You've probably seen it sitting there. Just a minimalist white card in your iPhone’s digital stack, tucked between a credit card and maybe a Starbucks pass. It’s the Apple account card in wallet, and honestly, most people have no idea what it actually does beyond showing how much money is left over from a birthday gift card. It’s quiet. It doesn't scream for attention like the titanium Apple Card does with its color-shifting spending categories.

But here is the thing.

This little digital sliver is basically the central nervous system for your entire financial relationship with the Apple ecosystem. If you’ve ever wondered why a subscription didn't lapse when your credit card expired, or how some people seem to breeze through the Apple Store without pulling out a physical wallet, you’re looking at the culprit. It's not just a balance tracker; it’s a specialized payment instrument that bridges the gap between your bank account and your iCloud identity.

What is the Apple Account Card Anyway?

Basically, the Apple account card in wallet is a digital representation of your Apple Account balance. Think of it as a dedicated "internal" debit card. When you redeem a gift card or add funds directly from a linked bank account, that money lives here.

It used to be a lot more confusing. Remember the "iTunes Pass"? That was the old-school version where you had to show a QR code to a specialist at an Apple Store just to put money on your account. It felt clunky. It felt like 2012. Apple eventually realized that having a separate pass for "Store credit" and "Apple ID balance" was a mess. So, they streamlined. Now, it’s all integrated into the Wallet app as a standard-looking card.

The beauty of this is that it works with NFC (Near Field Communication).

If you walk into a physical Apple Store in the US, you don’t have to wait for an emailed receipt or dig through your inbox for a gift card code. You just double-click the side button on your iPhone, select the Apple account card, and tap. It’s seamless. It’s also a safety net. Apple’s billing logic is actually pretty smart; it usually tries to drain this "hidden" balance before it ever touches your actual credit or debit card. That’s why you might see a $0.99 iCloud charge "disappear" if you had a few bucks left over from a stray gift card.

