You’re staring at the screen at 3:00 AM. The red and green numbers are flickering like a broken neon sign in a noir film. We've all been there. Watching a dow futures live ticker can feel a bit like reading tea leaves, except the tea leaves are worth billions of dollars and can ruin your morning coffee before you’ve even brewed it.

Most people think the Dow Jones Industrial Average is just a number that tells you if "the economy" is doing well. That's a mistake. The Dow is actually a price-weighted index of 30 massive blue-chip companies, and the futures market is the world’s way of guessing what those companies will be worth when the opening bell rings at the New York Stock Exchange.

But here is the kicker. That ticker you're watching on a free finance app? It might be delayed by 15 minutes. Or it might be showing you "CME Globex" prices that don't perfectly align with the "cash" market you see on the news.

The Chaos Behind the Dow Futures Live Ticker

Trading never actually stops. Well, it stops for a tiny bit on Friday evenings, but for the most part, the world is constantly betting on American industry. When you look at a dow futures live ticker, you’re seeing the E-mini Dow ($5 principal) or the Micro E-mini. These are contracts. They are legal agreements to buy or sell the value of the index at a future date.

Why does this matter to you?

Because the "tail wags the dog" more often than you'd think. High-frequency trading algorithms at firms like Citadel or Renaissance Technologies react to news in milliseconds. If a manufacturing report drops in Germany or a tech giant’s factory in Taiwan has a hiccup, the futures move instantly.

👉 See also: Division of Labor Definition: Why Breaking Tasks Down Actually Makes the World Run

Most retail traders get chopped up because they don't understand the "basis." The basis is the difference between the spot price (what the Dow is right now) and the futures price. Sometimes the futures are trading at a "premium," meaning traders are bullish. Other times, they're at a "discount." If you see the Dow closed at 38,000 but the dow futures live ticker shows 37,900, don't panic. It doesn't always mean the world is ending. It might just be reflecting dividend adjustments or interest rate expectations.

Who Is Actually Moving the Needle?

It isn't just "investors." It's institutional hedging. Imagine you’re a pension fund manager. You own billions in Apple, Boeing, and Goldman Sachs. You can’t just dump your stocks at 2:00 AM if news breaks. Instead, you sell Dow futures to hedge your downside.

This creates a massive amount of "noise."

I’ve spent years watching these charts. Honestly, the most dangerous time to look at your ticker is during the "pre-market" hours between 4:00 AM and 9:30 AM ET. Volume is lower. This means a single large order can spike the price up or down, creating a "fake out." You see a 200-point jump, you get excited, and then the market opens and the price collapses. It’s a trap as old as time.

Decoding the Symbols and Spreads

If you’re hunting for a dow futures live ticker, you’ll likely see symbols like YM (for the E-mini) or MYM (for the Micro). The letters next to them tell you the expiration month. H is March. M is June. U is September. Z is December.

- YMZ2025 - This would be the Dow Futures for December 2025.

- The Tick Size - For the E-mini, a "tick" is one point, and it’s worth $5.

- The Spread - This is the gap between the bid and the ask. In a liquid market, it's tight. In a crisis? It widens fast.

Let's talk about the "Fair Value" calculation. You’ll often hear CNBC anchors mention "Fair Value." This is a mathematical estimate of where the futures should be trading relative to the cash index, accounting for lost interest and expected dividends. If the dow futures live ticker is trading significantly above fair value, the market is "indicated" to open higher. If it’s below, prepare for a sea of red.

The Psychological Trap of Overnight Trading

There’s a specific kind of madness that comes with checking your phone at 11:00 PM to see what the Dow is doing. You see it's down 0.5%. You start calculating your 401k losses. You can't sleep.

But here's the reality: overnight moves often mean nothing.

The "London Open" at 3:00 AM ET often sets a trend that gets completely reversed by the "New York Open" at 9:30 AM. Traders call this "fading the move." Professional money often waits for the "dumb money" to exhaust itself in the pre-market.

Think about the 30 stocks in the index. You have UnitedHealth Group, which has a massive weight because its share price is high. Then you have companies like Intel or Verizon with lower share prices. Because the Dow is price-weighted—not market-cap weighted like the S&P 500—a big move in one expensive stock like Goldman Sachs can move the dow futures live ticker more than a move in five smaller stocks combined. It’s an antiquated system, honestly. But it’s the system we use.

Where to Find Data That Isn't Garbage

If you want a real dow futures live ticker, you have to be willing to look past the surface.

- TradingView: Probably the best interface for retail users. You can see the "CME_MINI:YM1!" symbol which gives you the continuous contract.

- Investing.com: Good for quick checks, but the comment sections are a cesspool of "permabears" and "permabulls" screaming at each other. Avoid the comments.

- Thinkorswim (Schwab): If you want professional-grade tools, this is where you go. You get the real-time feed without the 15-minute lag that plagues free sites.

- Bloomberg Terminal: If you have $24,000 a year to spare. (Most of us don't).

The difference between "real-time" and "delayed" can be the difference between a winning trade and a disaster. If your ticker doesn't say "Real-Time" with a green light or a specific exchange timestamp, you are looking at old news. In the world of futures, 15 minutes is an eternity.

The Role of "The Plunge Protection Team"

It’s a bit of a conspiracy theory that’s actually somewhat grounded in reality. The Working Group on Financial Markets was created after the 1987 crash. When you see the dow futures live ticker plummeting 800 points in the middle of the night and then magically recover to zero by 8:00 AM, people start whispering about "The PPT."

