Let’s be real for a second. Investing feels like it’s becoming a video game. You open an app, things glow neon green or red, and there’s a constant pressure to "trade" rather than actually invest. It's exhausting. But then you have the Vanguard Roth IRA account. It isn't flashy. The interface won't win any design awards in Silicon Valley. Honestly, it feels a bit like a sturdy pair of boots—it’s built to last, it’s reliable, and it doesn’t care about trends.

If you’re looking to keep your money away from the IRS when you retire, this is arguably the most efficient vehicle ever created.

A Roth IRA is pretty simple at its core. You put in money that has already been taxed. It grows. You take it out at age 59½. Every single cent of that growth? Tax-free. That is the magic. But why Vanguard? Why do people talk about John Bogle’s brainchild like it’s a religious experience? It comes down to ownership. Vanguard is owned by its funds, which are owned by the investors. That means they aren't trying to squeeze you for profit to please outside shareholders. You are the shareholder.

The Vanguard Roth IRA Account: Beyond the Basics

Most people think a Roth IRA is just "an investment." It’s not. It’s an empty bucket. You have to put things inside the bucket.

With a Vanguard Roth IRA account, you get access to some of the lowest expense ratios in the entire industry. While some big-name banks might charge you 1% or more just to manage a mutual fund, Vanguard’s Admiral Shares often sit at 0.04% or 0.05%. That sounds like a tiny difference. It isn't. Over thirty years, that 1% fee can eat up six figures of your potential wealth. That's a house. Or a very nice boat. Or just peace of mind.

People get hung up on the "no-commission" craze. Sure, almost everyone offers $0 trades now. But Vanguard was the pioneer of low-cost indexing. They aren't just following a trend; it’s their entire DNA.

Does the "clunky" app matter?

Let’s talk about the elephant in the room. If you’re used to Robinhood or even Fidelity, Vanguard’s mobile app might feel like stepping back into 2014. It’s utilitarian. Some people hate it.

But here’s a weird take: maybe that’s a good thing?

💡 You might also like: What is the S\&P 500 Doing Today? Why the Record Highs Feel Different

If your retirement account is too fun to look at, you’re going to look at it too often. When you look at it too often, you’re tempted to fiddle with it. When you fiddle with your Vanguard Roth IRA account during a market dip, you usually lose money. The "boring" nature of the platform actually encourages the exact behavior that leads to long-term wealth: buying and holding.

Why Everyone Is Obsessed With Index Funds

Vanguard is the house that Jack Bogle built on the foundation of the index fund. Instead of trying to find the next Nvidia or Apple—which, let's be honest, most of us are bad at—you just buy the whole market.

Take the Vanguard Total Stock Market Index Fund (VTSAX). When you hold this in your Vanguard Roth IRA account, you own a piece of basically every publicly traded company in the U.S. From the tech giants to the mid-sized industrial firms in the Midwest. If the American economy grows, you grow.

- You don't have to pick winners.

- You don't have to read balance sheets.

- You don't have to worry if one CEO has a breakdown on social media.

It's the ultimate "set it and forget it" strategy. For a lot of people, the Target Retirement Funds are even better. You pick the year you want to stop working—say, 2055—and the fund automatically shifts from "aggressive" to "conservative" as you get older. It’s like having a professional manager who doesn't charge you professional manager prices.

The Tax Games You Can Actually Win

We have to talk about the 2026 tax landscape. Taxes are rarely going down in the long run. If you think tax rates will be higher when you retire than they are now, the Vanguard Roth IRA account is a mathematical no-brainer.

There’s also the flexibility factor that people forget.

Because you’ve already paid taxes on the money you put into a Roth, you can actually withdraw your contributions (not the earnings) at any time, for any reason, without penalty. I wouldn’t recommend it—that’s your future self’s money—but if the world ends and you need cash, it’s there. You aren't "locking" your money away in a cage the way you are with a Traditional IRA or a 401(k) where the IRS hits you with a 10% stick for early withdrawals.

📖 Related: To Whom It May Concern: Why This Old Phrase Still Works (And When It Doesn't)

The Backdoor Strategy

What if you make too much money? For 2024 and 2025, there are income limits. If you’re a high-earner, the IRS says "No Roth for you."

Except, there’s a loophole. The "Backdoor Roth."

You put money into a Traditional IRA (which has no income limits for contributions) and then immediately convert it to a Vanguard Roth IRA account. Vanguard’s system handles this relatively well, though you’ll want to be careful about the "Pro-Rata Rule" if you have other IRA assets. It sounds like a spy maneuver, but it’s a perfectly legal way for doctors, lawyers, and tech workers to get that tax-free growth.

Real Talk: The Limitations

It’s not all sunshine.

Vanguard isn't great for day traders. If you want to trade options or buy crypto or flip stocks every Tuesday, go elsewhere. Seriously. Their system isn't built for speed. It's built for gravity.

Also, their customer service has faced some criticism lately. As they’ve grown to trillions of dollars under management, some users report longer wait times than they’d like. It’s the trade-off for having the lowest fees in the game. You aren't paying for a concierge; you’re paying for a vault.

