You remember the song. Everyone does. The "I don't wanna grow up" jingle is basically burned into the collective DNA of anyone born between 1960 and 2010. But if you’re looking for Toys R Us stock on your E*TRADE or Robinhood dashboard today, you’re going to run into a wall. It’s not there. It’s frustrating, honestly. You see the brand popping up in Macy’s stores, you hear about new flagship locations at the American Dream mall, and you think, "Hey, this comeback is real. I want in."

But the stock market doesn't care about nostalgia.

The reality of Toys R Us stock is a messy, complicated tale of private equity, bankruptcy courts, and a brand name that refused to die even when the stores did. If you're searching for a ticker symbol, you're actually looking for a ghost. The original company, TRU, was delisted years ago. What's left is a tangled web of intellectual property owned by a group called WHP Global.

The 2017 Collapse and Why the Ticker Vanished

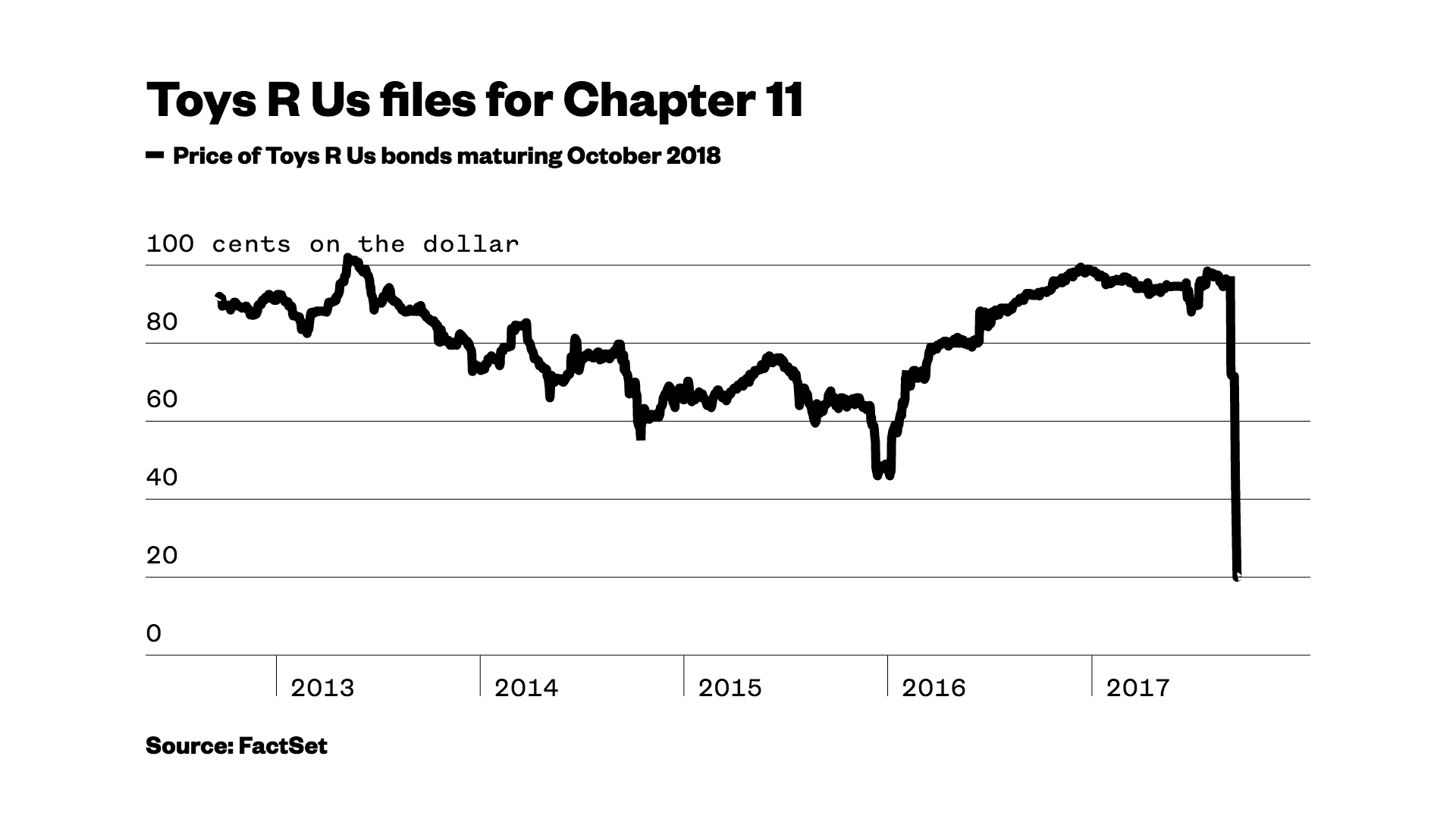

To understand why you can't just buy a thousand shares of Toys R Us stock right now, we have to look at the 2017 bankruptcy. This wasn't just a "people are buying on Amazon now" problem, though that was part of it. The real killer was a leveraged buyout (LBO) from 2005. Bain Capital, KKR, and Vornado Realty Trust took the company private in a $6.6 billion deal.

They loaded the company with debt. Huge debt.

Imagine trying to run a marathon while carrying a backpack full of lead bricks. That was Toys R Us. Even when they were making money, almost every cent of profit went toward paying off the interest on that debt. They couldn't innovate. They couldn't fix their clunky websites. By the time they filed for Chapter 11, the debt load was over $5 billion. When the liquidation happened in 2018, the equity—the actual stock—became worthless. It was wiped out. Gone.

Who Actually Owns the Brand Now?

After the 2018 liquidation, the lenders took control of the scraps. They formed a new entity called Tru Kids Inc. They tried a couple of small "experiential" stores in malls, but they fizzled out pretty quickly. Then, in 2021, WHP Global stepped in.

🔗 Read more: Price of Tesla Stock Today: Why Everyone is Watching January 28

