If you want to feel small, look at the total market cap of S&P 500. It’s a number so large it basically stops being math and starts being philosophy. Right now, we are looking at a figure north of $50 trillion. Think about that. That is more than the GDP of the United States and China combined, sitting inside a single basket of American stocks. But here is the thing: most people treat this number like a thermometer for the "economy." Honestly? It's not. It’s more like a thermometer for how the wealthiest 1% of the world feels about the next ten years of tech dominance.

The S&P 500 isn't just a list of the 500 biggest companies anymore. It’s a top-heavy monster. When you talk about the market cap of the entire index, you’re mostly talking about a handful of guys in Silicon Valley and Seattle. It’s weird. It’s a bit scary. And if you’re trying to use it to figure out if you should buy a house or start a business, you might be looking at the wrong data point.

What Actually Makes Up the Total Market Cap of S&P 500?

Most people think the index is an equal representation of American industry. Nope. Not even close. It is "float-adjusted market-cap weighted." Basically, that means the bigger a company is, the more it dictates the direction of the entire index. If Apple has a bad day, the "market" is down, even if 400 other companies in the index had a great day.

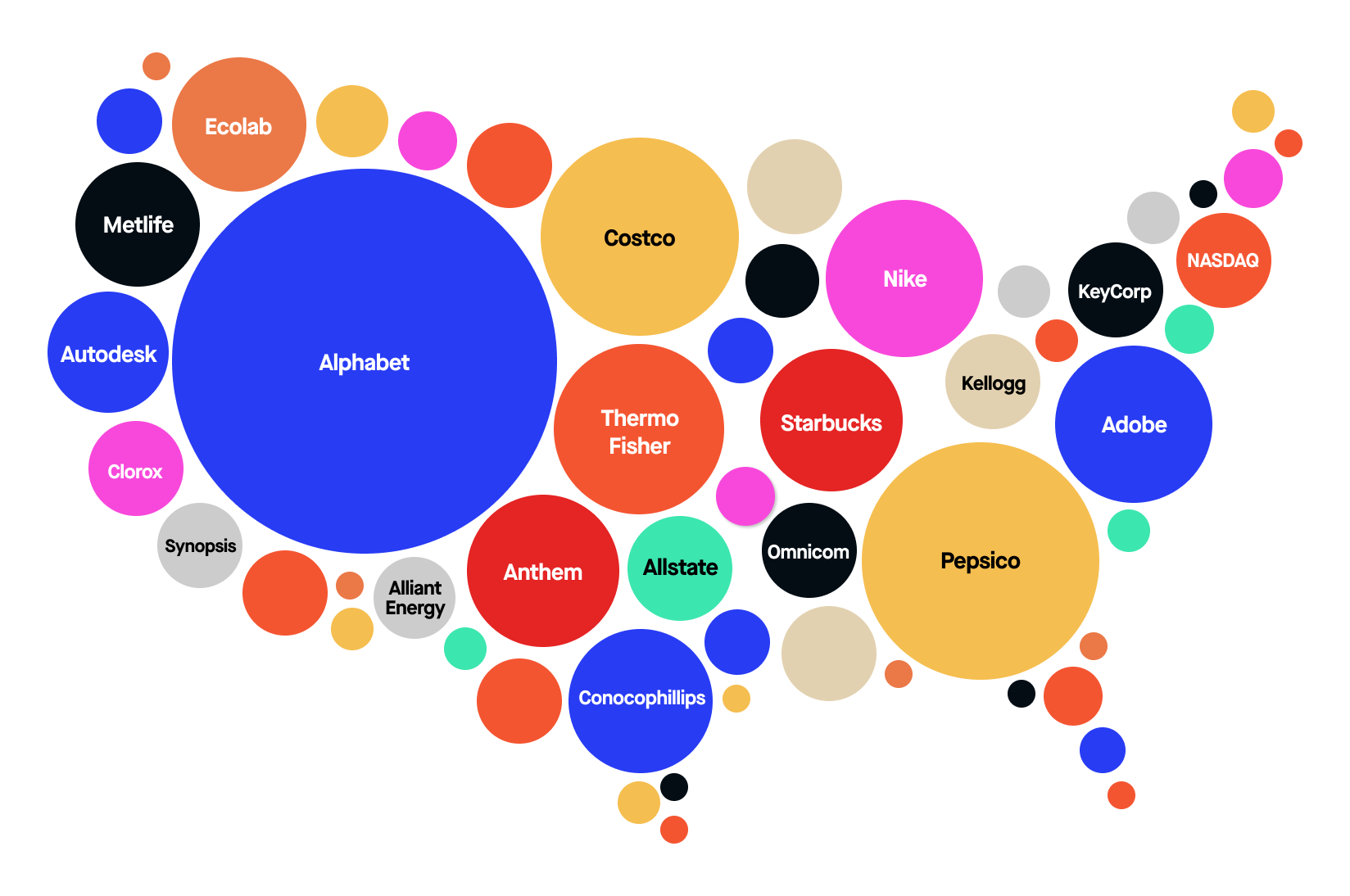

Standard & Poor’s (S&P Dow Jones Indices) has strict rules for who gets in. A company needs a market cap of at least $18 billion—though that number moves—and it has to be profitable. But the total value is where the story gets wild. Because it’s weighted, the "Magnificent Seven" (think Nvidia, Microsoft, Apple, Amazon, Meta, Alphabet, and Tesla) account for nearly 30% of the total market cap of S&P 500.

Imagine a school bus where seven kids weigh as much as the other forty-three kids combined. That’s the S&P 500. When people say "the market is at an all-time high," they often just mean "AI stocks are booming." If you stripped out those top tech giants, the rest of the index—the banks, the energy companies, the retailers—looks much more modest. In fact, for long stretches of 2023 and 2024, the "S&P 493" was barely moving while the total market cap skyrocketed because of a few chips being sold by Nvidia.

The Math Behind the Trillions

Let’s get technical for a second, but not too boring. To calculate the market cap of a single company, you take the share price and multiply it by the number of shares outstanding. To get the total market cap of S&P 500, you sum those up, but you only count the "float"—the shares actually available for the public to trade.

Why does this matter? Because of the "divisor."

The S&P uses a proprietary mathematical constant called the Index Divisor. It’s a number that keeps the index level consistent even when companies do stock splits or issue new shares. Without it, the index would jump or drop for no reason related to actual value. So when you see the S&P 500 at 5,000 or 6,000 points, that’s just a scaled version of that massive $50+ trillion market cap.