Setting Up and Finding the "Hidden" Card

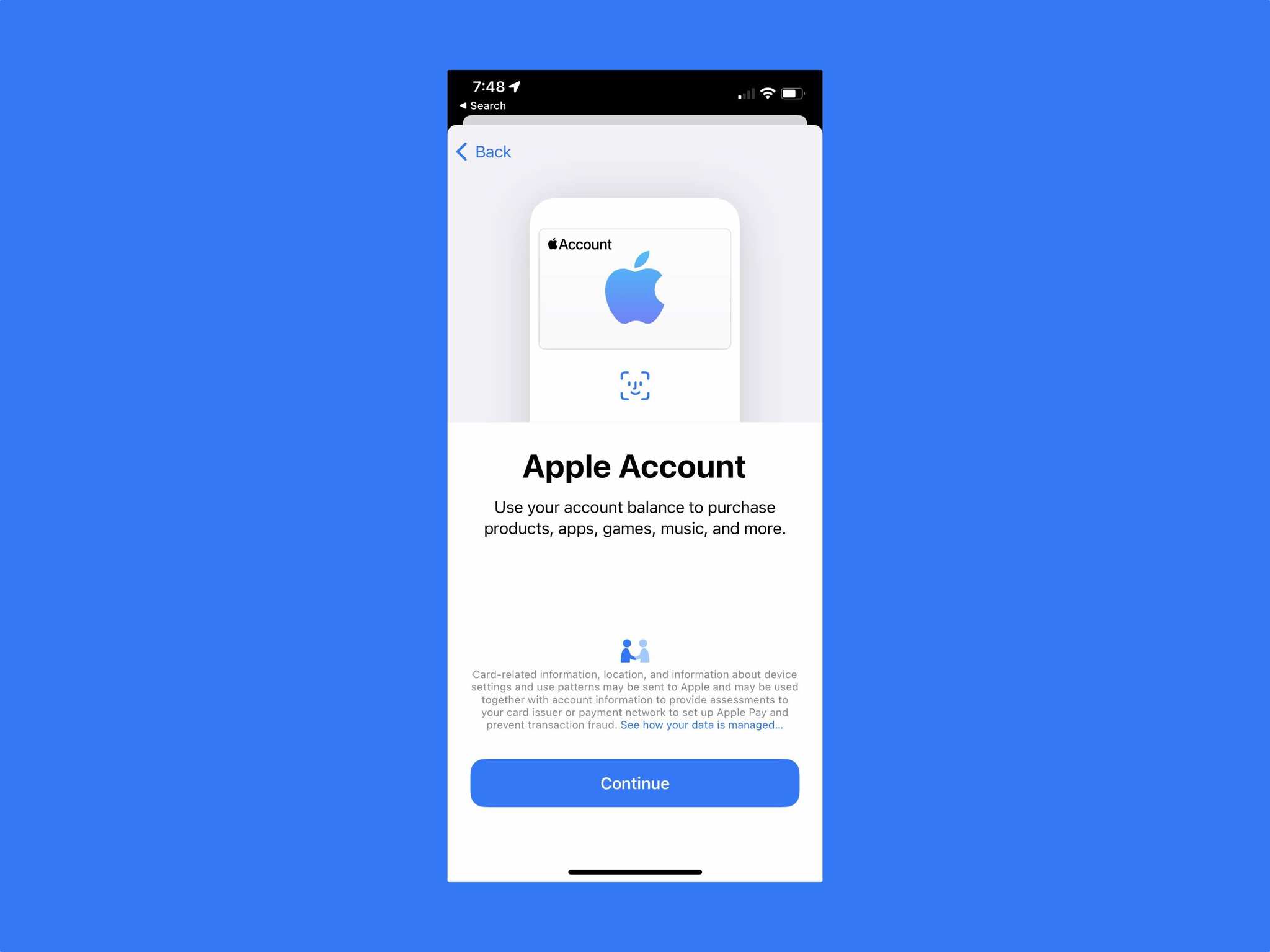

Most people don’t even realize they have to manually add this card to the Wallet app. It doesn't just "show up" because you have an iPhone. You have to go looking for it.

Open your Wallet app. Tap that little plus (+) icon in the top right corner. You’ll see a list of options: Debit or Credit Card, Transit Card, and then the one people miss—Add Apple Account. If you have a balance, even if it's just forty-two cents, it will let you create the card. If your balance is zero, the option might not even appear, which is a bit of a weird UI choice on Apple's part, but that's how they roll.

🔗 Read more: The MOAB Explained: What Most People Get Wrong About the Mother of All Bombs

Once it's in there, it’s live.

You can see your balance in real-time. No more logging into "Media & Purchases" inside the Settings app just to see if you can afford that new Final Cut Pro for iPad subscription. It’s right there, sandwiched between your Visa and your gym membership.

The Confusion Between Apple Account and Apple Card

Let's clear this up right now because it's a massive point of confusion.

The Apple account card in wallet is NOT the same as the Apple Card (the credit card issued by Goldman Sachs). I've seen people try to pay for a coffee at a local cafe using their Apple Account balance. It won't work. The Apple Account balance is "closed-loop," meaning it only works within the Apple universe. You can buy a MacBook, an iPhone case, a movie on Apple TV, or more iCloud storage. You cannot buy a sourdough loaf at the farmer's market with it.

The Apple Card, conversely, is a standard credit card.

However, they do talk to each other. If you have an Apple Card, your "Daily Cash" rewards are funneled into an Apple Cash account (which is also different). It’s a bit of a Russian Nesting Doll situation. Here is the hierarchy:

- Apple Account Card: Your pre-paid balance (Gift cards/Direct deposits).

- Apple Cash: Like a digital Venmo card for sending money to friends.

- Apple Card: The actual credit card.

Why You Should Actually Care About This

There is a huge privacy angle here that nobody talks about.