How to Actually Get Started Without Messing Up

Don't overthink this. Most people freeze because they don't know which fund to pick.

👉 See also: The Stock Market Since Trump: What Most People Get Wrong

- Open the account. It takes about 10 minutes. You’ll need your bank info and your Social Security number.

- Fund it. Even if it’s just $50 to start. Just get the pipe connected.

- Pick a Target Date Fund. If you want the easiest life possible, find the Vanguard Target Retirement Fund that matches your expected retirement year.

- Automate. Set up a monthly transfer. Even $100 a month into a Vanguard Roth IRA account starts a compounding engine that is incredibly hard to stop once it gains momentum.

The biggest mistake isn't picking the "wrong" fund. The biggest mistake is leaving the money in the "Settlement Fund." I’ve seen people who put $6,000 into their Roth, come back a year later, and realize it never actually got invested. It just sat there like cash. Don't be that person. Once the money is in the account, you have to actually click "Buy" on a fund.

Actionable Steps for Your Future Self

If you're sitting on the fence, here is the move. Check your eligibility based on your Modified Adjusted Gross Income (MAGI). For 2024, the limit for singles starts phasing out at $146,000. If you’re under that, you’re golden.

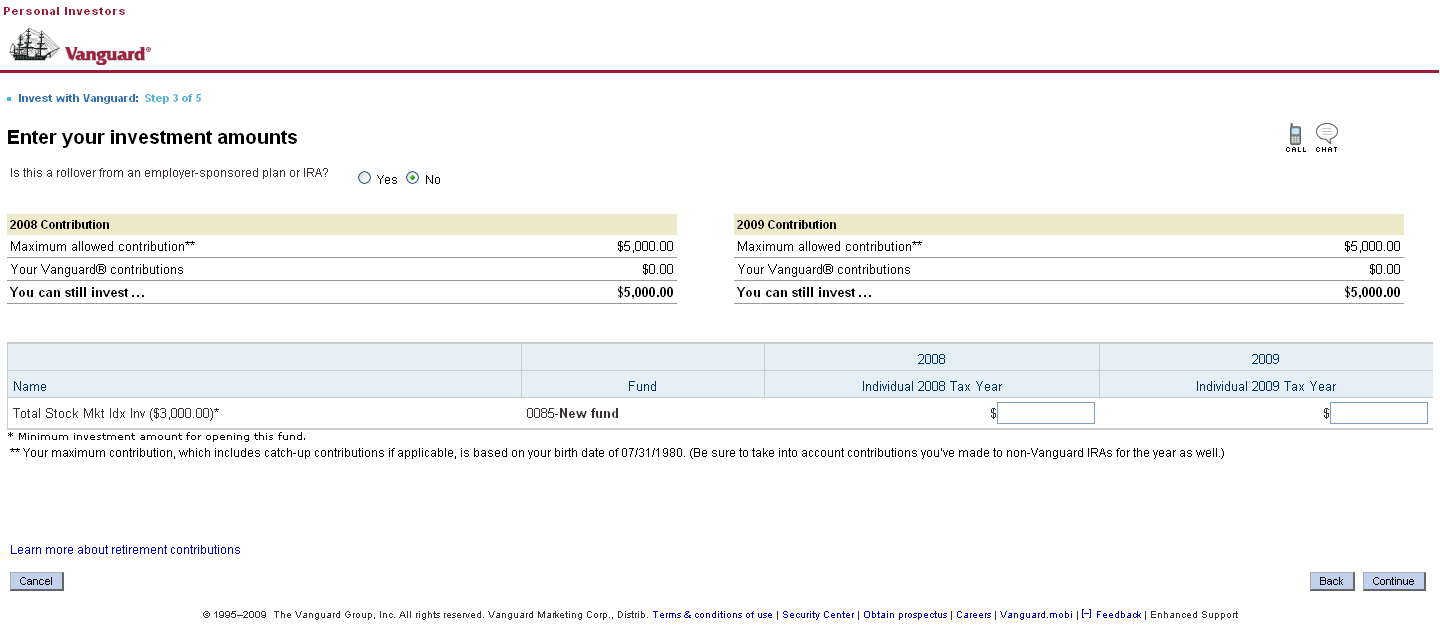

Go to the Vanguard site. Look for the "Open an Account" button. Choose "Roth IRA." When it asks how you want to invest, look at the Vanguard Star Fund (VGSTX) if you have a lower starting balance, or go straight for the Total Stock Market Index (VTSAX) if you have the $3,000 minimum.

If you don't have the $3,000 minimum for Admiral Shares, you can buy the ETF version (VTI) for the price of a single share. There is no excuse to wait. The best day to start was ten years ago; the second best day is today. Compound interest is a snowball that needs a long hill. Give it the longest hill possible.

Max out that contribution. For 2024, it’s $7,000 ($8,000 if you’re 50 or older). Future you—the one who wants to travel, buy a cabin, or just not worry about the price of eggs—will thank you.

The Vanguard Roth IRA account isn't just a financial tool. It’s a declaration that you want to own your time later in life. It’s quiet, it’s boring, and it’s arguably the smartest move you can make with your paycheck. Keep it simple. Stay the course. That was Bogle’s mantra, and it still works.