Tax day isn't the only time the government comes for your wallet. It happens every time you buy a coffee, a laptop, or a new pair of shoes. But here is the kicker: where you stand on the dirt literally determines how much you pay. If you’ve ever stared at a sales tax by state map and felt a headache coming on, you aren't alone. It’s a mess.

Most people think sales tax is a flat, simple percentage. It isn't.

Take a walk across the border from Oregon into Washington. In Oregon, that $1,200 iPhone costs exactly $1,200 at the register. Zero sales tax. Walk a few miles north into Vancouver, Washington, and you’re suddenly looking at an extra hundred bucks or so in tax. It’s wild. This isn't just trivia for road trippers; it’s a massive logistical nightmare for small business owners and online sellers who have to track "nexus" across 50 different jurisdictions.

The Five "Nomad" States You Should Know

There are five states that basically told the sales tax system to kick rocks. They use the acronym NOMAD: New Hampshire, Oregon, Montana, Alaska, and Delaware.

If you live in these spots, you don't pay a state-level sales tax. Period.

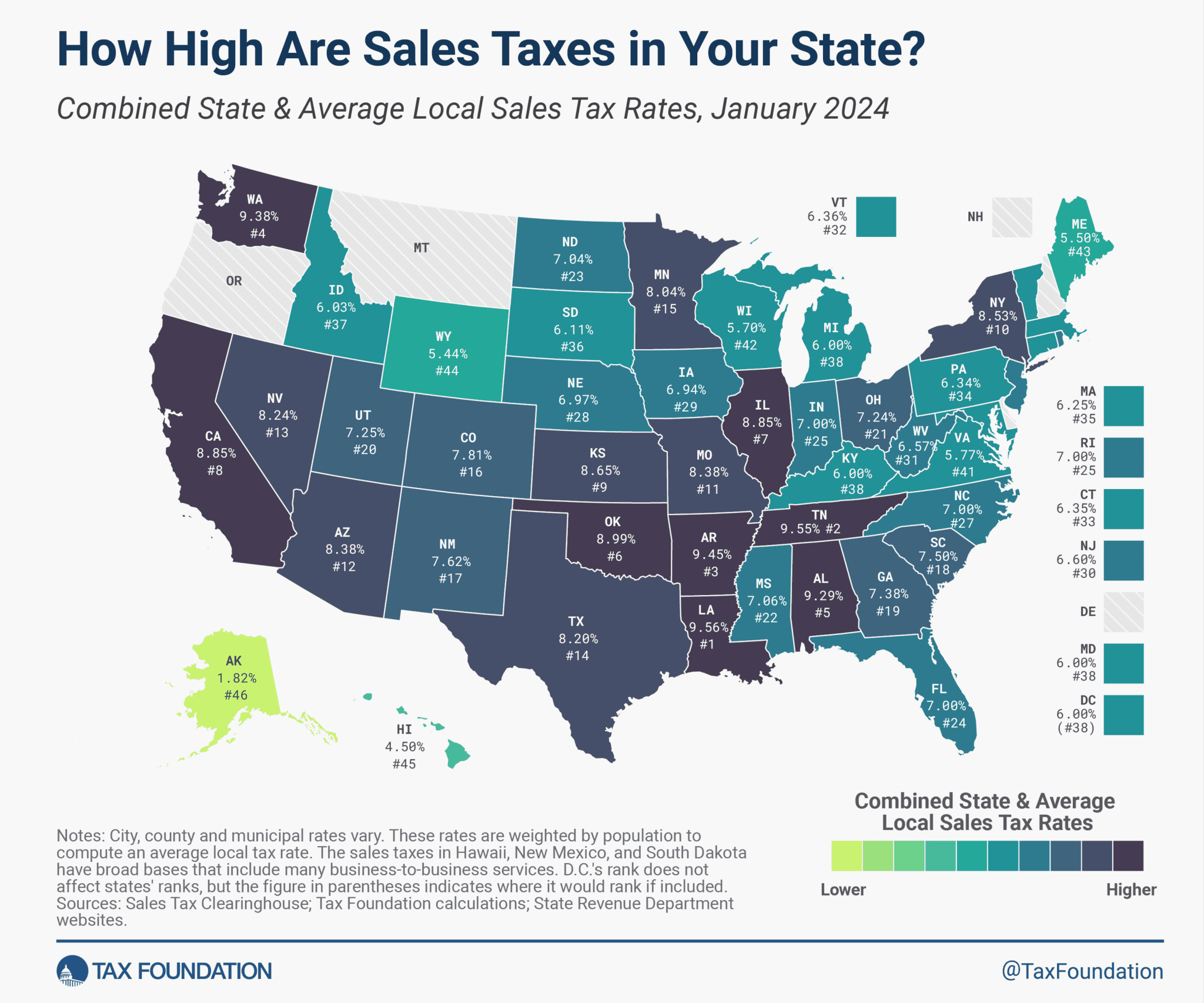

But even that comes with a catch. Alaska, for example, has no state sales tax, but it lets local municipalities go rogue. Juneau might charge you 5%, while Anchorage stays at zero. It’s why a generic sales tax by state map can be so misleading—it often only shows the state-level rate, ignoring the local layers that actually drain your bank account. Delaware is the real winner for corporations because they have no sales tax and a very "friendly" legal system, which is why half the companies you buy from are technically headquartered in a nondescript office building in Wilmington.

Why Tennessee and Louisiana Feel So Expensive

On the flip side, you have the high-tax heavyweights. Tennessee usually sits at the top of the list for "combined" rates. While their base state rate is 7%, local jurisdictions pile on more, often pushing the total over 9.5%.

Why? Because Tennessee has no state income tax.

The money has to come from somewhere. Roads don't pave themselves. Schools need books. If a state doesn't take a bite out of your paycheck every month, they’re going to take it when you buy groceries or a new truck. It’s a trade-off. Florida does the same thing. No income tax, but they’ll get you at the theme park gift shop and the register. Louisiana is another tough one, often hitting combined rates near 9.55%. It’s a complex web of parishes and special districts that makes "simple" tax software cry.

📖 Related: Owner of Wynn Las Vegas: What Really Happened Behind the Scenes

The Wayfair Decision Changed Everything

Back in the day, you could buy stuff online and skip the tax. It was the "wild west" era of the internet. If the company didn't have a physical store in your state, they didn't collect tax.

That ended in 2018.

The Supreme Court case South Dakota v. Wayfair, Inc. changed the game. Now, states can force you to collect sales tax based on "economic nexus." Basically, if you sell enough stuff to people in a state—even if you've never set foot there—you owe that state tax money. This is why your Etsy shop or your small e-commerce brand suddenly became a massive accounting project. Most states set the threshold at $100,000 in sales or 200 separate transactions.