When you use the Apple account card in wallet to buy something at an Apple Store, you aren't sharing your primary credit card details with the point-of-sale system in the same way. You're using pre-loaded funds. For the privacy-conscious, it’s a way to silo your tech spending.

💡 You might also like: What Was Invented By Benjamin Franklin: The Truth About His Weirdest Gadgets

It’s also a budgeting lifesaver.

Some people use it as a "tech allowance." You can set up a recurring deposit—say $20 a month—to your Apple Account. This money sits there, and all your subscriptions (Netflix, Disney+, iCloud, Apple Music) pull from that balance first. It keeps your main bank statement clean. Instead of fifteen small charges for apps and games, you just see one "Reload" charge. Honestly, it makes tracking your digital life way less of a headache.

The Limitations (Because Nothing is Perfect)

You can't use it for everything.

While you can buy physical hardware at an Apple Store with your balance, you usually can't use it for "Apple Card Monthly Installments." If you’re trying to finance a new iPhone 15 or 16, Apple wants a "real" credit card on file for those recurring payments. They won't let you just keep a balance on your account card and hope you remember to top it up.

Also, family sharing gets weird.

If you are the "Family Organizer," your Apple Account balance is used to pay for everyone’s apps. But, if a family member has their own Apple account card in wallet with a balance, their phone will prioritize their own money first before charging yours. It’s a nuanced bit of logic that prevents kids from accidentally draining their parents' bank accounts when they have ten bucks of their own.

Real-World Use Case: The Apple Store Visit

Imagine you’re at the Genius Bar. Your screen is cracked. The repair is going to cost $199. You happen to have $50 on an old gift card you found in a drawer and redeemed months ago.

Usually, this would be a nightmare to coordinate.

📖 Related: When were iPhones invented and why the answer is actually complicated

But with the card in your wallet, the specialist just scans your repair ID, and when the payment terminal lights up, you tap your iPhone. The system automatically takes that $50 balance and then asks you how you want to pay the remaining $149. You don't have to explain anything. You don't have to dig through emails. The phone just knows.

Managing the Balance and Topping Up

If you're running low, you don't need a physical gift card anymore.

Inside the Wallet app, you can tap the Apple account card and hit "Add Funds." This is instantaneous. It uses Apple Pay to pull money from your linked debit card and puts it onto the account card.

Why would you do this?

Sometimes Apple offers promotions. We’ve seen "bonus credit" periods where adding $100 to your account gets you an extra $5 or $10. It’s rare, but it happens, usually around the holidays or back-to-school season. Having the card ready in your wallet makes you eligible for these quick-tap promos.

Final Practical Steps for the User

If you want to get the most out of this feature, don't just leave it to chance. Start by checking if you have any "ghost" balances. Most people have a few dollars lingering from years ago.

- Open the App Store app.

- Tap your profile picture (top right).

- Select Add Money to Account. Even if you don't add money, this screen will show you exactly what you have.

- If there is a balance, go to the Wallet app immediately.

- Hit the Plus (+) sign and choose Add Apple Account.

Once that card is visible, you have a real-time window into your digital spending. Use it to pay for your next iCloud upgrade or that movie rental you’ve been eyeing. It’s a cleaner, faster, and slightly more private way to navigate the Apple ecosystem without constantly pinging your primary bank account for every $0.99 transaction.

Keep an eye on the "Manage Payments" section in your iPhone settings as well. You can actually drag the Apple Account balance to the top of your payment hierarchy. This ensures that no matter what, your "gift money" or "pre-paid money" is spent before your "real-world money." It’s the smartest way to make sure no credit goes to waste.

The system is surprisingly robust if you actually use it. It’s not just a digital receipt; it’s a tool. Use it to silo your subscriptions, protect your primary card data, and breeze through the Apple Store. It’s one of those rare features that actually makes the "walled garden" feel a bit more convenient.