Concentration Risk: The Elephant in the Room

You’ve probably heard the term "diversification." It's the golden rule of investing. Buy the S&P 500, they say. It’s diversified, they say.

✨ Don't miss: Online Associate's Degree in Business: What Most People Get Wrong

Is it, though?

When the total market cap of S&P 500 is driven by such a small group of companies, you aren't as diversified as you think. You’re heavily leveraged into "Big Tech." Howard Marks, the billionaire co-founder of Oaktree Capital, has talked about this "top-heaviness" repeatedly. He notes that while these companies are incredible, the sheer concentration creates a fragile system. If one of those pillars cracks—say, a massive regulatory shift in AI or a hardware supply chain collapse—the total market cap of the index doesn't just dip. It craters.

- The 1970s "Nifty Fifty" era: Similar vibes. Everyone thought 50 stocks were "one-decision" buys. You bought them and never sold. Then the 1973-74 bear market happened, and some of those "invincible" companies dropped 80%.

- The Dot-com Bubble: In 2000, tech made up a huge chunk of the market cap. When it popped, it took the S&P 500 years to recover.

- Today: We are at levels of concentration that exceed the 2000 bubble.

This isn't to say a crash is coming tomorrow. These companies actually make billions in profit, unlike the 2000-era companies that were just selling "eyeballs" and hopes. But it means the total market cap of S&P 500 is no longer a broad reflection of the American mid-western factory or the local bank. It’s a reflection of global software dominance.

Why the Market Cap and the Economy Are Divorced

Here is a fun fact that feels wrong: The stock market is not the economy.

The GDP (Gross Domestic Product) measures the value of goods and services produced. The total market cap of S&P 500 measures the discounted future profits of 500 specific corporations.

There are plenty of times when the economy is struggling—high inflation, stagnant wages, struggling small businesses—but the market cap of the S&P 500 hits record highs. Why? Because the S&P 500 companies are global. Apple sells iPhones in Beijing. Exxon sells oil in Europe. They don't just rely on the American consumer.

Also, these companies are masters of "financial engineering." They buy back their own shares. When a company buys back its stock, it reduces the number of shares in the market, which makes the remaining shares more valuable even if the company didn't actually grow its business. This props up the market cap. It’s a legal way to manipulate the scoreboard.

The Role of Passive Investing

We also have to talk about Vanguard and BlackRock.

🔗 Read more: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

Every time you put money into your 401(k) and buy a "Total Stock Market" or "S&P 500 Index Fund," you are contributing to the rising total market cap of S&P 500. Because these funds have to buy stocks in proportion to their size, most of your money goes straight to the biggest companies.