While it's unlikely the government is literally buying futures contracts to prop up the market, large institutional players and central banks do step in to provide liquidity during "flash crashes." Understanding that the market has these invisible floors—and ceilings—is part of becoming a seasoned observer.

How to Use This Information Without Losing Your Mind

Monitoring a dow futures live ticker should be about context, not obsession.

Look at the "Daily Pivot Points." If the futures are trading above the central pivot, the sentiment is generally bullish. If they’re hammering against a support level (S1 or S2) during the Asian session, expect a volatile morning.

Also, watch the "VIX" or the Fear Gauge. If Dow futures are down and the VIX is spiking above 20, the move has legs. If the Dow is down but the VIX is quiet, it might just be a low-volume drift that will get bought up.

Common Misconceptions About the Ticker

People think the Dow Futures represent "The Market." They don't. They represent 30 specific companies. If tech is booming but the Dow is flat, it’s probably because Boeing or 3M is having a bad day. The S&P 500 (ES futures) or the Nasdaq (NQ futures) are often better indicators of general market health.

Another myth: "The futures are down, so the market will definitely close lower."

Statistically, there is a very low correlation between where the futures trade at 2:00 AM and where the cash market closes at 4:00 PM the next day. The "Intraday Trend" is its own beast. Use the ticker to gauge the "opening gap," but don't bet the house on it staying that way.

Actionable Steps for the Informed Investor

Stop treating the ticker like a scoreboard and start treating it like a weather vane. It tells you which way the wind is blowing right now, not where it will be blowing in six hours.

- Check the Economic Calendar: Before you react to a move in the dow futures live ticker, check if there’s a CPI report or a Fed announcement scheduled. Often, futures will "front-run" these events.

- Verify the Source: Ensure your data provider isn't giving you "BATS" exchange data only, which can be thin. Look for CME (Chicago Mercantile Exchange) data.

- Watch the "Big Three": Keep an eye on Treasury Yields (10-year), the US Dollar Index (DXY), and Oil. If the Dow futures are moving, one of those three is usually the reason.

- Don't Trade the "Open": The first 30 minutes of the NYSE open (9:30-10:00 AM ET) is pure volatility. Let the futures-driven gap settle before making a move.

The most successful people in this game aren't the ones with the fastest ticker; they're the ones with the most discipline. They know that a 100-point swing in the Dow is less than 0.3% in today’s environment. It’s noise.

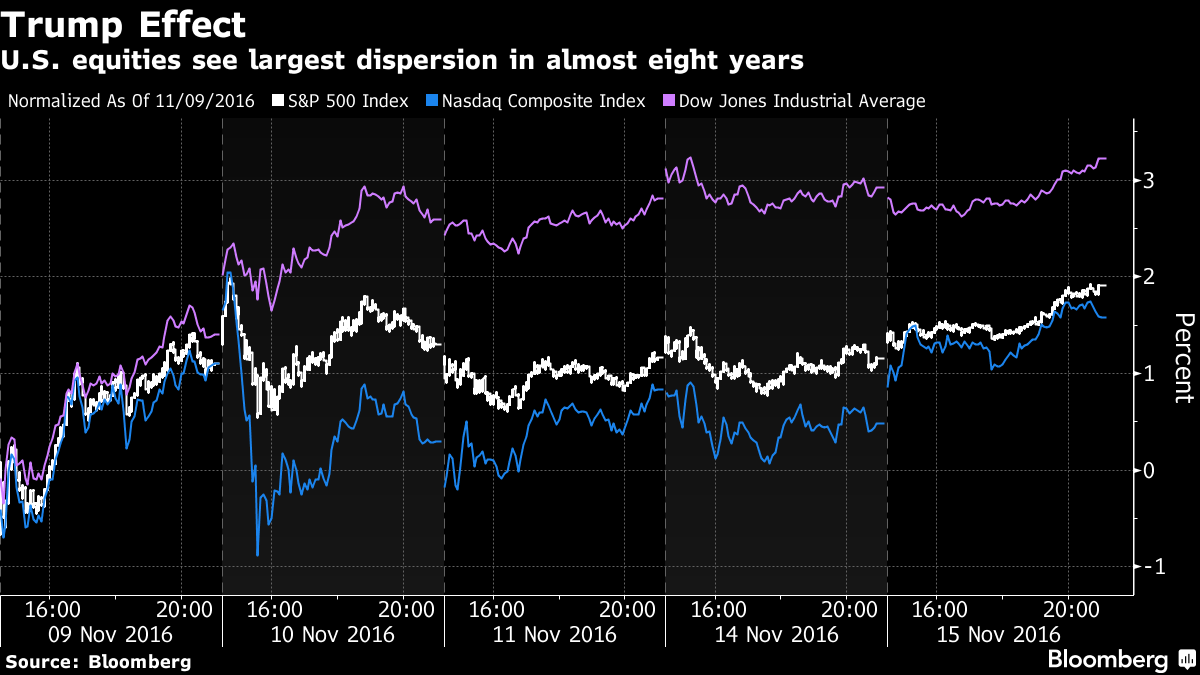

Focus on the long-term trend lines. Use the dow futures live ticker to spot extreme outliers—like a 3% move—which usually signal a genuine regime shift or a major geopolitical event. Everything else is just the market breathing. And right now, the market is taking a very deep, very expensive breath. Keep your head cool, check your timeframes, and remember that the numbers on the screen are just a reflection of collective human emotion. And humans, as we know, are rarely rational at 3:00 AM.