Money is weirdly emotional. Most of us treat our bank accounts like a scary movie—we watch through our fingers, hoping nothing jumps out. But honestly, the fix is usually just a piece of paper. I’ve seen people drop hundreds on complex subscription apps only to realize they’re more confused than when they started. That’s why a printable monthly budget template is still the gold standard for actually seeing where your cash goes.

It’s tactile. You feel the pen hit the paper.

Studies from researchers like Dr. Gail Matthews at the Dominican University of California have shown that people who physically write down their goals are significantly more likely to achieve them compared to those who just keep a digital mental note. Budgeting isn't just math; it’s psychology. When you use a printable monthly budget template, you’re forcing your brain to slow down and acknowledge that $7 latte or that "oops" Amazon purchase.

The Friction Problem with Digital Apps

Most people think they need a high-tech solution. They download Mint (well, RIP Mint), YNAB, or Rocket Money and expect the AI to solve their overspending. It doesn't work like that. Automatic syncing is great until it’s not. It makes you passive. You glance at a notification, swipe it away, and keep spending.

Physical templates create friction.

Friction is usually bad in tech, but in personal finance, friction is your best friend. If you have to manually write down "Target: $142.50" under your "Household" column, it hurts a little. That's the point. You want that slight sting of accountability.

Finding a Printable Monthly Budget Template That Actually Works

Don't just grab the first colorful PDF you see on Pinterest. Most of them are designed to look "cute" rather than be functional. You need specific zones. A real-world budget isn't just a list of bills; it’s a living document that accounts for the fact that life is messy and unpredictable.

💡 You might also like: Cooper City FL Zip Codes: What Moving Here Is Actually Like

The Zero-Based Method

The most effective templates usually follow the Zero-Based Budgeting (ZBB) philosophy. This isn't some new-age trend; it’s the method popularized by guys like Dave Ramsey, though it’s been used by accountants for decades. The logic is simple: Your Income minus your Expenses must equal zero.

If you have $4,000 coming in this month, every single one of those 4,000 dollars needs a "job." Some go to rent. Some go to the electric bill. Some go to your Roth IRA. And yes, some should go to "fun stuff" so you don't burn out and quit by the 15th. If you have $200 left over at the bottom of your sheet, you haven't finished your budget. You need to assign that $200 to debt or savings.

Why? Because unassigned money has a habit of disappearing into the "I don't know where it went" void.

Common Mistakes People Make with Paper Budgets

I've seen it a thousand times. Someone prints out a beautiful sheet, fills it out on the 1st of the month, and then never looks at it again. They treat it like a static document.

A budget is a forecast, not a diary.

If you only write down what you already spent, you’re just doing an autopsy on your finances. You need to write down what you intend to spend. Then, you track against that.

📖 Related: Why People That Died on Their Birthday Are More Common Than You Think

- Forgetting "Sinking Funds": This is the big one. Your car insurance isn't a surprise. It comes every six months or every year. Christmas isn't a surprise; it's on December 25th every single year. A good printable monthly budget template should have a spot for these "non-monthly" expenses. You save a little bit each month so when the bill hits, it's a non-event.

- Being Too Rigid: If you budget $50 for gas but prices spike, you're going to go over. That's fine. Take the extra $10 from your "Dining Out" category. Move the numbers around. Your paper shouldn't be a prison; it’s a map.

- Ignoring the "Misc" Category: Life happens. Your kid needs a poster board for a school project. You get a flat tire. If your template doesn't have a "Misc" or "Crap I Forgot" line item, your whole system will collapse the moment something goes wrong.