WHP Global is a brand management firm. They specialize in taking "zombie brands"—names you know and love that have gone bust—and licensing them out to make money. They own Anne Klein, Joseph Abboud, and Isaac Mizrahi. When they bought a controlling interest in Tru Kids, they became the masters of Geoffrey the Giraffe.

Here is the kicker: WHP Global is a private company. This is the part that trips up most retail investors. Because WHP Global isn't traded on the New York Stock Exchange or the NASDAQ, you can't buy their stock either. They are backed by powerful private equity players like Ares Management and the pension fund of the Ontario Teachers' Federation. Unless you have a few hundred million dollars and a seat at the institutional table, you’re locked out of direct ownership.

The Macy’s Partnership: Can You Buy Toys R Us Stock Through a Proxy?

Since you can't buy the brand directly, people often ask if buying Macy’s (M) is the same thing. It's a fair question. In 2021, Macy’s announced they were bringing Toys R Us "shop-in-shops" to every single one of their department stores. It worked. It worked really well, actually. During earnings calls, Macy’s executives have noted that toy sales surged after the partnership began.

But buying Macy’s stock is not buying Toys R Us stock.

Macy’s is a massive department store chain struggling with its own set of "mall apocalypse" problems. When you buy M, you’re betting on perfumes, dresses, luggage, and a massive real estate portfolio. The Toys R Us section is a tiny slice of their overall revenue. It's a "halo" effect—it brings parents into the store who might then buy a pair of Levi’s—but it’s not a pure-play investment in the toy industry.

Why Everyone is Talking About a Possible IPO

There has been constant chatter about WHP Global eventually taking the brand public again. Why wouldn't they? The brand recognition is still 90% plus. People love a comeback story.

💡 You might also like: GA 30084 from Georgia Ports Authority: The Truth Behind the Zip Code

If WHP Global decides to launch an Initial Public Offering (IPO), that is the moment Toys R Us stock would technically return to the market. But it wouldn't be the old company. It would be a "capital-light" version. The old Toys R Us owned warehouses, trucks, and massive big-box stores. The new version mostly owns the name and gets a percentage of every toy sold by their partners.

It's a much safer business model. But it’s also less "grand."