It’s a feedback loop. Microsoft is big, so the index fund buys more Microsoft. This pushes the price up. Because the price is up, Microsoft’s market cap grows. Because its market cap grew, the index fund has to buy even more Microsoft next month.

Some experts, like Michael Burry (the "Big Short" guy), have called this a "passive investing bubble." He argues that price discovery is being lost. Instead of people looking at a company and saying "Is this worth it?", robots are just buying because "it's in the index."

How to Actually Use This Information

So, the total market cap of S&P 500 is huge, concentrated, and somewhat disconnected from your daily life. What do you do with that?

First, check your exposure. If you own an S&P 500 index fund and you also own individual shares of Nvidia or Apple, you are doubling down. You might be way more invested in tech than you realize.

Second, look at the "Equal Weight S&P 500" (ticker: RSP). This version of the index gives the same importance to the 500th company as it does to the 1st. If the total market cap of the standard S&P 500 is going up but the Equal Weight index is flat, the "rally" is a lie. It’s just the big guys dragging the rest of the market up the hill.

Third, pay attention to the Market Cap to GDP ratio, often called the "Buffett Indicator." Warren Buffett famously said that when the total market cap of all stocks (which the S&P 500 dominates) is significantly higher than the GDP, you’re in "playing with fire" territory. In 2026, we are deep in that territory.

Real-World Impact: The "Wealth Effect"

Even if you don't own a single share of stock, the total market cap of S&P 500 affects you. It’s called the Wealth Effect. When the market cap is high, wealthy people and pension funds feel rich. They spend more. They invest in new projects.

💡 You might also like: Modern Office Furniture Design: What Most People Get Wrong About Productivity

When the market cap collapses, that "paper wealth" vanishes. Companies freeze hiring. Luxury spending stops. Then the layoffs hit the "regular" economy. So while the market isn't the economy, it acts like a giant psychological lead weights or a jet engine for it.

We also have to consider the "Value vs. Growth" debate. For a decade, growth (tech) has eaten value (banks, manufacturing) for lunch. This has shifted the total market cap of S&P 500 toward high-multiple stocks. These are stocks where you pay $40 for every $1 they earn. In the old days, you’d pay $15. This means the total market cap is "inflated" by high expectations. If those expectations aren't met, the drop will be violent.

Historical Perspective: From Millions to Trillions

It’s hard to remember, but the S&P 500 wasn't always this behemoth. When it launched in its current form in 1957, the companies involved were the titans of steel, aluminum, and railroads.

- 1980s: The total market cap was less than $1 trillion.

- 2000: It hit around $12 trillion before the crash.

- 2020: It sat near $30 trillion.

- 2026: We are dancing with $50-$55 trillion.

The sheer speed of this growth is what catches experts off guard. It took decades to reach the first $10 trillion. It took only a few years to add the last $20 trillion. Much of this is due to the "debasement" of currency—as more dollars are printed, the assets those dollars buy (like stocks) naturally go up in price. It's not necessarily that the companies are 5x "better" than they were in 2010; it's that the dollar is worth less.

Actionable Steps for the Average Investor

Don't just stare at the total market cap of S&P 500 and panic or celebrate. Take control of the data.

- Check your "Overlap": Use a tool like Morningstar’s "Instant X-Ray" to see how much of your portfolio is actually just the top 10 companies of the S&P. You might be surprised to find you're 40% tech.

- Look at Small Caps: Keep an eye on the Russell 2000. If the S&P 500 market cap is growing but small companies are dying, the economy is unhealthy.

- Diversify by Weight, not just Ticker: Consider adding an "Equal Weight" fund to your portfolio to balance out the massive influence of the tech giants.

- Watch the Yield: When the market cap goes up, the dividend yield usually goes down. If the S&P 500 yield drops below 1.3%, historically, that’s a sign of an "overheated" market.

The total market cap of S&P 500 is a fascinating, terrifying, and essential number. It tells the story of American corporate triumph and the risks of extreme concentration. Just don't mistake it for the "whole" story. It’s just the loudest voice in the room.

If you’re watching the markets today, remember that the "total" value is a moving target. It fluctuates by billions every single hour. What matters isn't the number itself, but the "breadth"—how many companies are actually participating in the growth. A healthy market has 500 winners. A bubble has five. We are currently somewhere in between, and that’s exactly why you need to keep your eyes open.

Stop looking at the S&P 500 as a "safe" index and start looking at it for what it is: a high-stakes, tech-heavy bet on the future of global productivity. Adjust your risk accordingly. Don't be the person caught holding the bag when the divisor finally meets its match in reality.