your real return is only 1%. You aren't "making" 5%; you're just preventing your purchasing power from evaporating.

Savings accounts are for three things:

- Your emergency fund (3-6 months of expenses).

- Short-term goals (a wedding, a house down payment, a new car).

- A "dry powder" fund for when the stock market crashes and you want to buy the dip.

Don't keep $500,000 in a savings account if you don't need that money for ten years. Put it in the market. The S&P 500 has historically returned around 10% annually over long periods. A savings account is a shield, not a sword. Use it to protect your lifestyle, not to build a dynasty.

The psychology of the "Side Bucket"

There’s a weird psychological trick that happens when you move money out of your main checking account and into a separate savings account with high interest rate.

Out of sight, out of mind.

📖 Related: Modern Office Furniture Design: What Most People Get Wrong About Productivity

When your "fun money" and your "emergency money" are in the same account, you're constantly negotiating with yourself. "I can afford these shoes because I have $5,000 in my account," you say. But that $5,000 was supposed to be for your car transmission when it eventually blows up.

By moving that cash to a high-yield account at a completely different bank, you create friction. Friction is your friend. It takes a day or two to transfer the money back. That delay is often just enough time for your brain to realize you don't actually need the shoes.

Real-world numbers: The cost of waiting

Let's look at two people.

Sarah keeps $25,000 in a "big name" bank earning 0.05%. In a year, she earns $12.50. That’s barely a burrito.

Mike moves his $25,000 to a savings account with high interest rate earning 4.50%. In a year, he earns $1,125.

Mike just paid for a round-trip flight to Europe just by moving his money from one digital box to another. Sarah stayed where she was because moving banks seemed "annoying." Don't be Sarah. It takes maybe ten minutes to open an account online. $1,125 for ten minutes of work is an hourly rate of $6,750. You are not too busy for that.

How to spot a winner in 2026

When you're shopping around, ignore the flashy influencers. Look for these specific traits:

- No monthly maintenance fees: There is absolutely no reason to pay a fee to a bank for holding your money.

- No minimum balance requirements: Life happens. If you need to drain your account to $5 for a week, the bank shouldn't penalize you for it.

- High-rated mobile app: If the app crashes every time you try to check your balance, the interest rate doesn't matter. You'll hate using it.

- Customer support: Try calling them before you deposit. If it takes 40 minutes to reach a human, find a different bank.

The "Fintech" vs. "Legacy" debate

We’ve seen a lot of "neobanks" pop up lately. Some are great. Some are risky.

Legacy banks like Capital One (with their 360 Performance Savings) offer a middle ground. They have the high rates of an online bank but the stability and some physical locations of a traditional bank.

👉 See also: US Stock Futures Now: Why the Market is Ignoring the Noise

Then you have the tech-heavy options like Wealthfront or Betterment. Technically, these are robo-advisors, but their cash accounts often offer some of the highest rates in the industry because they "sweep" your money across dozens of different banks to maximize both interest and FDIC coverage. It’s a smart system, but it feels a bit more "digital" than some people are comfortable with.

Actionable steps to maximize your cash

Stop overthinking it.

First, check your current interest rate. Go into your banking app, look at your last statement, and find the APY. If it starts with a zero followed by another zero (like 0.01% or 0.05%), you are losing money every single day.

Second, pick a reputable online bank. You don't need the #1 highest rate on some obscure list. Pick a top-five contender. American Express, Discover, Ally, or Marcus are all solid bets that won't disappear overnight.

Third, set up an automatic transfer. Even if it's just $50 a week. The magic of a savings account with high interest rate works best when you are consistently adding to the pile.

Fourth, treat it like a "one-way" valve. Money goes in, but it only comes out for true emergencies or the specific goal you saved for.