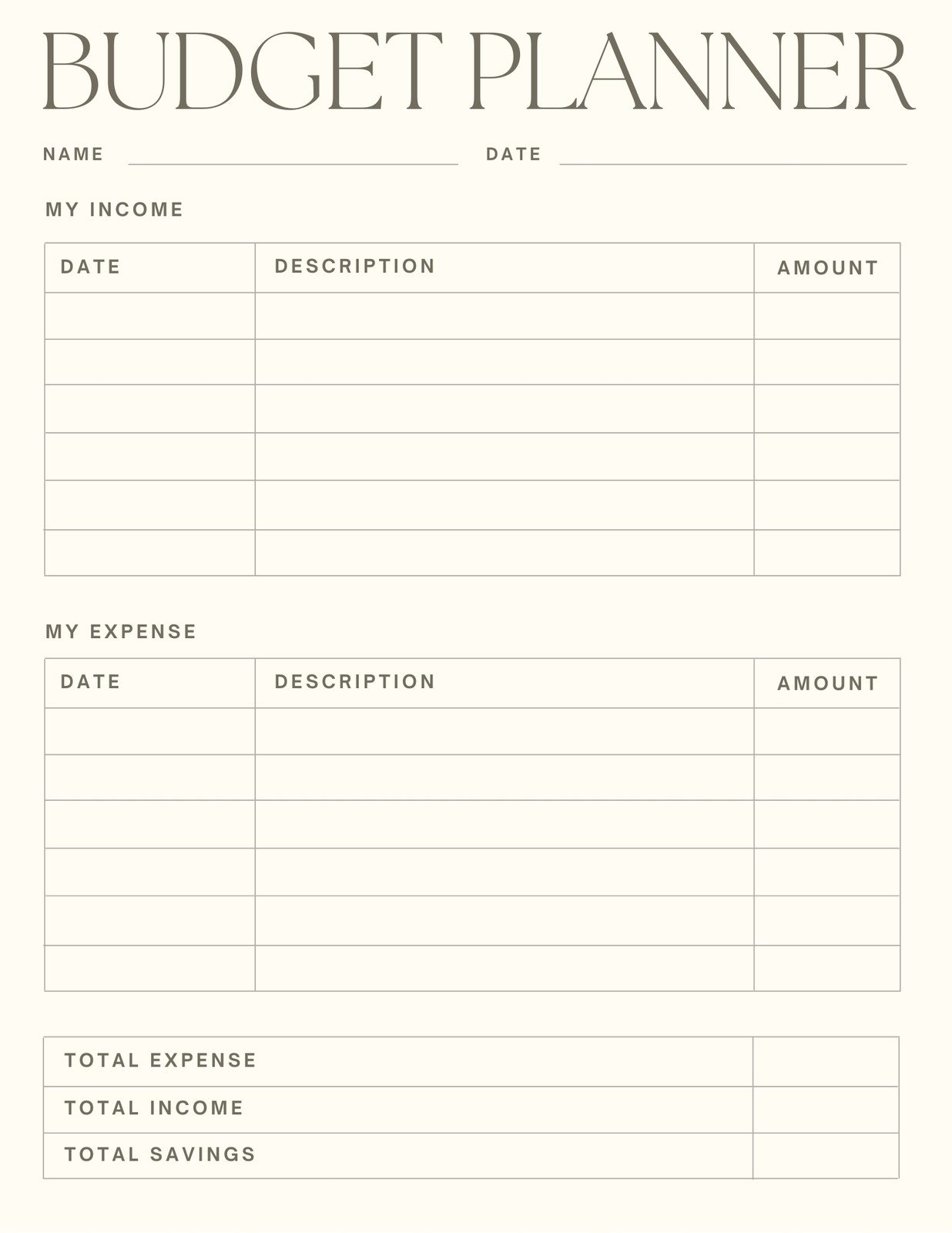

The Anatomy of a High-Quality Template

When you're looking for a file to download, or if you're sketching one out yourself in a notebook, look for these specific sections. If they aren't there, keep looking.

First, you need an Income Tracker. Don't just put your salary. Include side hustles, tax refunds, or that $20 your aunt sent you for your birthday.

Second, look for Fixed Expenses. These are the boring ones. Rent, mortgage, car payments, insurance. They don't change much. They're the "walls" of your financial house.

Third—and most important—is Variable Expenses. This is where the battle is won or lost. Groceries, gas, entertainment, clothing. This is the section you need to check every single week.

Finally, ensure there is a Debt and Savings section. This is for your future self. If you're paying off a credit card, write the balance at the top of the page. It’s a brutal reminder of why you’re skipping the overpriced appetizers at dinner.

Paper vs. Spreadsheet: The Final Verdict

I get asked this constantly: "Can't I just use Excel?"

👉 See also: Marie Kondo The Life Changing Magic of Tidying Up: What Most People Get Wrong

Sure. Excel is powerful. It does the math for you. But for many people, the computer is a place of distraction. You open a spreadsheet, get a Slack notification, click a YouTube link, and suddenly an hour is gone and you still haven't looked at your spending.

Paper is "offline." There are no tabs to click. No notifications. Just you and your reality. Plus, there is something deeply satisfying about physically crossing off a debt or highlighting a savings goal that's been reached. You can't get that same dopamine hit from a cell in a spreadsheet turning green.

Real World Example: The "Cash Envelope" Hybrid

Many people use a printable monthly budget template alongside the cash envelope system. Elizabeth Warren popularized the 50/30/20 rule in her book All Your Worth, but for those struggling with overspending, physical cash is the ultimate guardrail.

You write down "$400 for groceries" on your template. You go to the bank, withdraw $400, and put it in an envelope. When the envelope is empty, you stop eating. It sounds harsh, but it’s the only way some of us—myself included—actually learn to respect the budget.

Actionable Steps to Start Today

Don't wait for the first of the month. That's a procrastinator's trap.

- Print a simple template now. Don't overthink the design. Black and white is fine.

- Pull up your banking app for the last 30 days. Look at the "hidden" leaks. Those $5.99 subscriptions you forgot about? Cancel them before you even write the first number down.

- List your "Must-Haves" first. Housing, utilities, transportation, and basic food. Everything else is negotiable.

- Set a "Weekly Check-In" time. Sunday nights are usually best. Sit down with your template, a pen, and your receipts. Spend 15 minutes updating your totals.

- Forgive yourself. You will blow your budget. You’ll buy something stupid. You’ll forget a bill. Don't throw the whole template in the trash just because you messed up one week. Turn the page, start a new sheet, and try again.

The goal isn't perfection; it’s awareness. A printable monthly budget template gives you the clarity to stop wondering where your money went and start telling it where to go. It’s the difference between being a victim of your finances and being the boss of them.

Start by filling out your fixed costs tonight. Just the rent and the utilities. Once those numbers are on paper, the rest of the puzzle starts to fall into place.

Everything gets easier once you can see it.