The "Zombie Stock" Trap: Beware of Scams

If you search for Toys R Us stock on some OTC (Over-the-Counter) markets, you might see weird tickers that look similar or old shells of companies. Be extremely careful. These are often "zombie stocks." They have no assets, no operations, and are often used for pump-and-dump schemes.

One specific trap is the old TRU ticker or companies that claim to be "the next Toys R Us." If a company isn't officially affiliated with WHP Global, they don't own the rights to the name, the logo, or the mascot. Don't throw your money into a void because of a name.

What Actually Drives the Toy Market Today?

If you're looking for where the "toy money" is actually going since you can't buy TRU, you have to look at the manufacturers. This is where the real action is.

- Hasbro (HAS): They own Transformers, Nerf, and My Little Pony. They've struggled lately with their film division, but they are a powerhouse in the "kidult" market—adults who buy toys for themselves.

- Mattel (MAT): The "Barbie" movie changed everything for them. They proved that a toy brand can become a cinematic universe.

- Spin Master (SNMSF): These guys own PAW Patrol. If you have a toddler, you’re basically a silent donor to Spin Master already.

These companies are public. You can buy their stock today. They are the ones actually making the products that sit on the shelves of the new Toys R Us boutiques.

📖 Related: Jerry Jones 19.2 Billion Net Worth: Why Everyone is Getting the Math Wrong

The "Kidult" Factor: Why the Brand Still Matters

The reason people still care about Toys R Us stock isn't just because of kids. It's because of "kidults." Research from the Toy Association shows that adults are now the fastest-growing segment of the toy industry. We’re talking about $150 LEGO sets, Star Wars collectibles, and high-end action figures.

Toys R Us was the Mecca for these collectors. WHP Global knows this. That’s why the new flagship stores look more like showrooms than the chaotic, messy aisles of the 1990s. They are targeting the nostalgia of the people who now have the disposable income to buy what they couldn't afford as kids.

The Real Risks of a Future Toys R Us IPO

Let's say WHP Global goes public tomorrow. Should you buy?

Maybe. But remember: the retail landscape is brutal. Even with the Macy's deal, Toys R Us has to compete with Amazon's logistics and Target's "cheap chic" appeal. The "shop-in-shop" model is smart because it reduces overhead, but it also means Toys R Us doesn't control the customer experience. If the Macy's store is messy or understaffed, it hurts the Toys R Us brand.

Also, birth rates are declining in many major markets. Fewer kids usually means fewer toy sales, unless you can keep convincing 35-year-olds to buy plastic spaceships.

Actionable Insights for Investors

Since you can't click "buy" on Toys R Us stock right now, here is how you should actually play this:

- Monitor WHP Global News: Follow their press releases. If they hire an investment bank like Goldman Sachs or Morgan Stanley to "explore options," that’s the signal an IPO is coming.

- Look at the Partners: If you believe in the Toys R Us comeback, look at Macy’s (M). Just realize you're buying a department store, not a toy store.

- The "Lego" Strategy: Sometimes the best way to invest in toys isn't through the stock market at all. Rare, discontinued LEGO sets have historically outperformed the S&P 500. It’s a physical asset, but it requires a lot of storage space and a bit of luck.

- Watch the Manufacturers: If Mattel or Hasbro starts reporting massive sales through Toys R Us channels, it’s a sign the brand's "revival" is actually moving the needle.

The "Toys R Us" we knew is dead. The one that exists now is a clever marketing machine that lives inside other stores. It’s leaner, meaner, and way more profitable on paper because it doesn't have the massive "big box" debt. But as an investor, you have to be patient. You're waiting for a private equity firm to decide it's time to cash out. Until then, Geoffrey the Giraffe stays behind the velvet rope of private ownership.

Don't get fooled by old tickers or penny stocks claiming to be the "new" version. Real wealth is built on real assets, and right now, the assets of Toys R Us are tucked away in a private portfolio in New York. Keep your eyes on the IPO filings, and keep your nostalgia in check. Investing is about the future, not just the "good old days" of 1994.