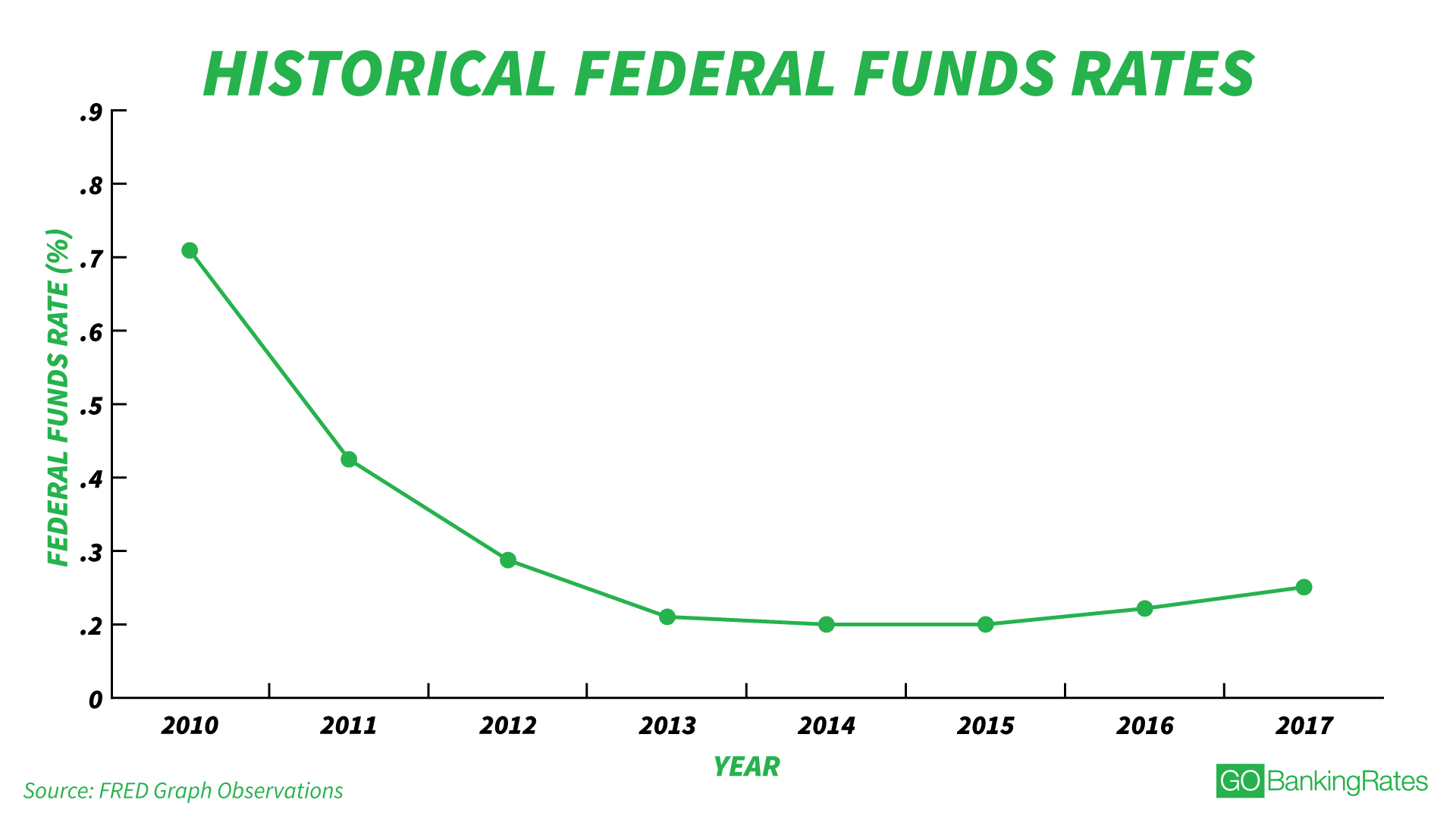

Lastly, keep an eye on the Federal Reserve. Interest rates are not fixed. When the Fed cuts rates, your high-yield savings rate will go down too. It’s not the bank being mean; it’s just how the plumbing of the global economy works. When rates drop, you might want to look into CDs (Certificates of Deposit) to "lock in" a rate, but for pure flexibility, the savings account is still king.

The goal isn't to find the "perfect" account. The goal is to stop being a "free loan" for a billion-dollar bank. Move your money, get your interest, and let the compound effect do the heavy lifting while you sleep. Your future self will be very glad you spent those ten minutes setting this up.