Honestly, it’s a lot to keep track of.

Grocery Taxes and the "Hidden" Costs

You’d think bread and milk would be safe, right? Not everywhere.

Most states exempt groceries because taxing food is seen as "regressive"—it hits poor people harder than rich people. However, states like Mississippi and Alabama still tax groceries at the full state rate. Imagine paying 7% extra just to feed your family. Some states, like Tennessee, tax groceries but at a slightly lower rate than other goods. It’s these tiny nuances that make a sales tax by state map look like a patchwork quilt of confusion.

Then there’s "Tax-Free Weekends."

Every August, parents in states like Texas or Florida go into a fever dream of shopping. These states waive sales tax on school supplies and clothes for a few days. It's great for the consumer, but it’s a chaotic scramble for retail workers who have to reprogram POS systems for a 48-hour window.

The Local Layer Cake

To really understand what you’re paying, you have to look at the three-layer cake of sales tax:

- The State Rate (The big slice)

- The County Rate (The middle slice)

- The City/Special District Rate (The frosting)

In places like Chicago, you’re looking at a combined rate of over 10%. That’s $10 for every $100 spent. That adds up fast. Meanwhile, in Hawaii, they don't even call it sales tax; they call it the General Excise Tax (GET). It’s technically a tax on the business, not the consumer, but businesses just pass it on to you anyway. Plus, it’s "pyramided," meaning it can be charged at every level of production, making the effective rate higher than it looks on paper.

💡 You might also like: Why the Chick-fil-A Jingle Is Stuck in Your Head and What It Actually Means

What You Should Actually Do About It

If you’re a consumer, there isn't much you can do unless you’re planning to move or drive across state lines for a big-ticket item like a diamond ring or a sofa. But for business owners, this is serious business.

Don't rely on a static image you found on Google Images. Those maps are usually a year out of date the moment they’re posted. Use a real-time lookup tool. Services like TaxJar or Avalara exist because this stuff is too hard for a human to track manually. They sync with your online store and calculate the exact tax down to the zip code +4.

If you are filing taxes yourself, keep a log of where your customers are. If you hit that 200-transaction mark in a state like Illinois or Ohio, you need to register for a sales tax permit immediately. Ignoring it doesn't make it go away; it just leads to audits and "back tax" bills that can sink a small company.

Check the specific nexus laws for the "big four" states—California, Texas, New York, and Florida—as they are the most aggressive about enforcement. If you're selling into those markets, you're on their radar. Stay ahead of the curve by reviewing your "economic nexus" status every quarter, not just at the end of the year.