Money isn't just paper. It’s a scoreboard. When you look at your bank account, you see a number, but that number is constantly shifting in value against everything else in the world. This is where the Wall Street Journal Dollar Index enters the chat. Most people just glance at the DXY (the Intercontinental Exchange Index) and call it a day, but that's a mistake. The WSJ version is different. It’s more modern. It feels more like the actual world we live in today.

The US dollar is the world's reserve currency, period. But how you measure that strength changes the entire narrative of your investments.

The WSJ Dollar Index vs. The DXY: A Real Rivalry

You've probably heard of the "Dixie." That's the U.S. Dollar Index (DXY) that's been around since the early 70s. It’s the old guard. But honestly, it’s kinda stuck in the past. It weighs the Euro at nearly 60%. Think about that. It treats the Eurozone like it’s the only trade partner that matters.

The Wall Street Journal Dollar Index (BUXX) takes a different swing at the ball.

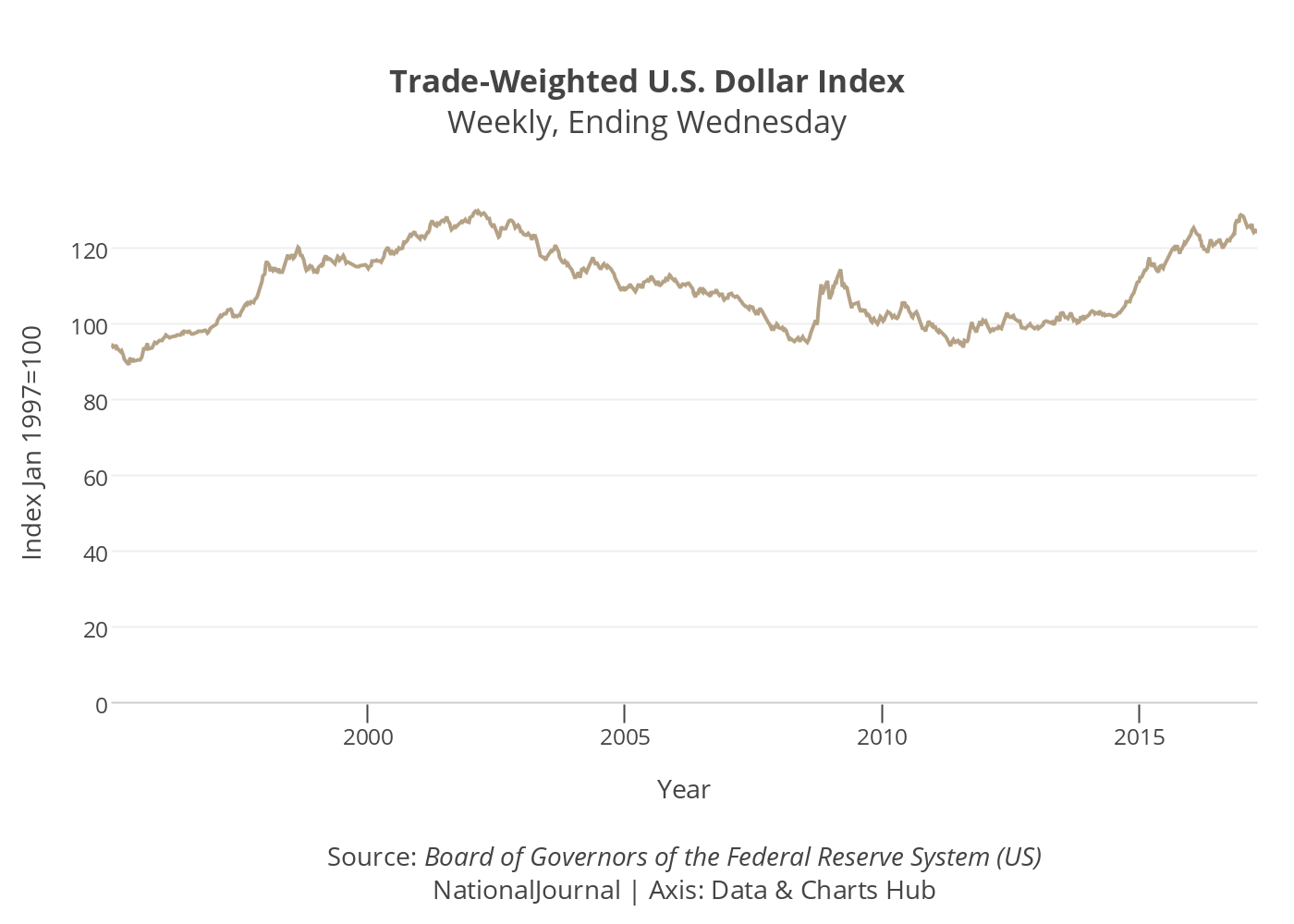

Back in the day, the folks at Dow Jones and the Journal realized the global economy had shifted. China happened. Mexico became a manufacturing powerhouse. The WSJ index uses a "trade-weighted" approach that actually reflects who the U.S. is doing business with right now. It tracks the dollar against a basket of 16 currencies.

It’s broader. It’s more inclusive of emerging markets.

Why the Math Matters

In the WSJ version, you aren't just looking at the Euro, Yen, and Pound. You’re seeing the Chinese Yuan. You’re seeing the Mexican Peso. These are massive players. If the dollar is crushing the Euro but weakening against the Yuan, the DXY might tell you the dollar is "strong," while the WSJ Dollar Index gives you a more nuanced, "it's complicated" vibe.

Complexity is the truth in finance.

👉 See also: E-commerce Meaning: It Is Way More Than Just Buying Stuff on Amazon

The Components That Make It Tick

If you want to understand the Wall Street Journal Dollar Index, you have to look at the ingredients. It isn't a static list. The WSJ rebalances this thing annually. They look at data from the Bank for International Settlements (BIS) to see who is actually trading what.

- The Euro: Still a big deal, but not the king it is in other indices.

- The Chinese Yuan: This is the big differentiator. Since China is a massive trade partner, its inclusion makes the WSJ index more sensitive to Asian market shifts.

- The Japanese Yen: A classic safe-haven currency that balances the riskier assets in the basket.

- The British Pound: Good old Sterling.

- The Mexican Peso & Canadian Dollar: Because geography is destiny, and USMCA trade is a monster.

When the Federal Reserve hikes interest rates, all these currencies react differently. The WSJ index captures that friction. It’s a tug-of-war. On one side, you have U.S. yields pulling capital into the States. On the other, you have the industrial output of Beijing and the energy exports of Canada.

What Happens When the Index Spikes?

A rising Wall Street Journal Dollar Index is a double-edged sword. It’s great if you’re a tourist heading to Rome. Your coffee is cheaper. Your hotel feels like a bargain. But if you’re a CEO of a Fortune 500 company? It’s a nightmare.

Most big U.S. companies earn a huge chunk of their revenue overseas. When they bring those Euros or Pesos back home and convert them into a "strong" dollar, the earnings shrink. It’s called a "currency headwind." You’ll hear this on every earnings call when the dollar is ripping.

"Our revenue grew 10% on a constant-currency basis, but only 4% after the dollar's impact."

You’ve probably seen that line a thousand times. It’s the index talking.

The Impact on Commodities

Gold and oil hate a strong dollar. Usually. Since these are priced in dollars globally, a spike in the WSJ index makes these commodities more expensive for people using other currencies. Demand drops. Prices often follow. If you’re trading futures, you’re basically watching the dollar index more than the actual oil supply sometimes.

✨ Don't miss: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

Why Investors Ignore This at Their Peril

If you only watch the S&P 500, you’re flying blind. The Wall Street Journal Dollar Index is a leading indicator.

When the index starts trending up aggressively, it often signals "risk-off" sentiment. People are scared. They want the safety of the greenback. Conversely, when the index slides, it usually means the world is feeling spicy. Investors are moving money into emerging markets, looking for higher returns in places like Brazil or South Korea.

Is the dollar too strong? Sometimes.

Economists talk about "Dutch Disease" or the "Dollar Smile" theory. The dollar wins when the U.S. economy is booming, but it also wins when the whole world is in a recession because everyone runs to it for safety. It only loses in the middle—when the rest of the world is doing better than the U.S.

The 2026 Perspective: Where We Are Now

Looking at the current data, the index has shown remarkable resilience. Despite all the talk of "de-dollarization," the WSJ index hasn't crashed. People have been predicting the death of the dollar for decades. It hasn't happened. Why? Because you can’t replace an entire global financial infrastructure overnight with a handful of bilateral trade agreements.

The WSJ index proves this daily. It shows the sheer volume of liquidity moving through the U.S. system.

Practical Steps for Your Portfolio

Don't just read the index; use it. It’s a tool, not just a headline.

🔗 Read more: Private Credit News Today: Why the Golden Age is Getting a Reality Check

Watch the 200-day moving average. If the WSJ index is trading above its 200-day average, you might want to be cautious with international stocks. The currency conversion will eat your gains.

Diversify based on the basket. If you notice the dollar is weakening specifically against the Asian currencies in the WSJ basket, it might be time to look at some ADRs (American Depositary Receipts) for companies based in that region.

Check the "Real" Value. Remember that the index is nominal. It doesn't always account for inflation differences between countries. A "strong" dollar in a high-inflation U.S. environment feels very different than a strong dollar in a low-inflation one.

Hedge your bets. If you have significant exposure to overseas markets, look into currency-hedged ETFs. These funds use derivatives to cancel out the fluctuations of the Wall Street Journal Dollar Index, letting you bet on the company's performance without the currency volatility.

Listen to the Fed. The Federal Open Market Committee (FOMC) meetings are the primary driver of this index. If they signal a "pivot" to lower rates, expect the index to drop. If they stay "higher for longer," the dollar will likely keep its crown.

The dollar isn't going anywhere, but it is changing. The way we measure it has to keep up. The Wall Street Journal's approach provides that modern lens, capturing the shift from a Euro-centric world to a truly global one. Keep the ticker BUXX on your watchlist. It tells a story that the DXY simply can't finish.